Canada Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

Canada Animal Feed Market Overview:

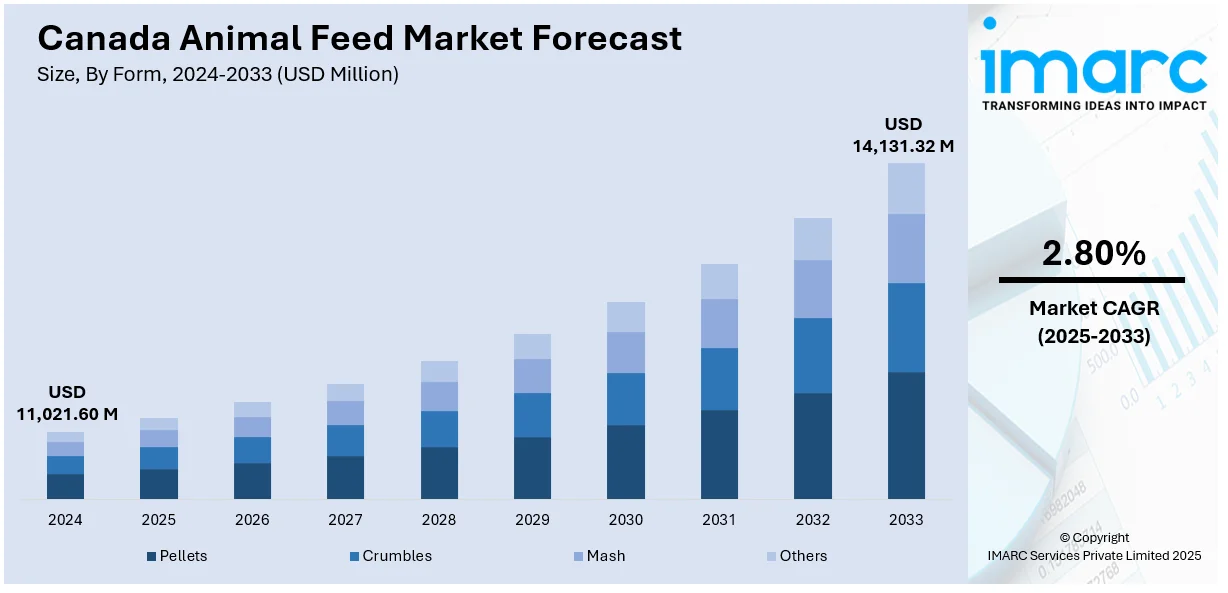

The Canada animal feed market size reached USD 11,021.60 Million in 2024. The market is projected to reach USD 14,131.32 Million by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. The market is expanding due to increasing demand for sustainable, high-quality feed ingredients. Innovations in plant-based proteins and alternative sources like insect meal are driving growth. These trends are strengthening the Canada animal feed market share, particularly in the livestock sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11,021.60 Million |

| Market Forecast in 2033 | USD 14,131.32 Million |

| Market Growth Rate 2025-2033 | 2.80% |

Canada Animal Feed Market Trends:

Shift Toward Functional and Custom Feed

Functional and custom nutrition solutions are steadily transforming the Canada animal feed market. Livestock producers are prioritizing feed that enhances immunity, growth efficiency, and product quality, creating strong demand for specialized feed formulations. This trend is particularly driven by the shift from conventional bulk feed to tailored nutrition programs targeting species-specific needs. As animal health becomes closely tied to productivity, feed blends enriched with vitamins, minerals, probiotics, and amino acids are gaining traction. One of the key drivers behind this trend is the need to reduce dependency on antibiotic growth promoters, in line with both regulatory guidelines and consumer preference for clean-label animal products. As part of recent developments, manufacturers are introducing micro-ingredient dosing systems and enzyme-infused products to improve nutrient absorption and feed efficiency. These innovations also support environmental goals by minimizing feed waste and lowering methane emissions from ruminants. The expansion of organic livestock operations across Canada is further influencing feed producers to reformulate with natural ingredients and avoid genetically modified components. As a result, the Canada animal feed market growth is being steered by the evolving intersection of animal performance, sustainability, and consumer-driven transparency.

To get more information on this market, Request Sample

Smart Technologies Reshaping Feed Strategies

Digital transformation in livestock farming is directly influencing feed management strategies across Canada. The use of precision feeding systems, real-time animal monitoring, and AI-based analytics is enabling producers to align feed inputs with animal health and output performance. These technologies are helping farms fine-tune feed quantities, improve nutrient delivery, and reduce overall feed costs. A key driver here is the rising pressure to operate profitably while adhering to environmental and food safety standards. Automation in feed mills is also becoming more widespread, allowing for consistent production and faster response to shifting demand. Among the notable developments, blockchain technology is being explored for transparent traceability of feed ingredients from source to farm. Meanwhile, sustainable innovations such as insect protein, fermented algae, and by-product utilization are starting to reshape feed composition in niche markets. These alternatives not only reduce the carbon footprint of feed production but also offer protein-rich solutions during global supply disruptions. As the market grows competitive, feed companies are leveraging digital tools and sustainable inputs to differentiate their products. These changes collectively contribute to resilient, adaptive, and high-performing Canada animal feed market.

Canada Animal Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on form, animal type, and ingredient.

Form Insights:

- Pellets

- Crumbles

- Mash

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pellets, crumbles, mash, and others.

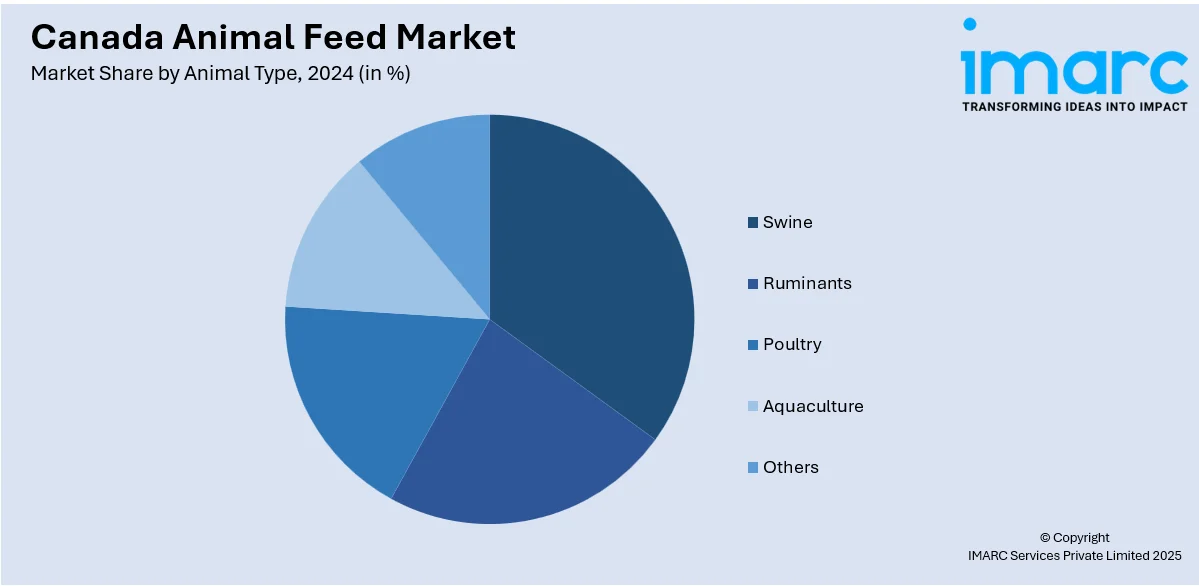

Animal Type Insights:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes swine (starter, finisher, and grower), ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, turkeys, and others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, and others), and others.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others), and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also Provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Animal Feed Market News:

- December 2024: Novibio Inc. launched Poultrirom Plus, a product designed to enhance intestinal health in broilers and turkeys. This innovative blend of organic acids and essential oils improves nutrient absorption and feed conversion, aligning with the demand for sustainable solutions in the Canada animal feed market.

- December 2024: The Canadian Food Inspection Agency (CFIA) launched a pilot project to test regulatory guidance for microbial mitigants in livestock feeds. This initiative aims to improve feed safety by preventing microbial contamination, potentially enhancing the efficiency and safety of the Canada animal feed industry.

Canada Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada animal feed market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada animal feed market on the basis of form?

- What is the breakup of the Canada animal feed market on the basis of animal type?

- What is the breakup of the Canada animal feed market on the basis of ingredient?

- What is the breakup of the Canada animal feed market on the basis of region?

- What are the various stages in the value chain of the Canada animal feed market?

- What are the key driving factors and challenges in the Canada animal feed market?

- What is the structure of the Canada animal feed market and who are the key players?

- What is the degree of competition in the Canada animal feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada animal feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)