Canada Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033

Canada Aquaculture Market Overview:

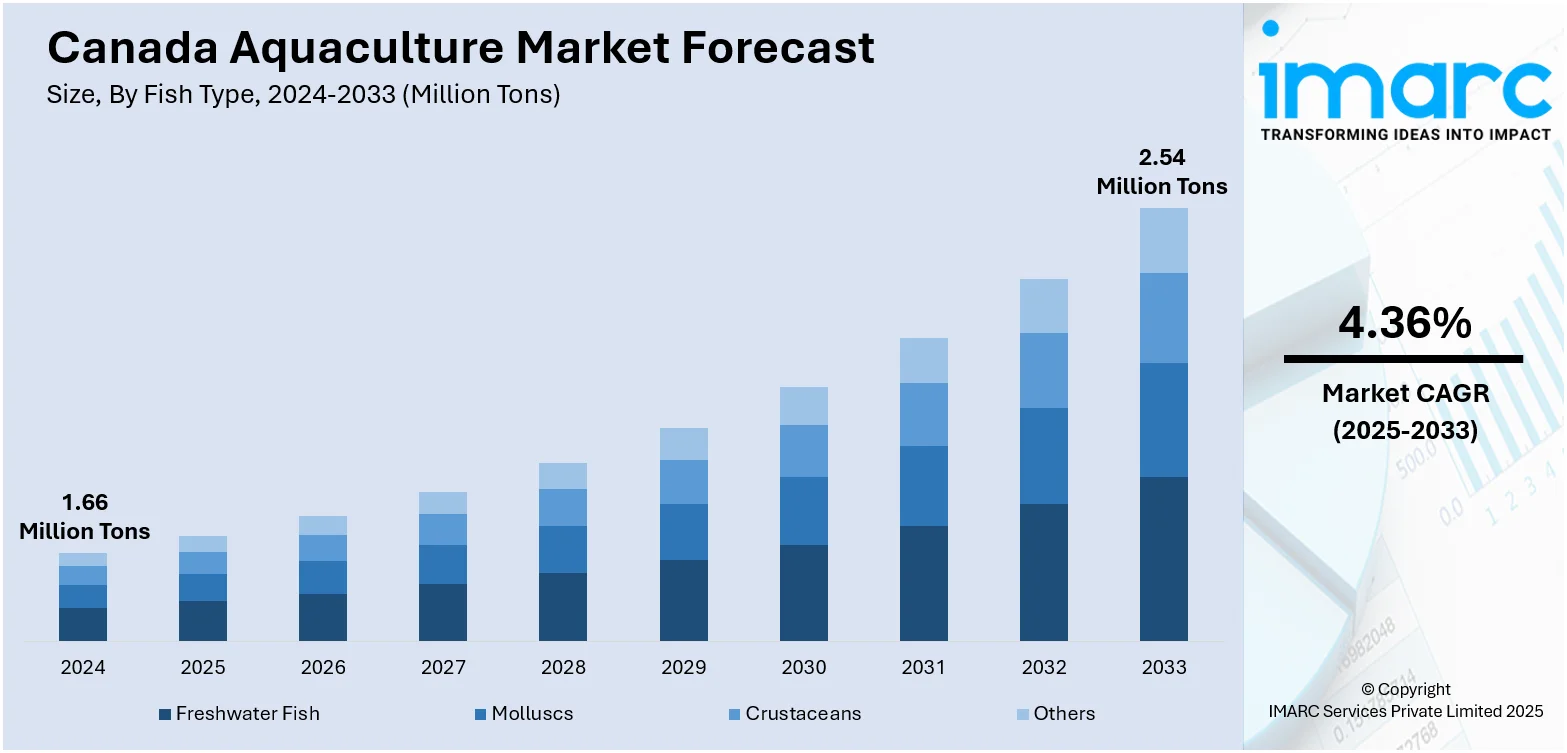

The Canada aquaculture market size reached 1.66 Million Tons in 2024. Looking forward, the market is projected to reach 2.54 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.36% during 2025-2033. The market is growing, supported by rich marine resources, export demand, and government mandates for sustainable production. Growth in closed-containment and feed innovation strengthens the Canada aquaculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.66 Million Tons |

| Market Forecast in 2033 | 2.54 Million Tons |

| Market Growth Rate 2025-2033 | 4.36% |

Canada Aquaculture Market Trends:

Expansion of Marine Salmon and Shellfish Sectors

Canada’s marine component, heavily focused on salmon and shellfish, is expanding to serve global markets. The country is exploring alternative species and offering premium-quality seafood. Export-driven growth, supported by stable ocean territory and infrastructure, sustains industry momentum. Enhanced aquaculture cages, selective breeding, and improved logistics contribute to production resilience. These marine innovations are critical to Canada aquaculture market growth, widening value streams while preserving sustainability. For instance, in July 2025, Nova Scotia introduced a coastal mapping tool designed to support sustainable aquaculture development for oysters, mussels, salmon, and trout. Created in partnership with the Centre for Marine Applied Research, the tool offers data on factors like water depth, temperature, and distance from protected zones to aid in site selection. Alongside this, the province allocated USD 1.27 Million to 22 seafood-sector projects aimed at reducing carbon emissions. Together, these initiatives strengthen sustainability and drive economic growth in Nova Scotia’s aquaculture industry.

To get more information on this market, Request Sample

Transition to Closed-Containment / RAS Systems

In response to environmental concerns, Canada is phasing out open-net pens in sensitive coastal areas and transitioning to closed-containment aquaculture systems by 2029. Land-based recirculating aquaculture systems (RAS) and flow-through systems offer reduced ecological risk, improved biosecurity, and greater flexibility in site location. Innovations in containment materials and biofiltration technology are also helping to lower operational costs. Backed by regulatory support and incentive programs, these system upgrades are central to the growth of Canada's aquaculture sector, enabling production expansion while safeguarding ecosystems. Further advancing this shift, the Canadian government announced on June 19, 2024, a full ban on open net-pen salmon aquaculture in British Columbia’s coastal waters, effective by June 30, 2029, to protect wild Pacific salmon. A detailed transition plan will guide this process, including economic support measures, stricter licensing conditions, and broader stakeholder engagement, particularly with industry and First Nations. During the five-year transition period, operations moving toward closed containment may qualify for extended nine-year licences, reinforcing Canada’s commitment to sustainable aquaculture, reconciliation, and environmental innovation.

Canada Aquaculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033 Our report has categorized the market based on fish type, environment, and distribution channel.

Fish Type Insights:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

The report has provided a detailed breakup and analysis of the market based on the fish type. This includes freshwater fish, molluscs, crustaceans, and others.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

A detailed breakup and analysis of the market based on the environment have also been provided in the report. This includes fresh water, marine water, and brackish water.

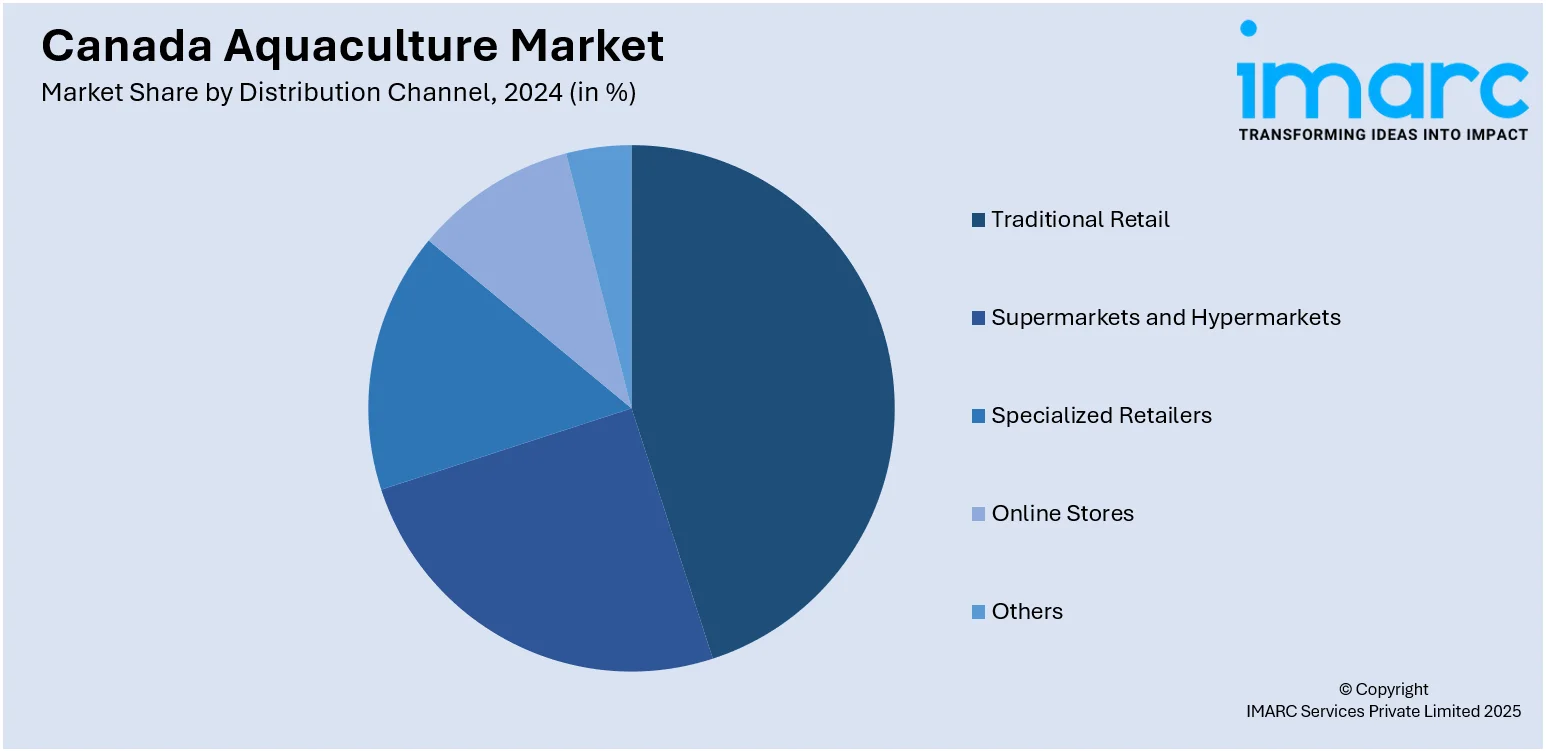

Distribution Channel Insights:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Aquaculture Market News:

- In July 2025, Grieg Seafood agreed to sell its operations in Finnmark and Canada to Cermaq for USD 988 Million. The deal includes Grieg’s sites in Newfoundland, British Columbia, and North American sales, allowing Grieg to focus on Rogaland, Norway. Cermaq, a Mitsubishi subsidiary, aims to expand its sustainable salmon farming. Both companies emphasize fish welfare and environmental responsibility.

- In March 2025, Canada’s Atlantic Canada Opportunities Agency (ACOA) invested $473,000 in a two-year initiative led by the Atlantic Canada Fish Farmers Association (ACFFA) to boost growth, sustainability, and innovation in the region’s finfish aquaculture sector. The project focuses on workforce development, marketing, and global outreach, including a trade mission to Aquanor 2025 in Norway.

Canada Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada aquaculture market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada aquaculture market on the basis of fish type?

- What is the breakup of the Canada aquaculture market on the basis of environment?

- What is the breakup of the Canada aquaculture market on the basis of distribution channel?

- What is the breakup of the Canada aquaculture market on the basis of region?

- What are the various stages in the value chain of the Canada aquaculture market?

- What are the key driving factors and challenges in the Canada aquaculture market?

- What is the structure of the Canada aquaculture market and who are the key players?

- What is the degree of competition in the Canada aquaculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada aquaculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)