Canada Automotive Electronics Market Size, Share, Trends and Forecast by Component, Vehicle Type, Distribution Channel, Application, and Region, 2025-2033

Canada Automotive Electronics Market Overview:

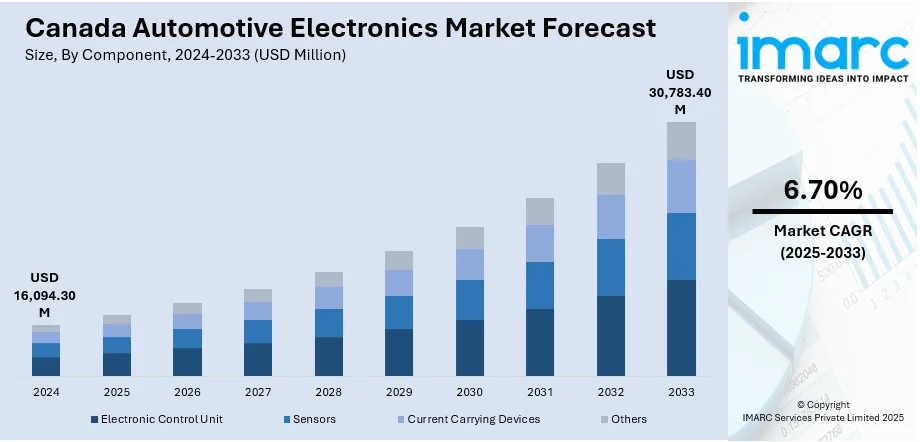

The Canada automotive electronics market size reached USD 16,094.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 30,783.40 Million by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The rising vehicle electrification, increasing demand for advanced driver-assistance systems (ADAS), rapid integration of Internet of Things (IoT) technology, enhanced connectivity features, supportive government initiatives for vehicle safety, the growing shift towards electric vehicles (EVs), and consumer preference for smart and innovative automotive solutions are some of the key factors strengthening the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16,094.30 Million |

| Market Forecast in 2033 | USD 30,783.40 Million |

| Market Growth Rate 2025-2033 | 6.70% |

Canada Automotive Electronics Market Analysis:

- Major Market Drivers: Government incentives, environmental regulations, and adoption of EVs are major drivers. Growing demand for battery systems and power electronics stimulates innovation. Canada automotive electronics market analysis indicates how electrification and sustainability objectives are transforming supply chains and technology priorities throughout the industry.

- Key Market Trends: Over-the-air updates, vehicle connectivity, and advanced driver-assistance systems are future trends. 5G and AI are being incorporated by automakers into infotainment and safety features. These are trends that are synchronized with changing customer expectations and digital mobility experiences in Canada's automotive technology space.

- Competitive Landscape: Canada's market features international suppliers and local specialists targeting ADAS, telematics, and EV electronics. Collaborations with automakers provide quicker product launches. Innovation clusters and tech hubs are enhancing capabilities and establishing a dynamic, innovation-based competitive landscape for automotive electronics.

- Challenges and Opportunities: Excessive cost of components, shortages of talent, and complexity of integration are challenges. However, growth in EV adoption, smart mobility, and connected vehicle presents enormous opportunities. Canada automotive electronics market demand will grow, stimulated by technology adoption and pro-government policies.

Canada Automotive Electronics Market Trends:

Electrification of vehicles

The transition toward electric vehicles (EVs) is a major trend shaping the automotive electronics sector in Canada. With zero-emission vehicles making up 16.5% of new vehicle registrations in Q3 2024, the industry is experiencing swift electrification. Government initiatives to cut greenhouse gas (GHG) emissions and enforce stricter environmental regulations are accelerating this shift. Growing demand for batteries, electric powertrains, and power management systems is driving automotive electronics innovation, with the aim of efficient energy usage and better battery performance. Lithium-ion and solid-state battery technology improvements are enhancing vehicle range and lowering charging times. The growth of charging infrastructure is also contributing to demand for electronic components, supporting the industry's growth. This shift is significantly impacting the Canada automotive electronics market share as manufacturers realign their production capabilities to support EV systems.

To get more information on this market, Request Sample

Advanced driver-assistance systems (ADAS)

ADAS integration is among the most prevalent trends in the automotive sector due to consumer pull for increased safety and regulatory pressures. Adaptive cruise control, lane-keeping, and collision prevention systems are all becoming more pervasive in new cars. These advanced systems are all based on state-of-the-art automotive electronics technology, such as sensors, cameras, and radar technology, which enhance road safety. Regulatory authorities are also supporting this trend, and the National Highway Traffic Safety Administration (NHTSA) is making Automatic Emergency Braking (AEB) mandatory for all passenger vehicles, trucks, and buses weighing up to 10,000 pounds to avoid crashes. Increasing concern for road safety and increased regulation are encouraging vehicle manufacturers to make heavy investments in ADAS technology. Consequently, demand for electronics related to ADAS is also likely to surge heavily, increasing market growth even further. This reflects one of the most influential Canada automotive electronics market trends emerging from both regulatory and technological drivers.

Connectivity and IoT integration

The growing focus on connectivity in vehicles is another driver fueling the automotive electronics market. The creation of connected vehicles that can talk to outside systems as well as between themselves is now possible due to the Internet of Things. Connectedness enhances driving by providing amenities such as remote diagnostics, over-the-air upgrades for software, and real-time traffic updates. Also, connected vehicles can utilize data analytics to provide more personalized services depending on vehicle performance as well as driver behavior. It is also expected that the advent of fifth generation (5G) technology will further augment connectivity, enabling faster and more secure communication between the car and infrastructure. This trend is motivating vehicle manufacturers to invest in telematics, infotainment systems, and other electronic features that enable connectivity features, thus supporting the growth of the auto electronics market in Canada. Such advancements highlight the ongoing Canada automotive electronics market growth across both consumer and commercial segments.

Canada Automotive Electronics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, vehicle type, distribution channel and application.

Component Insights:

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes electronic control unit, sensors, current carrying devices, and others.

Vehicle Type Insights:

- Light Commercial Vehicles

- Passenger Vehicles

- Heavy Commercial Vehicles

- Others

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes light commercial vehicles, passenger vehicles, heavy commercial vehicles, and others.

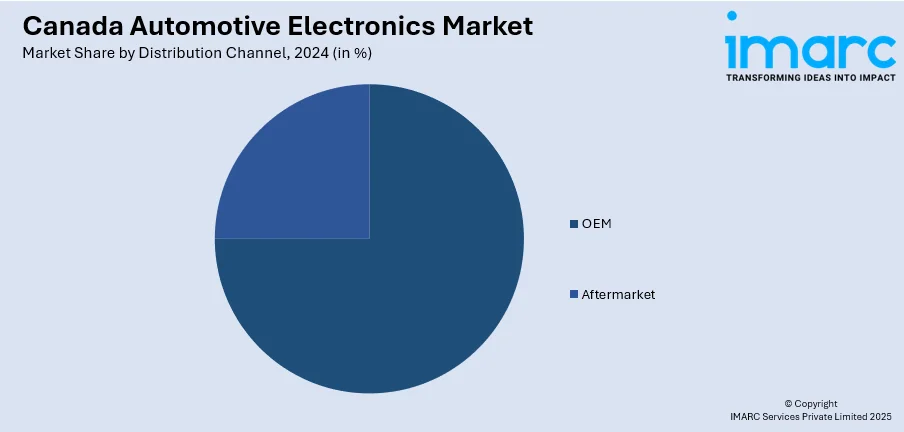

Distribution Channel Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEM, and aftermarket.

Application Insights:

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes ADAS, infotainment, body electronics, safety systems, and powertrain.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Automotive Electronics Market News:

- In December 2024, Canadian company Tenstorrent and South Korea's Hyundai Motor Group-backed BOS Semiconductors released "Eagle-N," the world's first automotive chiplet AI accelerator for infotainment and autonomous driving. Produced through Samsung's 5nm process, the chips are aimed at improving customization and cost-effectiveness for future connected cars.

- In April 2024, Toronto-based Untether AI announced a collaboration with Arm to deliver high-performance, energy-efficient AI solutions for automotive applications. The partnership integrates Untether AI’s inference acceleration with Arm's Automotive Enhanced technology to support advanced driver-assistance systems and software-defined vehicle platforms, addressing key performance, safety, and power efficiency requirements.

Canada Automotive Electronics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Electronic Control Unit, Sensors, Current Carrying Devices, Others |

| Vehicle Types Covered | Light Commercial Vehicles, Passenger Vehicles, Heavy Commercial Vehicles, Others |

| Distribution Channels Covered | OEM, Aftermarket |

| Applications Covered | ADAS, Infotainment, Body Electronics, Safety Systems, Powertrain |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada automotive electronics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada automotive electronics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada automotive electronics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive electronics market in Canada was valued at USD 16,094.30 Million in 2024.

The Canada automotive electronics market is projected to exhibit a (CAGR) of 6.70% during 2025-2033, reaching a value of USD 30,783.40 Million by 2033.

Key drivers of the Canada automotive electronics market are the increasing usage of electric vehicles, incentives by the government towards zero-emission transport, and stricter regulations on emissions. Amplifying demand for ADAS, vehicle connectivity, and battery management systems is also driving innovation. The development of 5G, IoT, and smart mobility infrastructure is also driving the growth of the market in several segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)