Canada Bioresorbable Polymers Market Size, Share, Trends and Forecast by Product, Application, End Use, 2026-2034

Canada Bioresorbable Polymers Market Summary:

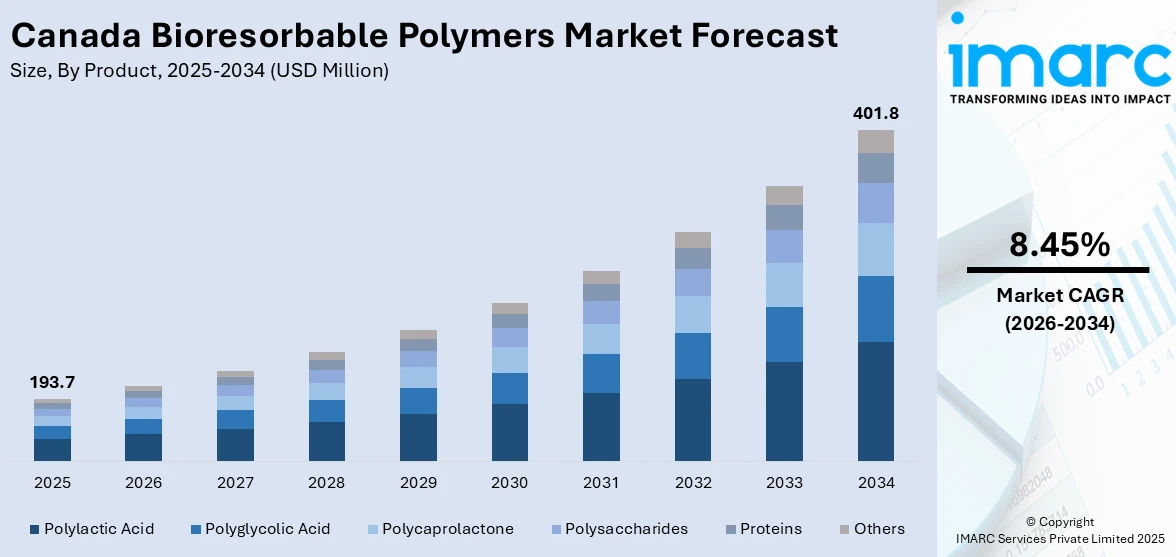

The Canada bioresorbable polymers market size was valued at USD 193.7 Million in 2025 and is projected to reach USD 401.8 Million by 2034, growing at a compound annual growth rate of 8.45% from 2026-2034.

The Canada bioresorbable polymers market is driven by increasing adoption of biodegradable medical materials across healthcare settings. Rising demand for advanced drug delivery systems, orthopedic implants, and surgical sutures that safely absorb within the body is fueling expansion. Growing preference for minimally invasive procedures and sustainable medical solutions among healthcare providers continues to strengthen the Canada bioresorbable polymers market outlook.

Key Takeaways and Insights:

- By Product: Polylactic acid dominates the market with a share of 38% in 2025, owing to its excellent biocompatibility, biodegradability, and versatile applications in medical devices. The polymer's ability to degrade into harmless lactic acid metabolites makes it preferred for sutures, tissue scaffolds, and controlled drug release formulations.

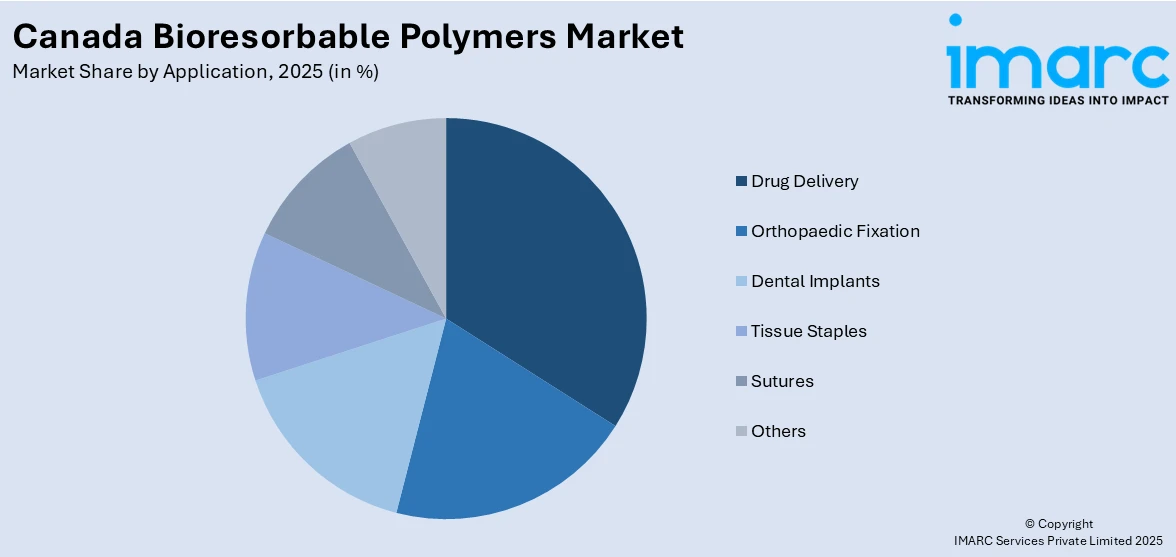

- By Application: Drug delivery leads the market with a share of 32% in 2025. This dominance is driven by increasing demand for targeted therapeutic delivery systems that provide controlled medication release while eliminating the need for surgical retrieval, enhancing patient convenience and treatment outcomes.

- By End Use: Hospitals represent the largest segment with a market share of 60% in 2025, reflecting their critical role in performing specialized surgical procedures utilizing bioresorbable implants across orthopedic, cardiovascular, and other complex medical interventions requiring advanced biocompatible materials.

- Key Players: Key players drive the Canada bioresorbable polymers market by expanding product portfolios, advancing polymer formulations with improved degradation rates, and strengthening distribution networks. Their investments in research, manufacturing capacity, and partnerships with healthcare providers accelerate adoption across diverse medical applications. Some of the key players operating in the market include Ashland, Bezwada Biomedical LLC, Corbion, Evonik Industries, Foster Corporation, Polysciences, Inc., Putnam Plastics, and Zeus Industrial Products, Inc.

To get more information on this market Request Sample

The Canada bioresorbable polymers market is experiencing robust growth, driven by the expanding geriatric population and rising incidences of musculoskeletal disorders requiring advanced medical interventions. In 2024, 18.9% of the population in Canada was aged 65 and above, anticipated to increase to 24% by the close of the 2030s. Bioresorbable polymers offer significant advantages over traditional permanent implants by eliminating the need for secondary removal surgeries, thereby reducing infection risks, healthcare costs, and patient discomfort. The increasing adoption of minimally invasive surgical procedures across Canadian healthcare facilities is creating substantial demand for biocompatible materials that safely degrade within the body. Healthcare providers are increasingly recognizing the clinical benefits of these polymers in applications, ranging from orthopedic fixation devices to sophisticated drug delivery systems. The rising focus on sustainable medical solutions, combined with technological advancements in polymer chemistry, is further propelling market expansion across therapeutic applications.

Canada Bioresorbable Polymers Market Trends:

Integration of 3D Printing Technologies

The integration of additive manufacturing with bioresorbable polymers is revolutionizing medical device production in Canada. 3D printing enables the fabrication of patient-specific scaffolds, implants, and drug delivery constructs with precise geometries tailored to individual anatomical requirements. This technology allows healthcare providers to create customized tissue engineering solutions that optimize healing outcomes while controlling degradation profiles for specific therapeutic needs. Additionally, additive manufacturing reduces material waste and shortens production timelines, making personalized bioresorbable medical devices more cost-effective and scalable for clinical use.

Advanced Controlled-Release Drug Delivery Systems

Canadian healthcare institutions are increasingly adopting sophisticated drug delivery platforms utilizing bioresorbable polymer matrices for targeted therapeutic release. These systems enable precise medication administration at specific sites while gradually degrading into biocompatible metabolites. The development of nanoparticle-based carriers and microsphere technologies is enhancing treatment efficacy for chronic conditions, including cardiovascular diseases and oncological applications, requiring sustained medication delivery. In Canada, it was projected that 247,100 individuals would be diagnosed with cancer in 2024, resulting in 88,100 fatalities.

Growing Preference for Minimally Invasive Procedures

The shift towards minimally invasive surgical techniques across Canadian hospitals is driving demand for bioresorbable polymer-based devices. These materials support smaller incision procedures while providing necessary mechanical support during healing before safely dissolving. Healthcare providers increasingly prefer absorbable fixation devices, sutures, and implants that reduce operative trauma, shorten recovery times, and eliminate the complications associated with permanent implant retention. This trend is further accelerating the adoption of innovative bioresorbable polymer solutions in orthopedics, cardiovascular, and soft tissue repair applications across Canada.

Market Outlook 2026-2034:

The Canada bioresorbable polymers market demonstrates strong growth potential, driven by increasing healthcare investments and aging demographics. Technological innovations in polymer formulations are enhancing mechanical properties and degradation control, expanding applications across medical specialties. The market generated a revenue of USD 193.7 Million in 2025 and is projected to reach a revenue of USD 401.8 Million by 2034, growing at a compound annual growth rate of 8.45% from 2026-2034. Rising surgical volumes, particularly among elderly populations, combined with expanding applications in tissue engineering and regenerative medicine, position the market for sustained expansion throughout the forecast period. Additionally, growing awareness among healthcare providers and patients about the benefits of bioresorbable implants over permanent devices is further fueling adoption and market growth in Canada.

Canada Bioresorbable Polymers Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Polylactic Acid |

38% |

|

Application |

Drug Delivery |

32% |

|

End Use |

Hospitals |

60% |

Product Insights:

- Polylactic Acid

- Polyglycolic Acid

- Polycaprolactone

- Polysaccharides

- Proteins

- Others

Polylactic acid dominates with a market share of 38% of the total Canada bioresorbable polymers market in 2025.

Polylactic acid represents the preferred product in the market, due to its exceptional biocompatibility and predictable degradation characteristics. Made from renewable resources, including corn starch and sugarcane, polylactic acid degrades via hydrolysis to lactic acid, which naturally and safely rests in the body because it is a body metabolite. Polylactic acid boasts excellent mechanical properties and can be used in sutures, orthopedic fixations, and tissue engineering scaffolds due to its versatility and process ability into 3D printed personal implants and scaffolds in modern medicine applications.

The widespread use of polylactic acid in the Canadian market can be attributed to its established regulatory approvals and more affordable manufacturing processes relative to other bioresorbable materials. Medical practitioners widely prefer polylactic acid for use in situations involving moderate strength with specified biodegradation intervals of several months to years. An important property of polylactic acid is its radiolucency, making it feasible for medical imaging with fewer artifacts from metal. Research on copolymers is enhancing its use in demanding phases of medical interventions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Drug Delivery

- Orthopaedic Fixation

- Dental Implants

- Tissue Staples

- Sutures

- Others

Drug delivery leads with a share of 32% of the total Canada bioresorbable polymers market in 2025.

Drug delivery dominates the Canada bioresorbable polymers market because it directly improves patient outcomes and treatment convenience. Polymer-based carriers allow medications to be delivered exactly where they are needed and released gradually over days or months, helping maintain consistent therapeutic levels while reducing unwanted side effects. Bioresorbable microspheres, nanoparticles, and implantable matrices are increasingly used to manage chronic conditions, such as diabetes and cancer, lowering the need for frequent injections or repeat procedures. As per IMARC Group, the Canada diabetes market size reached USD 3,895.3 Million in 2025.

The segment is supported by rising pharmaceutical investments in biodegradable polymer technologies for next-generation therapies. Canadian healthcare providers are adopting drug-eluting bioresorbable stents and implants that deliver medication while naturally dissolving, improving long-term comfort and safety. These systems eliminate foreign body retention concerns while ensuring consistent therapeutic concentrations at treatment sites. Drug delivery systems utilizing bioresorbable materials support precise treatment and localized gradual resorption, particularly valuable for cardiovascular care applications requiring sustained medication presence without permanent implant complications.

End Use Insights:

- Hospitals

- Ambulatory Surgical Centers

- Others

Hospitals exhibit a clear dominance with a 60% share of the total Canada bioresorbable polymers market in 2025.

Hospitals dominate bioresorbable polymer consumption in Canada due to their essential role in performing complex surgical procedures utilizing advanced biodegradable implants. These facilities possess the specialized infrastructure, trained medical personnel, and financial resources necessary to adopt sophisticated bioresorbable technologies across orthopedic, cardiovascular, and reconstructive applications. Hospital surgical departments require high-quality absorbable materials for procedures ranging from fracture fixation to soft tissue repair. Total healthcare spending in Canada reached CAD 372 Billion in 2024, with hospitals accounting for 26.8% of expenditures, representing the largest single spending category in the healthcare system.

The hospital segment benefits from increasing surgical volumes, driven by demographic changes and expanding treatment capabilities. Canadian hospitals handle substantial patient volumes requiring bioresorbable devices for both elective and emergency procedures. The adoption of value-based care models incentivizes bioresorbable implant utilization to reduce readmissions and shorten hospital stays. Additionally, hospitals are increasingly investing in training programs and advanced surgical equipment to support the safe and effective use of bioresorbable polymers.

Market Dynamics:

Growth Drivers:

Why is the Canada Bioresorbable Polymers Market Growing?

Expanding Geriatric Population and Rising Musculoskeletal Disorders

Canada is experiencing significant demographic shifts with its aging population driving unprecedented demand for orthopedic and medical interventions utilizing bioresorbable polymers. The elderly population segment is particularly susceptible to conditions, including osteoporosis, osteoarthritis, and bone fractures, requiring surgical treatment with advanced biodegradable materials. Bioresorbable implants offer substantial advantages for geriatric patients by eliminating the need for secondary removal surgeries, reducing infection risks, and minimizing recovery complications associated with permanent hardware. Additionally, these implants support gradual load transfer to healing bone, improving recovery outcomes in fragile patients. Rising healthcare investments and increased access to orthopedic care are further accelerating adoption, while surgeons increasingly favor bioresorbable polymers to enhance patient comfort, reduce long-term complications, and improve overall treatment efficiency across geriatric care pathways.

Substantial Healthcare Investment and System Modernization

The Canadian healthcare system is undergoing significant modernization, supported by substantial federal and provincial investments aimed at improving patient care and clinical outcomes. Government initiatives are prioritizing advanced medical technologies, including bioresorbable materials that enhance surgical effectiveness while reducing long-term healthcare costs. In 2023, the federal government announced delivery of additional USD 200 Billion over ten years to strengthen public healthcare infrastructure, enabling hospitals and surgical centers to adopt sophisticated biodegradable implant technologies. These investments support facility upgrades, equipment procurement, and workforce development necessary for implementing bioresorbable polymer applications across medical specialties. Healthcare institutions are increasingly integrating absorbable fixation devices and drug delivery systems into standard treatment protocols as funding enables technology adoption. The focus on reducing surgical backlogs and wait times is accelerating procurement of efficient bioresorbable solutions that streamline procedures.

Growing Demand for Biocompatible and Sustainable Medical Solutions

Healthcare providers across Canada are increasingly prioritizing biocompatible materials that align with patient safety requirements and environmental sustainability goals. Bioresorbable polymers address both concerns by safely degrading within the body into harmless metabolites while eliminating permanent foreign material retention. The medical community recognizes that absorbable implants reduce chronic inflammation responses, implant-related complications, and the psychological burden of permanent hardware presence. Patients increasingly prefer treatment options utilizing biodegradable materials that minimize long-term health implications while supporting natural healing processes. The shift towards sustainable healthcare practices is driving institutional procurement policies favoring renewable resource-derived polymers over petroleum-based permanent alternatives. Technological advancements in polymer chemistry are enabling the development of formulations with enhanced mechanical properties and controlled degradation profiles suitable for demanding clinical applications.

Market Restraints:

High Production Costs and Complex Manufacturing Requirements

Bioresorbable polymers require specialized manufacturing processes and stringent quality controls that significantly increase production costs compared to conventional medical materials. The complex synthesis procedures, purification requirements, and sterilization protocols necessary to achieve medical-grade purity levels create substantial cost premiums affecting market accessibility. These high costs can limit widespread adoption in price-sensitive healthcare systems, particularly in emerging markets.

Stringent Regulatory Approval Processes

Government agencies maintain rigorous regulatory frameworks for bioresorbable medical devices requiring extensive preclinical testing, biocompatibility documentation, and clinical validation before market approval. These comprehensive evaluation processes extend product development timelines and increase investment requirements, potentially limiting innovation pace and market entry for newer formulations. Regulatory delays can also increase the risk exposure for manufacturers, impacting strategic planning and resource allocation.

Mechanical Property Limitations for Load-Bearing Applications

A key challenge for bioresorbable polymers is their mechanical strength limitations, which restrict applicability in high-stress load-bearing orthopedic implants. The inherent trade-off between biodegradability and structural integrity makes it difficult to develop devices that provide extended mechanical support while safely resorbing over time. This challenge limits adoption in demanding clinical scenarios and necessitates ongoing research into reinforced composites and advanced polymer formulations to overcome performance constraints.

Competitive Landscape:

The Canada bioresorbable polymers market exhibits a moderately consolidated competitive structure, characterized by established specialty chemical manufacturers and medical device suppliers competing through technological differentiation and product quality. Market participants focus on expanding polymer portfolios with enhanced degradation profiles and mechanical properties tailored to specific medical applications. Strategic partnerships between polymer manufacturers and healthcare institutions facilitate clinical validation and market adoption. Companies invest substantially in research and development (R&D) activities to innovate formulations addressing emerging therapeutic needs while maintaining regulatory compliance. Distribution network expansion and manufacturing capacity enhancement remain key competitive strategies, enabling market share growth across Canadian healthcare facilities.

Some of the key players include:

- Ashland

- Bezwada Biomedical LLC

- Corbion

- Evonik Industries

- Foster Corporation

- Polysciences, Inc.

- Putnam Plastics

- Zeus Industrial Products, Inc.

Canada Bioresorbable Polymers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Polylactic Acid, Polyglycolic Acid, Polycaprolactone, Polysaccharides, Proteins, Others |

| Applications Covered | Drug Delivery, Orthopaedic Fixation, Dental Implants, Tissue Staples, Sutures, Others |

| End Uses Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Companies Covered | Ashland, Bezwada Biomedical LLC, Corbion, Evonik Industries, Foster Corporation, Polysciences, Inc., Putnam Plastics, and Zeus Industrial Products, Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Canada bioresorbable polymers market size was valued at USD 193.7 Million in 2025.

The Canada bioresorbable polymers market is expected to grow at a compound annual growth rate of 8.45% from 2026-2034 to reach USD 401.8 Million by 2034.

Polylactic acid dominated the market with a share of 38%, owing to its excellent biocompatibility, predictable degradation characteristics, and widespread applications in sutures, orthopedic devices, and drug delivery systems.

Key factors driving the Canada bioresorbable polymers market include expanding geriatric population with rising musculoskeletal disorders, substantial healthcare system investments, and growing demand for biocompatible materials eliminating secondary removal surgeries.

Major challenges include high production costs associated with specialized manufacturing processes, stringent regulatory approval requirements from Health Canada, mechanical property limitations for load-bearing applications, and complex quality control protocols for medical-grade materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)