Canada Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033

Canada Bottled Water Market Overview:

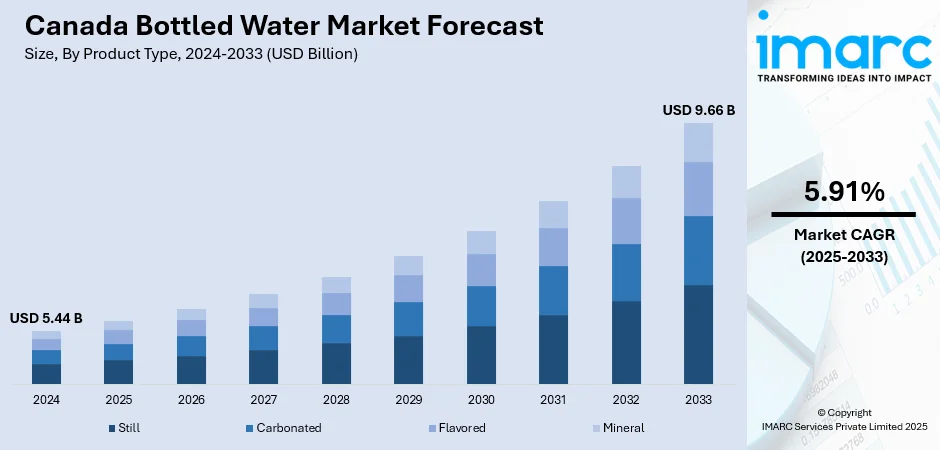

The Canada bottled water market size reached USD 5.44 Billion in 2024. Looking forward, the market is expected to reach USD 9.66 Billion by 2033, exhibiting a growth rate (CAGR) of 5.91% during 2025-2033. The market is fueled by increasing health awareness, which leads consumers to opt for clean, calorie-free drinking water instead of sugary beverages. Quality and safety concerns regarding tap water also tend to fuel use of bottled water. Sustainability efforts like recycled and plant-based packaging resonate with nature-conscious Canadians, while local pride in regionally sourced spring water brands reinforces consumer trust and further influence the Canada bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.44 Billion |

| Market Forecast in 2033 | USD 9.66 Billion |

| Market Growth Rate 2025-2033 | 5.91% |

Canada Bottled Water Market Trends:

Health and Wellness-Driven Choices

In Canada, the market for bottled water is dominated by an increasing emphasis on health and wellness. Bottled water is becoming more and more popular as a calorie-free, healthier alternative to sugar-sweetened beverages. This shift is most noticeable among urban dwellers and health-conscious consumers who view bottled water as an integral part of a wellness lifestyle rather than just a way to stay hydrated. Added-functionality products containing electrolytes, minerals, or vitamins are gaining traction as consumers look for added value from drinks. Natural and spring-purified water are also gaining popularity, seen as cleaner and healthier. This need for clean, natural hydration has pushed brands to get creative with wellness-driven products and marketing campaigns that highlight health, performance, and active lifestyles. As more Canadians make health a priority in their everyday decisions, bottled water is becoming a prevalent product in the functional drink category, further contributing to the Canada bottled water market growth.

To get more information on this market, Request Sample

Environmental Responsibility and Sustainable Packaging

Environmental sustainability is having a more and more significant impact on the Canadian bottled water category. People are very concerned about the environment, especially plastic pollution, and are making brands reduce their environmental footprint. Due to this, brands have taken to investing in environmentally friendly packaging, such as bottles made of recycled plastic, bioplastics, and even plant-based bottles. Local brands are also going the extra mile to cut their carbon footprint by getting their water locally and taking energy-efficient bottling techniques. These initiatives strongly resonate with Canadian cultural values of environmental conservation and stewardship. Companies that speak to their sustainability commitment tend to have higher customer loyalty, particularly among younger, eco-conscious consumers. In addition, the growth of reusable bottled water packaging and refills is getting increasingly noticed in major cities, where consumers desire convenience coupled with reduced environmental footprint. Generally, the pressure for more sustainable solutions is promoting innovation and defining the future of Canada's bottled water.

Convenience, Distribution, and Digital Innovation

Convenience continues to be a powerful market driver in Canada's bottled water market. Bottled water is conveniently found in a range of retail settings, from supermarkets and convenience stores to vending machines, gyms, and cafes. This global availability allows customers to conveniently buy bottled water at any time during the day, aligning with their busy and on-the-go lifestyles. Additionally, e-commerce and at-home delivery are creating a new dimension of convenience. Direct subscriptions or online shopping are being introduced by several brands of bottled water to reach households and offices alike. Alongside physical distribution, digital participation is emerging as a significant trend. Brands are using social media, mobile applications, and influencer collaborations to engage with consumers and encourage hydration as a lifestyle choice. Some are even integrating technology into their products, providing QR codes for point-of-source information or tailored advice on hydration. These innovations are indicative of the changing demands of Canadian consumers, both in terms of convenience and experience.

Canada Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

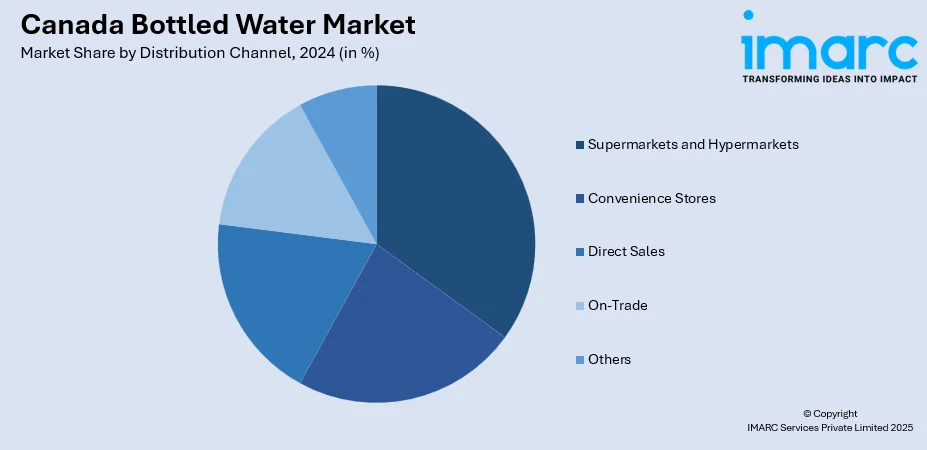

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, direct sales, on-trade, and others.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

A detailed breakup and analysis of the market based on the packaging type has also been provided in the report. This includes PET bottles, metal cans, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada bottled water market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada bottled water market on the basis of product type?

- What is the breakup of the Canada bottled water market on the basis of distribution channel?

- What is the breakup of the Canada bottled water market on the basis of packaging type?

- What is the breakup of the Canada bottled water market on the basis of region?

- What are the various stages in the value chain of the Canada bottled water market?

- What are the key driving factors and challenges in the Canada bottled water market?

- What is the structure of the Canada bottled water market and who are the key players?

- What is the degree of competition in the Canada bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)