Canada Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Canada Carbon Black Market Overview:

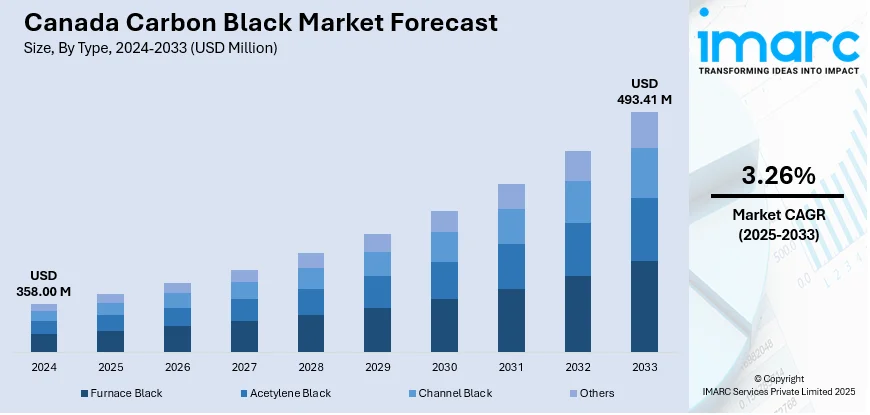

The Canada carbon black market size reached USD 358.00 Million in 2024. Looking forward, the market is projected to reach USD 493.41 Million by 2033, exhibiting a growth rate (CAGR) of 3.26% during 2025-2033. The market is driven by significant tire and vehicle production standards demanding high-performance carbon variants, alongside regulatory mandates that elevate specialty grade adoption. Simultaneously, regulatory emphasis on emissions reduction and feedstock innovations fosters sustainable manufacturing and broad compliance alignment, further augmenting the Canada carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 358.00 Million |

| Market Forecast in 2033 | USD 493.41 Million |

| Market Growth Rate 2025-2033 | 3.26% |

Canada Carbon Black Market Trends:

Automotive and Tire Industry Demand Coupled with Specialized Legislation

Canada’s mature automotive and tire manufacturing sector serves as a consistent anchor for carbon black demand. As of 2024, there are 58 tire manufacturing businesses in Canada, reflecting a 1.8% increase from 2023. Over the five-year period from 2019 to 2024, the sector has grown at an average annual rate of 1.8%. Passenger and commercial tire production, especially in Ontario and Quebec, requires high-reinforcement grades to improve tensile strength, abrasion resistance, and durability. As electric vehicles gain traction, tire makers are increasingly using high-surface-area furnace blacks to manage higher torque and battery load. At the same time, Canada’s mandatory tire-labeling regulations mandate rolling resistance and wet grip scoring, prompting reformulation with higher-performance specialty-grade carbon black. These regulations incentivize use of premium black types optimized for particle morphology, enabling premium pricing and enhanced technical performance. Independent testing and conformity demonstration strengthen supplier positioning. Stable automotive production, tire standards and premium-grade requirements are fundamental drivers of Canada carbon black market growth.

To get more information on this market, Request Sample

Environmental Regulations and Sustainable Feedstock Innovations

Canada’s stringent environmental oversight compels industry players to adopt cleaner production practices in carbon black manufacturing. Regulatory bodies such as Environment Canada enforce emissions reduction, waste management, and energy efficiency standards, shaping plant operations. Producers are investing in novel feedstocks like bio-oils and biomass pyrolysis and exploring CO₂ capture technologies at scale to minimize environmental impact. These efforts align with broader national commitments to net-zero emissions and circular economy priorities, supported by financial mechanisms and emerging carbon credit markets. Moreover, recovered carbon black (rCB) adoption is encouraged by OEM ESG targets in automotive and sustainability-focused sectors. In 2025, Cabot Canada Limited received USD 5,634,000 (around 5.63 Million) through Canada’s Decarbonization Incentive Program to upgrade its carbon black facility by recovering thermal energy from tail gas for onsite power via cogeneration. This project is expected to cut emissions by 51,100 tCO₂e by 2030, supporting Canada's broader industrial decarbonization goals and strengthening its competitive position in the global carbon black market. These environmental drivers not only align operational models with regulatory expectations but also appeal to value-conscious buyers seeking lower-impact materials, reinforcing market maturity and demand stability.

Canada Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

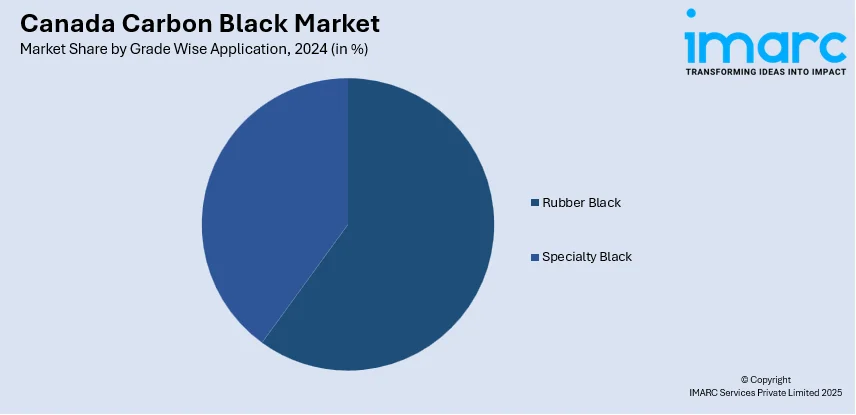

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Carbon Black Market News:

- In July 2025, Canadian cleantech company Ecolomondo shipped a second commercial truckload of 23 metric tons of recovered carbon black (rCB) from its Hawkesbury TDP facility, following a repeat order from its primary offtake client after meeting strict quality benchmarks. The fully operational facility is designed to process 1 Million scrap tires annually, producing approximately 4,000 metric tons of rCB, 5,000 metric tons of pyrolysis oil, 2,000 metric tons of steel, and 1,200 metric tons of process gas.

Canada Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada carbon black market on the basis of type?

- What is the breakup of the Canada carbon black market on the basis of grade wise application?

- What is the breakup of the Canada carbon black market on the basis of region?

- What are the various stages in the value chain of the Canada carbon black market?

- What are the key driving factors and challenges in the Canada carbon black market?

- What is the structure of the Canada carbon black market and who are the key players?

- What is the degree of competition in the Canada carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)