Canada CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Canada CCTV Camera Market Overview:

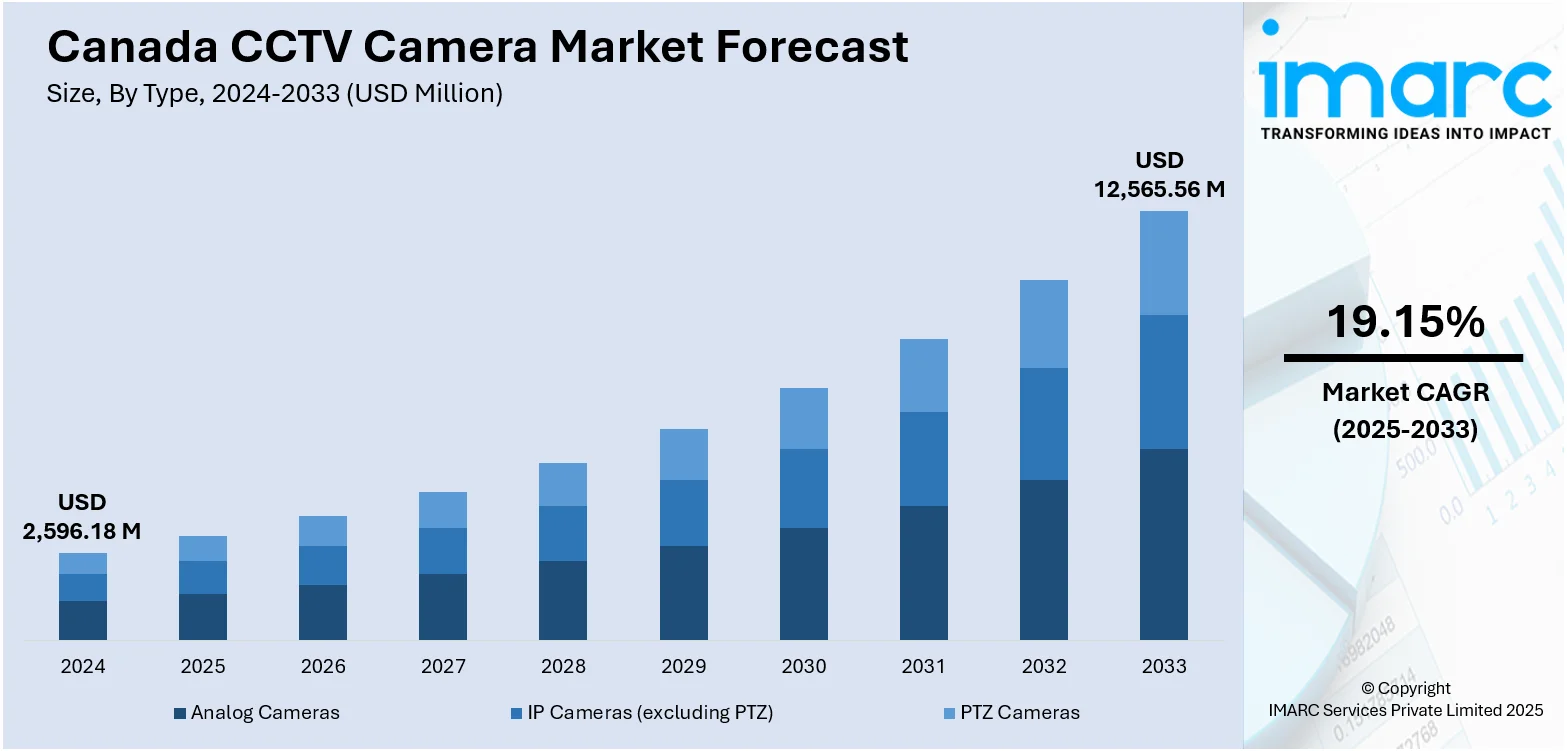

The Canada CCTV camera market size reached USD 2,596.18 Million in 2024. Looking forward, the market is projected to reach USD 12,565.56 Million by 2033, exhibiting a growth rate (CAGR) of 19.15% during 2025-2033. The market is expanding steadily, driven by heightened public safety awareness, urban infrastructure upgrades, and increased adoption across commercial, industrial, and residential sectors. Advanced technologies like AI-driven analytics, remote monitoring, and high‑resolution imaging are enhancing system capabilities and user convenience. Additionally, integration with smart city projects and transport networks is boosting demand. As surveillance becomes more pervasive and sophisticated, Canada CCTV camera market share is expected to grow consistently.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,596.18 Million |

| Market Forecast in 2033 | USD 12,565.56 Million |

| Market Growth Rate 2025-2033 | 19.15% |

Canada CCTV Camera Market Trends:

Migration to IP and AI-Enhanced Systems

The Canada CCTV camera market is experiencing a major transition from conventional analog systems to advanced IP-based and AI-driven surveillance technology. This change is driven by the increasing need for intelligent, real-time monitoring solutions in commercial, industrial, and public domains. IP cameras bring benefits such as enhanced image quality, remote access, and improved scalability, making them more appealing for contemporary infrastructure. Additionally, AI features like facial recognition, motion tracking, and behavioral analysis are boosting the effectiveness of surveillance systems. For instance, in June 2025, Leamington announced its plans to enhance waterfront safety by installing AI-powered security cameras at key locations, including the marina and parks. The USD 115,000 project, part of a broader safety initiative, aims to deter disruptive behavior and includes improved lighting and signage. OPP will boost their presence to support enforcement efforts. These capabilities facilitate automated threat detection, enhance response effectiveness, and ease the workload on operators. As the demand for public safety rises and businesses look to improve operational efficiency, AI-equipped cameras are becoming essential to modern security approaches. This ongoing adoption of technology is anticipated to significantly influence the Canada CCTV camera market growth in the years ahead.

To get more information on this market, Request Sample

Smart City and Infrastructure Integration

The incorporation of CCTV systems into Canada's progressive smart city projects is transforming the surveillance landscape across the nation. Local governments are integrating these systems within public transportation, intelligent traffic management, and emergency response frameworks to enhance urban management and ensure citizen safety. Real-time video feeds from CCTV cameras facilitate better traffic flow, quicker incident detection, and effective crime prevention. For instance, in March 2024, Rogers Communications anounced its plans to install 5G cameras and sensors at five downtown Toronto intersections to manage traffic congestion. The initiative, approved by the city, aims to gather real-time data on vehicle and pedestrian movement, enabling AI-driven traffic signal adjustments to enhance flow and safety for all road users. These systems are becoming more interconnected with centralized command centers and IoT platforms, which allows for faster decision-making and coordinated responses. Furthermore, their integration with analytical software helps authorities recognize patterns, anticipate events, and proactively address potential risks. This merging of surveillance with smart infrastructure not only improves urban efficiency but also boosts public confidence in safety measures. As these technologies continue to expand, they are likely to drive significant growth in demand and investment, further accelerating the development of the CCTV camera market in Canada.

Canada CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

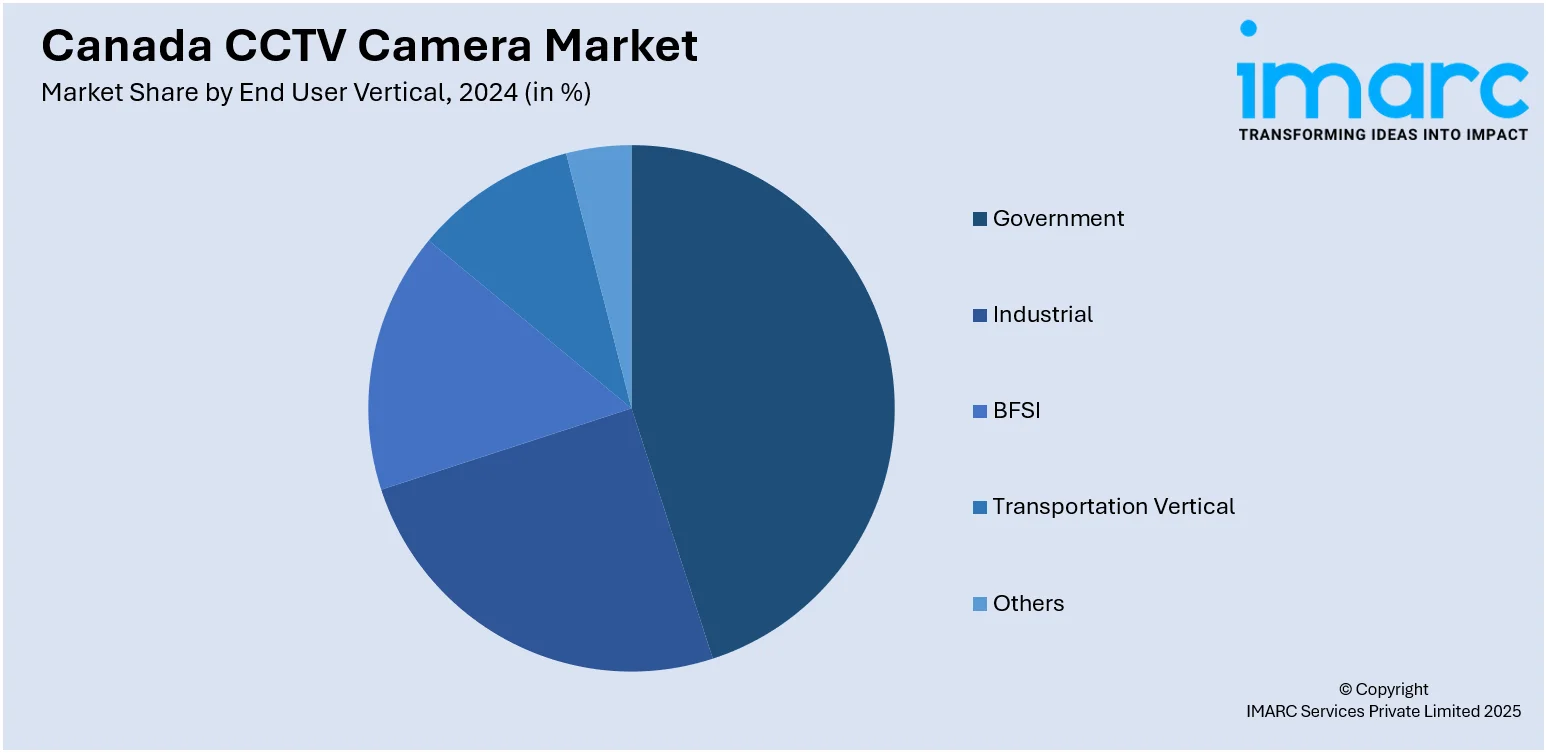

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada CCTV Camera Market News:

- In March 2024, World Guardian Security Services announced the launch of a CCTV camera installation service in Edmonton, Alberta, expanding nationwide in 2024. This new offering complements their cybersecurity solutions, addressing the growing demand for integrated security measures. The service includes consultation, installation, and ongoing maintenance to enhance asset protection.

Canada CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada CCTV camera market on the basis of type?

- What is the breakup of the Canada CCTV camera market on the basis of end user vertical?

- What is the breakup of the Canada CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Canada CCTV camera market?

- What are the key driving factors and challenges in the Canada CCTV camera market?

- What is the structure of the Canada CCTV camera market and who are the key players?

- What is the degree of competition in the Canada CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)