Canada Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Canada Commercial Insurance Market Overview:

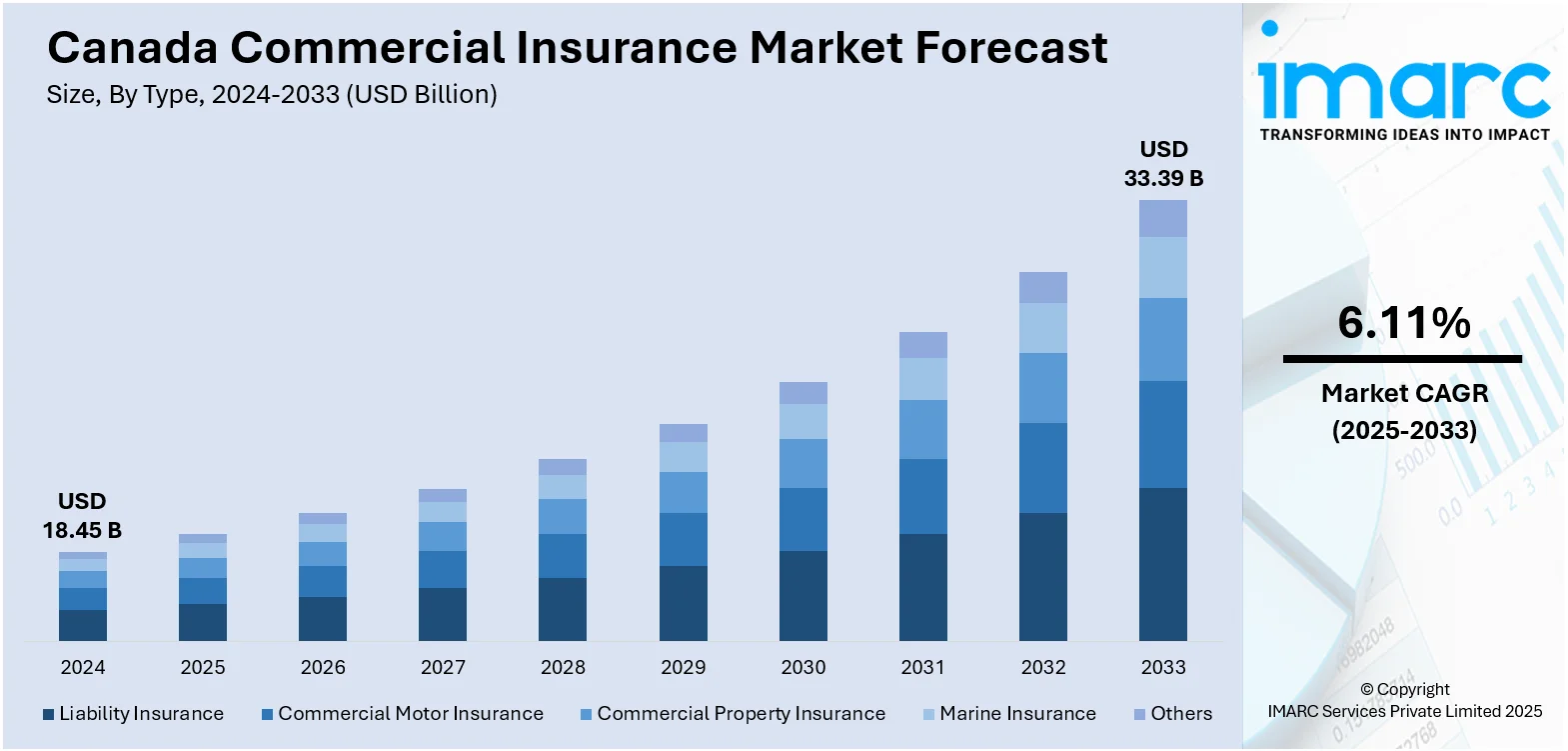

The Canada commercial insurance market size reached USD 18.45 Billion in 2024. The market is projected to reach USD 33.39 Billion by 2033, exhibiting a growth rate (CAGR) of 6.11% during 2025-2033. The market is expanding with increased demand for specialized coverage, including products tailored for industries like forestry and data centers. Innovation in risk solutions, such as AI-focused policies and sector-specific insurance, continues to support Canada commercial insurance market share across diverse sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.45 Billion |

| Market Forecast in 2033 | USD 33.39 Billion |

| Market Growth Rate 2025-2033 | 6.11% |

Canada Commercial Insurance Market Trends:

Specialized Coverage for Niche Industries

In the evolving Canada commercial insurance market, there has been an increasing focus on offering specialized coverage that caters to specific industries with unique risk profiles. As businesses face growing complexities in managing operational risks, the demand for tailored insurance solutions is on the rise. More sectors are realizing that off-the-shelf insurance policies often fail to adequately address their specialized needs. Insurers are recognizing this gap and responding with products designed to meet the particular challenges faced by different industries, ensuring that businesses can secure the coverage they need for both common and industry-specific risks. In June 2025, Hub International launched the Hub Forestry Select Insurance, targeting the forestry industry. This product, developed in partnership with Specialty Program Group Canada, addressed risks such as fire, equipment breakdown, and cargo loss, which are inherent to the sector. The product's introduction aligns with the growing demand for specialized insurance offerings, contributing to the Canada commercial insurance market growth by providing competitive and comprehensive coverage to businesses within the forestry industry. This move underscores a key trend of insurers refining their products to meet the specific needs of niche sectors, ensuring greater business resilience in the face of unique challenges. As more industries require coverage that aligns with their specific risks, insurers are responding with targeted solutions, enhancing the depth and diversity of Canada’s commercial insurance offerings. This trend of specialization is becoming a primary driver of the market's expansion, addressing sector-specific concerns and improving overall customer satisfaction. With more tailored products, businesses in these specialized sectors are better positioned to manage risk and achieve long-term success.

To get more information on this market, Request Sample

Integration of Technology in Risk Solutions

The demand for innovative insurance products has surged in response to the growing complexities of modern business operations, particularly in technology-driven sectors. As industries such as AI, cloud computing, and data centers face evolving risk landscapes, there is a notable shift toward integrating advanced solutions in commercial insurance offerings. The rapid growth of digital infrastructure has brought about new vulnerabilities, making it essential for insurance companies to develop solutions that specifically address the risks associated with emerging technologies. Companies are increasingly exposed to a wide range of threats, including cyberattacks, system failures, and data breaches, making comprehensive, tech-focused coverage a necessity. In July 2025, Aon introduced the Data Center Lifecycle Insurance Programme, which provides up to USD 1.5 billion in coverage for construction, operational risks, and business interruptions. This product, designed specifically for the technology infrastructure sector, caters to the unique risks associated with cloud and AI infrastructure. The launch of this program represents a significant development in the Canada commercial insurance market by offering integrated risk solutions that address both physical and cyber threats. Aon’s move to combine traditional coverage with emerging digital risk solutions highlights a broader industry trend of incorporating advanced risk management technologies into insurance products, catering to the needs of businesses in tech-heavy industries. This development reflects a key driver in the market, where insurers are increasingly focusing on providing flexible, multi-faceted coverage solutions. The growing intersection of technology and risk management is expanding the market, enabling businesses to better navigate digital transformation challenges while staying protected from a wider array of risks. By offering integrated coverage that addresses both physical and cyber risks, insurers are helping businesses better prepare for the complex, interconnected world of modern infrastructure and technology.

Canada Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

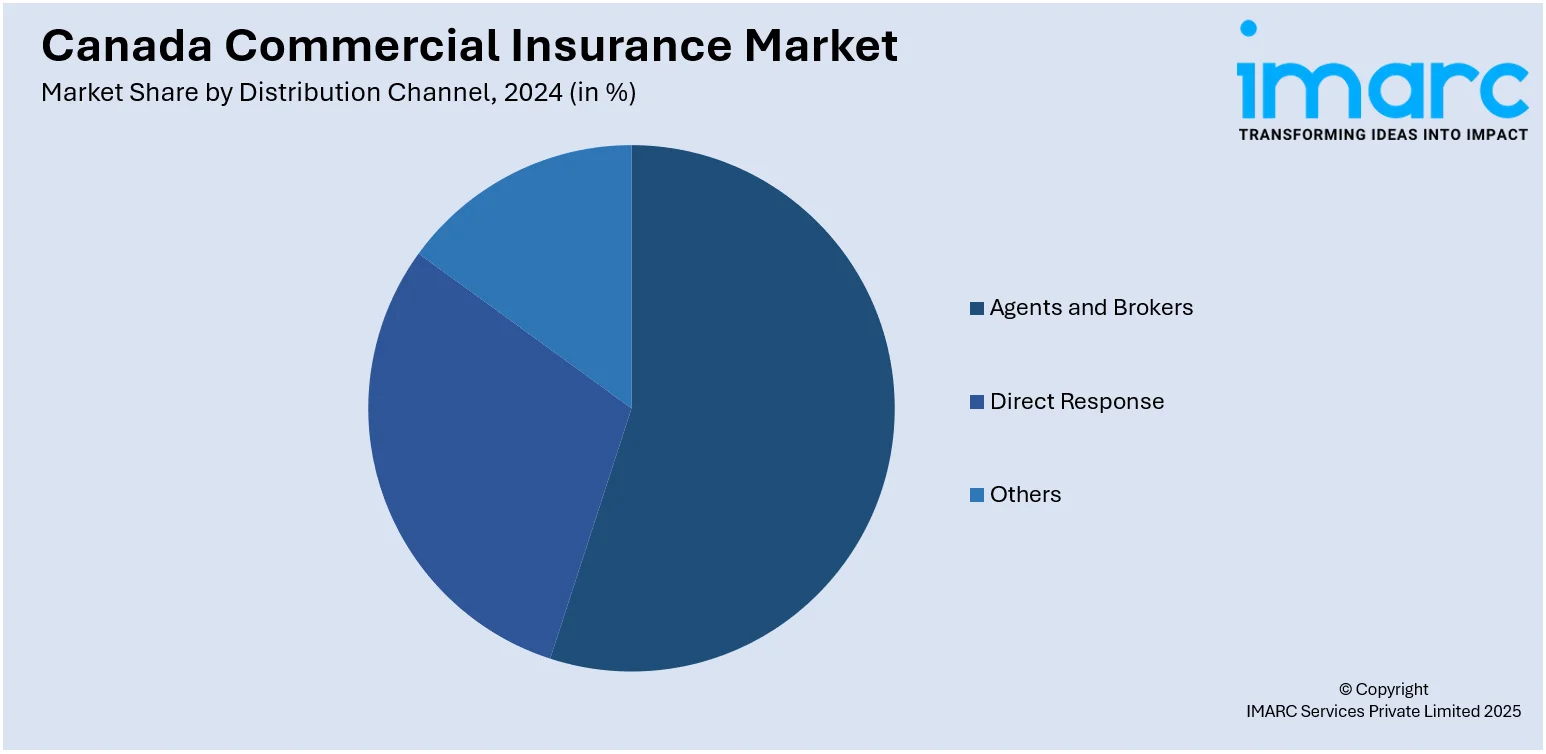

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also Provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Commercial Insurance Market News:

- August 2025: Berkshire Hathaway Specialty Insurance (BHSI) entered the Canadian Programs market, appointing David Tran as Head of Programs. This strategic move expanded BHSI’s specialty underwriting capabilities, enhancing the Canada commercial insurance market by offering tailored solutions through new partnerships with program administrators and brokers.

- June 2025: AXA XL launched its Canada Middle Market business, offering multiline coverage including property, general liability, and commercial auto. This expansion targeted middle-market clients in British Columbia, Alberta, and Ontario, enhancing the Canada commercial insurance market by providing tailored risk management solutions and expanding broker partnerships.

Canada Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada commercial insurance market on the basis of type?

- What is the breakup of the Canada commercial insurance market on the basis of enterprise size?

- What is the breakup of the Canada commercial insurance market on the basis of distribution channel?

- What is the breakup of the Canada commercial insurance market on the basis of industry vertical?

- What is the breakup of the Canada commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Canada commercial insurance market?

- What are the key driving factors and challenges in the Canada commercial insurance market?

- What is the structure of the Canada commercial insurance market and who are the key players?

- What is the degree of competition in the Canada commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)