Canada Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Canada Confectionery Market Overview:

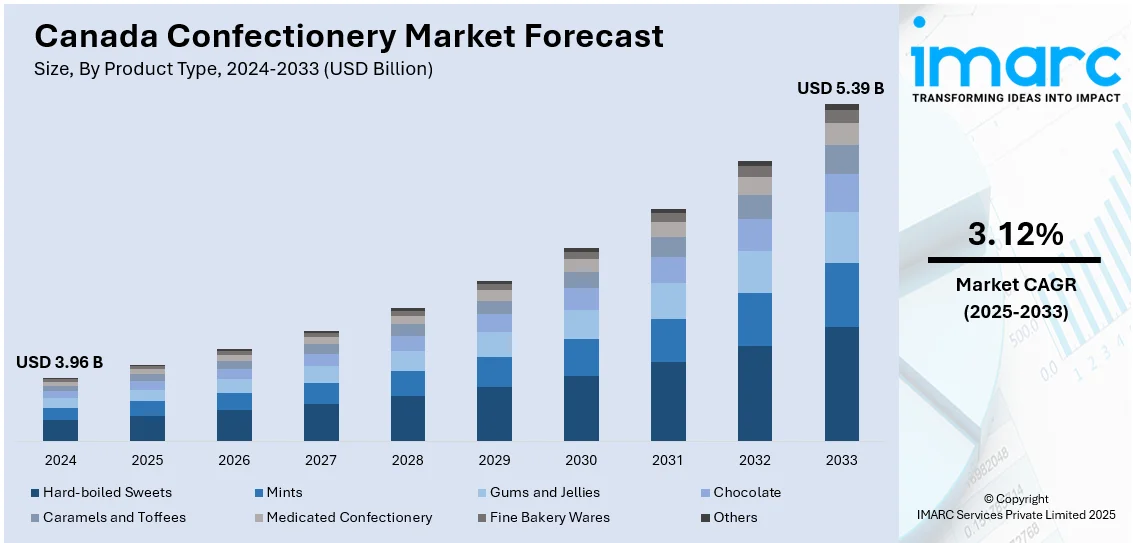

The Canada confectionery market size reached USD 3.96 Billion in 2024. The market is projected to reach USD 5.39 Billion by 2033, exhibiting a growth rate (CAGR) of 3.12% during 2025-2033. The market is fueled by consumer appetites for premium products, health-focused alternatives, and celebratory treats. The market is supported by strong retail networks, increasing e-commerce penetration, and a spur in demand for artisan and functional sweets. Seasonal patterns and gifting practices also enhance category performance, underlined by active product innovation and customized offerings. These changing consumption trends, along with a strong local manufacturing base and increased import diversity, account for the long-term increase in the Canada confectionery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.96 Billion |

| Market Forecast in 2033 | USD 5.39 Billion |

| Market Growth Rate 2025-2033 | 3.12% |

Canada Confectionery Market Trends:

Increased Demand for Premium and Artisan Products

The Canada confectionery industry is witnessing a rising demand for premium and artisan sweets, driven by consumers valuing quality, authenticity, and indulgence in greater numbers. This trend is driven by a demographic who are willing to pay extra for unique flavors, high-quality ingredients, and visually pleasing packaging. For instance, in June 2025, Ferrero revealed Nutella Peanut, its first new flavour since the brand was created 60 years ago, launching in spring 2026 in Canada and the U.S. and combining cocoa hazelnut with roasted peanuts. Moreover, small-batch products made with organic or locally available ingredients are especially in demand in both city and countryside retail spaces. Artisanal chocolates with single-origin cacao beans, hand-pulled sweets, and confectionery with gourmet ingredients such as exotic nuts or fruits are increasingly making their mark in the marketplace. In addition, the attractiveness of narrative through regional identity or heritage recipes heightens consumer affinity for such items. As manufacturers increase shelf space for upper-end segments and online channels boost exposure to niche brands, this trend is likely to deepen. This changing affinity is a key driver of Canada confectionery market growth, delivering value through innovation, customization, and experience.

To get more information on this market, Request Sample

Growing Preference for Better-for-You and Functional Confectionery

Against a backdrop of changing consumer values concerning wellness, the Canadian confectionery market is experiencing a shift toward the growth of better-for-you sweets. Items developed with lower sugar, natural sweeteners, high fiber, or functional added ingredients like collagen, probiotics, and adaptogens are increasingly featured across mainstream and specialty channels. Plant-based and vegan confectionery products are also gaining traction as dietary inclusivity grows in importance. As per the sources, in July 2025, Ferrero released new confectionery lines for North America, such as Ferrero Rocher chocolate squares and Tic Tac Dr Pepper, both of which will be released in autumn 2025 from its Brantford plant. Furthermore, the clean-label trend, with its focus on transparency and minimal processing, sustains this movement by confirming to consumers the integrity of ingredients. Consumers no longer crave just indulgence but also nutrition and balance. Brands that satisfy these demands with no loss of taste or texture are winning consumer loyalty. As health-aware consumers incorporate these functional substitutes into their snacking behaviors, Canada confectionery market trends demonstrate a wider intersection of indulgence and nutrition to facilitate long-term growth in an increasingly discerning and educated consumer base.

Surge in Seasonal and Gift-Motivated Purchasing

Seasonal and occasion-based buying remains a characteristic factor of the Canada confectionery market with regular surges in sales during holidays like Halloween, Christmas, and Easter. Furthermore, confectionery items have earned a solid space in the culture of gifting for birthdays, weddings, and business events. Consumers are attracted to eye-catching packaging, thematic shapes, and seasonal flavors that enhance celebratory mood. The personalized nature of confectionery gifts—through custom labeling, carefully selected assortments, or message-infused packaging—lends emotional value and consumer appeal. In addition, the expansion of online marketplaces and delivery networks has placed confectionery gifting within wider reach and convenience. This seasonal and emotional association with confectionery further cements its position as a culturally embedded product category. As gifting occasions become more varied and new festive routines develop, such consumption behavior prominently enhances Canada confectionery market growth, generating consistent revenue streams across the calendar year and consolidating brand presence during consumers' most salient life moments.

Canada Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

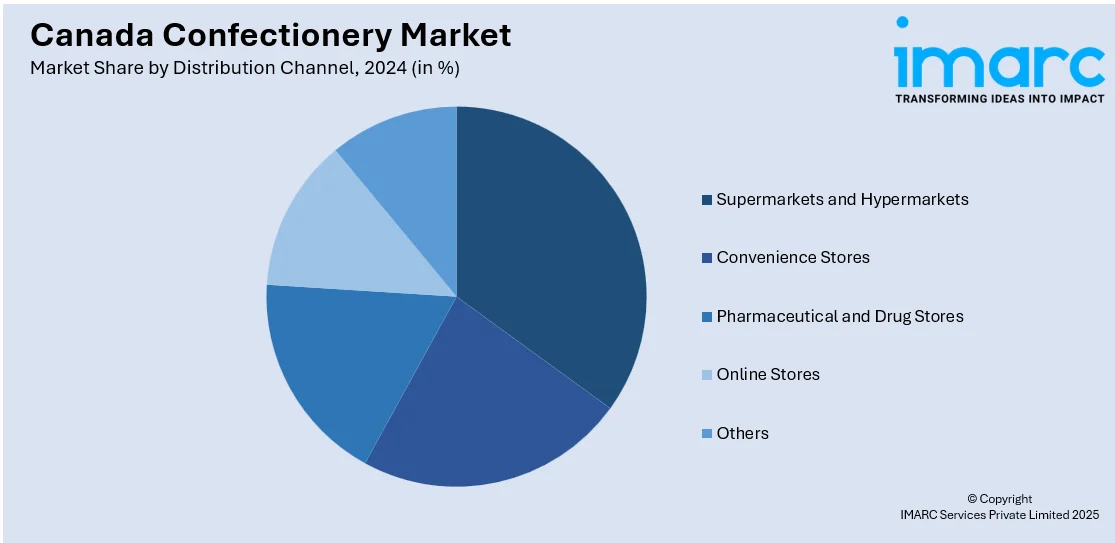

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Confectionery Market News:

- In May 2025, Lindt & Sprüngli introduce LINDOR Vegan Truffles in Canada, made with oat chocolate to mimic the rich flavor of milk chocolate. Found in Original and Dark Chocolate varieties, the launch is in response to strong demand among Canadian vegans looking for luxurious, plant-based chocolate without sacrificing texture or flavor.

- In February 2025, Ferrara launched NERDS® Gummy Clusters™ Berry in Canada with a distinctive crunchy-gummy experience. The introduction was timed with the brand's Big Game commercial and broad retail distribution across the nation. Based on the success of its antecedent, the original flavor won Product of the Year 2024 from Canadian consumers as a result of innovation.

Canada Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada confectionery market on the basis of product type?

- What is the breakup of the Canada confectionery market on the basis of age group?

- What is the breakup of the Canada confectionery market on the basis of price point?

- What is the breakup of the Canada confectionery market on the basis of distribution channel?

- What is the breakup of the Canada confectionery market on the basis of region?

- What are the various stages in the value chain of the Canada confectionery market?

- What are the key driving factors and challenges in the Canada confectionery market?

- What is the structure of the Canada confectionery market and who are the key players?

- What is the degree of competition in the Canada confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)