Canada Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Canada Cryptocurrency Market Overview:

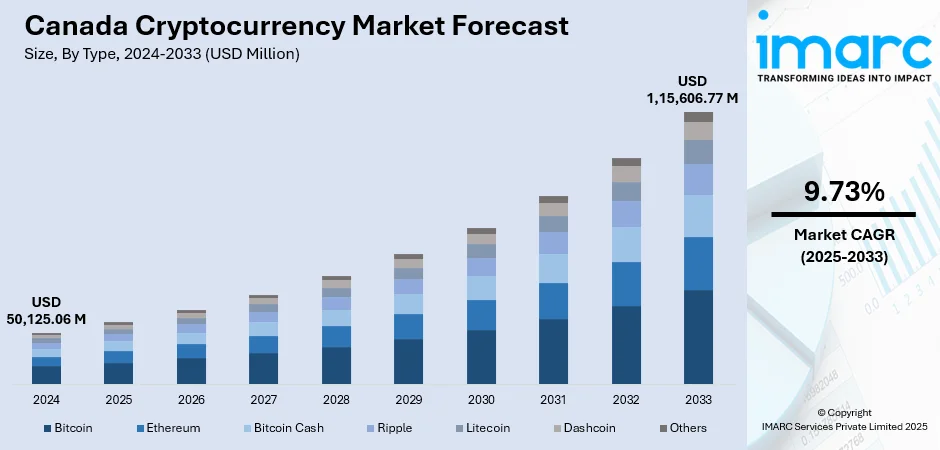

The Canada cryptocurrency market size reached USD 50,125.06 Million in 2024. The market is projected to reach USD 1,15,606.77 Million by 2033, exhibiting a growth rate (CAGR) of 9.73% during 2025-2033. In Canada, blockchain is driving secure, transparent financial solutions like tokenized assets and efficient cross-border payments, while also expanding into areas, such as identity and supply chain. Besides this, the growing utilization of artificial intelligence (AI), which assists in enhancing trading accuracy, automating compliance, and boosting cybersecurity on crypto platforms, is fueling the Canada cryptocurrency market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 50,125.06 Million |

| Market Forecast in 2033 | USD 1,15,606.77 Million |

| Market Growth Rate 2025-2033 | 9.73% |

Canada Cryptocurrency Market Trends:

Blockchain innovations

Blockchain innovations are enabling secure, transparent, and decentralized systems that support both financial and non-financial applications. Canada has a strong foundation in blockchain research and development, with universities, startups, and tech hubs actively exploring its potential across sectors. In finance, blockchain enables quick, safe, and inexpensive peer-to-peer transactions without requiring intermediaries. Canadian firms are using blockchain in finance to create more efficient systems for cross-border payments, digital asset management, and tokenized investment products. According to the IMARC Group, the Canada blockchain in finance market size reached USD 162.03 Million in 2024. Blockchain is also being applied to areas like healthcare data, digital identity, supply chain traceability, and energy trading, which increases overall public and institutional trust in the technology. The Canadian government is also showing interest in exploring blockchain for improving transparency in public services. Innovations in smart contracts, decentralized applications (dApps), and Web3 platforms are gaining momentum. These developments are creating new investment opportunities and expanding the practical use of cryptocurrencies. As blockchain technology continues to evolve in Canada, it is strengthening the infrastructure that underpins the crypto market, attracting both retail and institutional participants, and positioning the country as a forward-looking player in the digital economy.

To get more information on this market, Request Sample

Increasing AI adoption

Rising AI adoption is bolstering the Canada cryptocurrency market growth. Canadian investors and trading platforms are leveraging AI algorithms for predictive market analysis, helping users make more informed investment decisions in real time. AI-based bots are also being utilized to execute automated trading strategies, manage portfolio risks, and detect abnormal market behavior. In addition, AI enhances cybersecurity by identifying suspicious patterns, aiding in preventing fraud and cyberattacks on crypto platforms. Canadian fintech companies are integrating AI to streamline compliance processes, including automated anti-money laundering (AML) checks, simplifying the experience for users to enter the market while maintaining regulatory standards. AI is also playing an important role in optimizing blockchain networks by analyzing data for scalability, energy efficiency, and transaction validation. As Canada continues to wager on AI assimilation, especially in major cities like Toronto and Montreal, its intersection with crypto is creating new business models, such as AI-based DeFi tools and tokenized AI services. As per the information provided on the official website of the Government of Canada, the Canada AI market is set to attain USD 28.2 Billion in 2028.

Canada Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

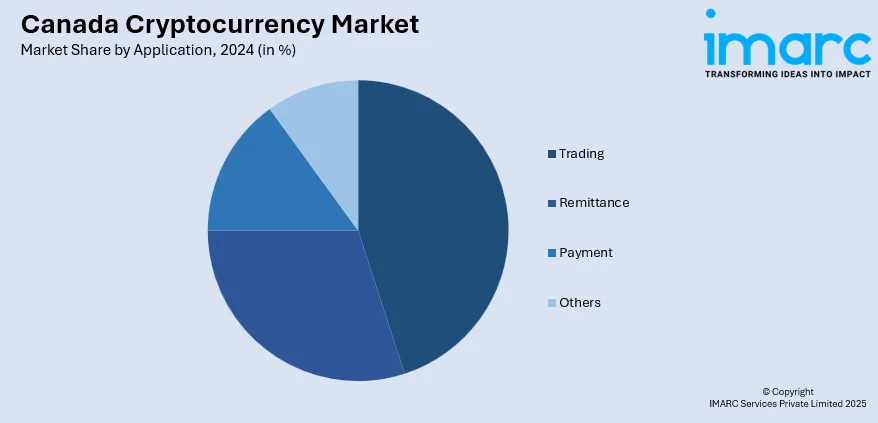

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Cryptocurrency Market News:

- In May 2025, Robinhood Markets Inc. was set to purchase WonderFi Technologies Inc., which ran two cryptocurrency platforms in Canada, for approximately CD 250 Million (USD 179 Million) in cash. WonderFi's cryptocurrency options would assist Robinhood in providing Canadians with enhanced access to crypto trading.

- In April 2025, Ndax, a major cryptocurrency trading platform in Canada, and the National Hockey League (NHL®) revealed a new alliance, designating Ndax as NHL’s crypto trading platform partner for the 2025 Stanley Cup Playoffs. Ndax would initiate a specialized campaign for the 2025 Stanley Cup Playoffs, called Ndax ICE, offering Canadian fans the opportunity to win a memorable Stanley Cup Playoffs experience. Ndax ICE would host daily, weekly, and round-specific giveaways, offering prizes, such as credits for purchasing cryptocurrency selected by the winner directly through Ndax.

Canada Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada cryptocurrency market on the basis of type?

- What is the breakup of the Canada cryptocurrency market on the basis of component?

- What is the breakup of the Canada cryptocurrency market on the basis of process?

- What is the breakup of the Canada cryptocurrency market on the basis of application?

- What is the breakup of the Canada cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the Canada cryptocurrency market?

- What are the key driving factors and challenges in the Canada cryptocurrency market?

- What is the structure of the Canada cryptocurrency market and who are the key players?

- What is the degree of competition in the Canada cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)