Canada Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End-Use Industry, and Region, 2026-2034

Canada Cyber Insurance Market Summary:

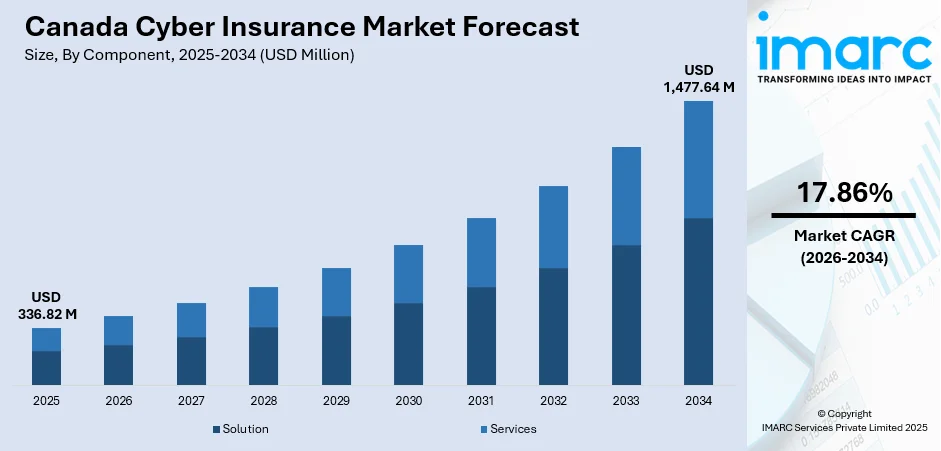

The Canada cyber insurance market size was valued at USD 336.82 Million in 2025 and is projected to reach USD 1,477.64 Million by 2034, growing at a compound annual growth rate of 17.86% from 2026-2034.

The Canadian cyber insurance landscape is experiencing robust expansion fueled by the escalating frequency and sophistication of cyberattacks targeting organizations across diverse sectors. Rising regulatory pressures, including federal mandates under OSFI Guideline B-13 and proposed legislation like Bill C-26, are compelling businesses to strengthen their cybersecurity posture and secure comprehensive insurance coverage. The increasing digitalization of operations and growing reliance on cloud-based infrastructure are amplifying cyber risk exposures, driving demand for tailored insurance solutions that address evolving threat vectors across the Canada cyber insurance market share.

Key Takeaways and Insights:

- By Component: Solution dominates the market with a share of 58% in 2025, owing to the comprehensive nature of solution-based offerings that integrate risk assessment platforms, threat monitoring tools, and incident response capabilities with insurance coverage. Organizations increasingly prefer end-to-end solutions that combine proactive security measures with financial protection.

- By Insurance Type: Stand-alone leads the market with a share of 68.32% in 2025. This dominance is driven by organizations seeking bespoke coverage terms addressing specific cyber exposures including ransom demands, data restoration expenses, and business interruption losses that packaged policies cannot adequately address.

- By Organization Size: Large enterprises represent the largest segment with a market share of 73.85% in 2025, reflecting substantial attack surface exposures, greater regulatory compliance requirements, and higher financial capacity to invest in comprehensive cyber insurance programs with elevated coverage limits.

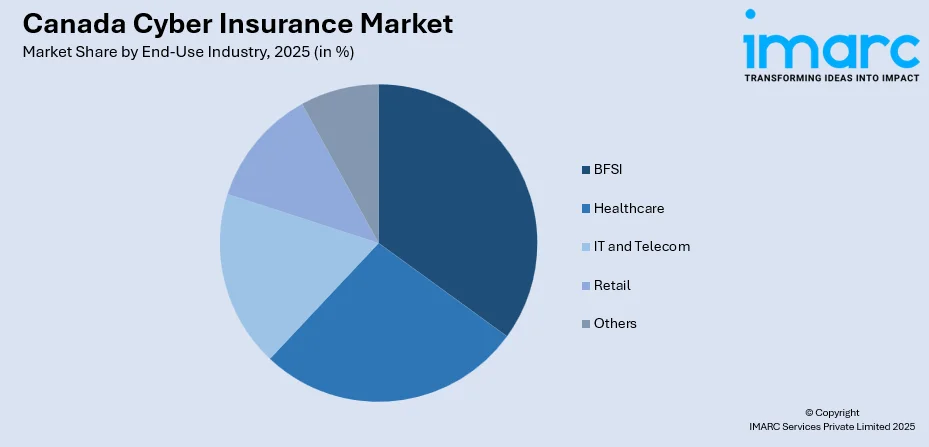

- By End-Use Industry: BFSI dominates the market with 28.28% share in 2025, driven by stringent OSFI regulatory mandates requiring robust governance, risk management, and compliance frameworks that necessitate comprehensive cyber liability protection.

- Key Players: Key players drive the Canada cyber insurance market by expanding product portfolios, enhancing underwriting capabilities through advanced analytics, and strengthening partnerships with cybersecurity service providers. Their investments in proactive risk assessment tools, incident response services, and regulatory compliance support boost market penetration and accelerate adoption across diverse industry segments.

To get more information on this market Request Sample

Canada's cyber insurance market continues to demonstrate resilience amid an evolving threat landscape characterized by increasingly sophisticated attack methodologies. The growing awareness among enterprises regarding financial repercussions of cyber incidents, including operational disruptions, regulatory penalties, and reputational damage, is accelerating policy uptake across sectors. Insurance carriers are responding by developing innovative coverage solutions that address emerging risks such as artificial intelligence-enabled attacks, supply chain vulnerabilities, and ransomware extortion schemes. According to IBM's Cost of a Data Breach Report 2024, Canadian organizations incurred an average breach cost of CAD 6.32 Million per incident, underscoring the critical importance of adequate coverage limits. The market is witnessing enhanced collaboration between insurers and cybersecurity vendors to deliver integrated risk management solutions that combine preventive technologies with comprehensive insurance protection, enabling organizations to build cyber resilience while transferring residual financial risks.

Canada Cyber Insurance Market Trends:

Integration of Artificial Intelligence in Underwriting Processes

Insurance carriers are increasingly leveraging artificial intelligence and machine learning technologies to enhance underwriting precision and risk assessment capabilities. Advanced analytics platforms enable real-time evaluation of organizational security postures, vulnerability identification, and premium optimization based on dynamic risk profiles. In October 2024, Ontario Centre of Innovation partnered with IBM Canada and University of Ottawa to establish a Cyber Range facility supporting cybersecurity capability development. This trend toward data-driven underwriting is improving policy pricing accuracy while enabling carriers to offer customized coverage aligned with specific organizational risk exposures.

Expanding Coverage for Emerging Threat Vectors

Cyber insurance policies are evolving to encompass coverage for emerging threat categories including deepfake-enabled fraud, cryptojacking incidents, and AI-powered social engineering attacks. Insurers are developing specialized endorsements addressing artificial intelligence security events that cause system failures or enable fraudulent fund transfers. In March 2024, Coalition introduced an Affirmative AI Endorsement to its Canada cyber insurance policies, expanding coverage definitions to include AI-related security failures and deepfake-facilitated fraud. This expansion reflects market recognition of evolving attack methodologies requiring tailored protection mechanisms.

Enhanced Regulatory Compliance Requirements Driving Adoption

Strengthening regulatory frameworks are compelling organizations to enhance cybersecurity investments and secure adequate insurance coverage to meet evolving compliance obligations. These frameworks establish comprehensive requirements for federally regulated financial institutions regarding cyber resilience, incident reporting, and third-party risk management protocols. Proposed federal legislation introduces mandatory cybersecurity standards and incident reporting obligations for designated operators within critical infrastructure sectors including telecommunications, energy, and transportation. These regulatory developments are creating sustained compliance-driven demand for comprehensive cyber insurance solutions across regulated sectors, as organizations seek coverage addressing regulatory defense costs and potential administrative penalties.

Market Outlook 2026-2034:

The Canada cyber insurance market is poised for sustained expansion throughout the forecast period, driven by escalating cyber threat sophistication and regulatory enforcement intensification. Organizations are increasingly recognizing cyber insurance as an essential component of enterprise risk management frameworks rather than discretionary coverage. The market generated a revenue of USD 336.82 Million in 2025 and is projected to reach a revenue of USD 1,477.64 Million by 2034, growing at a compound annual growth rate of 17.86% from 2026-2034. Market maturation will be characterized by enhanced product innovation, expanded coverage options, and deeper integration between insurance solutions and cybersecurity services.

Canada Cyber Insurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Solution | 58% |

| Insurance Type | Stand-alone | 68.32% |

| Organization Size | Large Enterprises | 73.85% |

| End-Use Industry | BFSI | 28.28% |

Component Insights:

- Solution

- Services

Solution dominates with a market share of 58% of the total Canada cyber insurance market in 2025.

The solution segment encompasses integrated platforms combining risk assessment tools, security monitoring capabilities, and policy management systems that enable organizations to proactively identify vulnerabilities while maintaining comprehensive insurance coverage. These solution-based offerings provide continuous visibility into organizational cyber risk postures through automated scanning, threat intelligence integration, and security scoring mechanisms. Coalition's Active Insurance platform exemplifies this approach, combining cybersecurity tools with coverage to help businesses manage digital risks effectively.

Organizations increasingly prefer solution-based cyber insurance products that deliver value beyond traditional indemnification by incorporating preventive technologies and incident response capabilities. The integration of risk assessment platforms enables insurers to offer dynamically priced premiums reflecting actual security postures while providing policyholders with actionable insights to improve their cyber resilience. This convergence of insurance and cybersecurity services is driving adoption among enterprises seeking holistic protection against evolving digital threats.

Insurance Type Insights:

- Packaged

- Stand-alone

Stand-alone leads with a share of 68.32% of the total Canada cyber insurance market in 2025.

Stand-alone cyber insurance policies provide dedicated coverage specifically designed to address comprehensive cyber risk exposures without the limitations inherent in bundled product offerings. These policies enable organizations to secure bespoke terms addressing specific threat scenarios including ransomware extortion, data breach notification costs, business interruption losses, and regulatory defense expenses. In May 2024, Coalition expanded its stand-alone cyber insurance offering to Canadian enterprises with revenues up to CAD 5 Billion, demonstrating market demand for dedicated coverage solutions.

The preference for stand-alone policies reflects growing recognition among risk managers that cyber exposures require specialized coverage terms that packaged products cannot adequately address. Stand-alone policies offer higher coverage limits, more comprehensive sub-limit structures, and tailored incident response provisions that align with organizational risk profiles. Insurance carriers continuously refine stand-alone policy wordings to address emerging threats including social engineering fraud, cryptojacking, and systemic business interruption scenarios arising from widespread cyber events.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises exhibit a clear dominance with a 73.85% share of the total Canada cyber insurance market in 2025.

Large enterprises represent the predominant purchasers of cyber insurance coverage due to their substantial attack surface exposures, complex IT infrastructure environments, and elevated regulatory compliance obligations. These organizations face heightened cyber risk exposures arising from extensive digital operations, large-scale data processing activities, and interconnected supply chain relationships that create multiple potential vulnerability points requiring comprehensive financial protection mechanisms.

Enterprise-level organizations demonstrate sophisticated understanding of cyber risk transfer mechanisms and typically maintain dedicated risk management functions responsible for insurance program design, broker engagement, and coverage placement activities. These buyers seek comprehensive coverage structures incorporating primary and excess layers, broad coverage terms, and integrated cybersecurity services that align with organizational risk appetites and tolerance thresholds. Large enterprises increasingly engage in multi-year policy arrangements that provide program stability and preferred pricing in exchange for demonstrated cybersecurity investments and proactive risk management practices. Board-level engagement with cybersecurity governance further strengthens organizational commitment to maintaining adequate coverage limits and ensuring policy terms address evolving threat landscapes effectively.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

BFSI represents the leading segment with a 28.28% share of the total Canada cyber insurance market in 2025.

The banking, financial services, and insurance sector demonstrates the highest cyber insurance adoption rates driven by stringent regulatory requirements and elevated cyber risk exposures associated with financial transaction processing. Federal regulatory guidelines mandate robust governance, risk management, and compliance frameworks for federally regulated financial institutions regarding technology and cyber risk management. These requirements compel BFSI organizations to maintain comprehensive cyber insurance coverage addressing funds transfer fraud, operational technology outages, and regulatory investigation costs.

Financial institutions routinely purchase full-suite cyber insurance coverage incorporating first-party and third-party liability protections that address the unique risk exposures inherent in banking operations. High board-level engagement with cybersecurity governance sustains multi-year policy partnerships that bundle analytics dashboards, tabletop exercises, and incident response retainers with insurance coverage. Claims trends within the BFSI sector show rising costs for regulatory investigation defense and customer notification obligations, reinforcing the need for comprehensive third-party liability coverage layers that adequately protect against evolving compliance enforcement activities and data breach response requirements.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario represents Canada's premier technology and financial services hub, hosting the headquarters of major banking institutions and insurance carriers while employing the largest share of the national technology workforce. The province's thriving cybersecurity ecosystem encompasses innovative startups, established technology vendors, and world-class research institutions driving advancement in cyber risk management solutions and insurance product development. This concentration of financial and technological expertise positions Ontario as the dominant market for cyber insurance adoption across the country.

Quebec's cyber insurance market benefits from the province's distinctive regulatory environment, including Law 25 privacy legislation that imposes enhanced data protection obligations on organizations. The concentration of aerospace, manufacturing, and financial services enterprises in the Montreal metropolitan area creates substantial demand for specialized cyber coverage addressing sector-specific risk exposures and compliance requirements.

Alberta's energy-intensive economy drives demand for cyber insurance solutions addressing operational technology risks and critical infrastructure protection requirements. The province's oil and gas sector faces elevated cyber threats targeting industrial control systems and operational continuity, creating demand for specialized coverage encompassing business interruption and contingent business interruption exposures.

British Columbia's diverse economy spanning technology, natural resources, and port operations generates substantial cyber insurance demand across multiple industry verticals. The Vancouver metropolitan area serves as a technology hub with growing cybersecurity expertise, while provincial government initiatives focus on enhancing cyber resilience across public sector organizations and critical infrastructure operators.

Market Dynamics:

Growth Drivers:

Why is the Canada Cyber Insurance Market Growing?

Escalating Frequency and Sophistication of Cyberattacks

The Canadian cyber threat landscape is experiencing unprecedented escalation characterized by increasingly sophisticated attack methodologies targeting organizations across all sectors. Ransomware attacks remain the most impactful threat facing Canadian critical infrastructure, with cybercriminals leveraging advanced techniques including double extortion schemes and ransomware-as-a-service platforms to maximize financial extraction. The proliferation of business email compromise schemes and funds transfer fraud incidents is driving organizations to seek comprehensive insurance coverage addressing financial losses arising from social engineering attacks. According to the Canadian Centre for Cyber Security's National Cyber Threat Assessment 2025-2026, ransomware is projected to remain the leading threat to critical infrastructure, compelling organizations to enhance their insurance protection mechanisms.

Accelerating Digital Transformation and Cloud Infrastructure Adoption

The rapid digitalization of business operations and widespread migration to cloud-based infrastructure are substantially expanding organizational cyber risk exposures across Canadian enterprises. Organizations increasingly rely on interconnected digital systems, software-as-a-service platforms, and remote access technologies that create multiple potential entry points for threat actors. The proliferation of Internet of Things devices, operational technology systems, and hybrid work environments is amplifying attack surface complexity, compelling businesses to secure comprehensive insurance coverage addressing diverse cyber vulnerabilities. According to a Microsoft report, generative AI adoption could contribute $180 Billion annually to the Canadian economy by 2030, highlighting the accelerating pace of technology integration that simultaneously introduces new risk vectors. This digital evolution is driving demand for cyber insurance products that address emerging exposures including cloud service provider failures, API vulnerabilities, and third-party technology dependencies that traditional property and liability policies cannot adequately cover.

Rising Data Breach Costs and Financial Impact of Cyber Incidents

The escalating financial consequences of cyber incidents are driving organizations to recognize cyber insurance as an essential component of enterprise risk management frameworks. Canadian organizations face substantial breach costs across multiple categories, with financial services and technology companies experiencing the highest remediation expenses due to their complex operational environments and stringent regulatory obligations. These significant financial exposures arising from operational disruptions, incident response costs, regulatory penalties, and reputational damage are compelling organizations to secure comprehensive coverage limits that adequately address potential loss scenarios. The growing recognition of cyber risk as a strategic business concern is accelerating board-level engagement with insurance program design and coverage adequacy assessments, ensuring organizations maintain appropriate protection against increasingly costly cyber events.

Market Restraints:

What Challenges the Canada Cyber Insurance Market is Facing?

Complexity of Cyber Risk Assessment and Pricing

The inherently dynamic nature of cyber threats presents significant challenges for accurate risk quantification and premium determination. Insurers face difficulties in developing actuarial models that adequately capture evolving attack patterns, emerging vulnerability categories, and systemic risk concentrations. The limited historical claims data and rapidly changing threat landscape complicate underwriting accuracy, potentially leading to premium volatility and coverage gaps.

Limited Cyber Risk Awareness Among Small and Medium Enterprises

Many small and medium-sized enterprises remain underinsured or uninsured against cyber risks due to limited awareness of threat exposures and misconceptions regarding organizational vulnerability. A significant proportion of SME operators believe their businesses are too small to be targeted by cybercriminals, resulting in inadequate investment in cybersecurity measures and insurance coverage. This awareness gap constrains market penetration within the SME segment despite elevated risk exposures.

Coverage Exclusions and Policy Uncertainty

Evolving policy exclusions, particularly regarding nation-state attacks and acts of war, create uncertainty regarding coverage applicability for significant cyber events. Insurers are implementing stricter underwriting requirements and more restrictive policy terms in response to escalating loss experience, potentially limiting coverage availability for higher-risk organizations or industry sectors. Policy language complexity and coverage interpretation disputes may discourage insurance adoption among risk-averse organizations.

Competitive Landscape:

The Canada cyber insurance market exhibits a competitive landscape characterized by established global insurers, specialized cyber insurance providers, and technology-enabled insurtech platforms competing for market share. Market participants differentiate through product innovation, underwriting expertise, claims handling capabilities, and integration of cybersecurity services with insurance coverage. Insurers are increasingly partnering with cybersecurity vendors to offer comprehensive risk management solutions combining prevention, detection, and response capabilities with financial protection. The market witnesses growing competition between traditional carriers expanding cyber offerings and specialized providers leveraging advanced analytics and proprietary risk assessment platforms. Distribution remains predominantly broker-mediated for commercial accounts, while digital platforms gain traction for small business segments seeking streamlined purchasing experiences.

Canada Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Canada cyber insurance market size was valued at USD 336.82 Million in 2025.

The Canada cyber insurance market is expected to grow at a compound annual growth rate of 17.86% from 2026-2034 to reach USD 1,477.64 Million by 2034.

Solution dominated the market with a share of 58%, driven by comprehensive integrated platforms combining risk assessment, security monitoring, and policy management capabilities that enable organizations to proactively manage cyber risks.

Key factors driving the Canada cyber insurance market include escalating cyberattack frequency and sophistication, strengthening regulatory compliance requirements including OSFI Guideline B-13 and Bill C-26, rising data breach costs, and increasing organizational recognition of cyber risk as a strategic business concern.

Major challenges include complexity of cyber risk assessment and pricing, limited awareness among small and medium enterprises, evolving coverage exclusions particularly regarding nation-state attacks, premium volatility, and policy interpretation uncertainties arising from emerging threat categories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)