Canada E-Commerce Logistics Market Size, Share, Trends, and Forecast by Product, Service Type, Operational Area, and Region, 2025-2033

Canada E-Commerce Logistics Market Overview:

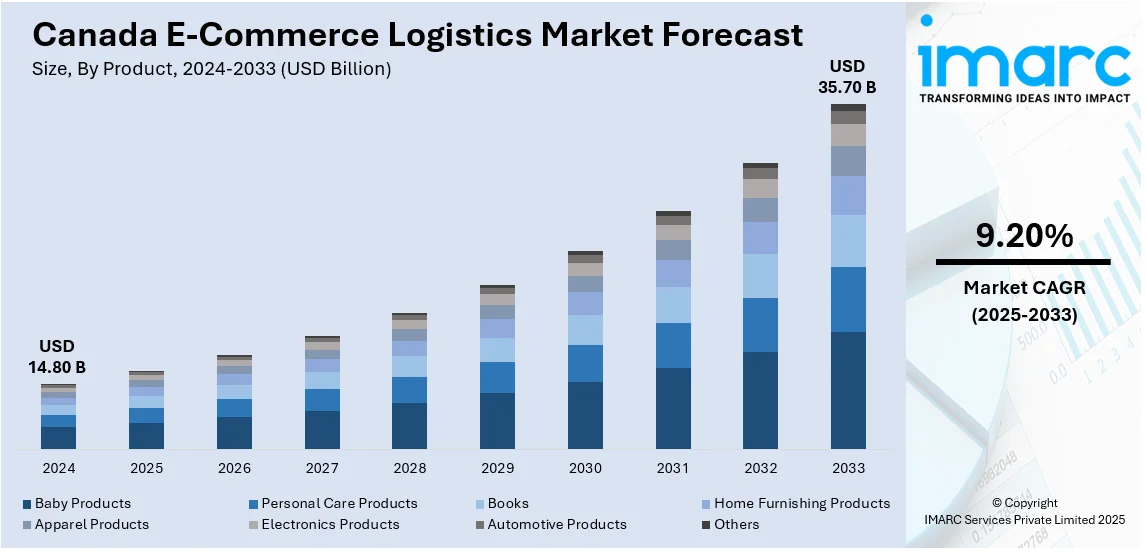

The Canada e-commerce logistics market size reached USD 14.80 Billion in 2024 Looking forward, IMARC Group expects the market to reach USD 35.70 Billion by 2033 exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The rapid growth of online shopping, innovations in technology, such as automated warehousing and real-time tracking, rising consumer expectations for fast delivery and convenient return processes, and increasing investment in infrastructure and distribution centers are some of the major factors propelling the Canada e-commerce logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.80 Billion |

| Market Forecast in 2033 | USD 35.70 Billion |

| Market Growth Rate 2025-2033 | 9.20% |

Canada e-commerce logistics Market Analysis:

- Key Market Trends: Canada’s e‑commerce logistics is evolving with growing adoption of automation, artificial intelligence (AI) for inventory management, micro‑fulfillment centers, sustainable delivery solutions, and innovative last‑mile strategies to meet rising customer expectations thus surging the market demand.

- Major Drivers: Increased online shopping habits, consumer demand for faster and flexible deliveries, cross‑border trade growth, supportive government policies, and digital transformation in logistics operations are key forces pushing the Canada e-commerce logistics market growth.

- Market Opportunities: Expanding third‑party logistics services, integrating AI‑powered platforms, adopting electric delivery vehicles, developing automated warehouses, strengthening cross‑border capabilities, and creating urban micro‑distribution hubs provide strong opportunities for logistics companies to scale efficiently.

- Market Challenges: Labor shortages in warehousing and delivery, rising operational costs, congested urban infrastructure, supply‑chain disruptions, complex customs procedures, and growing cybersecurity risks create significant challenges for sustaining efficient logistics operations in the Canada e-commerce logistics market analysis.

Canada E-commerce Logistics Market Trends:

Rising Online Shopping Trend

The growth of e-commerce, accelerated by changing consumer habits during and post-pandemic, has significantly increased the Canada e-commerce logistics market demand for efficient logistics to handle higher order volumes and quick delivery expectations. As per the International Trade Administration data published in 2023, there were more than 27 million users of e-commerce across Canada, pertaining to 75% of the country’s population in 2022. This number is anticipated to increase to 77.6% during the year 2025. It is further expected that by the rear 2025, retail e-commerce sales will total USD 40.3 Billion. In addition to this, enhanced internet connectivity facilitates online marketplaces, empowering businesses to reach remote areas and prompting logistics providers to expand delivery networks nationwide. For instance, in June 2024, the Ontario government announced an investment of approximately USD 4 billion to bring access to dependable high-speed Internet to all communities across the province by 2025 end.

To get more information on this market, Request Sample

Significant Technological Advancements

One of the Canada e-commerce logistics market trends is the innovations in technology, such as automated warehousing, artificial intelligence (AI), and real-time tracking systems, are transforming logistics operations. For instance, in June 2024, FANUC, the prominent global robotics and automation services provider, unveiled its new plant in Canada. This highlights a substantial keystone in a series of tactical investments for facilities in the Americas, reflecting a resilient aim to advancements, user support, and economic boost in the region. The new Canadian plant is set to emerge as a hub for leading-edge robotics technology, further fortifying FANUC’s foothold as a catalyst for innovations in the automation segment. These advancements improve efficiency, upgrade supply chain management, and improve the overall customer experience, allowing logistics providers to better manage the complexities of e-commerce delivery. Similarly, in September 2024, ePost Global announced the launch of Canada eDGE, a new service developed to upgrade cross-border as well as domestic e-commerce for Canada. This offering enables merchants with a robust solution for distributing goods across Canada, facilitating quicker delivery times and minimized costs for shipping.

Canada E-Commerce Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, service type, and operational area.

Product Insights:

- Baby Products

- Baby Products

- Books

- Home Furnishing Products

- Apparel Products

- Electronics Products

- Automotive Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes baby products, baby products, books, home furnishing products, apparel products, electronics products, automotive products, and others.

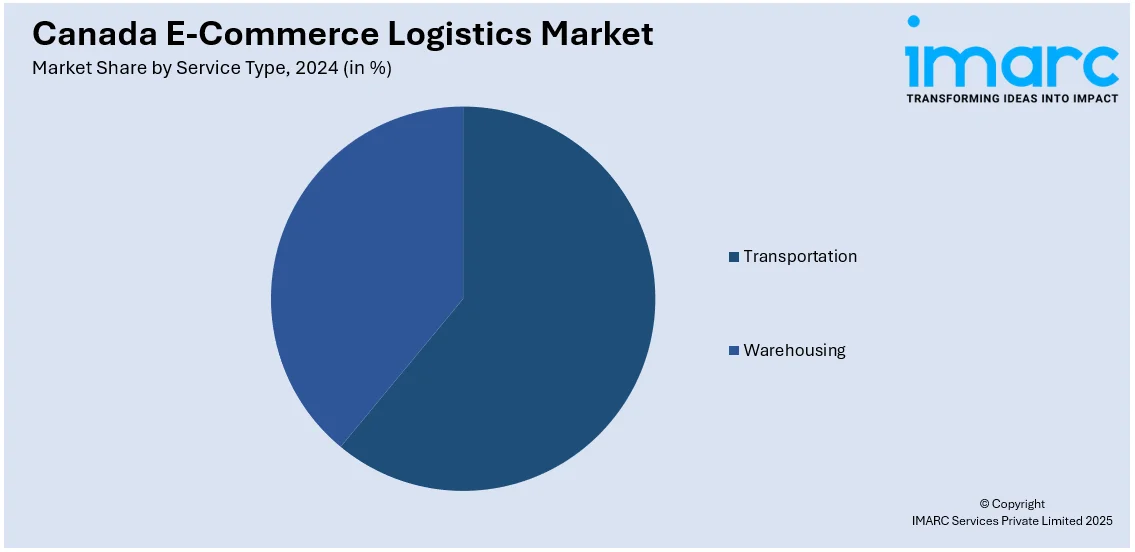

Service Type Insights:

- Transportation

- Warehousing

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes transportation and warehousing.

Operational Area Insights:

- International

- Domestic

The report has provided a detailed breakup and analysis of the market based on the operational area. This includes international and domestic.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In July 2025, UniUni launched a new Cross-Border delivery solution designed to help U.S. e-commerce brands ship to Canadian customers faster and more cost-effectively. This end-to-end service integrates UniUni’s U.S. and Canadian last-mile networks, offering full control from initial pickup through customs clearance to final doorstep delivery. The solution aims to enhance speed, efficiency, and overall customer experience for cross-border e-commerce shipments between the two countries.

- In June 2025, ULS Freight launched advanced logistics solutions to boost supply chain efficiency for Canadian businesses. The new services feature real-time tracking, automated load planning, predictive route optimization, and integrated warehouse management. Designed for sectors like manufacturing, retail, food service, and e-commerce, these solutions aim to reduce delays and simplify complex distribution needs. “Rubab Haider, Senior Digital Marketing Manager at ULS Freight, stated, "Our solutions do more than just manage bottlenecks; they eradicate them.

- In September 2024, ePost Global launched Canada eDGE, a multi-carrier solution designed to enhance domestic and cross-border eCommerce shipping in Canada. Leveraging a network of postal and alternative last-mile carriers, the service uses proprietary routing logic to optimize delivery speed and cost. With hubs in Toronto and Vancouver, Canada eDGE enables merchants to split inventory for faster, more flexible nationwide distribution, streamlining logistics for eCommerce businesses.

Canada E-Commerce Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Baby Products, Baby Products, Books, Home Furnishing Products, Apparel Products, Electronics Products, Automotive Products, Others |

| Service Types Covered | Transportation, Warehousing |

| Operational Areas Covered | International, Domestic |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada e-commerce logistics market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada e-commerce logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada e-commerce logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-commerce logistics market in Canada was valued at USD 14.80 Billion in 2024.

The Canada e-commerce logistics market is projected to exhibit a CAGR of 9.20% during 2025-2033, reaching a value of USD 35.70 Billion by 2033.

Key factors driving Canada’s e-commerce logistics market include the rapid growth of online shopping, increasing consumer demand for faster and more flexible deliveries, expansion of cross-border trade, and adoption of advanced technologies like automation and AI in logistics operations. Additionally, government support for infrastructure development, rising investments in last-mile delivery solutions, and the growth of third-party logistics providers are further fueling market expansion across multiple sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)