Canada Edtech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2025-2033

Canada Edtech Market Overview:

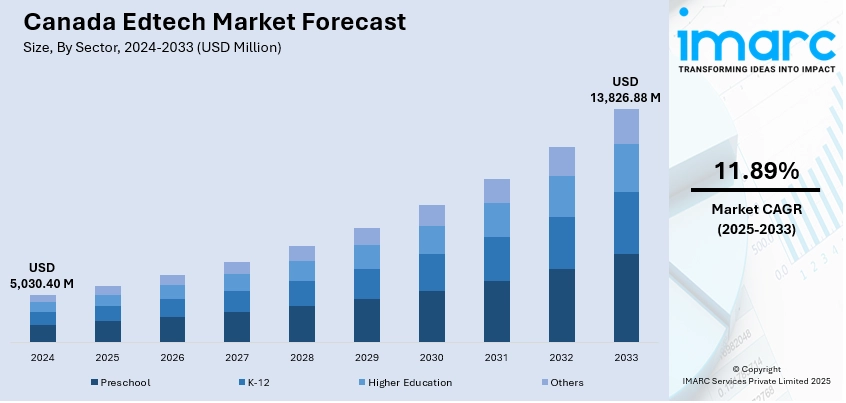

The Canada edtech market size reached USD 5,030.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 13,826.88 Million by 2033, exhibiting a growth rate (CAGR) of 11.89% during 2025-2033. The market is driven by the rising demand for AI-powered personalized learning, as schools and corporations adopt adaptive platforms for real-time analytics and tailored instruction. Accelerated by the need for workforce upskilling, micro-credentials are gaining traction, supported by employer preferences for skill-based certifications and government-funded upskilling initiatives. Advancing edtech innovations and digital literacy, are further augmenting the Canada edtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,030.40 Million |

| Market Forecast in 2033 | USD 13,826.88 Million |

| Market Growth Rate 2025-2033 | 11.89% |

Canada Edtech Market Trends:

Increasing Adoption of AI-Powered Learning Tools

The market is experiencing an increase in demand for AI-powered learning tools, driven by the need for personalized and adaptive education. Schools, universities, and corporate training programs are increasingly integrating AI-driven platforms that offer customized learning experiences, real-time feedback, and predictive analytics. These tools help educators identify student weaknesses, recommend tailored content, and improve engagement through interactive modules. Companies are gaining traction in Canada, offering AI-based tutoring systems that adjust to individual learning paces. Additionally, the rise of generative AI, such as ChatGPT, is being leveraged for automated essay grading, virtual tutoring, and language learning applications. As digital literacy grows and institutions seek cost-effective solutions, AI in EdTech is expected to expand further, supported by governmental programs that encourage STEM education and foster innovation in educational technologies. As of 2025, Canada has 38 million internet users, reaching a penetration rate of 95.2%, which indicates very high digital literacy levels among its population. Active social media users are 31.7 million, representing 79.4% of the population. The growth in the use of digital platforms reflects the rising need for educational technology solutions to support the requirements of Canada's more networked and technologically skilled learners.

To get more information on this market, Request Sample

Growth of Micro-Credentials and Upskilling Platforms

The rising popularity of micro-credentials and online upskilling platforms, catering to professionals and lifelong learners, is further supporting the Canada edtech market growth. With rapid technological advancements and shifting job market demands, Canadians are turning to short, flexible courses offered by platforms, including Coursera, Udemy, and LinkedIn Learning to acquire new skills. Universities and colleges are also partnering with edtech firms to provide stackable certifications in fields such as data science, cybersecurity, and digital marketing. This trend aligns with employers' growing preference for skill-based hiring over traditional degrees. Government-backed programs, such as the Education and Training Benefit, further encourage workforce upskilling by offering financial support for online courses. In 2025, Canada's Education and Training Benefit (ETB) program remains committed to helping veterans further their education, with a requirement of at least 2,191 days of service. The benefit offers flexible funding towards both full-degree programs and shorter-term education opportunities, including business boot camps and workshops. The program aligns with the growing need for flexible and accessible education in Canada's edtech sector. As remote and hybrid work models persist, the demand for bite-sized, on-demand learning will continue to rise, positioning micro-credentials as a critical component of Canada’s future education landscape.

Canada Edtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

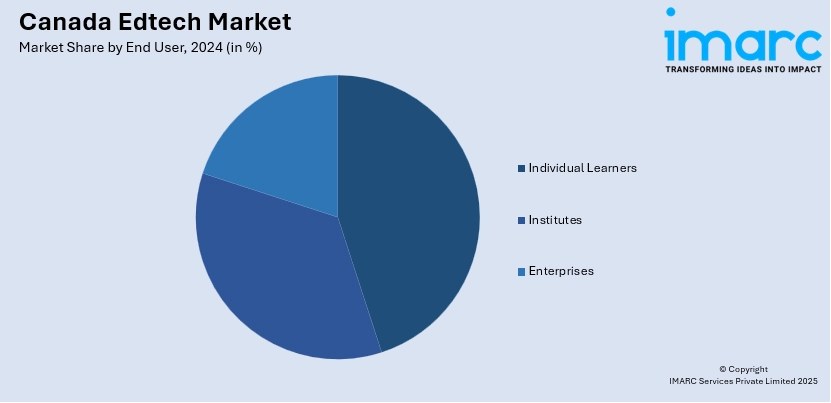

End User Insights:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Edtech Market News:

- October 16, 2024: Carnegie Learning opened its new Canadian headquarters in St. John's, Newfoundland, to promote the development of its AI-driven educational technology for K-12 schools. The 10,000-square-foot building will foster collaboration and innovation with the addition of 30 new staff members and an increase in work-study programs. The company's growth, backed by over $90 million in funding, showcases its commitment to advancing the edtech industry and expanding its reach across Canadian districts.

Canada Edtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada edtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada edtech market on the basis of sector?

- What is the breakup of the Canada edtech market on the basis of type?

- What is the breakup of the Canada edtech market on the basis of deployment mode?

- What is the breakup of the Canada edtech market on the basis of end user?

- What is the breakup of the Canada edtech market on the basis of region?

- What are the various stages in the value chain of the Canada edtech market?

- What are the key driving factors and challenges in the Canada edtech market?

- What is the structure of the Canada edtech market and who are the key players?

- What is the degree of competition in the Canada edtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada edtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada edtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)