Canada Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement and Region, 2025-2033

Canada Electric Two-Wheeler Market Overview:

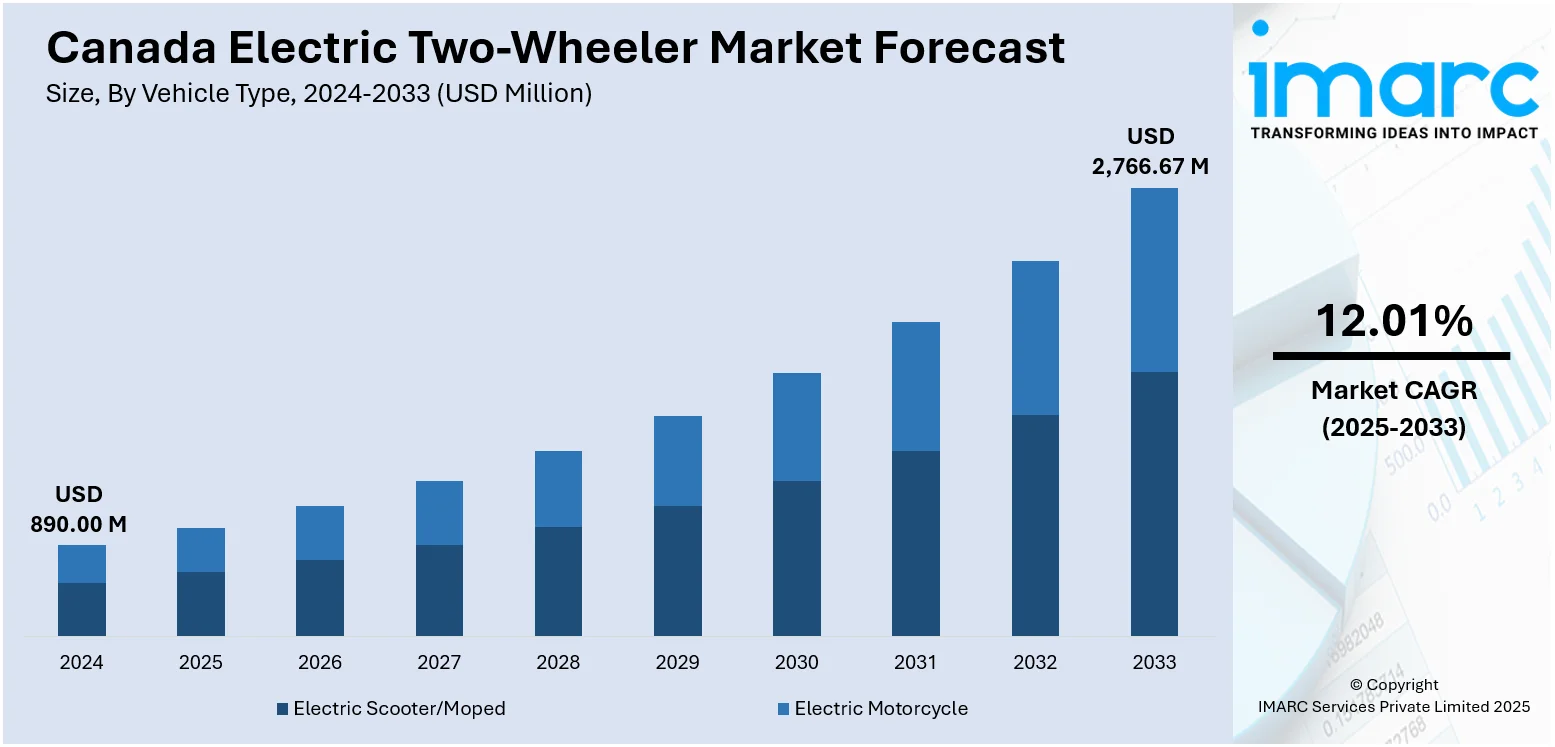

The Canada electric two-wheeler market size reached USD 890.00 Million in 2024. The market is projected to reach USD 2,766.67 Million by 2033, exhibiting a growth rate (CAGR) of 12.01% during 2025-2033. The market is driven by growing environmental awareness, rising fuel costs, and urban congestion, encouraging consumers to adopt eco-friendly transportation. Government incentives for electric mobility, expanding cycling infrastructure in major cities, and demand for cost-effective commuting solutions further boost the market. Additionally, the entry of global brands like AIMA and domestic distributors offering advanced, UL-certified e-bikes with reliable components increases consumer confidence thus strengthening the Canada electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 890.00 Million |

| Market Forecast in 2033 | USD 2,766.67 Million |

| Market Growth Rate 2025-2033 | 12.01% |

Canada Electric Two-Wheeler Market Trends:

Environmental Sustainability and Green Mobility Goals

Canada’s commitment to reducing greenhouse gas emissions is a significant driver for electric two-wheeler adoption. Under the Canadian Net-Zero Emissions Accountability Act, the federal government has pledged to achieve net-zero emissions by 2050, with legally binding sector-by-sector reduction plans and a 2030 target of 40–45% below 2005 levels, alongside interim targets for 2035, 2040, and 2045. These goals encourage clean mobility solutions, making e-bikes and scooters vital to Canada’s climate strategy. Urban centers like Toronto, Vancouver, and Montreal are promoting cycling and low-emission transportation, further supporting adoption. Electric two-wheelers provide zero tailpipe emissions, bridging the gap between bicycles and cars while reducing traffic-related pollution. Combined with stricter regulations on gas-powered vehicles and active transportation policies, these initiatives make sustainability a key factor fueling Canada’s electric two-wheeler market growth.

To get more information on this market, Request Sample

Rising Fuel Prices and Cost-Effective Commuting Needs

The sharp increase in fuel prices over recent years has prompted Canadians to seek cost-effective transportation alternatives. Electric two-wheelers provide a low-cost solution for daily commuting compared to traditional gas-powered vehicles, with lower maintenance and energy costs. This affordability makes them attractive to urban dwellers, students, and delivery services. E-bikes, in particular, offer flexibility, such as avoiding traffic congestion, requiring no costly licensing or insurance in many cases, and offering cheaper charging compared to refueling a car. As living costs rise, these economic benefits significantly influence consumer decisions. Additionally, electric scooters and mopeds are gaining popularity among last-mile delivery providers, helping businesses cut operating expenses. With Canadians increasingly prioritizing cost savings without sacrificing mobility, the affordability and efficiency of electric two-wheelers make them an appealing option across diverse user groups.

Government Support and Infrastructure Development

Government initiatives supporting electric mobility is another key Canada electric two-wheeler market trends. Federal and provincial programs often provide subsidies for e-bike purchases, while investments in cycling lanes and multi-use pathways enhance safety and accessibility for riders. Municipalities like Vancouver, Montreal, and Toronto are expanding bike-friendly infrastructure, making electric two-wheelers a viable commuting choice. In addition, policies aimed at reducing reliance on cars in dense urban areas indirectly support e-bike adoption. Some provinces also offer rebates for purchasing electric bicycles, further incentivizing adoption. The integration of charging infrastructure in urban areas is growing, ensuring convenient access for two-wheeler users. This combination of financial support, policy backing, and infrastructure development creates a favorable environment for consumers and retailers, fostering rapid growth and making electric two-wheelers a widely accepted transportation option in Canada.

Canada Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

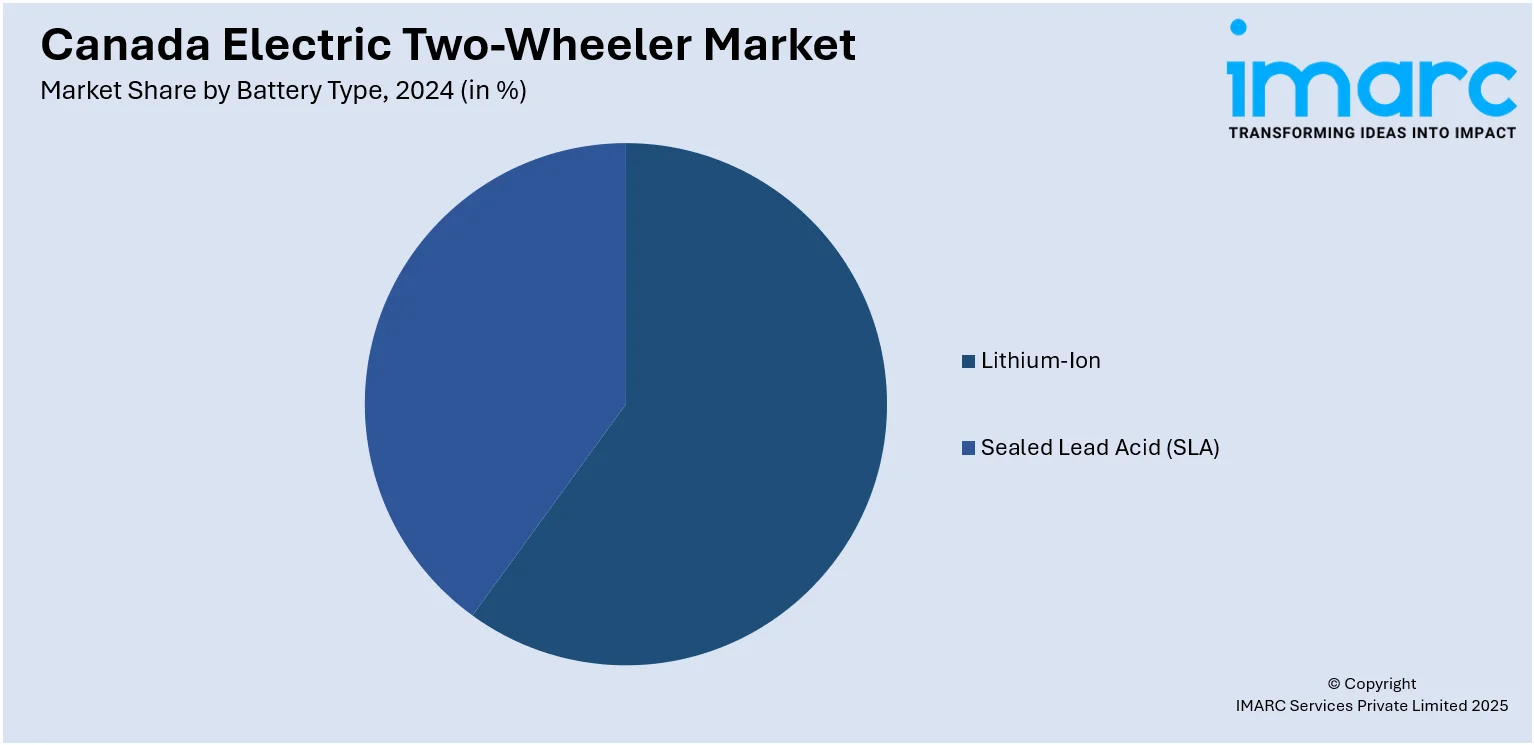

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Electric Two-Wheeler Market News:

- In November 2024, UNIVELO, a new Canadian distributor, has partnered with AIMA Technology Group to exclusively distribute AIMA’s high-performance e-bikes across Canada. Available through partner retailers, these UL-2849 certified bikes feature reliable Bafang systems, advanced welding, and premium components for easy after-sales support. AIMA, a global leader with 80 million electric vehicle sales across 50+ countries, brings its expertise to the Canadian market, offering competitive pricing and strong retailer programs.

Canada Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Canada electric two-wheeler market on the basis of battery type?

- What is the breakup of the Canada electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Canada electric two-wheeler market on the basis of peak power?

- What is the breakup of the Canada electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Canada electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Canada electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Canada electric two-wheeler market?

- What are the key driving factors and challenges in the Canada electric two-wheeler market?

- What is the structure of the Canada electric two-wheeler market and who are the key players?

- What is the degree of competition in the Canada electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)