Canada Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2025-2033

Canada Family Offices Market Overview:

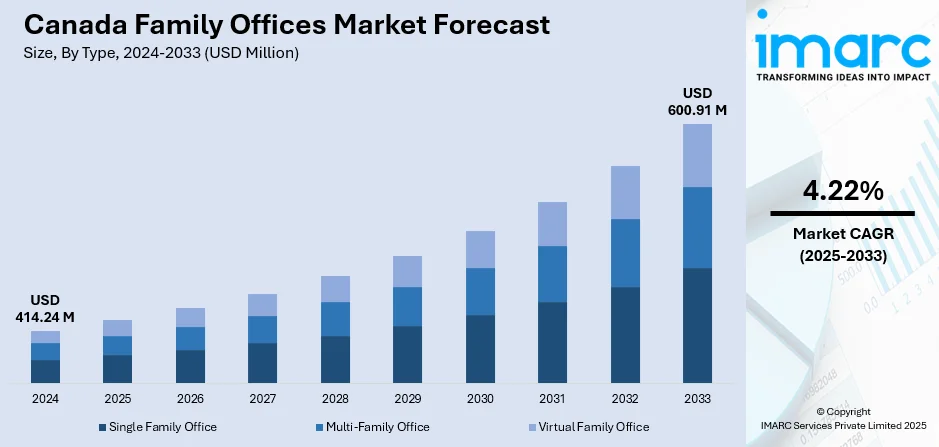

The Canada family offices market size reached USD 414.24 Million in 2024. The market is projected to reach USD 600.91 Million by 2033, exhibiting a growth rate (CAGR) of 4.22% during 2025-2033. The market is witnessing considerable growth led by heightened direct investments, high emphasis on ESG and impact investing, and embracing sophisticated digital technologies and cybersecurity. These changes signify a move towards greater control, ethical stewardship, and operational efficiency in wealth management. Families are looking to maintain and expand their wealth over generations while making investments that align with their values and risk profile. These trends are likely to improve the Canada family offices market share substantially.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 414.24 Million |

| Market Forecast in 2033 | USD 600.91 Million |

| Market Growth Rate 2025-2033 | 4.22% |

Canada Family Offices Market Trends:

Heightened Demand for Direct Investments and Co-Investment Options

Family offices in Canada are now being increasingly drawn to direct investments, especially in private equity, real estate, and venture capital. This strategy offers higher control over deal terms, transparency, and alignment with family values and long-term wealth conservation objectives. In addition to direct investments, co-investments with other family offices and institutional investors are becoming more common, allowing for access to bigger deals and diversification of risk. These actions represent a shift from historical fund investments toward more tailored portfolio building. Such activity represents larger market trends that value customization, governance, and sustainable value creation in a more complicated world investment environment. This intensifying focus on direct and co-investing is one of the main drivers of Canada family offices market growth, enabling families to directly participate in areas of interest while maximizing returns.

To get more information on this market, Request Sample

Focus on ESG and Impact Investing

Canadian family offices are showing strong interest for environmental, social, and governance (ESG) factors and impact investing, incorporating these practices into their fundamental investment decisions. The younger generation of relatives plays a significant role in spearheading this transition to purpose-based investing that also demands quantifiable social and environmental outcomes as well as financial returns. Investments in clean energy, sustainable agriculture, affordable housing, and Indigenous economic growth are increasingly prioritized. Improved reporting regimes and impact measurement frameworks are making it easier to hold people accountable and be transparent. This trend is in line with the increasing interest in responsible investment strategies, which is one of the major drivers of market expansion. It is also consistent with wider Canada family offices market trends, where the incorporation of values and legacy into wealth management is increasingly becoming best practice.

Adoption of State-of-the-Art Digital Solutions and Cybersecurity Protocols

Canadian family offices are highly adopting state-of-the-art digital solutions for enhancing operational effectiveness, investment analysis, and cybersecurity. Technologies like artificial intelligence, data analysis, and cloud-based solutions are facilitating real-time portfolio tracking, risk management, and decision-making processes. As the complexity of multi-asset portfolios increases and regulatory needs do the same, technology usage is paramount to ensure compliance and protect sensitive data. Cybersecurity has emerged as a top concern since family offices are highly exposed to cyberattacks and data breaches. As such, investment in secure digital infrastructure is rapidly growing. This technology advancement is one of the major drivers of the market expansion, offering scalability and resilience. It also identifies where innovation and security intersect to enable sustainable, long-term stewardship of wealth.

Canada Family Offices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, office type, asset class, and service type.

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes single family office, multi-family office, and virtual family office.

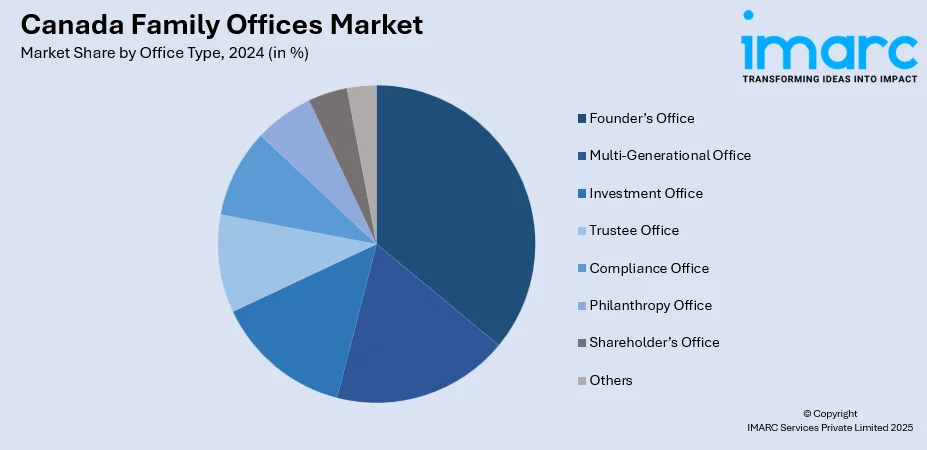

Office Type Insights:

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

A detailed breakup and analysis of the market based on the office type have also been provided in the report. This includes founder’s office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others.

Asset Class Insights:

- Bonds

- Equalities

- Alternatives Investments

- Commodities

- Cash or Cash Equivalents

The report has provided a detailed breakup and analysis of the market based on the asset class. This includes bonds, equalities, alternatives investments, commodities, and cash or cash equivalents.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes financial planning, strategy, governance, advisory, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Family Offices Market News:

- In February 2025, Robertson Stephens launched a family office targeting ultra-high-net-worth clients who have grown beyond multi-family office platforms but are not yet at the stage of needing a single-family office. The launch is meant to offer a tailored solution closing the gap between the current wealth management offerings.

Canada Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founder’s Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equalities, Alternatives Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada family offices market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada family offices market on the basis of type?

- What is the breakup of the Canada family offices market on the basis of office type?

- What is the breakup of the Canada family offices market on the basis of asset class?

- What is the breakup of the Canada family offices market on the basis of service type?

- What is the breakup of the Canada family offices market on the basis of region?

- What are the various stages in the value chain of the Canada family offices market?

- What are the key driving factors and challenges in the Canada family offices market?

- What is the structure of the Canada family offices market and who are the key players?

- What is the degree of competition in the Canada family offices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada family offices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada family offices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada family offices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)