Canada Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033

Canada Fintech Market Overview:

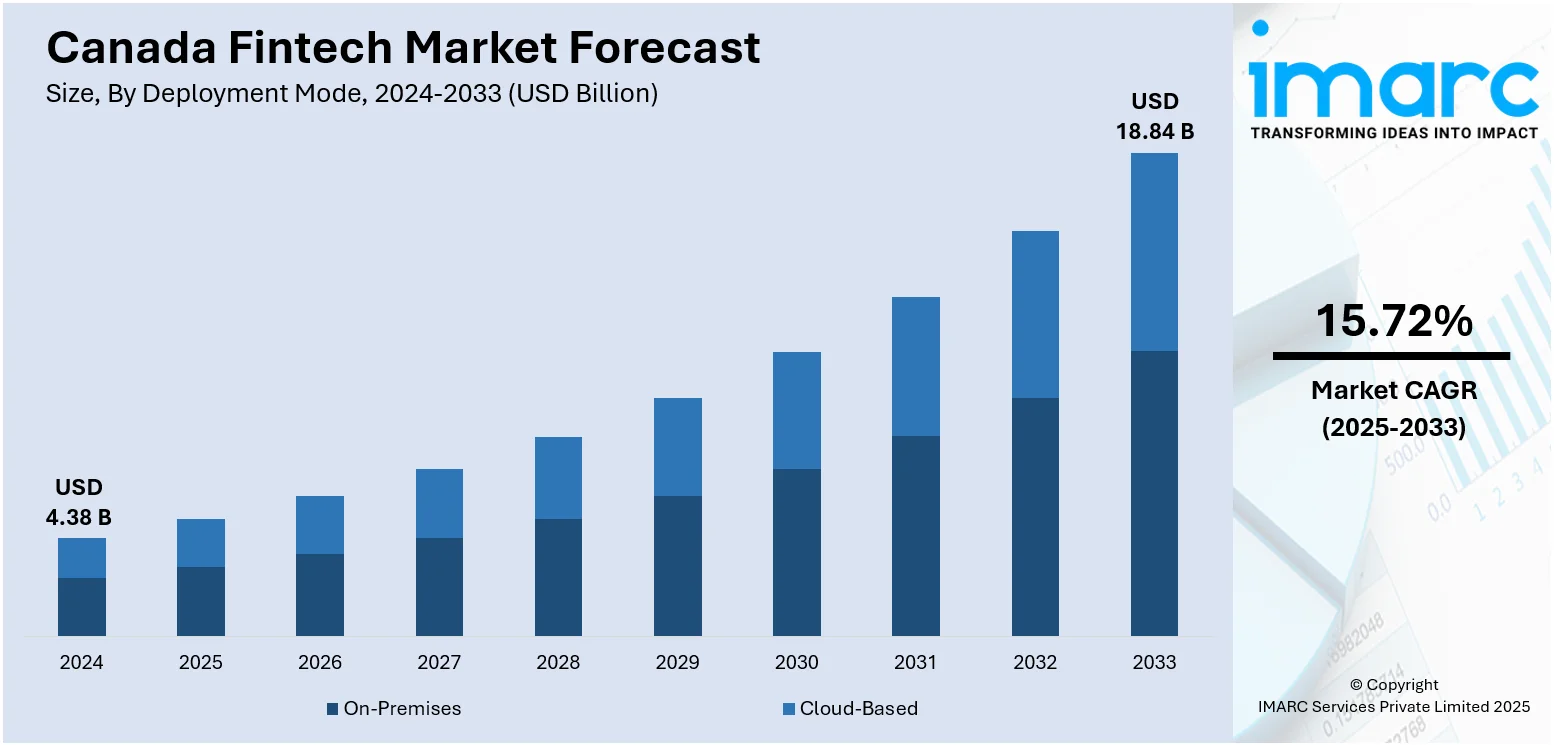

The Canada fintech market size reached USD 4.38 Billion in 2024. The market is projected to reach USD 18.84 Billion by 2033, exhibiting a growth rate (CAGR) of 15.72% during 2025-2033. The market is growing substantially, driven by innovation in artificial intelligence, blockchain, and digital banking.These innovations are improving customer experience along with operational efficiency for financial services. Open banking initiatives provide more power to the consumers when it comes to their money. Increased investment is being directed to areas of strategic importance like digital payments, AI, and blockchain, leading to further growth and innovation. Together, the factors lead to the incessant expansion and competitiveness of the Canada fintech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.38 Billion |

| Market Forecast in 2033 | USD 18.84 Billion |

| Market Growth Rate 2025-2033 | 15.72% |

Canada Fintech Market Trends:

Surge in Digital Payment Transactions

In November 2024, the Bank of Canada began registering payment service providers (PSPs) as part of efforts to strengthen the oversight and security of digital payment systems. This registration process is designed to promote competition and innovation by allowing PSPs companies that facilitate electronic money storage and transfers to compete with major banks within the real-time payment infrastructure planned for 2026. The move reflects Canada’s commitment to modernizing its financial ecosystem, ensuring that payment services are not only efficient but also secure for consumers and businesses alike. With digital payments becoming increasingly common among Canadians, this regulatory initiative supports safer transactions and increased trust in fintech solutions. The growing volume of digital payment activity is a key contributor to Canada fintech market growth, highlighting how regulatory advancements and technological adoption go hand in hand to shape a dynamic financial landscape. By encouraging a diverse range of providers, Canada is fostering a competitive environment that benefits users through improved services and broader access to cashless payment options.

To get more information on this market, Request Sample

Growth in Digital Lending for SMEs

In 2024, digital lending platforms in Canada played a crucial role in expanding access to credit for many small and medium enterprises (SMEs). These platforms offer faster loan approvals and more flexible qualification criteria than traditional banks, making it easier for SMEs to secure funding for growth, inventory, and operations. This accessibility has been particularly important for businesses facing challenges in obtaining traditional financing due to strict collateral or paperwork requirements. The increased use of digital lending demonstrates fintech’s growing influence in supporting entrepreneurship and economic resilience across Canada. By enabling more SMEs to obtain the capital they need, digital lending helps stimulate innovation and job creation in various sectors. This trend is an essential component of Canada fintech market growth, reflecting how technology-driven financial solutions are addressing gaps in business financing. Overall, the rise of digital lending represents one of the prominent Canada fintech market trends shaping a more inclusive and agile financial ecosystem for businesses nationwide.

Advancements in Open Banking Framework

In December 2024, the Canadian government released a wide-ranging framework to enable consumer-led banking, representing a move toward open banking. The framework is intended to supplant legacy data-sharing techniques, including screen scraping, with robust application programming interfaces (APIs). These APIs enable financial products and services to interact effortlessly and securely, providing consumers with increased control over their personal financial data. The government also mandated the implementation of a single technical standard to bring Canada in line with the best international standards for security, privacy, and liability protection. Users of this system must abide by enhanced privacy and national security requirements to safeguard users. This initiative will roll out in early 2026 and is intended to increase cooperation between incumbent financial institutions and fintech companies. These developments are part of wider Canada fintech market as the sector moves toward more open, transparent, and consumer-focused financial services. By facilitating improved portability of data, the framework has the potential to drive innovation, enhance customer experience, and advance financial inclusion throughout the nation.

Canada Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

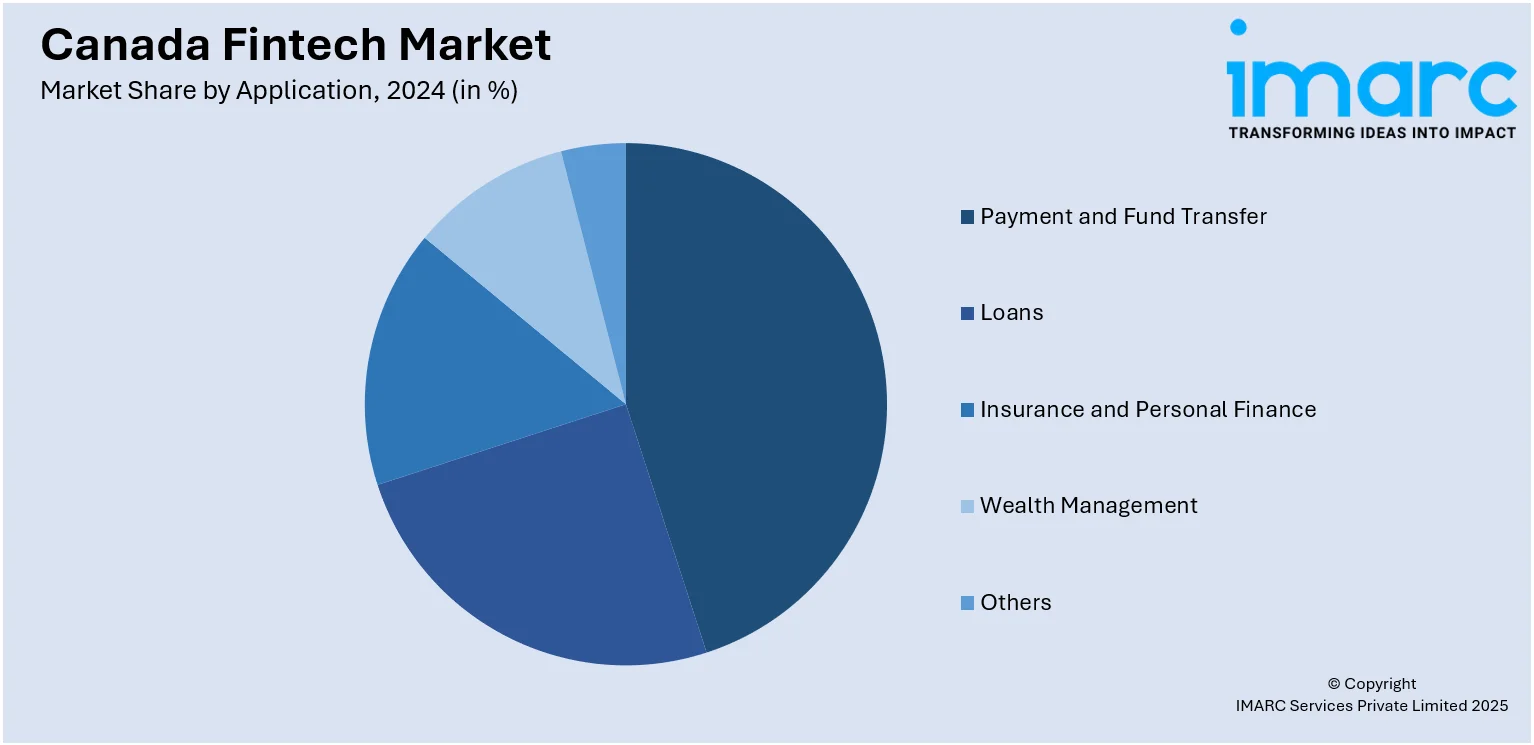

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Fintech Market News:

- August 2025: Eric Saumure, co-founder of Ottawa-based Zenbooks, has launched OpenSME to support Canadian small businesses in advocating for open banking. This volunteer-led initiative aims to encourage the Canadian government to implement open banking by raising awareness through petitions, roundtables, and policy recommendations ahead of Budget 2026. OpenSME focuses on securing equal API access for business accounts and obtaining grant funding to help Canadian small businesses safely adopt open banking technologies, strengthening the country’s financial ecosystem.

- March 2025: Visa has partnered with Fintech Cadence to support Canada's fintech ecosystem. This collaboration aims to foster innovation in the payments and remittance sectors through curated programming, educational resources, and industry events. Visa will serve as a Champion Sponsor for the 2025 Fintech Drinks Series, with events scheduled in Montreal, Halifax, Calgary, Toronto, and a second session in Montreal later in the year. This initiative reflects Visa's commitment to empowering Canadian fintech startups and enhancing the country's digital payment landscape.

Canada Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada fintech market on the basis of deployment mode?

- What is the breakup of the Canada fintech market on the basis of technology?

- What is the breakup of the Canada fintech market on the basis of application?

- What is the breakup of the Canada fintech market on the basis of end user?

- What is the breakup of the Canada fintech market on the basis of region?

- What are the various stages in the value chain of the Canada fintech market?

- What are the key driving factors and challenges in the Canada fintech market?

- What is the structure of the Canada fintech market and who are the key players?

- What is the degree of competition in the Canada fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)