Canada Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Canada Foreign Exchange Market Overview:

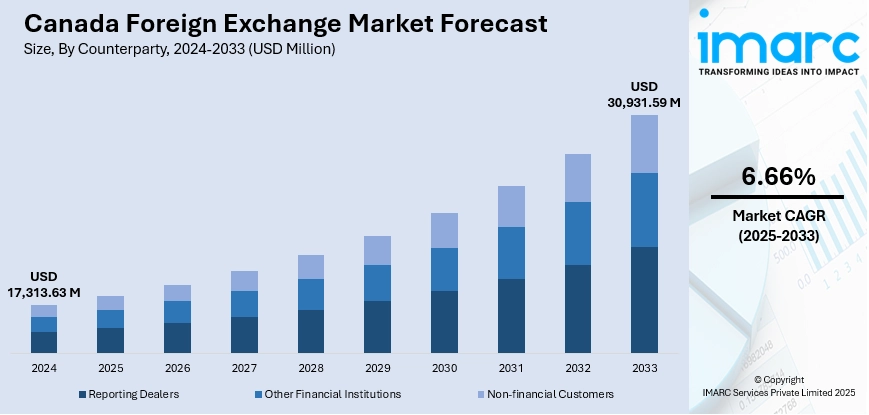

The Canada foreign exchange market size reached USD 17,313.63 Million in 2024. The market is projected to reach USD 30,931.59 Million by 2033, exhibiting a growth rate (CAGR) of 6.66% during 2025-2033. The market is fueled by increasing international trade and cross-border investments, which fuel the demand for foreign currencies in Canada. Apart from that, fluctuations in commodity prices, particularly oil and natural gas, significantly influence currency valuations, attracting both institutional and retail participants to the market. In addition, expanding financial services, rising immigrant inflows, and the growing adoption of digital trading platforms are further augmenting the Canada foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17,313.63 Million |

| Market Forecast in 2033 | USD 30,931.59 Million |

| Market Growth Rate 2025-2033 | 6.66% |

Canada Foreign Exchange Market Trends:

Rise of Algorithmic and Electronic Trading

The market is undergoing a structural transformation fueled by the rise of algorithmic and electronic trading. As global FX markets increasingly prioritize speed, precision, and cost-efficiency, Canadian financial institutions are adopting advanced trading algorithms to automate execution, reduce latency, and optimize pricing strategies. These systems can process massive data streams and execute trades in milliseconds, enabling tighter bid-ask spreads and improving liquidity, especially in high-volume currency pairs involving the Canadian dollar. Apart from this, electronic trading platforms have further enhanced direct market access, giving traders greater control over execution while minimizing human error. However, this evolution also brings added complexity, requiring robust monitoring systems and regulatory compliance. For instance, in July 2025, Trader AI launched an AI-driven cryptocurrency trading platform tailored for Canadian users. Integrating real-time analytics and automated execution through FINTRAC-registered brokerages, the platform reflects broader industry trends toward digital innovation and regulatory alignment, including features like optional KYC, PIPEDA compliance, and regional investor education. As algorithmic trading becomes more entrenched, firms are scaling their investments in data infrastructure and analytics talent, highlighting a long-term shift toward tech-led FX operations in Canada.

To get more information on this market, Request Sample

Growing Role of Institutional Investors in Currency Markets

With the technological shift, institutional investors and asset managers are playing a more prominent role in the market. Their increased participation significantly contributes to the Canada foreign exchange market growth. Unlike commercial banks that primarily facilitate corporate and interbank transactions, these entities engage in currency trading to support global investment strategies, manage risk, and hedge foreign exposure. With Canadian pension funds, mutual funds, and insurance firms expanding their international portfolios, currency hedging has become critical. Tools such as forwards, options, and swaps are commonly used to protect returns from exchange rate volatility. This institutional activity adds liquidity and strategic depth to the FX market, influencing demand for the Canadian dollar. According to an industry report, Canadian investors acquired USD 12.3 Billion in foreign securities in August 2024, driven largely by U.S. equities. Also, foreign investors increased their holdings of Canadian assets by USD 10.0 Billion. The resulting net capital outflow of USD 2.4 Billion marks a reversal from the USD 6.4 Billion inflow recorded in July 2024, illustrating the dynamic interplay between domestic and global capital flows. This growing participation by institutional investors underscores the maturity and global integration of Canada’s capital markets. Their long-term perspective and active currency management are now integral to the structure and stability of the Canadian FX ecosystem.

Canada Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

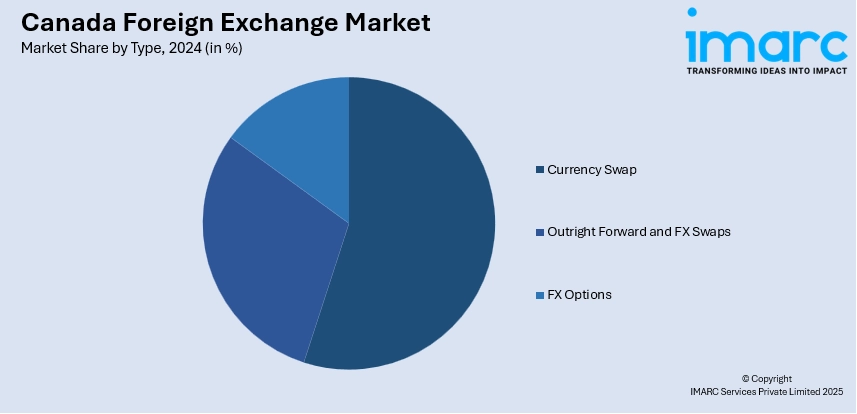

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Foreign Exchange Market News:

- March 2025, Export Development Canada (EDC) launched the Trade Impact Program to support Canadian exporters facing increased global trade uncertainty. The program includes CAD 5 Billion in additional support over two years, offering financing, credit insurance, and foreign exchange risk management tools, directly aiding businesses in navigating currency volatility. While primarily aimed at strengthening international trade, the initiative also holds relevance for Canada’s foreign exchange market by facilitating cross-border transactions and enhancing exporters’ ability to manage exchange rate exposure.

Canada Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada foreign exchange market on the basis of counterparty?

- What is the breakup of the Canada foreign exchange market on the basis of type?

- What is the breakup of the Canada foreign exchange market on the basis of region?

- What are the various stages in the value chain of the Canada foreign exchange market?

- What are the key driving factors and challenges in the Canada foreign exchange market?

- What is the structure of the Canada foreign exchange market and who are the key players?

- What is the degree of competition in the Canada foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)