Canada Frozen Bakery Market Size, Share, Trends and Forecast by Product, Consumption, Distribution Channel, and Region, 2025-2033

Canada Frozen Bakery Market Size and Share:

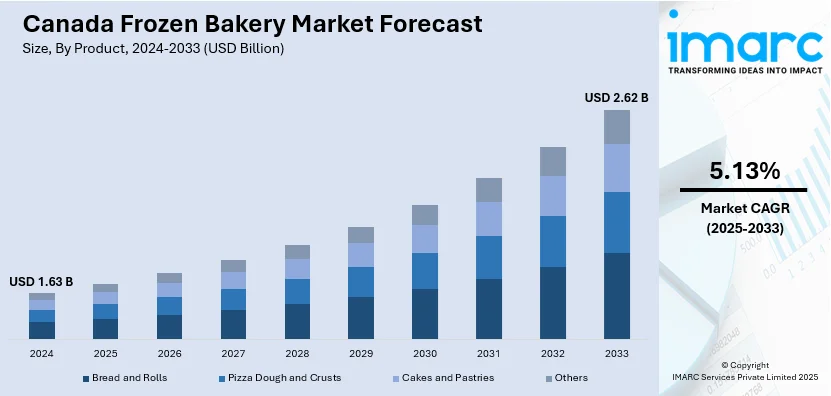

The Canada frozen bakery market size was valued at USD 1.63 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.62 Billion by 2033, exhibiting a CAGR of 5.13% from 2025-2033. The Canada frozen bakery market is growing steadily, driven by demand for convenient, time-saving food options and increasing consumer interest in specialty products like gluten-free and organic items. Additionally, ongoing advancements in freezing technologies ensure quality and variety, appealing to both retail and food service sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.63 Billion |

| Market Forecast in 2033 | USD 2.62 Billion |

| Market Growth Rate (2025-2033) | 5.13% |

The rising demand for convenience and time-saving food solutions significantly drives the frozen bakery market in Canada. With increasingly busy lifestyles, consumers seek ready-to-eat (RTE) or easy-to-prepare options that minimize meal preparation time. Frozen bakery products like bread, pastries, and pizza bases cater to these preferences, offering quality and variety. Furthermore, advancements in freezing technologies ensure longer shelf life and minimal compromise on taste and texture, enhancing their appeal. Retailers and foodservice providers also favor frozen bakery items for their ease of storage and reduced wastage, further bolstering the market growth across diverse consumer demographics. For instance, Canada's population continues to grow and diversify, offering new opportunities across various sectors. As of October 1, 2023, Canada's population was estimated at 40.5 million, with over one million people having entered the country in the first nine months of the year.

The growing inclination toward specialty frozen bakery items, including gluten-free, organic, and vegan options, is a key driver in Canada. Health-conscious consumers and those with dietary restrictions increasingly opt for such products, fostering market expansion. Manufacturers are responding by introducing innovative offerings that cater to niche markets while maintaining taste and texture. The rise of artisanal frozen bakery goods that emphasize premium ingredients and unique flavors also aligns with evolving consumer preferences. This trend is supported by retailers expanding their frozen sections to accommodate diverse options, enhancing accessibility and aiding the sustained market demand.

Canada Frozen Bakery Market Trends:

Shift towards RTE meals

As Canadian consumers increasingly prioritize convenience, the demand for RTE meals and snacks continues to rise, directly benefiting the frozen bakery market. Busy lifestyles, especially in urban areas, have led to a preference for quick, hassle-free meal solutions, including frozen breads, pastries, and pre-made pizza bases. These products cater to time-conscious consumers who do not want to compromise on quality. The variety and ease of use of frozen bakery items requiring little preparation make them an appealing choice for professionals, families and students. This shift towards RTE meals also supports the growth of frozen bakery products in both retail and foodservice channels, allying with the broader trend of convenient food consumption.

Innovation and product diversification

Innovation in the frozen bakery sector is a key driver of market growth in Canada. Manufacturers are increasingly focusing on product diversification, offering a range of options that cater to diverse consumer preferences, including healthier alternatives and premium products. Innovations in flavors, textures, and packaging are meeting demand for unique and high-quality frozen bakery items. Moreover, there is a growing trend towards small-batch, artisanal offerings that cater to consumers seeking more gourmet options. Companies are also experimenting with new ingredients, such as ancient grains or non-traditional sweeteners, to appeal to health-conscious buyers. This constant innovation enhances the appeal of frozen bakery products and attracts a broader consumer base.

Expansion of retail and online channels

The Canadian e-commerce market continues to grow rapidly and significantly, showing revenue projections of as high as CAD 68.17 billion by 2023. This growth mirrors the continuing expansion of the digital retail landscape, spurred by increasing consumer demand for online purchase across categories, including food, that are increasingly becoming popular across categories. The growth of these traditional retail outlets and online shopping platforms for groceries is influencing the frozen bakery market in the country. Retailers are expanding their frozen sections to accommodate a broader range of bakery products, from conventional bread to specialty pastries. The growing online grocery shopping adoption has also created new opportunities in frozen bakery product sales. Consumers are now able to order frozen products and receive them as a delivery, which again boosts the market growth.

Canada Frozen Bakery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Canada frozen bakery market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, consumption, and distribution channel.

Analysis by Product:

- Bread and Rolls

- Pizza Dough and Crusts

- Cakes and Pastries

- Others

Bread and rolls dominate the Canadian frozen bakery market, driven by consumer preference for convenience and variety. With the growing demand for whole grain, gluten-free, and artisanal options, frozen bread products offer long shelf life, easy preparation, and consistent quality, making them a staple in both retail and foodservice sectors.

Meanwhile, the pizza dough and crusts are gaining traction in the Canadian frozen bakery market due to the increasing popularity of at-home pizza-making. Offering convenience and customization, frozen pizza bases and dough allow consumers to quickly prepare fresh, quality pizzas. The demand for gluten-free and gourmet options further fuels growth in this category.

Additionally, frozen cakes and pastries are popular for their convenience and indulgence, catering to busy consumers seeking quick desserts. The category has seen growth with innovations in premium, healthier options such as low-sugar, gluten-free, and plant-based products. Both retail and food service channels have expanded their offerings to meet consumer demand.

Others segment in the Canada frozen bakery market includes an array of niche products like croissants, muffins, and frozen dough for homemade baking. While smaller in volume, these products are rising in popularity due to the increasing demand for specialty baked goods, health-conscious options, and premium ingredients.

Analysis by Consumption:

- Ready To Eat

- Ready To Bake

- Others

Ready-to-eat frozen bakery products are highly popular in Canada, driven by consumer demand for convenience. These products, including fully cooked breads, pastries, and snacks, require no preparation, making them ideal for busy individuals and families. They offer quick solutions for meals and desserts, fueling market growth in this segment.

Concurrently, ready-to-bake frozen bakery products allow consumers to enjoy freshly baked goods at home with minimal effort. Popular items include frozen pizza dough, rolls, and cookie dough. This segment appeals to those seeking the experience of homemade, warm baked goods without the preparation time, offering quality and convenience simultaneously.

Moreover, the others segment includes frozen bakery items that require some preparation, such as frozen dough or partially baked goods. These products cater to consumers who enjoy baking but seek the convenience of pre-made dough or ingredients. The segment's growth is driven by the trend of at-home baking and customization.

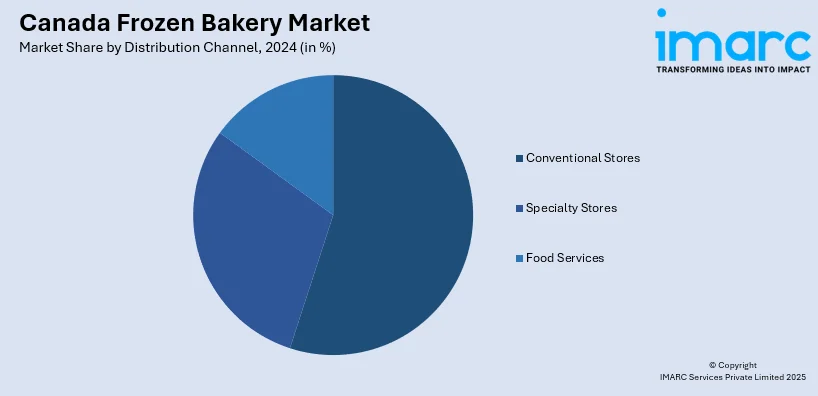

Analysis by Distribution Channel:

- Conventional Stores

- Mass Merchandisers

- Grocery Stores

- Online Retailers

- Specialty Stores

- Artisan Bakers

- Bakery Stores

- In-store Bakeries

- Food Services

- HORECA

- Institutional Food Service and Catering

Conventional stores, including mass merchandisers, grocery stores, and online retailers, are significant distribution channels for the Canadian frozen bakery market. They are offering a wide range of frozen bakery products to consumers with a need for convenience and affordability. These stores significantly play a role in driving accessibility and growth in the market.

The category also includes specialty stores such as artisan bakeries, bakery stores, and in-store bakeries, some of which offer handcrafted or otherwise high-quality frozen items for quality premium ingredients, unique flavors, and artisanal techniques. Most tend to appeal to the shopper wanting to indulge in gourmet options but on their watch.

Besides, frozen bakery products are also relied upon by food service channels, that is, hotels, restaurants, and catering (HORECA), and institutional food services for consistency and efficiency in their offerings. The sectors use ready-to-bake and RTE products to streamline preparation while meeting consumer demand for convenience, taste, and quality in mass food production.

Regional Analysis:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The Ontario region is one of the most populated provinces in Canada with high urbanization rates and therefore considered to be the biggest market for frozen bakery products. Consumer diversity, well-developed retail infrastructure, and an emphasis on convenience and quality support significant demand for both conventional and specialty frozen bakery items.

The demand in the frozen bakery market in Quebec comes mainly from its cultural preferences, which heavily favors artisanal and specialty products. The French speaking people in the province value high-end, gourmet-quality products. The food service sector of Quebec also positively influences growing demand, whereby it has ready-to-bake and RTE items on menus in restaurants and cafés.

Another factor that drives the demand for frozen bakery products is Alberta's increasing urban population, particularly in Calgary and Edmonton, as most people lead busy lifestyles and prefer convenience. The province's foodservice sector also contributes significantly to the market, with frozen bakery products being a major part of restaurant and catering services.

In addition, the frozen bakery market in British Columbia is characterized by health-conscious consumers and a strong demand for specialty products, such as gluten-free, organic, and plant-based options. The province's diverse population and focus on sustainability also influence purchasing patterns, with an increasing preference for premium and artisanal frozen bakery products.

Other parts including the Prairie provinces (Manitoba and Saskatchewan) and the Atlantic provinces (Nova Scotia and New Brunswick, Newfoundland and Labrador) also experience steady demand. Though smaller compared to the previous regions by market share, these show steady growth because of their increasing consumer demand for readily available, quality frozen baked goods in both retail as well as food service locations.

Competitive Landscape:

Competitive landscape features the presence of established global as well as regional players besides emerging local brands. Major companies are offering a wide range of frozen bakery products across various categories, from rolls, breads to pastries and pizza dough. These companies benefit from robust distribution networks and established brand loyalty. Simultaneously, artisanal smaller bakeries and specialty brands are gathering popularity by catering to specific markets in terms of high-premium organic and health-related products that include gluten-free and plant-based options. Innovative product lines are becoming increasingly popular in this market also, with a difference created due to the convenience, taste, and quality of their products. Recent and increased online sales-including direct-to-consumer or D2C-ways of selling increase the amount of competition and require the dynamic pricing strategies or even product offerings to go abreast with the escalating trends of consumers in a particular retail and food service market.

The report provides a comprehensive analysis of the competitive landscape in the Canada frozen bakery market with detailed profiles of all major companies.

Latest News and Developments:

-

In November 2023, B.C.-based OK Frozen Dough planned to expand to Southern Alberta in first quarter of 2024 with the opening of a 36,000-square-foot plant, which will enable it to become an SQF-certified facility validating the company’s stringent food safety program. It will contain spiral and blast freezers, mixers and forming equipment, to quick-freeze the products.

Canada Frozen Bakery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bread and Rolls, Pizza Dough and Crusts, Cakes and Pastries, Others |

| Consumptions Covered | Ready To Eat, Ready To Bake, Others |

| Distribution Channels Covered |

|

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada frozen bakery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Canada frozen bakery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada frozen bakery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Canada's frozen bakery market includes a wide range of RTE or easy-to-prepare frozen products, such as bread, pastries, cakes, and pizza bases. These items cater to consumer demands for convenience, variety, and quality. The market is driven by busy lifestyles, health-conscious trends, and innovations in product offerings.

The Canada frozen bakery market was valued at USD 1.63 Billion in 2024.

IMARC estimates the Canada frozen bakery market to exhibit a CAGR of 5.13% during 2025-2033.

Key factors driving the Canada frozen bakery market include increasing demand for convenience and time-saving food, rising health-conscious consumer preferences for specialty products like gluten-free and organic options, continuous product innovation, expansion of retail and online channels, and a shift towards RTE meals and snacks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)