Canada Generative AI Market Size, Share, Trends and Forecast by Offering Type, Technology Type, Application, and Region, 2025-2033

Canada Generative AI Market Overview:

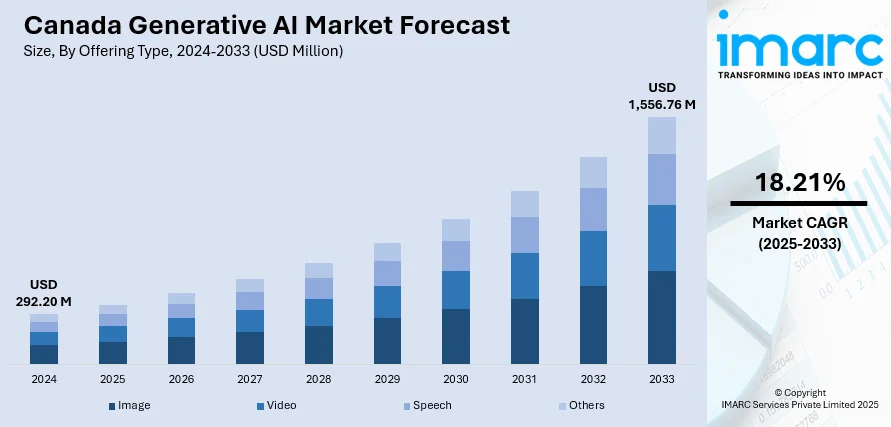

The Canada generative AI market size reached USD 292.20 Million in 2024. The market is projected to reach USD 1,556.76 Million by 2033, exhibiting a growth rate (CAGR) of 18.21% during 2025-2033. The market is propelled by the rising adoption of artificial intelligence-powered content generation across industries, especially in media, marketing, and customer service. Apart from this, growth in cloud computing infrastructure and increased investment by Canadian enterprises in AI research and development (R&D) also contribute to expansion. Moreover, government support for AI innovation, alongside a skilled talent pool, accelerates commercial deployment, which is significantly augmenting the Canada generative AI market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 292.20 Million |

| Market Forecast in 2033 | USD 1,556.76 Million |

| Market Growth Rate 2025-2033 | 18.21% |

Canada Generative AI Market Trends:

Enterprise Integration Across Sectors

A key trend in the market is the growing integration across diverse enterprise functions, notably within finance, healthcare, retail, and telecommunications. Organizations are increasingly leveraging generative AI to automate tasks such as content creation, customer communication, data summarization, and document drafting. According to an industry study, generative AI has become a leading area of investment for Canadian organizations. The survey of 424 IT decision-makers reveals that over 85% of businesses are actively experimenting with generative AI tools, and nearly 90% have already adopted them. Rather than treating AI as a trial technology, companies now regard it as a critical asset for maintaining a competitive edge. In banking and insurance, it is being used to generate synthetic data for model training and for drafting personalized customer reports. Furthermore, healthcare providers use AI-generated summaries of patient histories and transcriptions, improving clinical documentation processes. Besides, retailers are deploying AI-driven product descriptions and chatbot interfaces to enhance digital shopping experiences. Enterprise-grade AI models are also fine-tuned for domain-specific outputs, driven by the need for accuracy and compliance with sectoral regulations. This has led to increased demand for model customization and private AI deployments over public APIs. Moreover, Canadian businesses are prioritizing ethical AI adoption, focusing on transparency, explainability, and responsible data handling. Apart from this, strategic partnerships between AI vendors and consulting firms enable large-scale, managed deployments that comply with Canadian data privacy standards, which is positively impacting the Canada generative AI market growth.

To get more information on this market, Request Sample

Investment Surge in AI Startups and Research Ecosystems

Canada's generative AI landscape is witnessing a surge in venture capital funding and government-backed research. For instance, on March 7, 2025, the government of Canada launched the AI Compute Access Fund, committing up to CAD 300 Million (about USD 222 Million) to provide affordable high-performance computing resources to small and medium-sized enterprises, enabling the development of AI solutions domestically. By addressing computer-related barriers, the fund aims to empower Canadian SMEs to compete on a global stage in AI innovation. Major cities such as Toronto, Montreal, and Vancouver host a concentration of startups, academic labs, and innovation clusters that specialize in deep learning, language models, and content generation. Additionally, funding is flowing into startups focused on niche generative AI applications—ranging from AI-driven video generation and voice synthesis to synthetic data creation and marketing automation. At the same time, public institutions like the National Research Council Canada (NRC) and the Canadian Institute for Advanced Research (CIFAR) continue to support foundational AI research through grants and collaborative programs. This funding climate has fostered rapid prototyping, allowing Canadian AI firms to compete globally. Emphasis is placed on training local talent and securing intellectual property, leading to the rise of proprietary generative models developed in-country. These investments are strengthening the country's positioning as a strategic innovation hub for next-generation AI.

Canada Generative AI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on offering type, technology type, and application.

Offering Type Insights:

- Image

- Video

- Speech

- Others

The report has provided a detailed breakup and analysis of the market based on the offering type. This includes image, video, speech, and others.

Technology Type Insights:

- Autoencoders

- Generative Adversarial Networks

- Others

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes autoencoders, generative adversarial networks, and others.

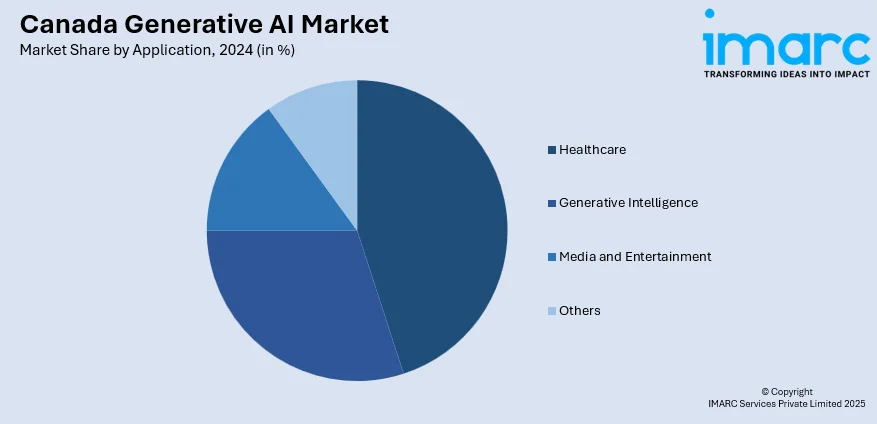

Application Insights:

- Healthcare

- Generative Intelligence

- Media and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes healthcare, generative intelligence, media and entertainment, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Generative AI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offering Types Covered | Image, Video, Speech, Others |

| Technology Types Covered | Autoencoders, Generative Adversarial Networks, Others |

| Applications Covered | Healthcare, Generative Intelligence, Media and Entertainment, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada generative AI market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada generative AI market on the basis of offering type?

- What is the breakup of the Canada generative AI market on the basis of technology type?

- What is the breakup of the Canada generative AI market on the basis of application?

- What is the breakup of the Canada generative AI market on the basis of region?

- What are the various stages in the value chain of the Canada generative AI market?

- What are the key driving factors and challenges in the Canada generative AI market?

- What is the structure of the Canada generative AI market and who are the key players?

- What is the degree of competition in the Canada generative AI market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada generative AI market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada generative AI market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada generative AI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)