Canada Greenhouse Horticulture Market Size, Share, Trends and Forecast by Material Type, Crop Type, Technology, and Region, 2025-2033

Canada Greenhouse Horticulture Market Overview:

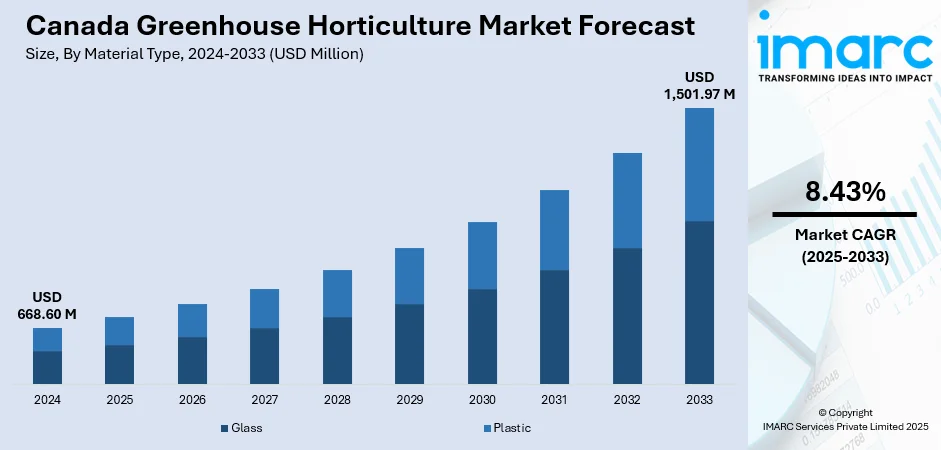

The Canada greenhouse horticulture market size reached USD 668.60 Million in 2024. The market is projected to reach USD 1,501.97 Million by 2033, exhibiting a growth rate (CAGR) of 8.43% during 2025-2033. The market is fueled by increasing demand for locally grown fruits, vegetables, and flowers across the region. Apart from that, continual advancements in greenhouse technologies, including climate control systems, automation, and energy-efficient solutions, further strengthen productivity and profitability for growers. Moreover, government support programs and investments in modern agricultural infrastructure are a significant factor that augments the Canada greenhouse horticulture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 668.60 Million |

| Market Forecast in 2033 | USD 1,501.97 Million |

| Market Growth Rate 2025-2033 | 8.43% |

Canada Greenhouse Horticulture Market Trends:

Adoption of Advanced Greenhouse Technologies

Greenhouse agriculture in Canada is seeing a dramatic trend towards automation and computerized control systems that maximize yield and resource utilization. Further, highly advanced climate control systems, precision irrigation, and artificial intelligence-based monitoring devices enable growers to realize ideal conditions for a variety of crops despite outside weather fluctuations. In addition to this, the use of LED lighting solutions specific to plant requirements has promoted year-round production, particularly of high-value vegetables and specialty products. These technologies minimize reliance on seasonal patterns, facilitating continuous supply and quality. In addition, computerized seeding, harvesting, and packaging technologies are reducing labor intensity, overcoming labor shortages, while advancing productivity. In addition to this, the application of data analytics platforms within greenhouses has also allowed for predictive insights, which assist producers in handling risks like outbreaks of pests and disease. This follows the general movement toward smart agriculture, making Canadian greenhouses more competitive in domestic and export markets through efficiency, sustainability, and cost-effectiveness.

To get more information on this market, Request Sample

Shift Toward Sustainable Practices

Sustainability has become a central driver in the Canada greenhouse horticulture market growth, driven by both regulatory requirements and growing consumer demand for environmentally responsible food production. Furthermore, growers are increasingly implementing renewable energy systems, such as solar panels and biomass heating, to reduce reliance on fossil fuels and mitigate greenhouse gas emissions. Also, water recycling technologies, including closed-loop irrigation and rainwater harvesting, are being adopted to address water conservation concerns. In addition to this, the use of biodegradable growing media and the reduction of synthetic pesticides through integrated pest management strategies are further enhancing eco-friendly practices. Certification programs and eco-labeling are gaining importance, allowing producers to differentiate themselves in the market and build consumer trust. Additionally, the incorporation of circular economy principles, where waste from greenhouse operations is repurposed into energy or soil amendments, is becoming more prevalent. This movement toward sustainable production is not only improving operational efficiency but also ensuring compliance with evolving environmental standards, which strengthens the long-term viability of the sector.

Expansion of Export-Oriented Production

The industry is increasingly oriented toward international markets, with producers expanding their capacity to meet rising global demand for fresh produce. High-value crops like tomatoes, peppers, cucumbers, and specialty flowers are being cultivated in greater volumes. Notably, Quebec’s government, under Agriculture Minister André Lamontagne, has successfully more than doubled annual greenhouse fruit and vegetable production, from approximately 41,500 tons to 86,000 tons, enabled by an initial USD 150 Million grant that triggered USD 875 Million in investments. This expansion, delivered via over 330 new greenhouses and 40 large tunnels, has substantially bolstered the province’s food self-sufficiency, particularly during winter months. While tomatoes (53%), cucumbers (35%), and lettuce (7%) remain dominant, crop diversification is beginning with peppers and eggplants, and the government is now refocusing efforts on enhancing productivity and competitiveness. Moreover, investments in large-scale greenhouse complexes, often exceeding several hectares, are enabling growers to achieve economies of scale and consistent year-round supply, making Canadian products competitive against other global producers. Also, improvements in cold chain logistics and packaging innovations are further ensuring that products maintain freshness and quality during long-distance transport. This export-driven expansion is reinforcing Canada’s role as a significant player in the global horticulture industry.

Canada Greenhouse Horticulture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type, crop type, and technology.

Material Type Insights:

- Glass

- Plastic

The report has provided a detailed breakup and analysis of the market based on the material type. This includes glass and plastic.

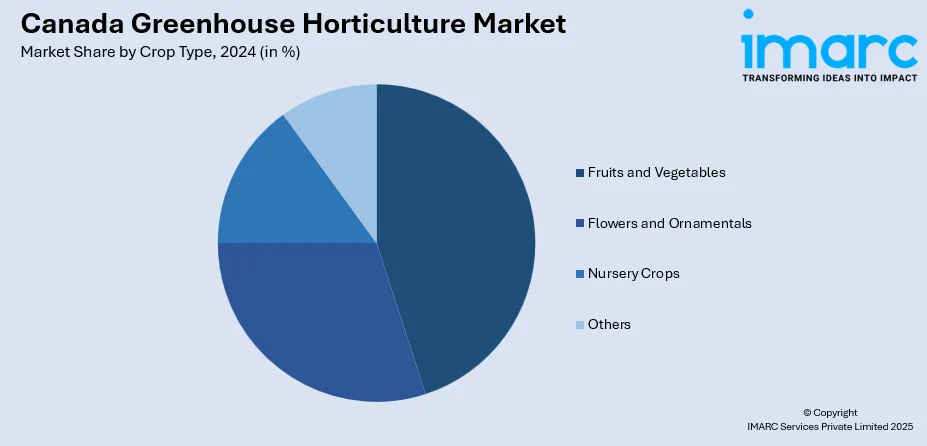

Crop Type Insights:

- Fruits and Vegetables

- Flowers and Ornamentals

- Nursery Crops

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes fruits and vegetables, flowers and ornamentals, nursery crops, and others.

Technology Insights:

- Heating System

- Cooling System

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes heating system, cooling system, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Greenhouse Horticulture Market News:

- February 2025: Cole Mucci, a third-generation grower from the Mucci family, announced the launch of KingsOne Farms, a 6.5-acre greenhouse in Kingsville, Ontario, focused on producing clean, nutritious, and flavorful lettuce through advanced automation and sustainable practices. The facility, scheduled to begin planting in fall 2025, is projected to yield nearly 11 Million heads of lettuce annually. By integrating high-tech climate controls and hydroponic systems, KingsOne Farms seeks to reduce Canada’s reliance on imported lettuce while ensuring a consistent, year-round local supply.

- January 2024: The governments of Canada and Manitoba announced an investment of over CAD 1.3 Million over five years through the Sustainable Canadian Agricultural Partnership to strengthen horticulture production at Assiniboine Community College (ACC). The funding will drive applied research in high-tunnel crop production, passive greenhouse systems to lower costs, and the development of resilient crop varieties and passive-solar greenhouses in collaboration with northern Indigenous communities to support year-round local food supply.

Canada Greenhouse Horticulture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Glass, Plastic |

| Crop Types Covered | Fruits and Vegetables, Flowers and Ornamentals, Nursery Crops, Others |

| Technologies Covered | Heating System, Cooling System, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada greenhouse horticulture market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada greenhouse horticulture market on the basis of material type?

- What is the breakup of the Canada greenhouse horticulture market on the basis of crop type?

- What is the breakup of the Canada greenhouse horticulture market on the basis of technology?

- What is the breakup of the Canada greenhouse horticulture market on the basis of region?

- What are the various stages in the value chain of the Canada greenhouse horticulture market?

- What are the key driving factors and challenges in the Canada greenhouse horticulture market?

- What is the structure of the Canada greenhouse horticulture market and who are the key players?

- What is the degree of competition in the Canada greenhouse horticulture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada greenhouse horticulture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada greenhouse horticulture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada greenhouse horticulture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)