Canada Home Decor Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Canada Home Decor Market Summary:

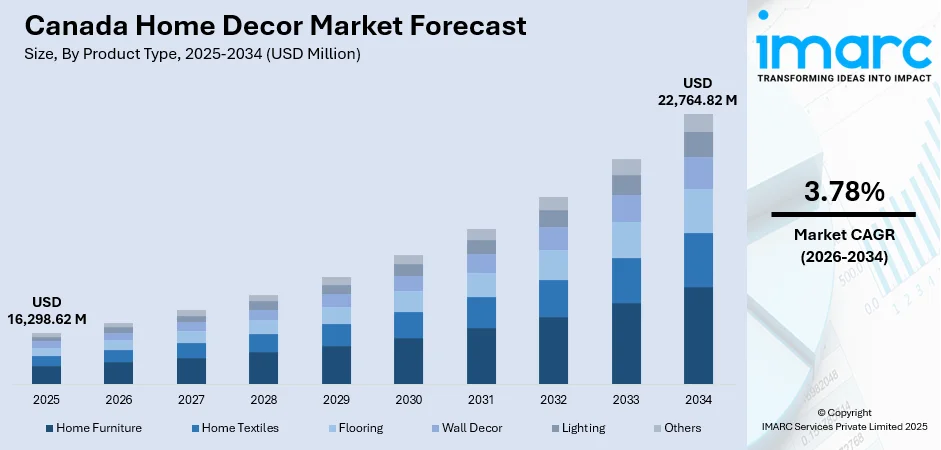

The Canada home decor market size was valued at USD 16,298.62 Million in 2025 and is projected to reach USD 22,764.82 Million by 2034, growing at a compound annual growth rate of 3.78% from 2026-2034.

The Canada home decor market is experiencing robust expansion driven by increasing consumer preference for aesthetically appealing and functional living spaces. Rising urbanization, evolving lifestyle patterns, and growing disposable incomes are fueling demand across product categories. The market benefits from strong housing activity and renovation spending, with consumers seeking personalized interior solutions. E-commerce proliferation and sustainability consciousness are reshaping purchasing behaviors, while multicultural demographics drive demand for diverse design aesthetics throughout the Canada home decor market share.

Key Takeaways and Insights:

-

By Product Type: Home furniture dominates the market with a share of 40% in 2025, owing to strong consumer demand for quality furnishings driven by increasing home renovation activities. Rising first-time homeownership among millennials and growing preference for sustainable wooden furniture continue fueling market expansion.

-

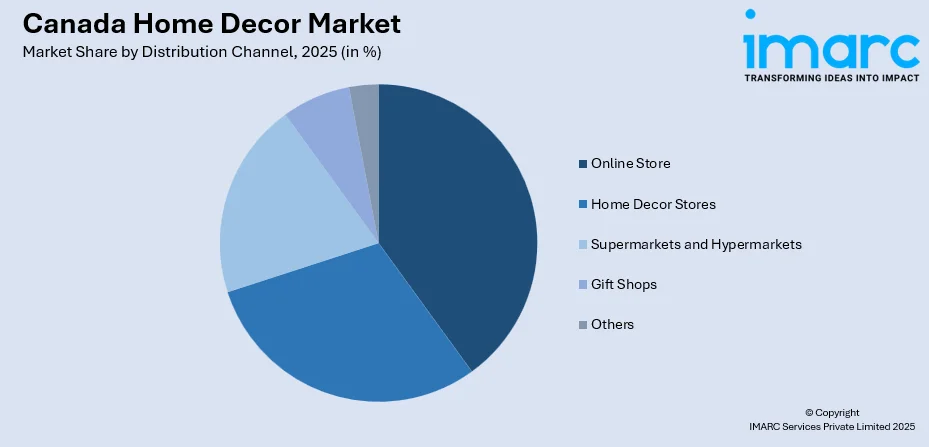

By Distribution Channel: Online store leads the market with a share of 32% in 2025. This dominance is driven by increasing smartphone penetration, convenient shopping experiences, extensive product variety, and competitive pricing that attract digitally savvy consumers seeking seamless purchasing options.

-

Key Players: Key players drive the Canada home decor market by expanding distribution networks, enhancing product portfolios, and investing in sustainable manufacturing practices. Their focus on digital transformation and omnichannel strategies strengthens market positioning.

To get more information on this market Request Sample

The Canada home decor market demonstrates significant resilience and growth potential, supported by fundamental shifts in consumer behavior and housing market dynamics. National renovation spending increased by an estimated $300 Billion between 2019 and 2023, representing an eight percent increase over the previous five-year period, which underscores the substantial investment Canadians are making in enhancing their living spaces. The market benefits from a diversified product landscape encompassing furniture, textiles, flooring, wall decor, and lighting solutions that cater to varying consumer preferences across urban and suburban demographics. Manufacturers are increasingly incorporating sustainable materials and eco-friendly production processes in response to growing environmental consciousness among consumers. The proliferation of digital platforms has democratized access to diverse design options while enabling personalized shopping experiences, thereby expanding the market reach to previously underserved segments throughout the nation.

Canada Home Decor Market Trends:

Sustainability and Eco-Friendly Materials Gaining Prominence

Environmental consciousness is reshaping the Canada home decor market as consumers increasingly prioritize sustainable and ethically produced products. Demand for recycled content, renewable materials, and organic textiles has surged significantly. Manufacturers are responding by adopting green manufacturing practices and obtaining eco-certifications that resonate with environmentally conscious consumers. In July 2025, Fuzion Flooring, a Canadian leader in flooring solutions, introduced its Hybrid Resilient with NXCORE, featuring a recyclable non-PVC core that combines sustainability with modern style.

Cultural Heritage and Artisanal Craftsmanship Integration

The multicultural demographic composition of Canada is driving demand for home decor that blends traditional heritage with contemporary design elements. Consumers increasingly seek products incorporating indigenous materials, handcrafted elements, and ethnic motifs that reflect cultural authenticity. Scandinavian-inspired minimalism emphasizing functionality remains popular alongside globally influenced aesthetics. In June 2025, IKEA launched the MÄVINN collection featuring eighteen handcrafted items that blend cultural heritage from countries including Bangladesh, India, and Thailand with contemporary design sensibilities. The collection is available in IKEA stores of Canada and online starting in September 2025.

Smart Home Technology Integration in Decor Products

Technological advancement is transforming the Canada home decor landscape through the integration of smart features into traditional furnishing categories. Smart lighting systems, connected home accessories, and IoT-enabled furniture are gaining consumer acceptance as households embrace digital convenience. Augmented reality visualization tools enable consumers to preview products within their spaces before purchasing, significantly enhancing online shopping confidence. Retailers implementing virtual room-planning technologies report improved conversion rates and reduced product returns throughout their digital channels.

Market Outlook 2026-2034:

The Canada home decor market outlook remains positive, supported by favorable demographic trends, housing market recovery, and evolving consumer preferences toward quality interior solutions. The market generated a revenue of USD 16,298.62 Million in 2025 and is projected to reach a revenue of USD 22,764.82 Million by 2034, growing at a compound annual growth rate of 3.78% from 2026-2034. Sustained urbanization, rising disposable incomes, and increasing focus on sustainable products will continue driving market expansion throughout the forecast period.

Canada Home Decor Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Home Furniture |

40% |

|

Distribution Channel |

Online Store |

32% |

Product Type Insights:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

Home furniture dominates with a market share of 40% of the total Canada home decor market in 2025.

The home furniture segment leads the Canada home decor market driven by sustained consumer demand for quality furnishings that combine functionality with aesthetic appeal. Rising urbanization and growing millennial homeownership are contributing to increased furniture purchases across residential settings. Canada ranks among the top ten furniture-producing nations globally, with particular strength in carved and specialty wood furniture manufacturing that caters to domestic and export markets.

Consumer preference for sustainable and eco-friendly furniture constructed from FSC-certified timber and recovered wood materials is accelerating segment growth. In June 2023, IKEA Canada announced investment exceeding $400 Million into projects expanding fulfillment capabilities across the Greater Vancouver and Toronto areas, reflecting the strong market potential. The emergence of multifunctional and space-saving furniture designs addresses urban dwelling requirements while manufacturers increasingly incorporate smart features to enhance product functionality.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Store

- Gift Shops

- Others

Online store leads with a share of 32% of the total Canada home decor market in 2025.

The online store segment demonstrates leadership in the Canada home decor distribution landscape, driven by increasing consumer preference for convenient digital shopping experiences. High smartphone penetration and internet accessibility enable seamless browsing and purchasing across extensive product catalogs. Retailers are investing significantly in augmented reality visualization tools that allow consumers to preview furniture placement within their homes, reducing purchase uncertainty and return rates considerably. The availability of detailed product descriptions, customer reviews, and comparison features further enhances the online shopping journey for home decor consumers.

The segment benefits from competitive pricing strategies, free shipping options, and personalized product recommendations that enhance customer engagement throughout the purchasing process. Direct-to-consumer brands are gaining market share by offering curated collections and streamlined purchasing experiences that appeal to design-conscious consumers seeking unique home styling solutions. Social media integration enables discovery of trending products while influencer collaborations drive brand awareness among younger demographics. The convenience of doorstep delivery and hassle-free return policies continues attracting consumers who value time efficiency and flexibility.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario represents the largest provincial market for home decor in Canada, driven by substantial population density, robust economic activity, and extensive housing stock. The Greater Toronto Area serves as a primary demand center where strong renovation spending and diverse consumer demographics support varied product offerings across all decor categories.

Quebec demonstrates strong growth potential within the Canada home décor market, supported by cultural preferences for distinctive design aesthetics and increasing household spending. The province's unique francophone heritage influences consumer choices toward European-inspired furnishings and artisanal craftsmanship. Growing urbanization in Montreal and surrounding areas drives demand for contemporary interior solutions while traditional Quebecois design elements remain popular among consumers seeking authentic regional character in their living spaces.

Alberta maintains a significant position in the regional home decor landscape, benefiting from relatively higher household incomes and active residential construction activity. Consumer preference for premium furnishings and contemporary design solutions drives demand across furniture and home accessory categories throughout urban centers.

British Columbia exhibits the fastest growth trajectory among Canadian provinces, supported by strong immigration inflows, technology sector employment, and recreational property investments. The region demonstrates pronounced preference for eco-friendly and sustainable home decor products, with consumers willing to pay premiums for verified environmental credentials.

Market Dynamics:

Growth Drivers:

Why is the Canada Home Decor Market Growing?

Rising Urbanization and Housing Market Activity

The expanding urban population in Canada is driving increased demand for home decor products as consumers seek to personalize and enhance their living spaces. Urban migration patterns are creating concentrated demand centers where housing turnover and renovation activity remain robust. The housing sector significantly influences home decor purchases as both homeowners and renters invest in furniture and decorative accessories to establish comfortable living environments. New residential construction projects and property transactions directly stimulate demand for complete home furnishing solutions across product categories. Renovation spending represents a substantial market driver, with Canadians investing significantly in home improvement projects that encompass decor upgrades, interior redesigns, and functional enhancements throughout their properties.

E-commerce Expansion and Digital Retail Transformation

Digital commerce is revolutionizing the Canada home decor market by providing consumers with convenient access to extensive product selections and competitive pricing. Most of the Canadians regularly make online purchases, with home furnishings representing a significant share of e-commerce transactions. Retailers are investing in advanced technologies including augmented reality visualization and virtual room planning tools that enhance the online shopping experience and reduce purchase hesitation. Mobile commerce continues gaining prominence as smartphones become primary shopping devices for home decor discovery and purchasing. The proliferation of direct-to-consumer brands and marketplace platforms is democratizing access to diverse design options while enabling personalized recommendations that drive customer engagement and conversion rates.

Growing Preference for Sustainable and Eco-Friendly Products

Environmental consciousness is reshaping consumer purchasing behavior in the Canada home decor market as sustainability becomes a primary consideration. Canadian homeowners express willingness to invest in energy-efficient home renovations that reduce long-term utility costs while minimizing environmental impact. Demand for products manufactured from recycled materials, organic textiles, and responsibly sourced timber continues expanding across all decor categories. Manufacturers are responding by adopting sustainable production practices and obtaining recognized environmental certifications that resonate with eco-conscious consumers. The emergence of circular economy initiatives including furniture rental services and upcycling programs reflects evolving consumer attitudes toward sustainable consumption patterns throughout the market.

Market Restraints:

What Challenges the Canada Home Decor Market is Facing?

High Product Costs and Pricing Pressure

Home decor products often command premium prices that limit accessibility for budget-conscious consumers across income segments. Rising raw material costs for wood, leather, and quality textiles continue pressuring manufacturers while economic uncertainties affect discretionary spending patterns throughout consumer demographics.

Fluctuating Raw Material Costs and Supply Chain Constraints

Volatile commodity prices and supply chain disruptions create operational challenges for home decor manufacturers and retailers. Material cost fluctuations affect production planning and pricing strategies while logistics bottlenecks extend delivery timelines and increase inventory management complexity throughout distribution networks.

Intense Market Competition and Consumer Price Sensitivity

The highly fragmented market structure intensifies competitive pressures as numerous domestic and international players contest market share. Consumer access to price comparison tools and alternative purchasing channels heightens price sensitivity while counterfeit products undermine brand value propositions.

Competitive Landscape:

The Canada home decor market exhibits a highly competitive and fragmented structure characterized by the presence of established international retailers, regional specialty chains, and emerging digital-native brands. Market participants compete across dimensions including product quality, design innovation, pricing strategies, and distribution capabilities. Leading companies leverage scale advantages, brand recognition, and omnichannel integration to maintain competitive positioning. Strategic initiatives focus on sustainability credentials, digital transformation, and fulfillment network expansion. The market witnesses ongoing consolidation through acquisitions and partnerships that enable participants to expand product portfolios and geographic reach while strengthening supply chain efficiency.

Recent Developments:

-

In February 2025, Walmart Canada launched its second exclusive home decor and kitchenware collection with designer Tori Wesszer for Spring 2025. The forty-one-piece line includes planters, lanterns, tablecloths, and bakeware featuring warm neutral tones and terracotta finishes, offering stylish and affordable home updates.

Canada Home Decor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Canada home decor market size was valued at USD 16,298.62 Million in 2025.

The Canada home decor market is expected to grow at a compound annual growth rate of 3.78% from 2026-2034 to reach USD 22,764.82 Million by 2034.

Home furniture dominated the market with a share of 40%, driven by increasing millennial homeownership, rising consumer preference for quality furnishings, and Canada's strong position among global furniture producers.

Key factors driving the Canada home decor market include rising urbanization and housing market activity, e-commerce expansion and digital retail transformation, growing preference for sustainable and eco-friendly products, and increasing consumer disposable incomes.

Major challenges include high product costs and pricing pressure, fluctuating raw material costs and supply chain constraints, intense market competition and consumer price sensitivity, and economic uncertainties affecting discretionary spending patterns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)