Canada Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, Distribution Channel, End Use, and Region, 2025-2033

Canada Hot Sauce Market Overview:

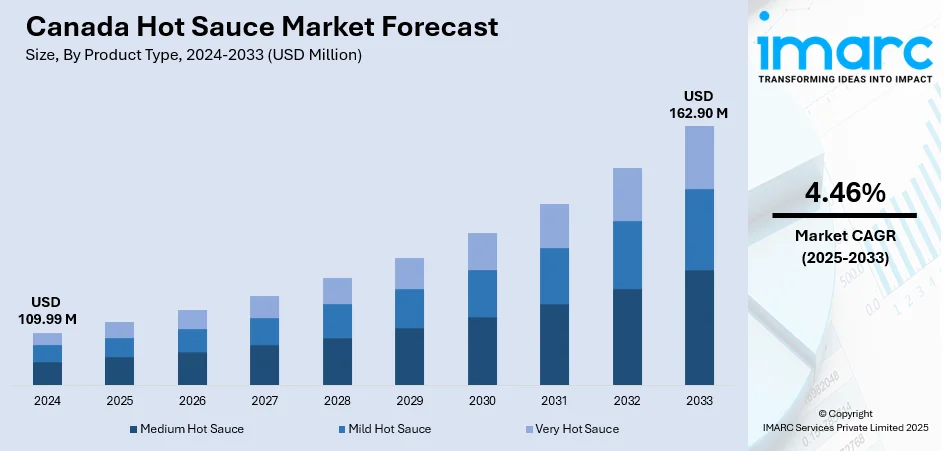

The Canada hot sauce market size reached USD 109.99 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 162.90 Million by 2033, exhibiting a growth rate (CAGR) of 4.46% during 2025-2033. The rise in cultural diversity and developing palates is impelling the growth of the market. Besides this, the increasing interest in health and wellness is influencing consumers' purchasing decisions in the country. Furthermore, the heightened expansion of retail and e-commerce channels, enhancing product visibility and availability, is expanding the Canada hot sauce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 109.99 Million |

| Market Forecast in 2033 | USD 162.90 Million |

| Market Growth Rate 2025-2033 | 4.46% |

Canada Hot Sauce Market Trends:

Increasing Multicultural Influence and Developing Palates

Canada's hot sauce market is experiencing significant growth as a result of the country's rise in cultural diversity and developing palates. Canadian consumers are increasingly adventurous with their diet and are actively looking for condiments with which to put heat and depth into meals. As more consumers try various ethnic cuisines at home and eat out at multicultural establishments, hot sauce is becoming a staple in the pantry. Social media and food influencers are also playing an important part in promoting diverse hot sauce choices, further driving consumer interest and demand. This cultural fusion is not only broadening the flavor array but is also influencing product innovation and regional flavor exploration within the hot sauce category in Canadian homes. Various companies are also bringing out various unique products to cater to the needs of consumers. In 2024, Foodrella unveiled a new range of sauces designed specifically for Korean-style chicken, representing a notable advancement in the company's growth within the North American market. As K-food becomes increasingly popular worldwide, especially in the U.S. and Canada, Foodrella's latest offerings enable consumers to effortlessly replicate the signature tastes of Korean fried chicken at home. Leading this launch is Foodrella’s sweet and spicy fried chicken sauce, crafted to enhance crispy fried chicken while faithfully mimicking the distinctive Korean tastes. This adaptable sauce is suitable for chicken as well as numerous dishes, such as barbecues, stir-fries, and unique combinations like pasta, tacos, and sandwiches.

To get more information on this market, Request Sample

Growing Health Consciousness and Natural Ingredient Demand

The increasing interest in health and wellness is influencing consumers' purchasing decisions, and hot sauce is gaining popularity as an added flavor, low-calorie option compared to thicker sauces. Canadians are making conscious choices about the ingredients they include in their diet and are moving towards natural, organic, and preservative-free products. Hot sauces featuring fresh peppers, vinegar, and spices fit the clean-label movement. Most varieties also include capsaicin, which is a known compound for its health benefits of increased metabolism and inflammation reduction, which renders them more desirable to health-oriented consumers. This trend is prompting manufacturers to revise classic formulas using healthier and more transparent ingredients. Craft and premium hot sauce brands are hitting the shelves with gluten-free, non-genetically modified organism (GMO), and additive-free products to address specific dietary requirements such as vegan and keto diets. Consequently, hot sauces are no longer merely perceived as spicy condiments but also as functional foods that enhance well-being, taste, and clean-eating ambitions.

Rapid Growth of Retail and E-commerce Environment

The rising expansion of retail and e-commerce channels is supporting the Canada hot sauce market growth. Key supermarket chains are expanding hot sauce specialty shelf space for local, artisanal, and international brands, enhancing product visibility and availability countrywide. Concurrently, e-commerce is also playing a crucial role, helping small and medium hot sauce manufacturers connect directly with consumers via channels and company websites. Influencer marketing, online reviews, and subscription boxes that are carefully curated are making it convenient for customers to try and find new flavors. Through customizable heat levels, limited-edition flavors, and themed offerings, brands are getting customers involved in novel ways. The ease of online shopping paired with retail availability is rising consumer access and propelling market growth. IMARC Group predicts that the Canada e-commerce market is projected to attain USD 5,162.18 Billion by 2033.

Canada Hot Sauce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, packaging, distribution channel, and end use.

Product Type Insights:

- Medium Hot Sauce

- Mild Hot Sauce

- Very Hot Sauce

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medium hot sauce, mild hot sauce, and very hot sauce.

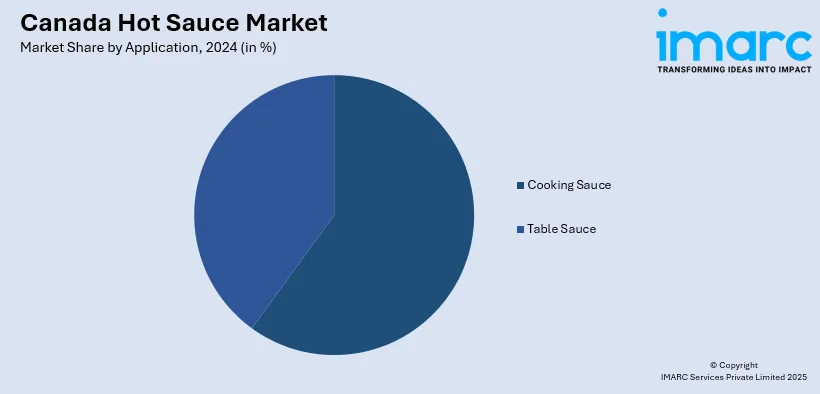

Application Insights:

- Cooking Sauce

- Table Sauce

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cooking sauce and table sauce.

Packaging Insights:

- Jars

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes jars, bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional grocery retailers, online stores, and others.

End Use Insights:

- Commercial

- Household

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial and household.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Hot Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Hot Sauce, Mild Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| End Uses Covered | Commercial, Household |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada hot sauce market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada hot sauce market on the basis of product type?

- What is the breakup of the Canada hot sauce market on the basis of application?

- What is the breakup of the Canada hot sauce market on the basis of packaging?

- What is the breakup of the Canada hot sauce market on the basis of distribution channel?

- What is the breakup of the Canada hot sauce market on the basis of end use?

- What is the breakup of the Canada hot sauce market on the basis of region?

- What are the various stages in the value chain of the Canada hot sauce market?

- What are the key driving factors and challenges in the Canada hot sauce market?

- What is the structure of the Canada hot sauce market and who are the key players?

- What is the degree of competition in the Canada hot sauce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada hot sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada hot sauce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)