Canada Hydrogen Fuel Cell Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Canada Hydrogen Fuel Cell Market Size and Share:

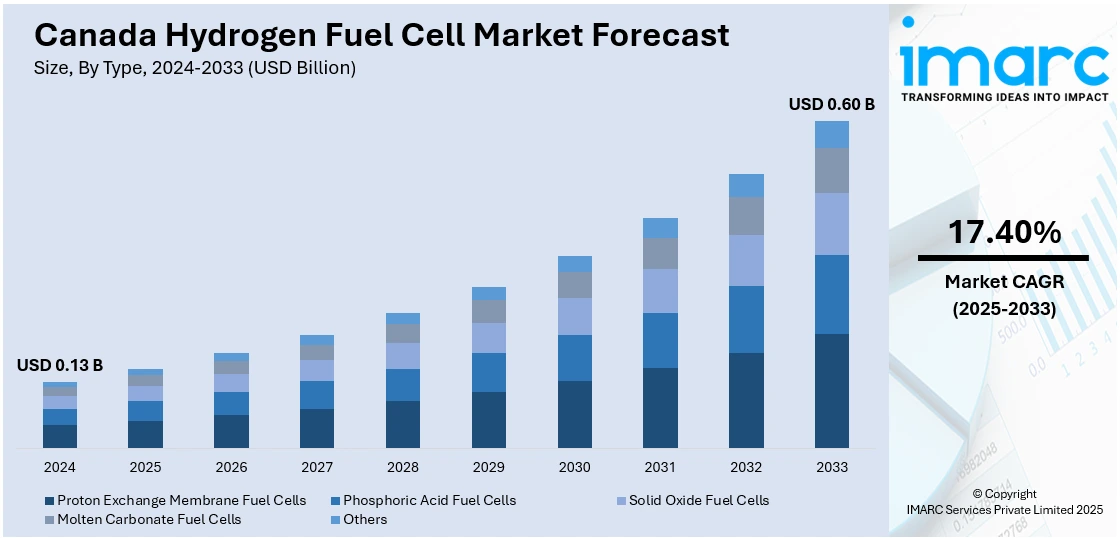

The Canada hydrogen fuel cell market size was valued at USD 0.13 Billion in 2024. Looking forward, the market is expected to reach USD 0.60 Billion by 2033, exhibiting a CAGR of 17.40% during 2025-2033. The market is fueled by Canada's clean energy ambitions, robust government incentives, and increasing investments in zero-emission transportation. Canada's rich renewable energy sources make efficient production of hydrogen through electrolysis possible, fueling green hydrogen projects. The transportation market, including commercial fleets and public transit, is increasingly embracing hydrogen fuel cell technologies in order to achieve sustainability objectives. These factors, coupled with Canada's strategic emphasis on greenhouse gas emission reduction, are fueling the Canada hydrogen fuel cell market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.13 Billion |

| Market Forecast in 2033 | USD 0.60 Billion |

| Market Growth Rate 2025-2033 | 17.40% |

As one of the foremost drivers of the Canadian hydrogen fuel cell market that receives strong backing from provincial and federal governments, the country's national plan defines a vision for the long term to make Canada a global clean hydrogen producer, distributor, and user. This state-supported approach highlights the significance of hydrogen in helping the nation attain the 2050 net-zero emissions target. Canada is tapping into its extensive clean energy resources like hydroelectricity, in particular, to create clean hydrogen using electrolysis, and thus it stands to be a world leader in green hydrogen production. Provinces like British Columbia, Quebec, and Alberta are also creating regional policies and funding programs to support hydrogen projects, from production and storage to refueling stations. This tiered policy commitment builds a conducive environment that induces private investment, enhances technology innovation, and unleashes cooperation between government entities, research organizations, and industry stakeholders, ultimately increasing the Canada hydrogen fuel cell market demand.

Canada's varied geography, robust industrial sector, and emphasis on transportation emissions reduction are key drivers for the take-up of hydrogen fuel cell technology. The nation's large distances and use of heavy-duty transportation, like freight trucks, buses, and trains, make hydrogen fuel cells a viable substitute for battery-electric vehicles, which could have limited range and extended charging. Provinces such as British Columbia are already testing hydrogen-powered buses and commercial vehicle fleets, with real-world application demonstrations underway. Aside from transportation, Canada's energy-intensive industries like mining, oil and gas, and steel, are considering hydrogen as a decarbonization opportunity for their operations. These industries need high levels of energy inputs, where hydrogen fuel cells present a cleaner, more efficient option compared to fossil fuels. Canada's extensive network of natural gas infrastructure also has a basis for gradual blending and eventual conversion to hydrogen-based energy systems. This combination of industrial demand and practical applications across sectors positions hydrogen fuel cells as a crucial component of Canada’s low-carbon future.

Canada Hydrogen Fuel Cell Market Trends:

Amplifying Government Policies and Support

The Canadian government is substantially bolstering the hydrogen fuel cell market through numerous beneficial policies, funding, and incentives. While provincial governments, particularly in important cities, are offering more assistance to support the development of hydrogen infrastructure, the federal government is presently concentrating on the creation of a low-carbon hydrogen economy in order to meet the climate goals. For instance, the Canadian government announced in May 2024 that it will invest USD 9.4 Million to build a new Clean Hydrogen Hub. Along with contributions from a number of other partners, this project will also secure USD 1 Million from the Innovative Clean Energy (ICE) Fund of the Province of British Columbia, USD 2.4 Million from Simon Fraser University, and USD 1 Million from the City of Burnaby. Moreover, this regulatory push aims to enhance production, distribution, and usage of hydrogen fuel cells in sectors like transportation and power generation. In addition, the alignment of public policies with international climate goals positions Canada is a key player in the global hydrogen market, attracting investment from both domestic and foreign companies eager to capitalize on these favorable conditions, which further ensures a positive Canada hydrogen fuel cell market outlook.

Rapid Expansion of Hydrogen Infrastructure

Canada hydrogen fuel cell market witnesses’ significant expansion pertaining to infrastructural development, especially in production plants and refueling stations. Several provinces lead initiatives to develop a resilient hydrogen base to support fuel cell vehicles. Furthermore, green hydrogen manufacturing facilities that use renewable energy sources like wind and solar are the focus of investments. In order to reduce expenses, create a strong supply chain, and accelerate the uptake of hydrogen-powered automobiles and industrial uses, this infrastructure expansion is essential. As per industry reports, Canada's deployed low-carbon hydrogen production capacity is 3,450 tons per year, supported by 80 projects that are either announced, under consideration, or in development. The total announced or developing capacity exceeds 5 Million Tons per year, with project investments surpassing USD 100 Billion. As a result, this proliferating infrastructure network facilitates the market’s long-term credibility and Canada’s goal to become a leader in global hydrogen industry.

Increasing Investment in Hydrogen Technology Advancement

There is a notable elevation in investments toward advancement in fuel cell technologies as per the Canada hydrogen fuel cell market trends. Leading research institutes and a large number of private sector businesses are collaborating strategically on developments that have the potential to greatly improve fuel cell affordability, effectiveness, and durability. In addition, various Canadian enterprises are actively emphasizing on improving hydrogen storage solutions and production methods, along with fuel cell designs, to upgrade performance in energy segments, transportation, and heavy industry. In April 2023, Canada was the world's fourth-largest producer of natural gas, with 17th-largest proven reserves, producing up to 3 Million Tons of hydrogen per year, mostly through the greenhouse gas-intensive process of steam methane reforming (SMR), according to a study published in the International Journal of Hydrogen Energy. Consequently, new natural gas pyrolysis technology has been developed for hydrogen production in Canada, offering near-zero onsite greenhouse gas (GHG) emissions and up to 41% lower emissions than SMR. This technological evolution is requisite for expanding hydrogen applications and sustaining competitiveness with other low-carbon energy sources. Moreover, the heightened focus on research and development activities highlights Canada's tactical efforts to fuel innovation in the global hydrogen market.

Canada Hydrogen Fuel Cell Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Canada hydrogen fuel cell market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Proton Exchange Membrane Fuel Cells

- Phosphoric Acid Fuel Cells

- Solid Oxide Fuel Cells

- Molten Carbonate Fuel Cells

- Others

PEM fuel cells are commonly utilized in the Canadian hydrogen market because of their low operating temperature and rapid start-up ability. They are best suited to use in transportation and portable applications, with high power density and efficiency. Their flexibility accommodates increasing demand in commercial vehicles and transit applications.

PAFCs work at moderate temperatures and mainly find stationary power generation applications in Canada. Being highly durable and fuel flexible, they find applications in industrial and commercial uses, supplying constant, reliable power. Due to their strength, they find it easy to be integrated into existing energy systems.

SOFCs operate at elevated temperatures and are applicable to large-scale power generation and industrial applications in Canada. By directly converting hydrocarbons into energy, they offer excellent efficiency and fuel flexibility. Particularly in distributed power production and combined heat and power applications, SOFCs help Canada's sustainable energy transition.

MCFCs are high-temperature systems that are applied in stationary power uses by Canada's industrial sector. MCFCs are efficiently utilized for natural gas and other hydrocarbons and are compatible with current energy infrastructure. MCFCs help in mitigating emissions and increasing energy efficiency in large-scale operations.

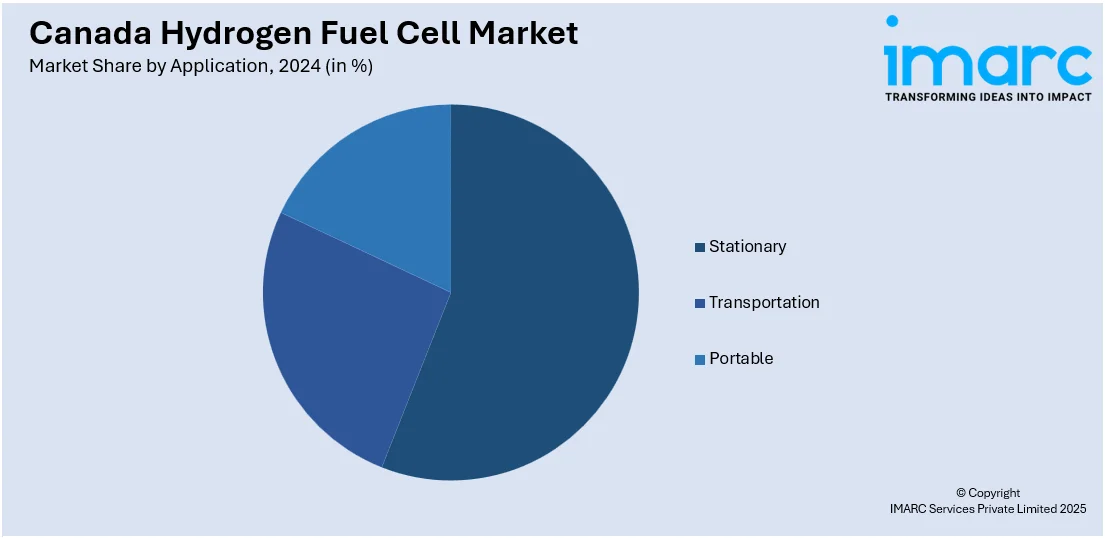

Analysis by Application:

- Stationary

- Transportation

- Portable

Stationary fuel cells based on hydrogen in Canada find most use in the generation of backup power, distributed power, and remote off-grid power supply. The systems supply stable, uninterrupted power to industrial sites, commercial complexes, and telecommunication infrastructure. Their capability for repeated use in various conditions aids Canada's efforts toward clean, reliable energy alternatives, particularly in remote or off-grid areas where access through conventional means is not feasible.

Transportation uses lead Canada's hydrogen fuel cell industry, with increasing implementation in buses, trucks, trains, and commercial fleets. Fuel cells provide increased range and quicker refueling than batteries, which makes them perfect for long-distance and heavy-duty vehicles. Canadian provinces are aggressively testing hydrogen-based public transportation and freight solutions, consistent with national initiatives to decrease transportation emissions and encourage sustainable mobility.

Canada's portable hydrogen fuel cells address specialized markets such as the military, emergency response situation, and off-grid exploration. Their portability and compactness make it possible to supply power for locations with no grid access or for critical missions. They offer clean, consistent power to electronic appliances, communications, and sensors, addressing Canada's needs for multiple-use, off-grid power systems in harsh conditions.

Analysis by End User:

- Fuel Cell Vehicles

- Utilities

- Defense

Fuel cell vehicles are a prominent end-user category as per the Canada hydrogen fuel cell market analysis, with an emphasis on passenger vehicles, buses, and commercial trucks. Fuel cell cars have rapid refueling and extended driving ranges, which are well-suited to Canada's extensive distances. Increasing government support and infrastructure deployment are driving adoption, enabling a move toward cleaner, zero-emission transportation in urban and rural Canada.

Canadian utilities are embracing hydrogen fuel cells to improve grid stability and enable integration of renewable energy. Backup power and distributed generation are offered by fuel cells to balance energy availability in isolated or off-grid areas. This segment uses Canada's vast clean energy resources to create green hydrogen, promoting national objectives for sustainable and resilient utility operations.

The defense sector in Canada uses hydrogen fuel cells to power military vehicles, remote installations, and portable equipment. Fuel cells offer silent, reliable, and efficient energy solutions essential for tactical operations and harsh environments. Adoption is driven by the need for sustainable, low-emission technologies that enhance operational capabilities while reducing logistical dependencies on fossil fuels.

Regional Analysis:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario is a central location for Canada's hydrogen fuel cell industry, led by vigorous government backing and industrial ingenuity. The province is centered on embedding hydrogen in transportation and manufacturing industries, taking advantage of its evolved infrastructure and research centers. Fuel cell utilization and hydrogen production are increasing as a result of Ontario's initiatives to reduce emissions and invest in clean energy technologies.

Quebec's hydrogen fuel cell industry is advantaged by plentiful hydroelectric power to allow mass production of green hydrogen. The province focuses on clean transport initiatives, such as hydrogen-fueled public transport and commercial vehicles. Robust government policy and partnerships with regional manufacturers set Quebec up as a champion for sustainable hydrogen technologies that underpin its wider environmental ambitions and economic diversification.

Alberta uses its energy industry know-how and natural gas resources to innovate blue and green hydrogen projects. The province decarbonizes heavy industries and transportation using hydrogen fuel cells. Alberta's investments in hydrogen infrastructure and collaboration with industry partners are poised to lead the province to a lower-carbon economy while promoting energy leadership.

British Columbia is a leader in Canada's hydrogen fuel cell industry, with early take-up of hydrogen-fueled transit and commercial fleets. The province's rich supply of clean energy resources and green policies foster strong hydrogen production and infrastructure investment. British Columbia's emphasis on sustainable transportation and innovation positions it as a leader in developing Canada's hydrogen economy.

Competitive Landscape:

Key players according to the Canada hydrogen fuel cell market forecast, are playing a crucial role in accelerating its growth through strategic investments, partnerships, and technological advancements. Companies like British Columbia-based Ballard Power Systems, a global leader, are advancing proton exchange membrane (PEM) fuel cell technology for heavy-duty and transportation applications. Ballard is currently working with global automakers, transit agencies, and logistics companies to make hydrogen fuel cell buses, trucks, and trains a reality. Loon Energy is also a Canadian company that is concentrating on creating fuel cell systems for commercial transportation and building its international presence with supply deals and pilot programs. Utility companies like Hydro-Québec and ATCO are spending money on hydrogen-producing facilities, tapping into Canada's rich hydropower resources and natural gas to fund green and blue hydrogen projects. These players are closely collaborating with government organizations to scale infrastructure, including hydrogen refueling stations and storage networks. Moreover, collaborations among Canadian companies and international technology developers are driving innovation and speeding up commercialization. Together, these initiatives by major players are creating a solid platform for hydrogen fuel cell adoption in different industries, further cementing Canada's status as a leader in the international hydrogen economy and propelling the Canada hydrogen fuel cell market growth.

The report provides a comprehensive analysis of the competitive landscape in the Canada hydrogen fuel cell market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: The Canadian government invested USD 466,956 through PacifiCan to support British Columbia’s hydrogen and fuel cell sector. The funding will help 40 companies expand globally, attract investment, and showcase innovations at international events, positioning B.C. as a leader in the growing hydrogen economy.

- May 2025: Canadian engineers in Burnaby, B.C. helped develop Cellcentric's NextGen fuel cell system for heavy-duty trucks. The system improves fuel efficiency by 20%, reduces waste heat by 40%, and offers over 500 horsepower, aiming to power long-haul trucks with hydrogen, advancing fuel cell technology for large-scale applications.

- May 2025: The Centre for Hydrogen Innovation, Workforce Development, and Outreach (CHIWDO) was established by the University of Alberta. The center will advance hydrogen technologies, including fuel cells, support workforce training, and engage with communities. It aims to position Alberta as a global leader in hydrogen production, fuel cells, and sustainable energy solutions.

- November 2024: Canada-based Ballard Power Systems announced a purchase order for 200 fuel cell engines to be supplied to New Flyer, an NFI Group affiliate. The 20 MW engines will supply electricity to New Flyer's next-generation hydrogen fuel cell buses, which will be deployed in California, New York, and Washington, among other places in the United States.

- August 2024: FuelCell Energy announced a CAD 4.9 Million grant from Canada's Clean Fuels Fund to finance two projects using its solid oxide electrolysis technology to produce low-carbon synthetic diesel fuels (eFuels). These projects, in collaboration with Canadian partners, aim to reduce emissions in sectors like transportation and heating.

Canada Hydrogen Fuel Cell Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proton Exchange Membrane Fuel Cells, Phosphoric Acid Fuel Cells, Solid Oxide Fuel Cells, Molten Carbonate Fuel Cells, Others |

| Applications Covered | Stationary, Transportation, Portable |

| End Users Covered | Fuel cell Vehicles, Utilities, Defense |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada hydrogen fuel cell market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada hydrogen fuel cell market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada hydrogen fuel cell industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydrogen fuel cell market in the Canada was valued at USD 0.13 Billion in 2024.

The Canada hydrogen fuel cell market is projected to exhibit a CAGR of 17.40% during 2025-2033, reaching a value of USD 0.60 Billion by 2033.

The Canada hydrogen fuel cell market is driven by strong government support, abundant renewable energy resources, and growing demand for zero-emission transportation. Strategic investments in hydrogen infrastructure and partnerships across industries further boost market growth. The country’s clean energy goals and industrial decarbonization efforts also enhance adoption and innovation in hydrogen technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)