Canada Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Canada Insurtech Market Overview:

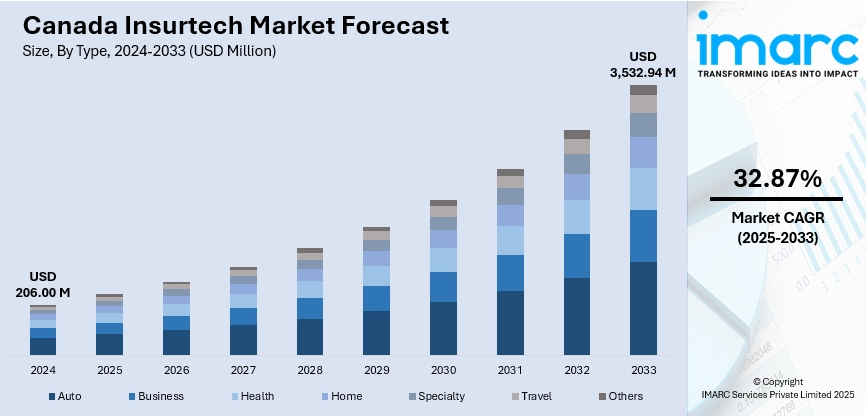

The Canada Insurtech market size reached USD 206.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,532.94 Million by 2033, exhibiting a growth rate (CAGR) of 32.87% during 2025-2033. The growth of Insurtech market in Canada is attributed to the rapid adoption of digital technologies like artificial intelligence (AI) and blockchain, enhancing operational efficiency and user experience. Additionally, strong venture capital support fuels innovation, enabling startups to create disruptive products and expand quickly, thereby influencing the Canada Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 206.00 Million |

| Market Forecast in 2033 | USD 3,532.94 Million |

| Market Growth Rate 2025-2033 | 32.87% |

Canada Insurtech Market Trends:

Digital Transformation in the Insurance Sector

The rapid adoption of technology is influencing the Insurtech market in Canada, with a significant focus on streamlining processes and enhancing user experience. Conventional insurance firms are progressively incorporating digital technologies like AI, machine learning (ML), and blockchain to enhance underwriting, streamline claims processing, and provide more tailored services. These technologies enhance the efficiency of insurance operations, minimizing the time and complexity for insurers and individuals alike. With the growing need for enhanced convenience, digital platforms provide effortless access, clarity, and quicker interactions, reshaping how insurance is purchased and administered. For example, in 2025, the Canadian Life and Health Insurance Association (CLHIA) broadened its AI-based fraud detection initiative in collaboration with Shift Technology. This program aggregates claims information from various sectors to improve fraud detection efforts, ensuring fiscal stability and enhancing the sustainability of group benefits programs. Firms that adopt these innovations can remain competitive and satisfy the changing demands of modern tech-savvy individuals. With the growing adoption of digital solutions by insurers, the industry is progressing toward a future where efficiency and client satisfaction become primary objectives, enhancing its appeal to investors and policyholders.

To get more information on this market, Request Sample

Strong Venture Capital Support

With the increasing need for more effective, client-focused insurance solutions, startups in the industry are drawing considerable investments to drive innovation and growth. Venture capital offers not just the funds needed for operational growth but also enables Insurtech firms to allocate resources for technology and skilled personnel, aiding them in competing with established industry players. With funding available, these startups can create innovative, disruptive products and improve their digital platforms, making insurance easier to access and more user-friendly. The funding also allows them to speed up product testing, enhance business models, and grow rapidly to target wider audiences. As investors acknowledge the ability of Insurtech to transform the insurance sector, their support fosters a loop of ongoing innovation and competitive development. This increasing investment interest creates a positive feedback cycle, where additional capital brings in more innovation, ultimately speeding up the transformation of the Insurtech sector. This influx of financing and backing is essential for bolstering the Canada Insurtech market growth, facilitating the creation of solutions that address the evolving requirements of individuals and companies in a progressively digital landscape. In 2024, Canadian Insurtech startup YouSet raised $3.5 million in an oversubscribed seed funding round. The investment coincided with the launch of a new feature allowing users to bundle home and auto insurance from different providers, potentially saving an additional 15%. The capital supported YouSet's expansion plans and team growth.

Canada Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

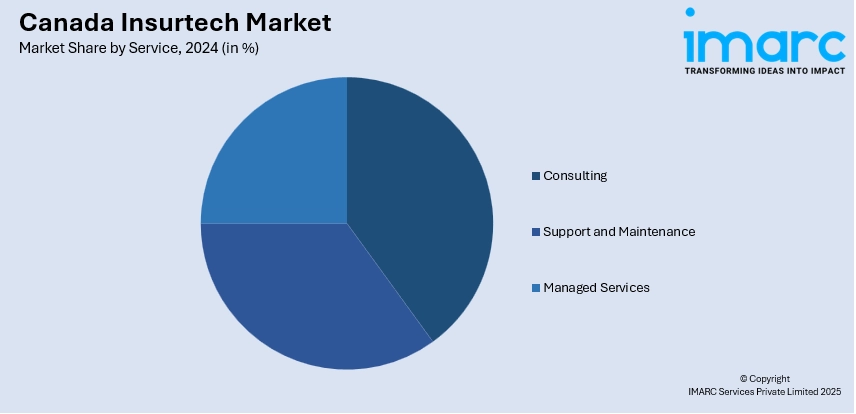

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Insurtech Market News:

- In July 2025, Canadian Insurtech startup Quandri raised $12 million in Series A funding to scale its AI-powered automation platform for insurance brokerages. The company aims to expand its presence across Canada and the US, with plans to enhance its AI and engineering capabilities.

- In February 2025, Insurtech firm Roamly expanded into the Canadian market by acquiring Canadian Access and establishing its Toronto headquarters. The company also formed a partnership with Aviva to strengthen its Canadian presence. Roamly aims to modernize the insurance experience for Canadian users, focusing on digital-first solutions for home, auto, and specialty insurance.

Canada Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada Insurtech market on the basis of type?

- What is the breakup of the Canada Insurtech market on the basis of service?

- What is the breakup of the Canada Insurtech market on the basis of technology?

- What is the breakup of the Canada Insurtech market on the basis of region?

- What are the various stages in the value chain of the Canada Insurtech market?

- What are the key driving factors and challenges in the Canada Insurtech market?

- What is the structure of the Canada Insurtech market and who are the key players?

- What is the degree of competition in the Canada Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)