Canada Kitchen Cabinet and Countertop Market Size, Share, Trends and Forecast by Material Type, Product Type, Application, Distribution Channel, and Region, 2026-2034

Canada Kitchen Cabinet and Countertop Market Summary:

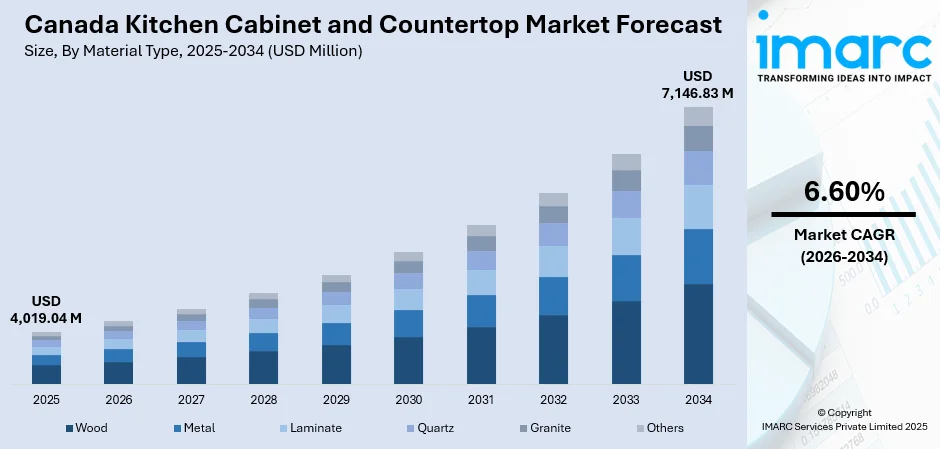

The Canada kitchen cabinet and countertop market size was valued at USD 4,019.04 Million in 2025 and is projected to reach USD 7,146.83 Million by 2034, growing at a compound annual growth rate of 6.60% from 2026-2034.

The market is driven by accelerating home renovation activities across urban and suburban regions, rising consumer preference for personalized and space-efficient kitchen solutions, and increasing adoption of sustainable materials aligned with environmental consciousness. Growing disposable incomes enable homeowners to invest in premium cabinetry and engineered stone countertops, while smart home integration trends encourage incorporation of technology-enabled storage systems. Demographic shifts toward smaller households and aging populations fuel demand for ergonomic and accessible kitchen designs, expanding the Canada kitchen cabinet and countertop market share.

Key Takeaways and Insights:

- By Material Type: Wood dominates the market with a share of 42% in 2025, driven by its aesthetic versatility, natural warmth, and cultural preference for timber cabinetry across Canadian households, complemented by availability of Forest Stewardship Council certified maple, oak, and birch options.

- By Product Type: Custom cabinets lead the market with a share of 29% in 2025, reflecting consumer demand for tailored solutions that accommodate unique spatial requirements, personalized design preferences, and integration of specialized storage features including adjustable shelving and integrated lighting systems.

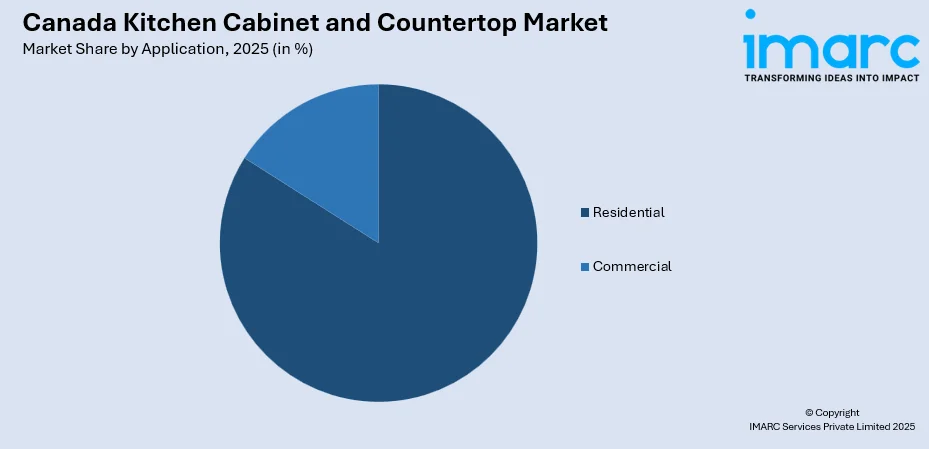

- By Application: Residential represents the largest segment with a market share of 84% in 2025, propelled by sustained housing stock renovation, aging infrastructure requiring kitchen modernization, and homeowner investment in property value enhancement through contemporary interior upgrades.

- By Distribution Channel: Offline leads the market with a share of 76% in 2025, benefiting from consumer preference for tactile product evaluation, professional consultation services, and immediate access to showroom displays facilitating informed purchasing decisions for high-value kitchen investments.

- Key Players: The Canada kitchen cabinet and countertop market exhibits moderate competitive intensity, characterized by fragmented regional manufacturers competing alongside established multinational suppliers across price segments. Market participants differentiate through product customization capabilities, material sustainability credentials, and integrated design-installation services.

To get more information on this market Request Sample

The Canadian kitchen cabinet and countertop sector represents a mature yet dynamically evolving market segment within the broader home improvement industry. Sustained urbanization drives apartment and condominium development requiring compact kitchen solutions, while suburban single-family residences pursue comprehensive renovation projects. The sector benefits from robust e-commerce infrastructure enabling online research and specification, though physical showrooms remain critical for final product selection. In June 2024, Miralis launched two new production facilities in Quebec, a cabinet plant in Saint-Anaclet-de-Lessard and a countertop plant in Quebec City, following a $45 million investment, with advanced automation aimed at doubling output by 2027 to produce 250 cabinet boxes daily. Material innovation encompasses eco-friendly alternatives including bamboo, recycled glass composite surfaces, and low-VOC finishes addressing health-conscious consumer preferences, while technological integration features automated cabinet mechanisms and smart appliance coordination systems enhancing kitchen functionality.

Canada Kitchen Cabinet and Countertop Market Trends:

Design Integration and Natural Material Emphasis

Canadian homeowners increasingly embrace biophilic kitchen aesthetics incorporating organic materials, wood textures, and earth-tone color palettes that establish visual connections to natural environments. This movement extends beyond superficial decoration to encompass structural elements including exposed ceiling beams, reclaimed timber countertops, and butcher block surfaces that introduce warmth and tactile richness. Design specifications favor warm-stained white oak lower cabinets paired with painted upper units in sage green or terracotta hues, reflecting broader interior trends toward Japandi and European farmhouse influences. Natural stone countertops maintain appeal through distinctive veining patterns, with granite and quartzite selections emphasizing unique geological characteristics. With falling interest rates, survey results reveal that home renovations fulfill both functional and emotional needs, as more than three out of five (63%) Canadians are motivated by the ambition to customize their living spaces and enhance property value. This is further driving the need for efficient and aesthetic kitchen countertops in the country.

Smart Technology Integration and Appliance Concealment

Contemporary kitchen renovations prioritize seamless technology integration through hidden appliance storage, automated cabinet mechanisms, and smart connectivity features enhancing convenience and maintaining minimalist aesthetics. Appliance garages, tall pantries, and countertop-mounted wall cabinets conceal small kitchen electronics, eliminating visual clutter while preserving accessibility for daily use. Voice-activated cabinet systems, touch-free door mechanisms, and integrated LED lighting respond to consumer demand for hands-free functionality particularly valued during food preparation activities. Power pods emerging from countertops provide electrical connections without permanent fixture visibility, while remote-controlled locking cabinets protect valuables and restrict access to cleaning supplies. In 2024, Richelieu Hardware unveiled the Qanto Electric Lift-Up system with integrated LED lighting, enhancing accessibility and maximizing space utilization in corner cabinets typically hard to reach. Richelieu collaborated with the European manufacturer Granberg to create a collection of countertops, cabinets, and closets that offer improved accessibility. Making its debut at the Woodworking Machinery & Supply Conference and Expo in Toronto last week, the company stated that this collaboration reinforces its commitment to accessibility and mobility in product creation

Customization and Multifunctional Space Optimization

Growing sophistication drives demand for bespoke cabinetry solutions accommodating individual lifestyle requirements, spatial constraints, and aesthetic preferences through flexible modular configurations. Homeowners specify adjustable shelving heights, specialized drawer organizers, pull-out pantry systems, and integrated waste separation compartments addressing specific storage challenges beyond standardized cabinet offerings. Kitchen islands evolve into multipurpose hubs incorporating built-in sinks, cooktops, power outlets, breakfast bars, and extensive storage while serving as social gathering points and workspace extensions. Double island configurations gain traction in spacious layouts, with one dedicated to meal preparation and another functioning as serving station or casual dining area. Countertop cabinets mounted directly on work surfaces rather than wall-hung provide decorative storage showcasing dishware collections while maintaining accessible placement. In 2025, BLANCO Canada won the 2025 Red Dot Product Design Awards for three innovative solutions for the kitchen water place. The INTEOS workstation sink, the BLANCOCULINA II faucet, and two base cabinet organization items including the Universal Bag and Storage Caddy have been acknowledged for their exceptional blend of design and practical use.

Market Outlook 2026-2034:

Growth trajectory of the Canada kitchen cabinet and countertop market benefits from anticipated interest rate stabilization improving housing affordability and mortgage accessibility for renovation-inclined homeowners. The market generated a revenue of USD 4,019.04 Million in 2025 and is projected to reach a revenue of USD 7,146.83 Million by 2034, growing at a compound annual growth rate of 6.60% from 2026-2034. Emerging design movements toward integrated indoor-outdoor kitchen spaces, particularly in temperate coastal regions like British Columbia, expand market scope beyond traditional interior boundaries.

Canada Kitchen Cabinet and Countertop Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material Type |

Wood |

42% |

|

Product Type |

Custom Cabinets |

29% |

|

Application |

Residential |

84% |

|

Distribution Channel |

Offline |

76% |

Material Type Insights:

- Wood

- Metal

- Laminate

- Quartz

- Granite

- Others

Wood dominates with a market share of 42% of the total Canada kitchen cabinet and countertop market in 2025.

Wood cabinets maintain market leadership through intrinsic aesthetic appeal, structural versatility, and alignment with consumer preference for natural materials evoking warmth and authenticity. Canadian suppliers emphasize Forest Stewardship Council certified hardwoods including maple, oak, and birch sourced from responsibly managed forests, addressing environmental consciousness while ensuring sustainable supply chains. Solid wood construction enables extensive customization through varied staining techniques, grain pattern selection, and profile shaping accommodating traditional, contemporary, and transitional design aesthetics.

Manufacturing advancements reduce volatile organic compound emissions through water-based finishes and formaldehyde-free adhesives, improving indoor air quality and supporting green building certifications. Price positioning spans budget-friendly options utilizing engineered wood veneers to premium solid hardwood installations, enabling market penetration across diverse socioeconomic segments while maintaining material dominance through perceived quality and longevity associations. Moreover, people are constantly seeking high-quality finishing in their kitchen cabinets which is often provided by wood surfaces. This is also responsible for the high demand for wooden storage cabinets in Canadian kitchens.

Product Type Insights:

- Ready-to-Assemble (RTA) Cabinets

- Custom Cabinets

- Stock Cabinets

- Semi-Custom Cabinets

Custom cabinets lead with a share of 29% of the total Canada kitchen cabinet and countertop market in 2025.

Custom cabinetry commands premium market positioning through tailored design solutions accommodating unique spatial configurations, specific functional requirements, and individualized aesthetic preferences unattainable through standardized product offerings. Fabrication processes involve detailed dimensional surveying, collaborative design consultation, and precision manufacturing enabling integration of specialized features including corner carousel systems, appliance panel matching, and custom hardware selections. Lead times extending eight to twelve weeks reflect labor-intensive production methodologies and material procurement requirements, offset by superior fit quality and design coherence.

Pricing structures reflect craftsmanship investment, with installations potentially exceeding twice the cost of semi-custom alternatives while delivering uncompromising spatial optimization and design expression. Market demand concentrates among affluent homeowners undertaking comprehensive renovations where kitchen investments represent focal points justifying premium expenditure for lifetime durability and aesthetic satisfaction. The product hierarchy reflects diverse user segments with varying budgets, timelines, and quality expectations, with manufacturers positioning offerings across multiple categories to capture broader market share while maintaining specialized expertise in core competency areas aligned with brand identity and target demographics.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential exhibits a clear dominance with 84% share of the total Canada kitchen cabinet and countertop market in 2025.

Residential installations dominate market activity through sustained homeowner investment in kitchen modernization driven by aging infrastructure, lifestyle evolution, and property value enhancement objectives. Renovation cycles typically span fifteen to twenty years, with extensive projects encompassing complete layout reconfiguration, appliance replacement, and finish material updates reflecting contemporary design trends. New construction residential projects incorporate builder-grade cabinetry specifications balancing cost efficiency with buyer appeal, with upgrades available through design center selections enabling purchaser customization.

Urban condominium developments emphasize space-efficient solutions including compact appliances, vertical storage maximization, and multipurpose furniture integration addressing dimensional constraints. Suburban single-family residences pursue expansive layouts with luxury finishes, multiple islands, and premium appliance packages reflecting disposable income availability and entertainment-oriented lifestyles prioritizing kitchen social functionality. In 2025, Prime Minister announced Build Canada Homes, a fresh federal agency aimed at constructing affordable housing. Build Canada Homes aims to combat homelessness by constructing transitional and supportive housing in collaboration with provinces, territories, municipalities, and Indigenous communities. It will create extensively affordable community housing for low-income families and collaborate with private developers to construct affordable homes for the Canadian middle class.

Distribution Channel Insights:

- Offline

- Online

Offline leads with a share of 76% of the total Canada kitchen cabinet and countertop market in 2025.

Traditional brick-and-mortar showrooms maintain distribution dominance through tactile product evaluation capabilities enabling customers to assess material quality, finish textures, and dimensional proportions before purchasing decisions. Professional design consultation services available at physical locations provide spatial planning expertise, material compatibility guidance, and aesthetic coordination supporting informed selections for complex renovation projects. Display installations showcasing complete kitchen vignettes facilitate visualization of finished results, addressing consumer concerns regarding appearance integration within existing architectural contexts.

Installation service coordination through retail partners streamlines project management by consolidating product procurement and labor scheduling through single contractual relationships. Regional specialty retailers develop local market expertise and supplier relationships enabling responsive customer service and community reputation building supporting repeat business and referral networks. In 2025, National home furnishings retailer The Brick has launched a newly conceptualized store in Richmond, British Columbia, signifying a significant step in the company’s ongoing growth under the Leon’s Furniture Limited brand. Situated at 4751 McClelland Road, Unit #2205, in Central at Garden City, the large 43,000-square-foot area provides a modern customer experience featuring furniture, mattresses, appliances, and electronics displayed in an engaging showroom layout.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario is the largest market for kitchen cabinets and countertops in Canada, driven by its diverse population and robust construction industry. The region's demand is bolstered by urban development, with both residential and commercial sectors showing significant growth. The preference for high-quality, durable materials like granite, quartz, and engineered wood is growing. Innovations in sustainable practices and customization are also becoming key factors influencing purchasing decisions in Ontario.

Quebec's kitchen cabinet and countertop market is marked by a mix of traditional and modern designs, with a rising trend towards sleek, minimalist aesthetics. French-speaking consumers in the region prioritize elegance and functionality. Natural stone and eco-friendly materials are gaining traction, driven by increasing awareness of sustainability. The market benefits from Quebec's strong construction and renovation industries, with both urban and suburban areas showing steady demand for upscale kitchen solutions.

Alberta’s kitchen cabinet and countertop market is thriving due to the province’s booming real estate and construction sectors. The demand is particularly strong in Calgary and Edmonton, driven by new residential projects and home renovations. Consumers in Alberta prefer robust materials such as granite and marble, as well as customized solutions to fit the state's modern home aesthetics. Sustainable and energy-efficient materials are also growing in popularity, reflecting Alberta’s environmental focus.

British Columbia’s kitchen cabinet and countertop market is characterized by high demand for premium materials, such as quartz and solid wood, often associated with luxurious, contemporary homes. Vancouver, as a metropolitan hub, influences trends toward modern designs with an emphasis on sustainability. With a growing focus on green building practices, eco-friendly materials are increasingly sought after. The market also sees significant demand from home renovations, particularly in upscale neighborhoods in the province.

Other provinces in Canada, such as Manitoba, Saskatchewan, and Nova Scotia, are witnessing steady growth in the kitchen cabinet and countertop market. These regions are characterized by a mix of new constructions and home renovation projects. Natural stone and laminate countertops are popular, offering a balance between affordability and durability. Consumers in these regions are becoming more design-conscious, with increased interest in modern, efficient kitchen solutions. Sustainable materials are also slowly gaining attention.

Market Dynamics:

Growth Drivers:

Why is the Canada Kitchen Cabinet and Countertop Market Growing?allic Finish

Sustained Home Renovation Investment and Aging Housing Infrastructure

The Canadian residential construction landscape comprises substantial aging housing stock requiring comprehensive modernization, with kitchens representing priority renovation categories due to functional obsolescence and aesthetic deterioration. Properties constructed during post-World War II suburbanization periods through the 1980s housing boom now approach or exceed forty-year service lives, necessitating infrastructure updates to maintain habitability and market competitiveness. In the post-pandemic time, Canada gained over 750,000 inhabitants annually. Recent federal policies designed to limit immigration and decrease dependence on temporary residents may now drive population growth to zero or potentially into negative figures for the first time since Confederation. The rise is residents in further increasing renovation activities, thereby supporting the market growth.

Urbanization Dynamics and Space-Efficient Design Innovation

Progressive population concentration in metropolitan centers drives demand for compact, highly functional kitchen solutions accommodating spatial constraints characteristic of urban high-density residential development. Canadian urban population rates are increasing, with major cities including Toronto, Vancouver, Montreal, and Calgary experiencing sustained population growth necessitating vertical residential construction and condominium proliferation. In November 2025, housing starts in Canada increased by 9.4% from the previous month, recovering from a 17% drop in October to attain a seasonally adjusted annual rate of 254,058 units, just exceeding the market forecast of 250,000. Urban market segments demonstrate willingness to invest premium pricing for space-optimized solutions delivering functional parity with larger suburban installations, supporting specialized product development and manufacturing innovation targeting density-challenged metropolitan markets.

Sustainability Consciousness and Eco-Friendly Material Adoption

Environmental awareness influences consumer purchasing decisions toward sustainably sourced materials, energy-efficient manufacturing processes, and products supporting healthy indoor environments through reduced chemical emissions. Forest Stewardship Council certification provides third-party verification of responsible timber harvesting, with Canadian suppliers emphasizing domestic hardwood sourcing from managed forests implementing regenerative forestry practices ensuring long-term resource availability. The Canada Green Buildings Strategy, released in July 2024, outlined the Government of Canada’s vision and future actions to enhance energy efficiency in Canadian homes and buildings, ultimately reducing energy expenses for Canadians and fostering quality employment across the country. Government green building incentives including tax credits and expedited permitting for LEED-certified construction motivate builders and renovators to specify sustainable materials meeting environmental performance criteria, creating market pull for eco-certified products.

Market Restraints:

What Challenges the Canada Kitchen Cabinet and Countertop Market is Facing?

Supply Chain Disruptions and Raw Material Cost Volatility

Global supply chain fragility continues affecting material availability and pricing stability, with timber, hardware components, and engineered materials subject to procurement uncertainties stemming from international trade dynamics, transportation bottlenecks, and geopolitical tensions. Hardwood lumber prices experience cyclical volatility reflecting forestry sector capacity constraints, while metal hardware components face availability challenges due to manufacturing concentration in specific geographic regions vulnerable to production disruptions. Extended lead times for imported materials delay project completions and increase carrying costs, while price unpredictability complicates project budgeting and contractor profitability.

Skilled Labor Shortages and Rising Installation Costs

The Canadian kitchen cabinet industry confronts acute skilled trades shortages, with aging workforce demographics creating gap between retiring craftspeople and new entrant recruitment failing to maintain replacement rates. Custom cabinetry fabrication requires specialized woodworking expertise developed through multi-year apprenticeships, while installation demands precision measurement and assembly skills not readily transferable from other construction trades. Labor market tightness drives wage inflation increasing project costs and potentially pricing segments of consumers out of premium product categories, while workforce constraints limit manufacturing capacity expansion despite demand growth. Industry estimates suggest ten percent job vacancy rates with projections indicating skilled trades workers retiring between 2019 and 2028.

Import Competition and Price Pressure from Low-Cost Manufacturers

Domestic Canadian manufacturers face intensifying competition from imported cabinetry originating in countries with lower production costs, particularly China where labor rates, environmental compliance requirements, and government subsidies enable substantial pricing advantages. Import penetration undermines local manufacturing viability, with Chinese cabinet imports to Canada rising, while U.S. imports declined during the same period. Price differentials approaching forty percent challenge domestic producers to compete beyond quality differentiation, as budget-conscious consumers prioritize affordability over local sourcing considerations. Trade association advocacy for protective tariffs and buy-local campaigns attempt to preserve domestic industry capacity against global competitive pressures.

Competitive Landscape:

The Canada kitchen cabinet and countertop market demonstrates fragmented competitive structure with no single participant commanding market share exceeding five percent, reflecting regional manufacturing concentration and diverse consumer preferences across price segments and design aesthetics. Local manufacturers leverage geographic proximity enabling responsive customer service, shorter delivery timelines, and customization flexibility appealing to discerning homeowners valuing personalized attention and specialized craftsmanship. Multinational suppliers compete through brand recognition, standardized quality assurance, and economies of scale supporting competitive pricing for stock and semi-custom product lines distributed through national retail partnerships. Moreover, competition intensifies differentiation strategies encompassing material sustainability credentials, technological integration capabilities, and comprehensive service offerings bundling design consultation, installation coordination, and warranty support. Market participants invest in showroom experiences, digital visualization tools, and social media marketing cultivating brand affinity among renovation-planning consumers conducting extensive pre-purchase research across multiple channels before finalizing substantial kitchen investment decisions.

Canada Kitchen Cabinet and Countertop Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Wood, Metal, Laminate, Quartz, Granite, Others |

| Product Types Covered | Ready-to-Assemble (RTA) Cabinets, Custom Cabinets, Stock Cabinets, Semi-Custom Cabinets |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report

The Canada kitchen cabinet and countertop market size was valued at USD 4,019.04 Million in 2025.

The Canada kitchen cabinet and countertop market is expected to grow at a compound annual growth rate of 6.60% from 2026-2034 to reach USD 7,146.83 Million by 2034.

Wood material type dominates the Canada kitchen cabinet and countertop market with 42% share, driven by aesthetic versatility, natural appeal, and availability of sustainably certified hardwood options including Forest Stewardship Council approved maple, oak, and birch meeting consumer preferences for authentic timber cabinetry across diverse design styles from traditional to contemporary aesthetics.

Key factors driving the Canada kitchen cabinet and countertop market include sustained home renovation investment addressing aging housing infrastructure, progressive urbanization necessitating space-efficient compact kitchen solutions for high-density residential development, and growing consumer adoption of sustainable materials including responsibly sourced wood and recycled-content engineered stone aligned with environmental consciousness and health-focused indoor air quality considerations.

Major challenges include supply chain disruptions affecting raw material availability and pricing stability, skilled labor shortages constraining custom fabrication capacity and driving installation cost inflation, intensifying import competition from low-cost international manufacturers particularly Chinese producers leveraging production cost advantages, volatile lumber pricing, extended procurement lead times, aging workforce demographics reducing craftsperson availability, and market pressure balancing quality differentiation against price-sensitive consumer segments prioritizing affordability over domestic sourcing considerations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)