Canada Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2025-2033

Canada Lithium-ion Battery Market Overview:

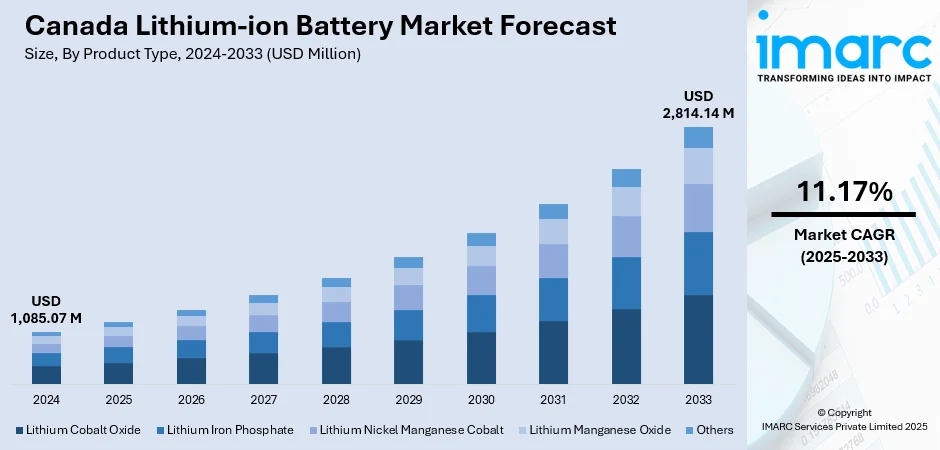

The Canada lithium-ion battery market size reached USD 1,085.07 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,814.14 Million by 2033, exhibiting a growth rate (CAGR) of 11.17% during 2025-2033. Government incentives, electric vehicle adoption, energy storage needs, and environmental regulations are some of the factors contributing to the Canada lithium-ion battery market share. Increasing investments in mining and domestic battery production, alongside technological advancements and the push for renewable energy integration, also support market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,085.07 Million |

| Market Forecast in 2033 | USD 2,814.14 Million |

| Market Growth Rate 2025-2033 | 11.17% |

Canada Lithium-ion Battery Market Trends:

Battery Recovery Agreements Reshaping Supply Chain

Canada is seeing a stronger alignment between electric vehicle producers and recycling firms. Multi-year collection partnerships are being set up across dealership networks to handle spent lithium-ion batteries. These batteries, no longer usable in vehicles, are now directed to local facilities for recovery and processing. The setup cuts logistics costs, reduces waste, and boosts domestic recycling infrastructure. It also fits into broader circular supply strategies aimed at reusing critical materials. With more battery processing capacity in provinces like Quebec, the country is reinforcing its place in the North American EV supply chain. As more automakers look for reliable recycling pathways, regional collaborations like this are becoming essential to scale up clean energy goals and meet environmental targets. These factors are intensifying the Canada lithium-ion battery market growth. For example, in October 2024, Hyundai Auto Canada named Lithion as its official EV battery recycling partner in a multi-year deal. Over 250 Hyundai and Genesis dealers across Canada would work with Lithion to collect and recycle end-of-life lithium-ion batteries. Recovered batteries would be processed at Lithion’s new Saint-Bruno facility in Quebec. The partnership builds on a 2021 agreement and supports Hyundai’s battery circularity goals and Canada’s growing clean energy ecosystem.

To get more information on this market, Request Sample

Domestic Production of EV Battery Components Gaining Ground

Canada is seeing increased investment in local manufacturing of lithium-ion battery components, especially materials critical to electric vehicle performance and safety. Coated separators, used to prevent internal short circuits, are among the key elements now being produced domestically. These facilities are not only supporting cleaner supply chains but also creating skilled jobs in regions aligned with national clean energy goals. As global demand for electric vehicles grows, battery material manufacturing is becoming more localized to reduce logistics risk, cut costs, and improve control over quality and innovation. The shift reflects a broader push to strengthen North American supply independence and scale up infrastructure essential to long-term EV adoption. For instance, in November 2024, Asahi Kasei Battery Separator Corporation began construction of a lithium-ion battery separator plant in Port Colborne, Ontario. Set to start commercial production by 2027, the facility is a joint venture with Honda. It will produce 700 million square meters of coated separator annually and create over 300 jobs in its first phase. The coated separator prevents short circuits in batteries, which is essential for electric vehicles.

Canada Lithium-ion Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, power capacity, and application.

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

The report has provided a detailed breakup and analysis of the market based on the power capacity. This includes 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh.

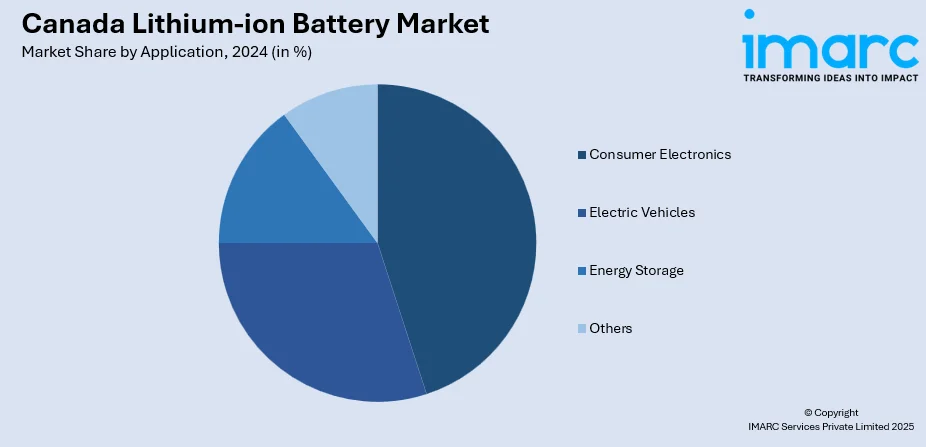

Application Insights:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, electric vehicles, energy storage, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Lithium-ion Battery Market News:

- In June 2025, Electra Battery Materials and the Three Fires Group advanced the Aki Battery Recycling joint venture, Canada’s first indigenous-led lithium-ion battery recycling initiative. Launched in 2024, Aki focuses on low-emission, circular battery waste management. Key progress includes formal venture establishment and the shortlisting of technology partners after due diligence on advanced recycling platforms. Aki aims to boost domestic battery supply chain resilience.

Canada Lithium-ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada lithium-ion battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada lithium-ion battery market on the basis of product type?

- What is the breakup of the Canada lithium-ion battery market on the basis of power capacity?

- What is the breakup of the Canada lithium-ion battery market on the basis of application?

- What is the breakup of the Canada lithium-ion battery market on the basis of region?

- What are the various stages in the value chain of the Canada lithium-ion battery market?

- What are the key driving factors and challenges in the Canada lithium-ion battery market?

- What is the structure of the Canada lithium-ion battery market and who are the key players?

- What is the degree of competition in the Canada lithium-ion battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada lithium-ion battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada lithium-ion battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)