Canada Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

Canada Logistics Market Overview:

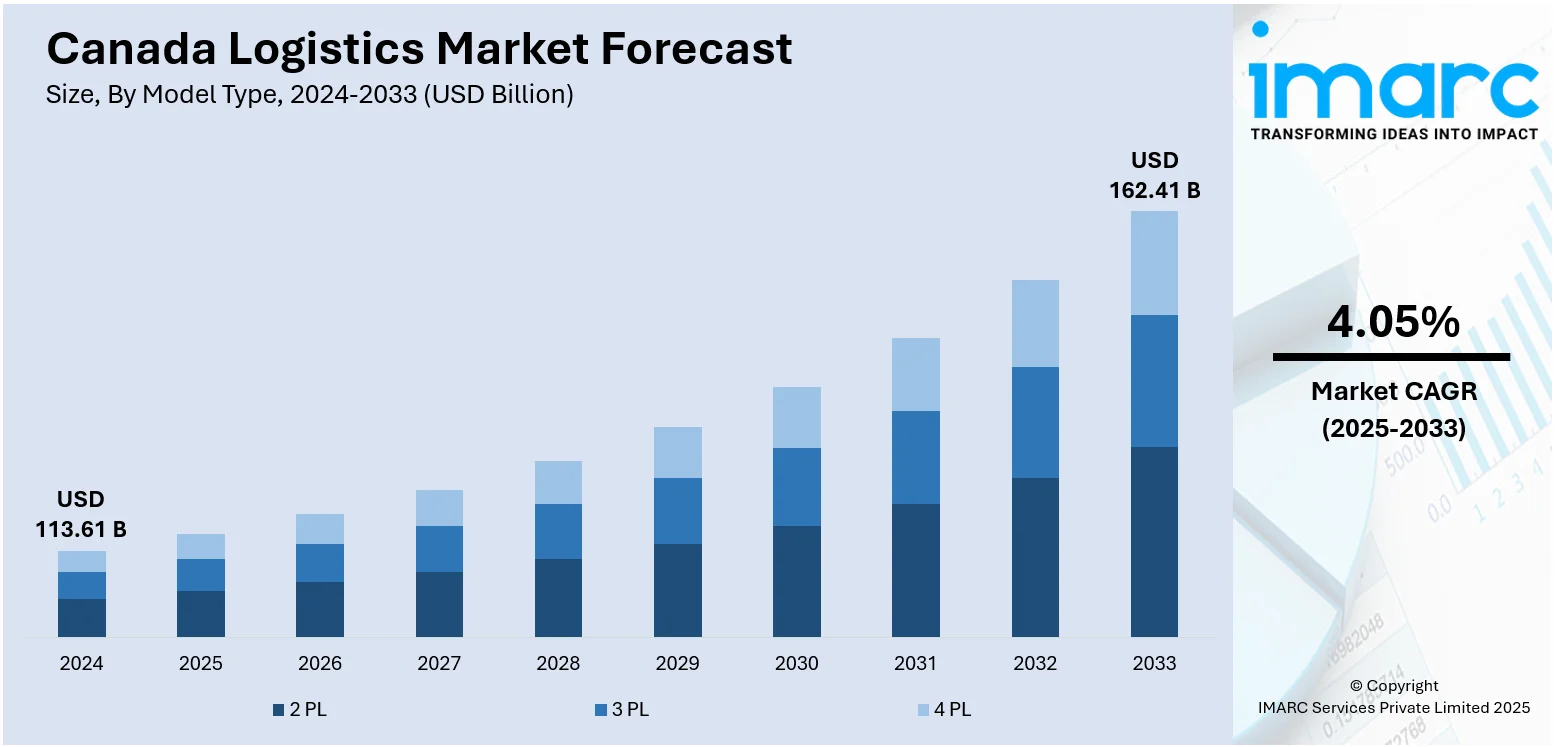

The Canada logistics market size reached USD 113.61 Billion in 2024. The market is projected to reach USD 162.41 Billion by 2033, exhibiting a growth rate (CAGR) of 4.05% during 2025-2033. The market is fueled by e-commerce expansion, technological advancements, more cross-border trade, and infrastructure spending. Rising demand for effective supply chain solutions and sustainable operations also fuels market expansion. All these factors combined consolidate operations and service delivery, promoting the overall Canada logistics market share in the global market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 113.61 Billion |

| Market Forecast in 2033 | USD 162.41 Billion |

| Market Growth Rate 2025-2033 | 4.05% |

Canada Logistics Market Trends:

Integration of Advanced Technologies

The Canadian logistics industry is increasingly leveraging cutting-edge technologies to increase efficiency and satisfy changing consumer demands. Technologies like Artificial Intelligence (AI), Internet of Things (IoT), and machine learning are being used to streamline route planning, track real-time shipment status, and forecast demand variations. For example, AI programs scan lots of data to identify the optimal routes for delivery, taking into account traffic flow and weather patterns. IoT offers real-time monitoring of goods, promising transparency and enhancing customer experience. Such technological innovations are not only making operations faster but also allowing logistics providers to provide more reliable and flexible services, hence contributing to Canada logistics market growth. For instance, in June 2025, UniUni, a tech-enabled logistics company based in Richmond, BC, has been named "Last Mile Company of the Year" by SupplyTech Breakthrough. The company uses AI-driven routing, robotic sorting, and real-time tracking to optimize last-mile delivery. UniUni now operates in over 500 North American cities, reaching 80% of Canada's population.

To get more information on this market, Request Sample

Expansion of E-Commerce and Last-Mile Delivery Solutions

The rapid growth of e-commerce in Canada is significantly influencing logistics situations, particularly in urban areas. Increasing demands from customers for faster delivery are compelling logistics firms to enhance the efficiency of last-mile deliveries. Firms are responding by adopting micro-fulfillment centers (MFCs), smaller warehouses in closer distance to consumers, which enable rapid shipping of products. Moreover, the innovation of self-delivery technologies like drones and delivery robots is being utilized to speed up delivery and reduce the cost of delivery. The technologies are revolutionizing the logistics sector to make it highly responsive and versatile to consumer demands, thus stimulating Canada logistics market growth. For instance, in June 2025, Exotec opened Exostudio, a new demo center at its North American HQ in Atlanta, to showcase the Next Generation of Skypod system. The facility features robot-to-robot picking, advanced software, and immersive demonstrations. It supports global virtual site access and hosts Exoseminars for supply chain leaders.

Canada Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

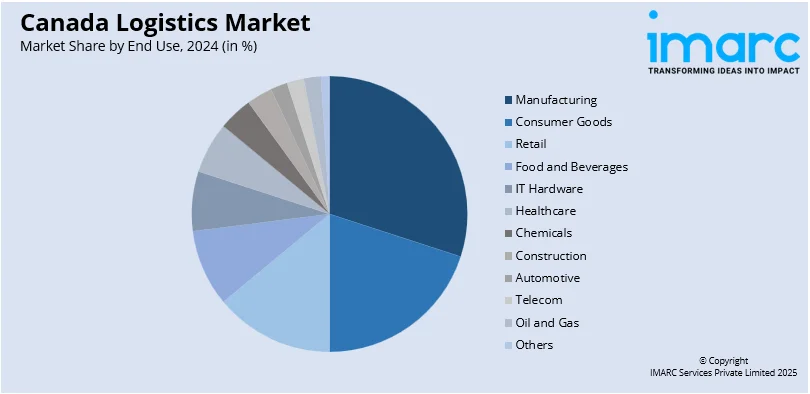

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Logistics Market News:

- In June 2025, GoBolt, a Toronto-based 3PL and last-mile logistics provider, was named “Overall Logistics Solution Provider of the Year” by the 2025 SupplyTech Breakthrough Awards. Recognized for its sustainable, tech-driven solutions, GoBolt integrates fulfillment, delivery, returns, and real-time tracking. Its smart routing and EV use enhance speed, efficiency, and environmental impact.

- In June 2025, Tecsys Inc. launched ESL+, a smart electronic shelf label for hospital inventory management. Integrated with Tecsys' Elite™ Point of Use platform, ESL+ enhances supply chain efficiency through real-time tracking, programmable restock features, and visual alerts. It streamlines workflows, reduces waste, and supports responsive replenishment directly at the point of care.

Canada Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada logistics market on the basis of model type?

- What is the breakup of the Canada logistics market on the basis of transportation mode?

- What is the breakup of the Canada logistics market on the basis of end use?

- What is the breakup of the Canada logistics market on the basis of region?

- What are the various stages in the value chain of the Canada logistics market?

- What are the key driving factors and challenges in the Canada logistics market?

- What is the structure of the Canada logistics market and who are the key players?

- What is the degree of competition in the Canada logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positiobns of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)