Canada Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Canada Luxury Fashion Market Overview:

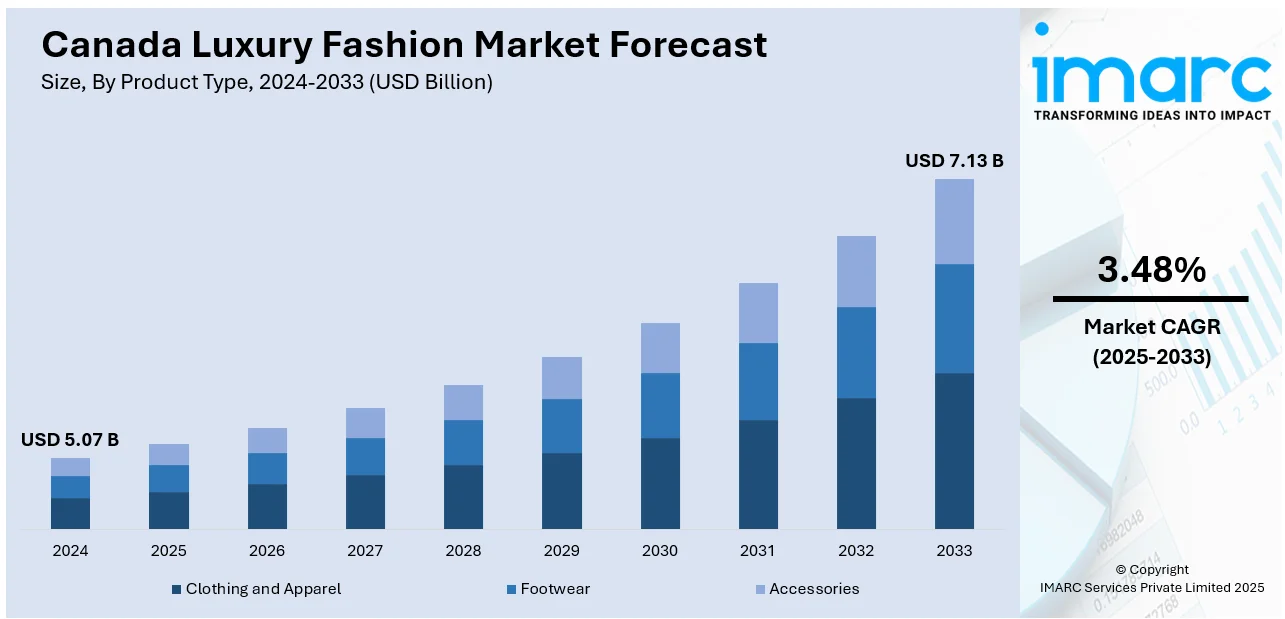

The Canada luxury fashion market size reached USD 5.07 Billion in 2024. The market is projected to reach USD 7.13 Billion by 2033, exhibiting a growth rate (CAGR) of 3.48% during 2025-2033. The market is propelled by rising disposable income and the desire for premium quality apparel among affluent consumers seeking exclusivity and craftsmanship. Moreover, growing brand presence, flagship stores, and experiential retail concepts strengthen consumer engagement and spending in luxury fashion. In addition to this, increasing demand for sustainable and ethically produced luxury items, with younger consumers prioritizing responsible sourcing and transparency, is further augmenting the Canada luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.07 Billion |

| Market Forecast in 2033 | USD 7.13 Billion |

| Market Growth Rate 2025-2033 | 3.48% |

Canada Luxury Fashion Market Trends:

Influence of Diverse Cultural Aesthetics and Local Artistry

Canada’s luxury fashion landscape has grown more diverse in its creative direction, driven by multicultural influences and a deepening appreciation for local talent. Major cities are home to cosmopolitan consumers who value designs reflecting varied cultural heritage, indigenous craftsmanship, and unique artisanal techniques. Luxury brands are collaborating with Canadian artists, indigenous designers, and multicultural creatives to produce capsule collections that resonate with Canada’s demographic fabric. Limited-run pieces inspired by indigenous motifs, Métis beadwork, or Asian textile traditions add distinctive elements to mainstream collections, differentiating brands in a saturated market. This trend supports the preservation of traditional techniques and promotes inclusive narratives within high-end fashion. Moreover, increasing attendance at Canadian fashion weeks, art-driven pop-ups, and cross-cultural exhibitions further amplifies these influences, encouraging luxury consumers to invest in pieces that carry cultural significance. By integrating authentic local artistry into their collections, brands strengthen community ties and appeal to a clientele that seeks exclusivity with a meaningful cultural connection.

To get more information on this market, Request Sample

Growth of Experiential and Omnichannel Retail

The transition towards experiential and omnichannel retail formats is positively impacting the Canada luxury fashion market growth. Traditional brick-and-mortar boutiques have evolved into immersive spaces that merge art, culture, and personalised services, offering clientele curated experiences beyond transactional shopping. Furthermore, flagship stores in cities like Toronto, Vancouver, and Montreal now feature private styling sessions, exclusive product launches, and bespoke tailoring, strengthening brand loyalty among high-net-worth individuals. In addition to this, online retail has gained ground, with consumers expecting seamless integration between digital and physical touchpoints. Brands are investing heavily in advanced digital platforms, virtual consultations, and augmented reality fitting rooms to replicate the tactile appeal of luxury shopping at home. Click-and-collect, personalised delivery, and flexible returns further refine the omnichannel approach. This blend of in-store intimacy and digital convenience is increasingly crucial for international brands expanding in Canada’s competitive luxury landscape, ensuring they meet rising expectations for exclusivity and flexibility.

Rising Demand for Sustainable and Ethical Luxury

In Canada’s luxury fashion sector, sustainability has shifted from a peripheral concern to a primary driver of purchasing behaviour. Affluent consumers, especially Millennials and Gen Z, are increasingly scrutinising brands for their environmental stewardship, supply chain transparency, and labour practices. This trend has prompted luxury houses to adopt circular models, integrate recycled materials, and invest in traceability technologies. Local designers and established global brands operating in Canada now highlight eco-certified collections and limited-edition lines produced with minimal environmental impact. Besides, the demand for pre-owned luxury goods and high-end vintage fashion has also gained momentum, supported by trusted resale platforms and boutiques. Also, consumers appreciate the balance between exclusivity and environmental responsibility, pushing brands to rethink packaging, distribution, and retail operations to align with Canada’s broader climate targets. This shift is not merely a marketing feature; it reflects a growing expectation that high-end fashion must embody values that resonate with modern Canadian ideals around sustainability and ethical sourcing.

Canada Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

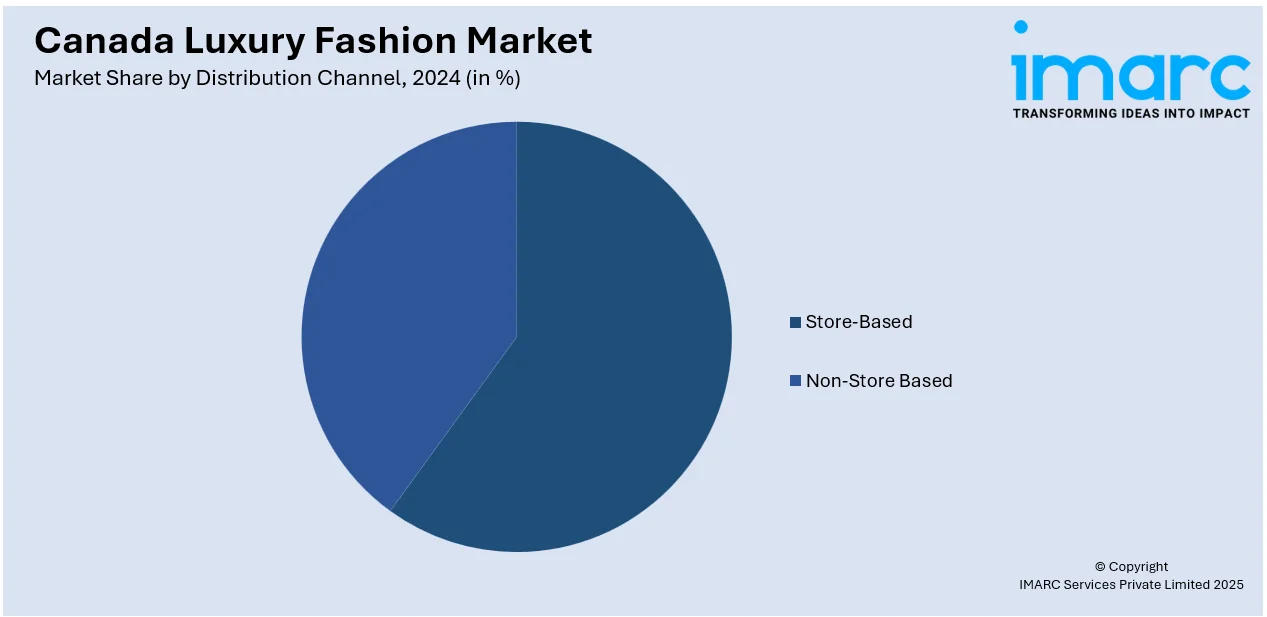

Distribution Channel Insights:

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Luxury Fashion Market News:

- On October 24, 2024, Canadian luxury outerwear brand Moose Knuckles launched its new creative platform Moose Lab, marking a strategic move into the high-fashion and luxury segment. The initiative debuted with a 12-piece capsule collection designed by Global Artistic Director Carlos Nazario, featuring bold, military-inspired silhouettes, 1990s aesthetics, and premium materials such as Mongolian wool, leather, down, and shearling. Moose Lab aims to bridge technical functionality with contemporary style while positioning Moose Knuckles as a creative incubator for luxury collaboration.

Canada Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada luxury fashion market on the basis of product type?

- What is the breakup of the Canada luxury fashion market on the basis of distribution channel?

- What is the breakup of the Canada luxury fashion market on the basis of end user?

- What is the breakup of the Canada luxury fashion market on the basis of region?

- What are the various stages in the value chain of the Canada luxury fashion market?

- What are the key driving factors and challenges in the Canada luxury fashion market?

- What is the structure of the Canada luxury fashion market and who are the key players?

- What is the degree of competition in the Canada luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)