Canada Microgreens Market Size, Share, Trends and Forecast by Type, Farming Method, Distribution Channel, End Use, and Region, 2025-2033

Canada Microgreens Market Overview:

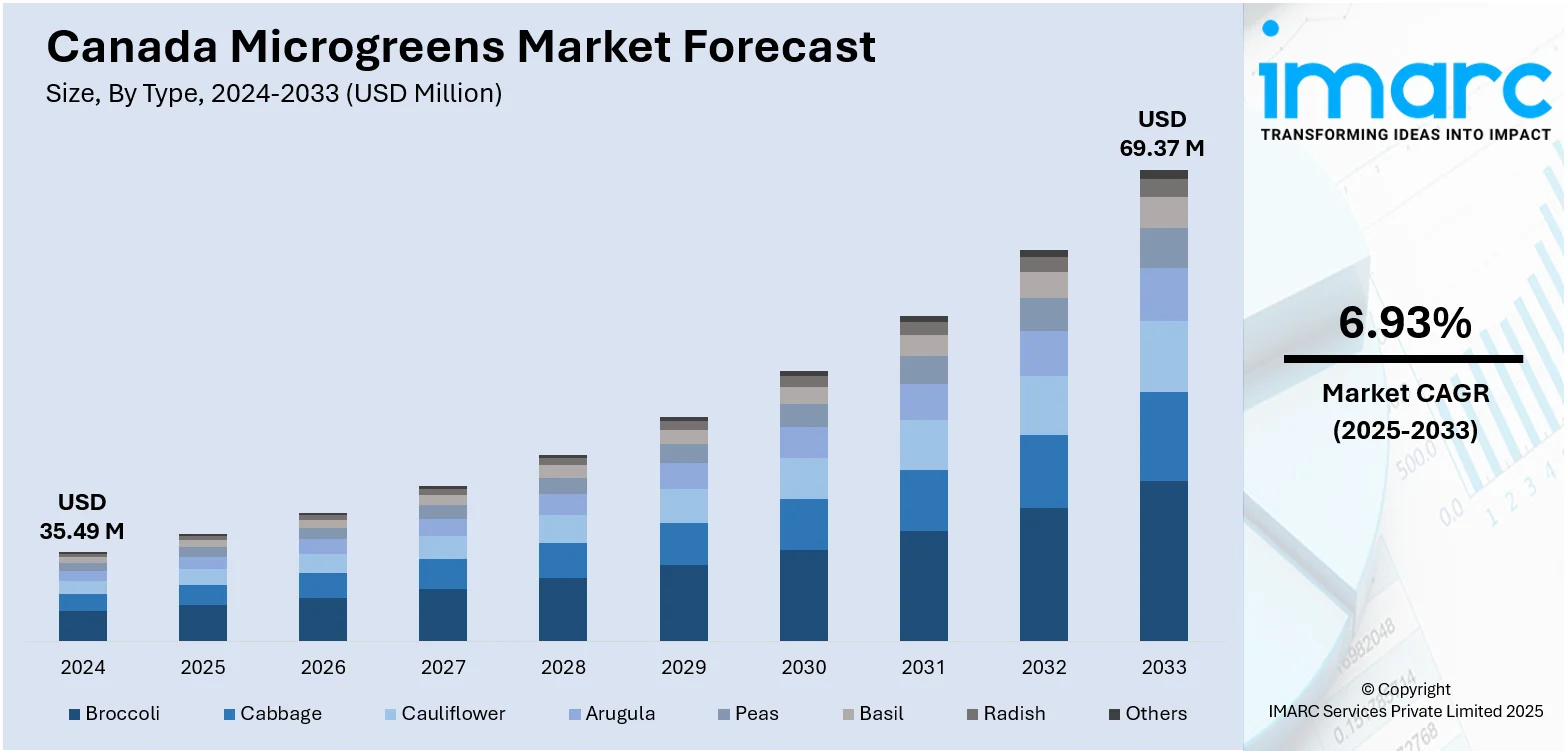

The Canada microgreens market size reached USD 35.49 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 69.37 Million by 2033, exhibiting a growth rate (CAGR) of 6.93% during 2025-2033. Rising consumer awareness of nutritional benefits, demand for locally grown produce, and support for sustainable agriculture are key drivers of the market. Increasing urban farming initiatives and a shift toward plant-based diets further stimulate Canada microgreens market share expansion across major regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 35.49 Million |

| Market Forecast in 2033 | USD 69.37 Million |

| Market Growth Rate 2025-2033 | 6.93% |

Canada Microgreens Market Trends:

Health-Conscious Consumption and Functional Foods

Health and wellness trends in Canada are significantly influencing consumer preferences, leading to growing interest in microgreens as nutrient-dense superfoods. For instance, according to industry reports, health is a priority for many Canadians, with 45% maintaining a proactive approach to their personal well-being and consistently seeking ways to enhance their health. Canadian consumers are increasingly seeking foods rich in antioxidants, vitamins, and phytochemicals for disease prevention and overall wellness. This trend aligns with the broader shift toward functional foods that support immune health, detoxification, and digestion. Health professionals and dietitians often highlight microgreens in public nutrition messaging, boosting awareness and uptake. Additionally, microgreens are being incorporated into health-focused meal kits, smoothies, and clean-label packaged foods. As more Canadians prioritize wellness through diet, demand for nutrient-rich greens is expected to rise, thus reinforcing Canada microgreens market growth, particularly through organic grocers, specialty stores, and nutrition-forward food service establishments.

To get more information on this market, Request Sample

Urban Agriculture and Controlled-Environment Farming

The expansion of urban agriculture and controlled-environment farming technologies is a significant trend in the Canadian microgreens industry. Given Canada's seasonal limitations, indoor vertical farming offers a reliable solution for year-round production. Microgreens are ideally suited for hydroponic systems and small-scale urban farms due to their fast growth cycle and low space requirements. Municipal governments and sustainability advocates have also supported urban growing initiatives to reduce food miles and increase local food resilience. Entrepreneurs and small-scale growers are leveraging technological innovation—such as LED lighting and climate control systems—to optimize yield and quality. This urban farming trend supports Canada microgreens market growth by enabling production closer to end consumers in cities like Toronto, Vancouver, and Montreal. For instance, in January 2025, GoodLeaf Farms, an indoor vertical farming company in Guelph, Ontario, received a strategic investment from Farm Credit Canada (FCC) to support innovation, food security, and expansion across Canada. In 2024, the company increased production to over 280,000 square feet and expanded retail presence to 2,700+ locations. FCC joins existing investors McCain Foods and Power Sustainable Lios. The investment reflects growing demand for microgreens and supports GoodLeaf’s role in sustainable agriculture through efficient, tech-driven farming with reduced water use and faster growth cycles.

Canada Microgreens Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on type, farming method, distribution channel, and end use.

Type Insights:

- Broccoli

- Cabbage

- Cauliflower

- Arugula

- Peas

- Basil

- Radish

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes broccoli, cabbage, cauliflower, arugula, peas, basil, radish, and others.

Farming Method Insights:

- Indoor Vertical Farming

- Commercial Greenhouses

- Others

A detailed breakup and analysis of the market based on the farming method have also been provided in the report. This includes indoor vertical farming, commercial greenhouses, and others.

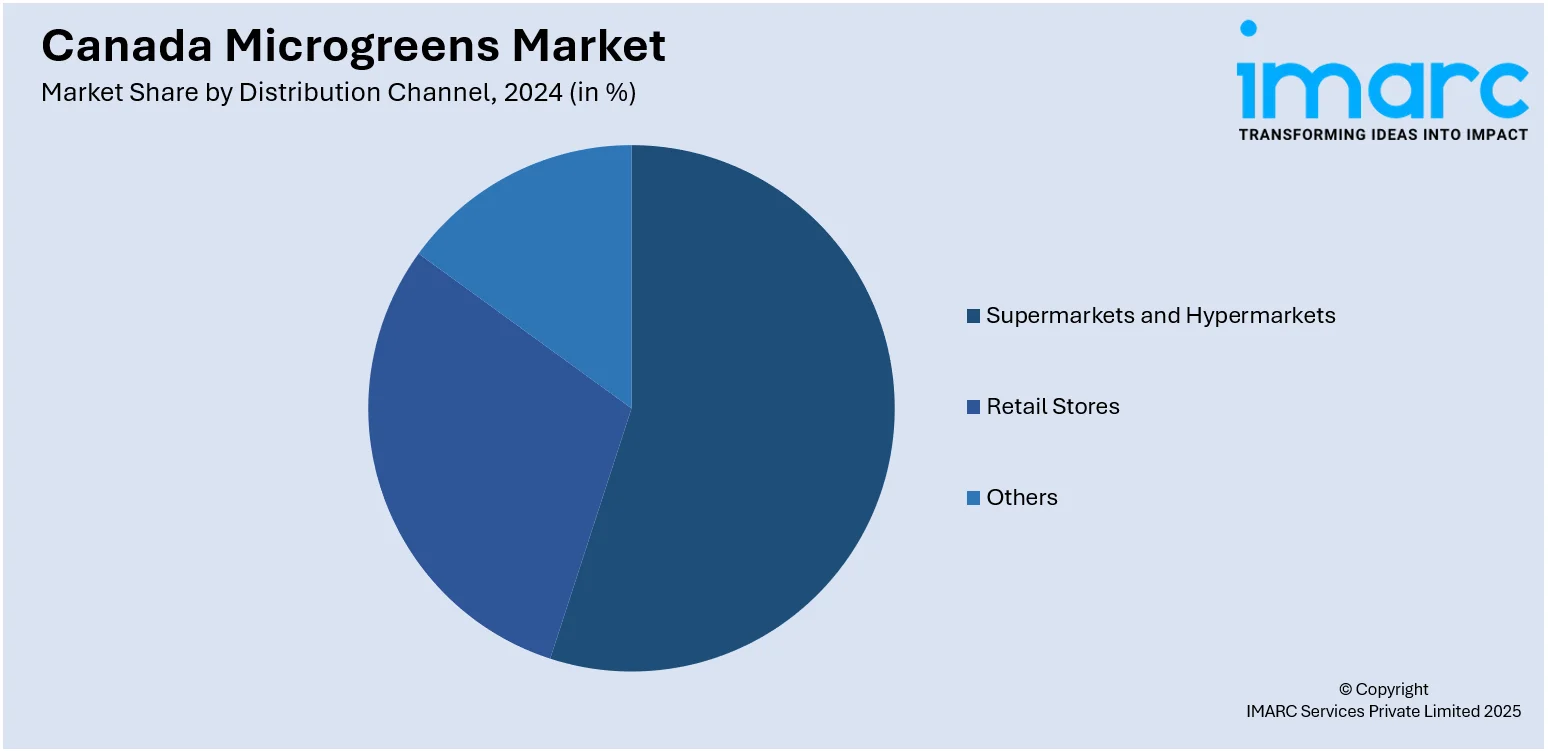

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, retail stores, and others.

End Use Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Microgreens Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Broccoli, Cabbage, Cauliflower, Arugula, Peas, Basil, Radish, Others |

| Farming Methods Covered | Indoor Vertical Farming, Commercial Greenhouses, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Retail Stores, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada microgreens market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada microgreens market on the basis of type?

- What is the breakup of the Canada microgreens market on the basis of farming method?

- What is the breakup of the Canada microgreens market on the basis of distribution channel?

- What is the breakup of the Canada microgreens market on the basis of end use?

- What is the breakup of the Canada microgreens market on the basis of region?

- What are the various stages in the value chain of the Canada microgreens market?

- What are the key driving factors and challenges in the Canada microgreens market?

- What is the structure of the Canada microgreens market and who are the key players?

- What is the degree of competition in the Canada microgreens market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various Korea market segments, historical and current market trends, market forecasts, and dynamics of the Canada microgreens market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada microgreens market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada microgreens industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)