Canada Outplacement Services Market Size, Share, Trends and Forecast by Services, End User, and Region, 2026-2034

Canada outplacement services Market Overview:

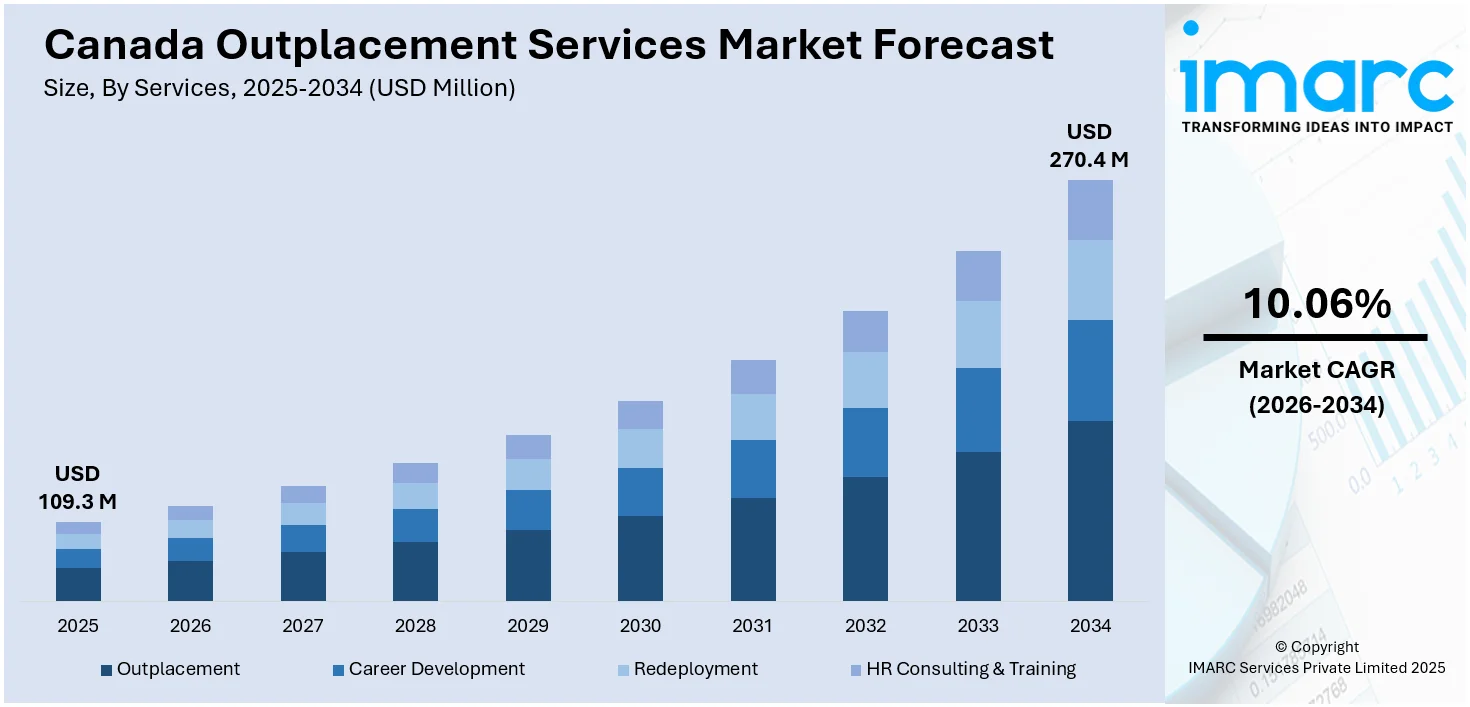

The Canada outplacement services market size reached USD 109.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 270.4 Million by 2034, exhibiting a growth rate (CAGR) of 10.06% during 2026-2034. The market is experiencing growth driven by economic uncertainty, technological integration, and the rise of remote work trend. Key trends include AI-driven career coaching, virtual platforms for job search assistance, and personalized support to enhance employee transitions, which are propelling the Canada outplacement services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 109.3 Million |

| Market Forecast in 2034 | USD 270.4 Million |

| Market Growth Rate 2026-2034 | 10.06% |

Canada Outplacement Services Market Analysis:

- Major Drivers: Corporate restructuring, mergers, and layoffs create strong demand. Employers focus on protecting brand reputation by supporting displaced employees. Also, the remote work expansion encourages virtual outplacement solutions, while growing SME participation fuels market development thus surging the Canada outplacement services market demand.

- Key Market Trends: Digital platforms dominate services, integrating AI‑driven coaching and automated matching. Programs emphasize upskilling, mental health support, and diversity initiatives. Collaboration with HR tech and education providers expands comprehensive career transition offerings.

- Market Opportunities: Expanding virtual and hybrid service models creates reach across provinces. Customized solutions for remote and gig workers grow in demand. Integrating personalized coaching, reskilling, and wellness programs enhances service value.

- Market Challenges: Based on the Canada outplacement services market analysis, high service costs hinder accessibility for smaller companies. Limited awareness reduces adoption, especially in underserved sectors. Maintaining consistent quality, personalization, and cultural sensitivity in digital offerings remains complex and resource‑intensive.

Canada Outplacement Services Market Trends:

Rise in Demand Due to Economic Uncertainty

Economic downturns and corporate restructuring largely boosted the need for outplacement services in Canada is one of the key Canada outplacement services market trends. With businesses today under financial strain and uncertainties of the market many are compelled to downsize or reorganize their staff. For example, during 2023, a series of layoffs continued to hit Canadian employees as recession forecasts loomed and the downturn in the technology sector widened. A number of businesses, such as Shopify, Meta Platforms Inc., and Nordstrom, made mass layoffs, displacing thousands of employees. Layoffs varied between 14 per cent at Benevity and 35 per cent at Canopy Growth Corp., with a number of companies dismissing more than 2,500 workers. This has seen people worry about the economic landscape and employment stability in Canada. To cope with the effects of layoffs, organizations today are looking toward outplacement services to offer essential assistance to displaced workers. Outplacement services assist laid-off individuals in making a smooth transition to another job opportunity by providing career counseling, writing resume and interview preparation and job searching help thus aiding the Canada outplacement services market growth. This assistance not only benefits employees and securing a job quicker but also assists organizations in upholding their reputation and generating goodwill among the remaining employees. The growing use of outplacement services is a sign of a wider commitment to responsible labor management and worker welfare in times of economic uncertainty.

To get more information on this market Request Sample

Integration of Technology

In Canada, outplacement services are becoming more reliant on technology to improve their efficacy and reach. The use of AI-based tools and virtual platforms is leading this change, with the delivery of extensive career guidance, resume preparation, and job search support. These technological improvements are especially relevant considering the increasing trend of remote work. Artificial intelligence (AI)-based tools scan large amounts of data to provide customized job suggestions, tailor resumes to applicant tracking systems (ATS), and practice interview situations to increase candidates' readiness. For example, Adecco has intensified its dedication to refugee integration by committing to hire 85,000 refugees and train 17,000 worldwide by 2027. The organization is introducing a specialized "Jobs for Refugees" platform to link refugees with hiring firms who match their skills. Adecco has been providing integration support for refugees since 2008 and is working in association with organizations and companies across the globe to help establish jobs. Adecco in Germany is collaborating with L'Oréal among other companies to integrate refugees in the workforce. Online platforms help provide outplacement services across the country with clients from everywhere benefitting from virtual coaching sessions and webinars which help them obtain professional guidance and support from wherever they are located. This integration of technology is such that the displaced employees get personalized assistance, and the transition process becomes efficient and effective. With Canadian firms increasingly becoming used to the digital era, utilization of sophisticated technologies in outplacement services is fast becoming necessary in order to respond to the changing needs of the workforce.

Canada Outplacement Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on services and end user.

Services Insights:

- Outplacement

- Career Development

- Redeployment

- HR Consulting & Training

The report has provided a detailed breakup and analysis of the market based on the service. This includes outplacement, career development, redeployment, and HR consulting & training.

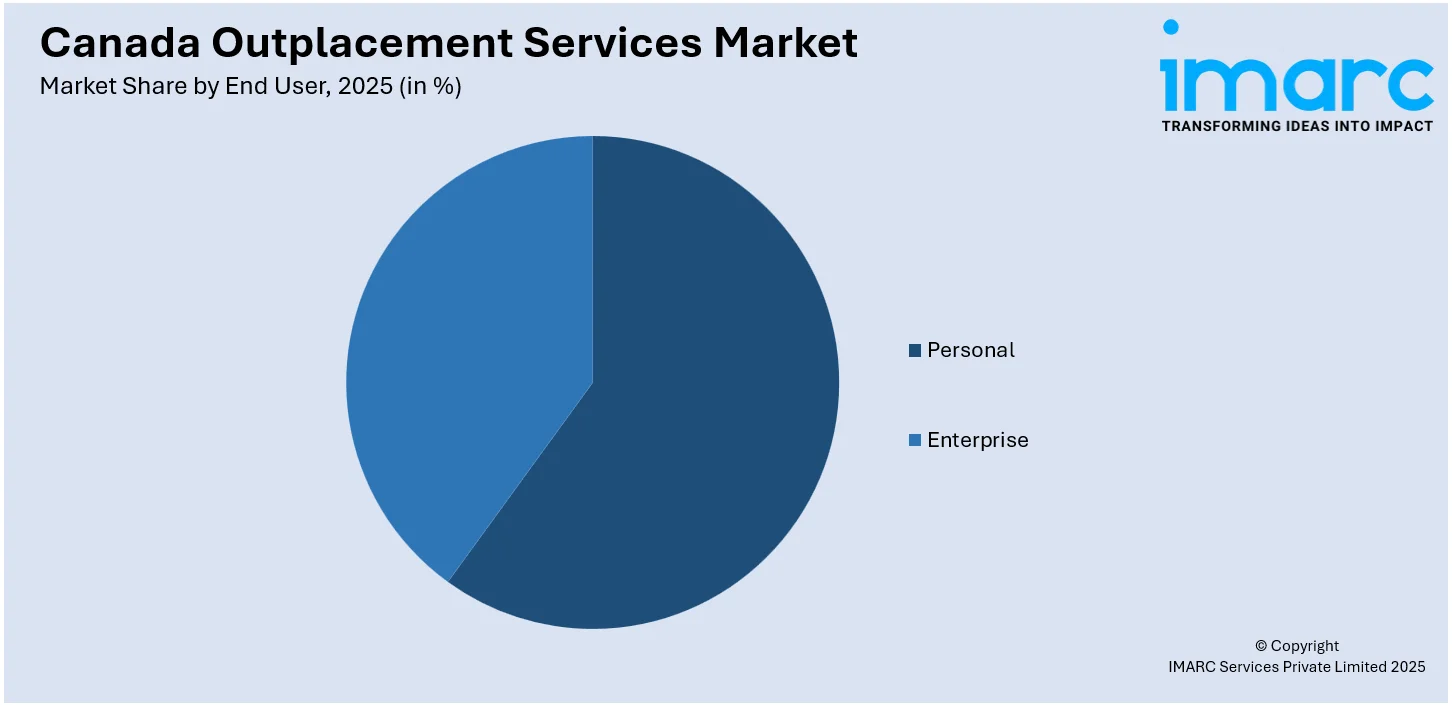

End User Insights:

Access the comprehensive market breakdown Request Sample

- Personal

- Enterprise

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal and enterprise.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In April 2024, Careerminds, a global leader in outplacement, leadership, and career development services, acquired Toombs, a respected Canadian outplacement firm serving sectors including energy, manufacturing, healthcare, and education. This acquisition combines Toombs’ strong client base and personalized services with Careerminds’ global reach and AI-driven platform, significantly enhancing its footprint and capabilities in the Canadian market.

Canada Outplacement Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Outplacement, Career Development, Redeployment, HR Consulting & Training |

| End Users Covered | Personal, Enterprise |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada outplacement services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada outplacement services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada outplacement services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The outplacement services market in Canada was valued at USD 109.3 Million in 2025.

The Canada outplacement services market is projected to exhibit a CAGR of 10.06% during 2026-2034, reaching a value of USD 270.4 Million by 2034.

The Canadian outplacement market is driven by corporate restructuring, growing adoption by small and medium enterprises, and the need for smooth career transitions. Advancements in virtual delivery and AI tools enhance service personalization, while a stronger focus on employee well-being, regulatory compliance, and employer branding further fuels market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)