Canada Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2025-2033

Canada Pallet Market Overview:

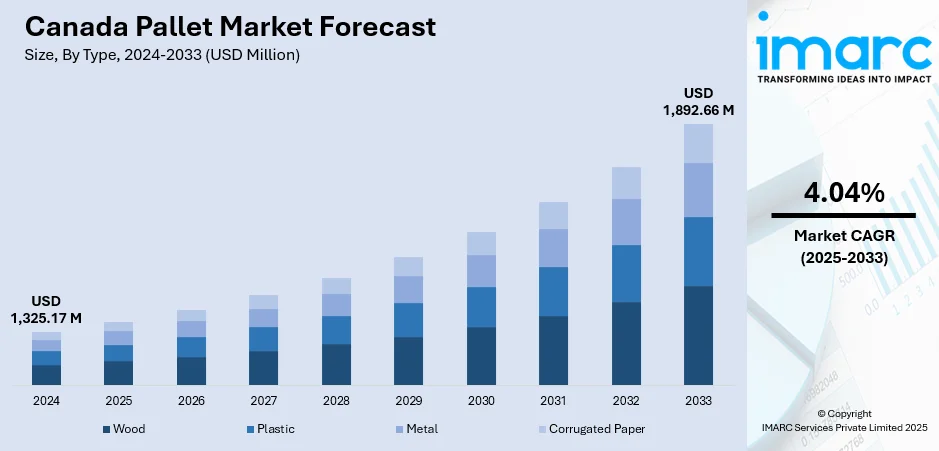

The Canada pallet market size reached USD 1,325.17 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,892.66 Million by 2033, exhibiting a growth rate (CAGR) of 4.04% during 2025-2033. The market is driven by tightening environmental mandates compelling adoption of reusable plastic pallets for lower lifecycle costs and compliance. It is further propelled by rapid e-commerce growth and warehouse automation, necessitating dimensionally precise. Manufacturers prioritizing GMA-optimized designs and pooling services to meet operational resilience demands is also augmenting the Canada pallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,325.17 Million |

| Market Forecast in 2033 | USD 1,892.66 Million |

| Market Growth Rate 2025-2033 | 4.04% |

Canada Pallet Market Trends:

Accelerating Shift Towards Sustainable and Reusable Plastic Pallets

Driven by intensifying environmental regulations, corporate sustainability goals, and long-term cost pressures, the market is experiencing a significant acceleration in the adoption of reusable plastic pallets, particularly within closed-loop systems. Canada generates 35 Million Tonnes of waste annually, with only 26% being recycled, highlighting the need for better waste management, especially for plastics, where only 9% is recycled. The government's move toward a circular economy, including a plastic ban and extended producer responsibility (EPR), is supporting the adoption of green packaging and advanced recycling technologies. This shift presents growing opportunities for the pallet market to enable more sustainable logistics solutions, especially in the context of increasing demand for recyclable and reusable materials. Federal carbon pricing and provincial initiatives such as BC's carbon tax increase the financial burden of waste disposal and frequent wood pallet replacement, making durable plastic alternatives increasingly attractive for their lifespan of 5-10+ years. Major retailers and manufacturers are mandating reusable packaging solutions to meet Scope 3 emissions targets, forcing suppliers throughout the supply chain to comply. Plastic pallets offer consistent hygiene, eliminate ISPM-15 treatment costs for international shipping, and resist damage, reducing product loss. While the initial investment is higher than wood, the total cost of ownership (TCO) over hundreds of trips, combined with pallet pooling services' growth including those from CHEP, iGPS, or regional players, is driving adoption. This trend is most pronounced in high-volume, high-value, or sensitive goods sectors but is expanding rapidly as businesses prioritize resilience and environmental, social, and governance (ESG) compliance.

To get more information on this market, Request Sample

Growing Demand for Automation-Compatible Pallet Solutions

The rapid expansion of e-commerce fulfillment and widespread warehouse automation across Canada is propelling the Canada pallet market growth. It is further reshaping pallet specifications, fueling strong demand for highly standardized, dimensionally precise, and structurally consistent pallets. Canada's online retailing market is expected to grow to around USD 89.4 Billion in 2024, higher than previous estimates, and is expected to expand to USD 104 Billion by 2029. The sector, driven by categories, including fashion, hobbies, and electronics, is still transforming post-pandemic, requiring more efficient logistics and pallet handling solutions for fulfilling orders. As strong demand for e-commerce continues to exist, Canadian warehouses and distribution facilities are gearing up for increased pallet storage and inventory management to support this growth. Automated Guided Vehicles (AGVs), robotic palletizers, Automated Storage and Retrieval Systems (ASRS), and conveyor networks require pallets with exact tolerances (typically +/- 3mm), specific entry configurations, and consistent weight distribution to function reliably. Wood pallets, with inherent variability and potential for protruding nails or splinters, pose significant operational risks and downtime in automated environments. This drives preference towards engineered wood pallets with enhanced precision or, more commonly, high-quality plastic pallets known for their uniformity, smooth surfaces, and durability under constant robotic handling. The trend is further amplified by persistent labor shortages, pushing companies to automate material handling. Consequently, pallet manufacturers and poolers are increasingly focusing on designs optimized for GMA standards (Grocery Manufacturers Association) with reinforced structures for heavy loads and features ensuring seamless robotic gripper compatibility, becoming a critical factor in purchasing decisions for modern distribution centers.

Canada Pallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

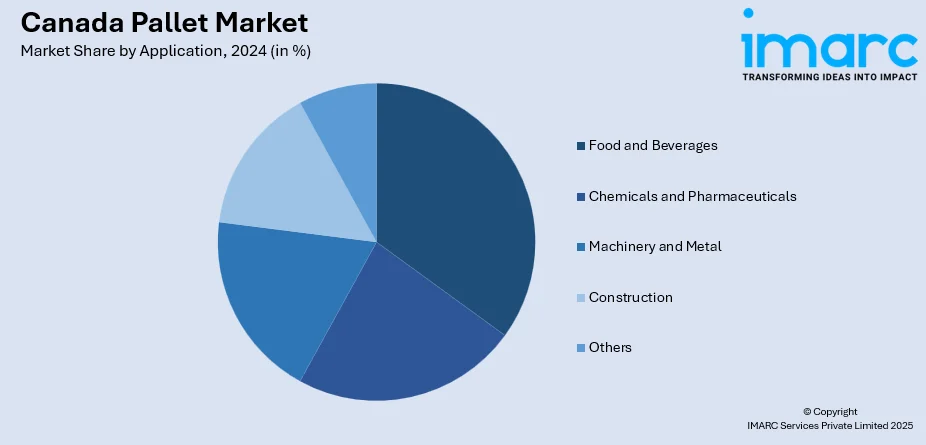

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Pallet Market News:

- May 01, 2024: The Pallet Book was launched nationally in Canada, with the objective of making pallet transactions easier through its groundbreaking platform. Building on more than 30 years of experience in the industry, it offers a web of suppliers, competitive prices, and real-time information to enhance the efficiency of pallet management. In addition, the platform includes Pallet Insights ERP that streamlines operations and reduces costs for manufacturers, brokers, and pallet recyclers.

Canada Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada pallet market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada pallet market on the basis of type?

- What is the breakup of the Canada pallet market on the basis of application?

- What is the breakup of the Canada pallet market on the basis of structural design?

- What is the breakup of the Canada pallet market on the basis of region?

- What are the various stages in the value chain of the Canada pallet market?

- What are the key driving factors and challenges in the Canada pallet market?

- What is the structure of the Canada pallet market and who are the key players?

- What is the degree of competition in the Canada pallet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada pallet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)