Canada Palm Oil Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Canada Palm Oil Market Overview:

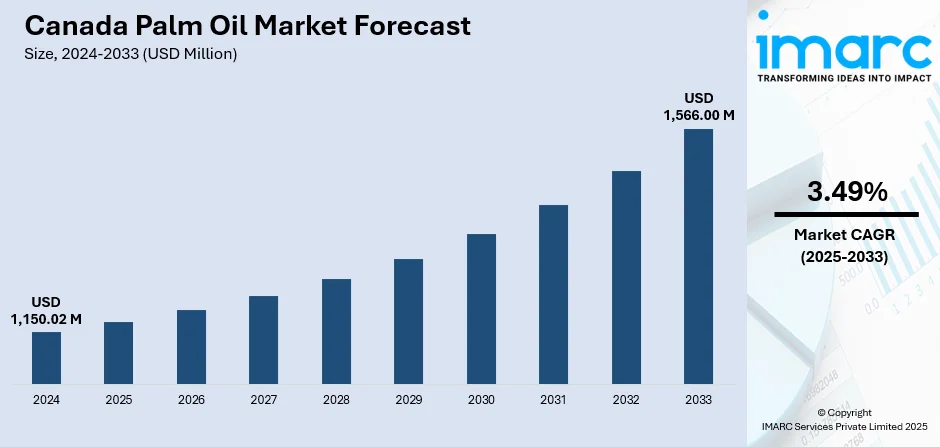

The Canada palm oil market size reached USD 1,150.02 Million in 2024. Looking forward, the market is expected to reach USD 1,566.00 Million by 2033, exhibiting a growth rate (CAGR) of 3.49% during 2025-2033. The market is shaped by import dependence, with most supply sourced from major global producers. Rising demand from food processing, cosmetics, and biofuels, along with growing emphasis on sustainability and certified palm oil, is also accelerating product sales. Regulatory oversight and ethical sourcing trends continue to influence procurement strategies, ultimately defining the evolving Canada palm oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,150.02 Million |

| Market Forecast in 2033 | USD 1,566.00 Million |

| Market Growth Rate 2025-2033 | 3.49% |

Canada Palm Oil Market Trends:

Versatile Applications Across Industries

Palm oil is a very versatile product that is readily utilized in food processing, cosmetic, pharmaceutical, and cleaning products industries in Canada. In the food industry, it increases shelf life, texture, and flavor stability of food products, e.g., margarine, baked goods, and snacks. It is semi-solid at room temperature, and it has long resistance to oxidation, so it is used to manufacture processed foods. In the non-food sector, palm oil derivatives serve as important raw materials in soaps, lotions, and detergents as an affordable substitute for the petroleum-based or animal fat products. This flexibility makes it have constant demand by the industrial consumer and by the retailer. With the ongoing popularity of convenience foods and multipurpose consumer products, palm oil remains an essential commodity, supporting consistent market demand and reinforcing its significance in Canada’s industrial supply chain.

To get more information on this market, Request Sample

Growing Demand for Sustainable and Certified Palm Oil

Consumer awareness of environmental issues is accelerating the shift toward sustainably sourced palm oil in Canada. As ecological concerns gain traction, businesses are prioritizing certified supply chains to meet consumer and regulatory expectations. Certifications such as RSPO (Roundtable on Sustainable Palm Oil) and other eco-labels have become increasingly important, especially in food, cosmetics, and retail sectors. Leading brands and retailers are setting sustainability targets and adopting traceability systems to ensure responsible sourcing. Additionally, public pressure and NGO campaigns are pushing for zero-deforestation commitments across palm oil supply chains. This growing demand for certified, ethical products not only influences sourcing decisions but also opens up market opportunities for suppliers meeting high sustainability standards, thereby propelling the Canada palm oil market growth.

Strategic Trade Relationships and Import Dependency

Canada does not produce palm oil domestically and relies entirely on imports from key global producers like Indonesia, Malaysia, and Colombia. These longstanding trade relationships enable stable access to both crude and refined palm oil products, essential for meeting the country’s food and industrial needs. Import infrastructure through major ports such as Montreal and Vancouver ensure efficient distribution across Canada. In addition, free trade agreements and logistical networks help maintain competitive pricing and uninterrupted supply. As exporting countries expand production while improving sustainability standards, Canadian buyers benefit from greater sourcing flexibility. This dependence on reliable international trade partners, combined with growing domestic demand, plays a pivotal role in driving the availability and growth of palm oil use across multiple sectors in Canada.

Canada Palm Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application.

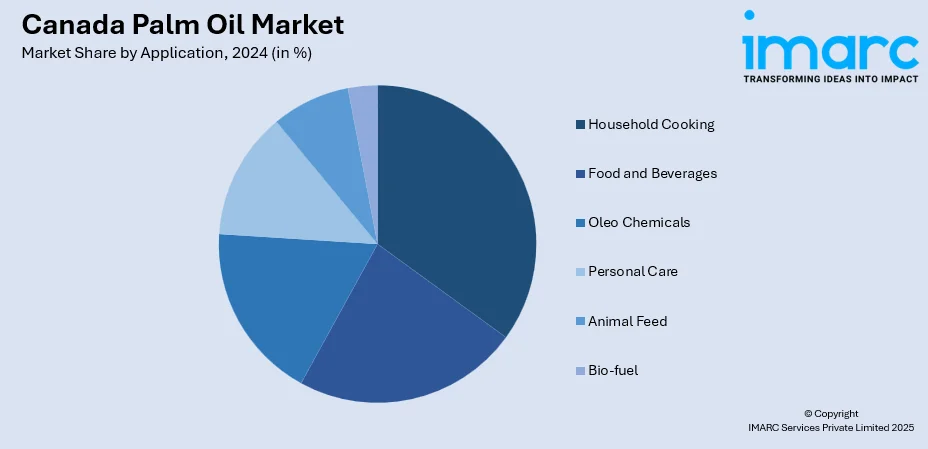

Application Insights:

- Household Cooking

- Food and Beverages

- Oleo Chemicals

- Personal Care

- Animal Feed

- Bio-fuel

The report has provided a detailed breakup and analysis of the market based on the application. This includes household cooking, food and beverages, oleo chemicals, personal care, animal feed, and bio-fuel.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Palm Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Household Cooking, Food and Beverages, Oleo Chemicals, Personal Care, Animal Feed, Bio-fuel |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada palm oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada palm oil market on the basis of application?

- What is the breakup of the Canada palm oil market on the basis of region?

- What are the various stages in the value chain of the Canada palm oil market?

- What are the key driving factors and challenges in the Canada palm oil market?

- What is the structure of the Canada palm oil market and who are the key players?

- What is the degree of competition in the Canada palm oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada palm oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada palm oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada palm oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)