Canada Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

Canada Paper Packaging Market Overview:

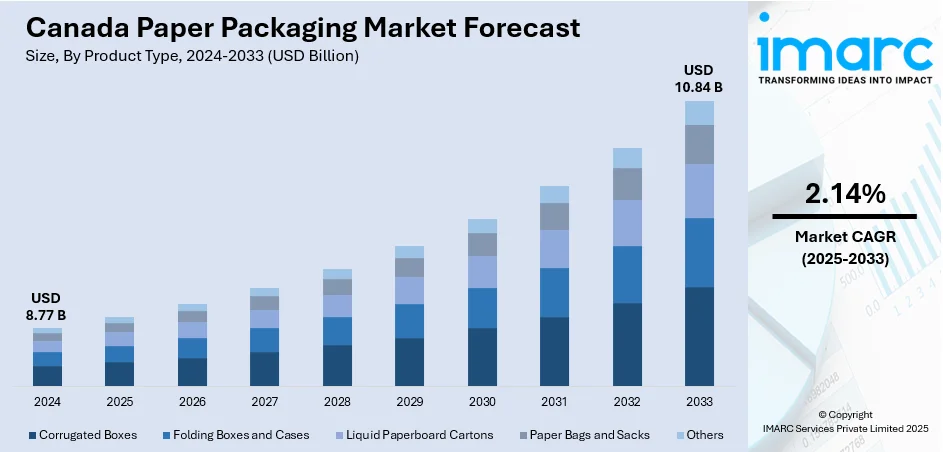

The Canada paper packaging market size reached USD 8.77 Billion in 2024. The market is projected to reach USD 10.84 Billion by 2033, exhibiting a growth rate (CAGR) of 2.14% during 2025-2033. The market is driven by stricter environmental regulations and rising consumer demand for eco-friendly solutions are pushing companies toward recyclable and compostable paper-based alternatives. Simultaneously, the rapid expansion of e‑commerce has increased the need for lightweight, durable, and customizable packaging to ensure product safety and enhance customer experiences. Additionally, innovations in materials, printing, and smart packaging technologies are enabling brands to create stronger, more engaging, and cost‑efficient solutions, solidifying Canada paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.77 Billion |

| Market Forecast in 2033 | USD 10.84 Billion |

| Market Growth Rate 2025-2033 | 2.14% |

Canada Paper Packaging Market Trends:

Innovation in Materials and Smart Packaging

Innovation in materials and design represents a key Canada paper packaging market trend. Firms are developing enhanced paperboard products integrating strength, light weight, and sustainability. Increased focus lies in creating not only functional but also interactive packaging, with digital print technologies facilitating customization, brand narratives, and interactive elements like quick response (QR) codes. Such innovations support improved consumer experience while maintaining sustainability credentials. Furthermore, advancements in manufacturing technologies are enabling smoother production runs, minimized waste, and enhanced design flexibility. These advances are being used by brands to differentiate their offerings, express values, and engage customers more effectively. The inclusion of innovative functionalities in paper packaging makes it a multi-purpose and future-proof option, promoting its use across food, retail, and pharmaceutical industries in Canada.

To get more information on this market, Request Sample

Sustainability and Regulatory Pressure

The Canadian paper packaging market is being significantly driven by the country’s strong emphasis on sustainability and environmental responsibility. Canadians generate roughly 3 million tonnes of plastic waste annually, with only about 9% being recycled, which has intensified the push for alternatives. Government policies are increasingly targeting the reduction of plastic consumption, encouraging companies to adopt paper-based solutions that are recyclable, compostable, and biodegradable. This shift reflects a broader cultural movement where businesses are expected to demonstrate environmental stewardship and align with evolving consumer values. Paper packaging offers a practical way to meet regulatory demands while appealing to eco‑conscious customers. Brands are actively replacing plastics with fiber-based options, redesigning packaging for circularity, and reducing their environmental footprint. These efforts are both regulatory responses and strategic initiatives to enhance brand reputation, making sustainability a core driver of Canada paper packaging market growth.

E‑commerce Expansion and Logistics Efficiency

The acceleration of e‑commerce growth in Canada is redefining packaging requirements and fueling higher demand for paper-based packaging. With online shopping becoming a retail core element, requirements for protective, lightweight, and cost-effective packaging have increased significantly. Paper packaging, especially corrugated boxes and mailers, is highly suitable for shipping as a durable solution that keeps products safe during transit. Its versatility also makes it simple to customize, making it ideal for branding and adding an enhanced unboxing experience for consumers. In addition, companies are looking for packaging that is both protected and sustainable, and paper products fit the bill on both counts. The popularity of direct‑to‑consumer (D2C) sales models has further driven this demand as brands seek to produce packaging that is functional for logistics and appealing to customers. This shifting retail landscape places paper packaging at the center of Canada's expanding e‑commerce environment.

Canada Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

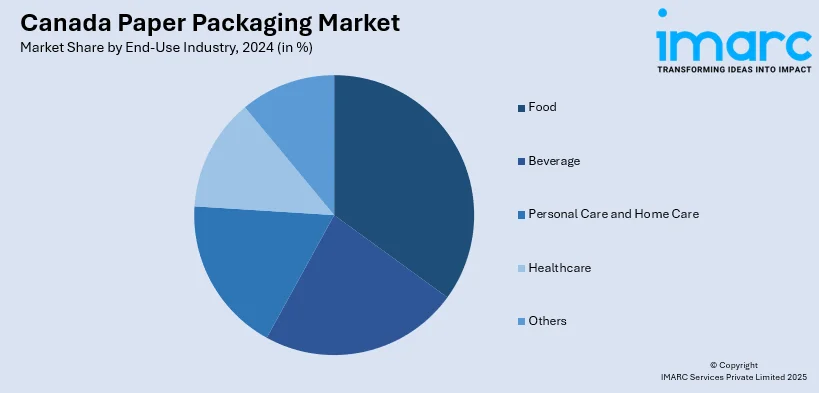

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Paper Packaging Market News:

- In July 2025, Eco Guardian, a Canadian leader in sustainable food and beverage packaging, launched its nationwide eCommerce store, offering fast access to eco-friendly solutions for businesses and households. Customers can now shop compostable and recyclable products, including PLA-lined coffee cups with compostable lids, bamboo food containers, sugarcane bagasse plates, paper food containers, and birchwood cutlery. All products are BPI Certified, compostable, recyclable, and designed to support sustainable living across Canada.

- In May 2024, Canpaco, Inc., which included Crystal Poly Converters, Arcadian Paper Converters, and Canadian Paper & Packaging Co. Ltd., was purchased by Imperial Dade, a prominent distributor of foodservice packaging, printing papers, and janitorial supplies. This marks Imperial Dade’s 87th acquisition, expanding its scale in Canada. Canpaco, established in 1936, is known for its customer-focused service and sustainable packaging solutions. The acquisition enhances Imperial Dade Canada’s product offerings and strengthens its presence in the Quebec and broader Canadian markets.

Canada Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada paper packaging market on the basis of product type?

- What is the breakup of the Canada paper packaging market on the basis of grade?

- What is the breakup of the Canada paper packaging market on the basis of packaging level?

- What is the breakup of the Canada paper packaging market on the basis of end-use industry?

- What is the breakup of the Canada paper packaging market on the basis of region?

- What are the various stages in the value chain of the Canada paper packaging market?

- What are the key driving factors and challenges in the Canada paper packaging market?

- What is the structure of the Canada paper packaging market and who are the key players?

- What is the degree of competition in the Canada paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)