Canada Portable Air Conditioner Market Report by Product Type (Standard Portable Air Conditioner, Smart Portable Air Conditioner), Capacity (Up to 10,000 BTUs, 10,001-15,000 BTUs, Above 15,000 BTUs), Price Range (Below US$ 100, US$ 100-200, US$ 200-700, US$ 700 and Above), End User (Commercial, Residential), Sales Channel (Wholesalers/Distributors, Hypermarkets/Supermarkets, Multi-Brand Stores, Specialty Stores, Independent Small Stores, Online Retailers, and Others), and Region 2026-2034

Canada Portable Air Conditioner Market Overview:

The Canada portable air conditioner market size reached USD 21.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 34.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.28% during 2026-2034. The market is propelled by the increasing temperatures and more frequent heatwaves, urbanization and population growth, improvements in energy efficiency and technological advancements, and awareness of the health benefits of maintaining a comfortable indoor environment thereby aiding the Canada portable air conditioner market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 21.7 Million |

|

Market Forecast in 2034

|

USD 34.9 Million |

| Market Growth Rate 2026-2034 | 5.28% |

Access the full market insights report Request Sample

Canada Portable Air Conditioner Market Analysis:

- Major Drivers: Demand rises due to warmer summers, smaller urban spaces, and the need for flexible, temporary cooling. Consumers value ease of use, mobility, and avoiding complex installations is surging the Canada portable air conditioner market growth.

- Key Market Trends: Manufacturers focus on energy efficiency, eco-friendly refrigerants, and smart features like app control and automation. Compact designs and quieter operation are increasingly prioritized by urban consumers.

- Market Opportunities: E-commerce platforms and rental housing trends create growth potential. Innovation in sustainable materials, smart integrations, and customization opens doors for brands targeting younger, tech-savvy, and eco-conscious consumers.

- Market Challenges: Some of the key challenges in the Canada portable air conditioner market analysis are the cooling limitations, seasonal demand spikes, noise levels, and environmental regulations on refrigerants pose barriers. Intense market competition and consumer expectations for silent, sleek, smart models raise development pressures.

Canada Portable Air Conditioner Market Trends:

Increasing Climate Changes

One of the key Canada portable air conditioner market trends is the climate change has increased the frequency and intensity of heatwaves in Canada, making portable air conditioners a must-have for many households. As per CBC Radio Canada, parts of eastern Canada, including Ontario and Quebec, are seeing more frequent heat waves and tropical nights, defined as nighttime temperatures 20 C or higher. For example, according to theClimate Atlas of Canada, the number of tropical nights in Toronto averaged roughly 6.9 annually from 1976 to 2005. With climate change, under a scenario where carbon emissions decline substantially, that is expected to climb to 17.6 annually from 2021 to 2050. If current rates of carbon emissions continue, the average number of tropical nights in Toronto is expected to hit 20.6 annually from 2021 to 2050. From 2051 to 2080, under the two different scenarios for emissions, the average number would rise to 26.4 and 42.8 respectively. As summers become hotter and more unpredictable, the demand for dependable, adaptable cooling solutions has increased. Portable air conditioners are ideal for Canadian users who may experience fluctuating weather conditions and require a cooling solution that can be quickly transported from room to room or put away when not in use. Portable air conditioners are popular due to their mobility and ability to provide rapid relief during extreme heat conditions. The rising frequency of extreme weather events is predicted to drive demand for portable air conditioners in the Canadian market.

Growing Urbanization

The rise of urbanization, as well as the growing number of people living in apartments and smaller living spaces, has greatly increased demand for portable air conditioners in Canada. In 2021, nearly three in four Canadians (73.7%) lived in one of Canada's large urban centres, up from 73.2% five years earlier. These large urban centres with a population of 100,000 or more people, referred to as census metropolitan areas (CMAs), accounted for most of Canada's population growth (+5.2%) from 2016 to 2021. The suburbs have 78.5% of the total CMA population, with 21.5% in the urban areas. As Canada's population grows, particularly in urban areas such as Toronto, Vancouver, and Montreal, there is a greater demand for residential, commercial, and public infrastructure developments. Portable units, unlike standard central air conditioning systems, do not require permanent installation, making them perfect for rental buildings and smaller living quarters when space is limited. Portable air conditioners are appealing to urban dwellers due to their ease of installation and ability to be moved between rooms as needed. Furthermore, many apartment complexes have restrictions on structural alterations, making portable units a simple and compliant cooling option. The expanding urban population is a major market driver, as more Canadians seek efficient and flexible cooling choices.

Latest News and Developments:

- In June 2025, The City of Toronto launched a pilot Air Conditioning Assistance Program to support low-income seniors with health-related cooling needs. Eligible seniors in multi-unit buildings without air conditioning can apply to receive a free portable unit. Selected through a randomized draw, recipients will be notified by mid-June, with distribution in July. The program aims to address extreme heat risks; electricity costs are not included. A follow-up survey will occur in fall 2025.

- In April 2025, EcoFlow launched two new outdoor-ready products: the WAVE 3, a portable air conditioner and heater, and the GLACIER Classic, a 3-in-1 electric cooler, freezer, and battery. Designed for camping, beach trips, and BBQs, both models offer improved portability, smart controls, and long-lasting power. EcoFlow aims to enhance outdoor comfort with sustainable, high-performance gear that solves common issues in rival products.

Canada Portable Air Conditioner Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, capacity, price range, end user, and sales channel.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Standard Portable Air Conditioner

- Smart Portable Air Conditioner

The report has provided a detailed breakup and analysis of the market based on the product type. This includes standard portable air conditioner and smart portable air conditioner.

Capacity Insights:

- Up to 10,000 BTUs

- 10,001-15,000 BTUs

- Above 15000 BTUs

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 10,000 BTUs, 10,001-15,000 BTUs, and above 15000 BTUs.

Price Range Insights:

- Below US$ 100

- US$ 100-200

- US$ 200-700

- US$ 700 and Above

The report has provided a detailed breakup and analysis of the market based on the price range. This includes Below US$ 100, US$ 100-200, US$ 200-700, and US$ 700 and Above.

End User Insights:

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial and residential.

Sales Channel Insights:

- Wholesalers/Distributors

- Hypermarkets/Supermarkets

- Multi-Brand Stores

- Specialty Stores

- Independent Small Stores

- Online Retailers

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes wholesalers/distributors, hypermarkets/supermarkets, multi-brand stores, specialty stores, independent small stores, online retailers, and others.

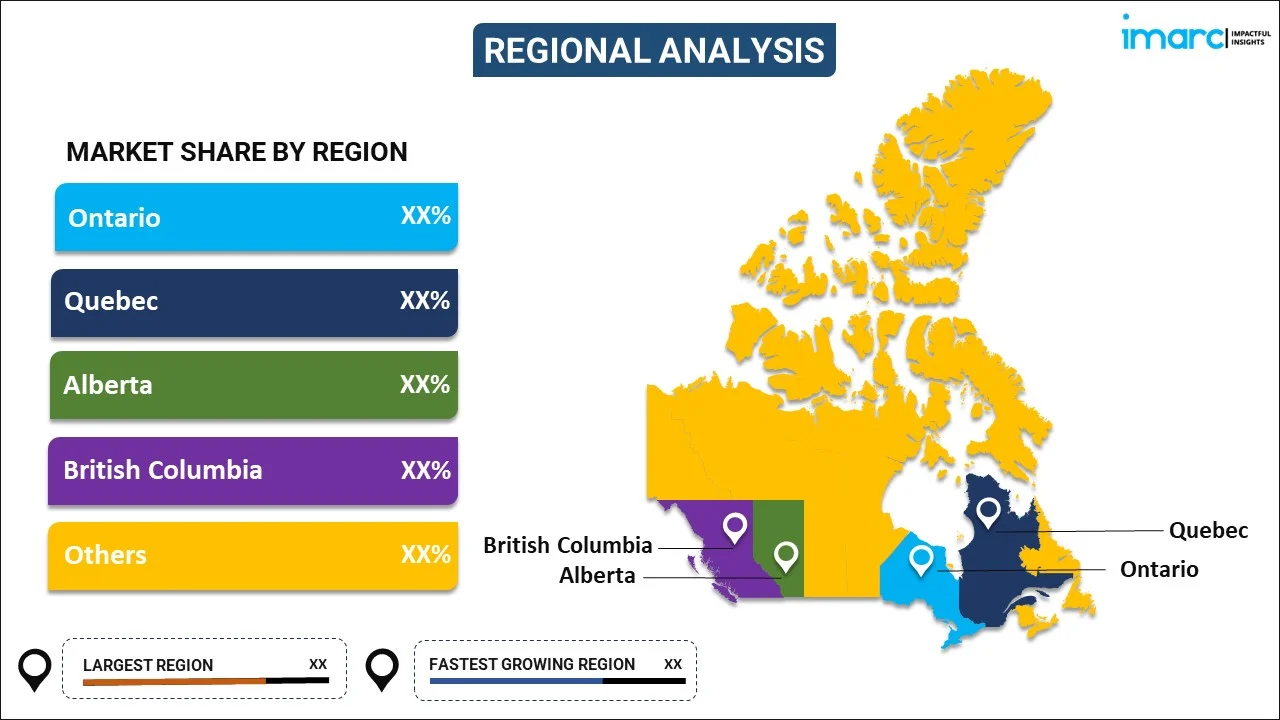

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Portable Air Conditioner Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Standard Portable Air Conditioner, Smart Portable Air Conditioner |

| Capacities Covered | Up to 10,000 BTUs, 10,001-15,000 BTUs, Above 15,000 BTUs |

| Price Ranges Covered | Below US$ 100, US$ 100-200, US$ 200-700, US$ 700 and Above |

| End Users Covered | Commercial, Residential |

| Sales Channels Covered | Wholesalers/Distributors, Hypermarkets/Supermarkets, Multi-Brand Stores, Specialty Stores, Independent Small Stores, Online Retailers, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada Portable Air Conditioner market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada Portable Air Conditioner market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada Portable Air Conditioner industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The portable air conditioner market in Canada was valued at USD 21.7 Million in 2025.

The Canada portable air conditioner market is projected to exhibit a CAGR of 5.28% during 2026-2034, reaching a value of USD 34.9 Million by 2034.

The Canada portable air conditioner market is driven by rising summer temperatures, increased urban living, and the need for flexible cooling in rental homes. Consumers prefer easy-to-install, mobile units with smart features and eco-friendly designs. Shifting lifestyle patterns and environmental awareness also contribute to growing interest in portable cooling solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)