Canada Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Canada Private Equity Market Overview:

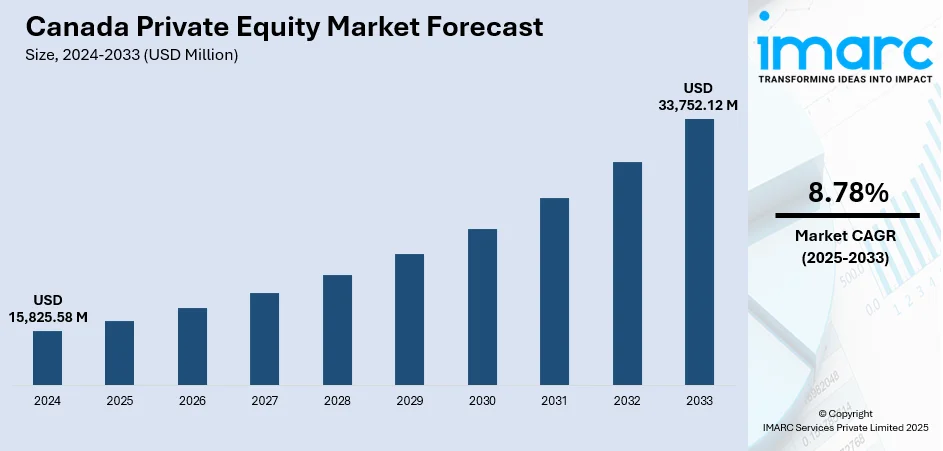

The Canada private equity market size reached USD 15,825.58 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 33,752.12 Million by 2033, exhibiting a growth rate (CAGR) of 8.78% during 2025-2033. Stable economic policies, a strong financial services sector, and increasing investor appetite for alternative assets are driving the market. Innovation hubs and digital transformation across industries also attract foreign capital. High-quality deal pipelines and strategic exits further reinforce Canada private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15,825.58 Million |

| Market Forecast in 2033 | USD 33,752.12 Million |

| Market Growth Rate 2025-2033 | 8.78% |

Canada Private Equity Market Trends:

Rise in Secondary Buyouts

Canada's private equity landscape is experiencing a marked rise in secondary buyouts, where one PE firm sells a portfolio company to another. This trend is driven by high levels of dry powder, extended holding periods, and a desire for liquidity amid market uncertainty. As firms seek to recycle capital and manage portfolio risk, secondary transactions offer an efficient exit strategy while allowing continued growth under new ownership. Canadian mid-market and tech-focused firms are particularly active in these deals, often supported by institutional investors. This growing prevalence of secondary buyouts reflects increasing market maturity, deeper capital pools, and the evolving role of private equity as a long-term value creation partner in Canada’s financial ecosystem. For instance, as of July 2025, Bain Capital, the controlling private equity shareholder in Canada Goose Holdings, is exploring options to sell part or all of its remaining stake, estimated at 60.5% of multiple voting shares (55.5% of total voting power), in a deal potentially led by other private equity firms. Canada Goose, a luxury outerwear brand with a market cap near USD 1.26 Billion, posted C$1.3 billion in revenue and C$95 million in net income for the fiscal year ending March 2025.

To get more information on this market, Request Sample

Growing Role of Institutional Investors

Institutional investors, including pension funds and sovereign wealth entities, are playing an increasingly influential role in the Canada private equity market. Their preference for long-term investments aligns with private equity’s time horizons and potential for outsized returns. Canadian pension funds like CPPIB and OMERS are not only limited partners but also active co-investors, often establishing direct investment arms. This trend enhances deal flow, fosters operational efficiency, and drives competitive valuations. Moreover, the stability and scale of institutional capital help fortify the market against global volatility. Their participation is central to accelerating Canada private equity market growth. For instance, in July 2025, First National Financial, one of Canada's largest non-bank mortgage lenders, announced it will be acquired by Birch Hill Equity Partners and Brookfield Asset Management in a deal valued at C$2.9 billion. Shareholders will receive C$48 per share in cash.

Canada Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on fund type.

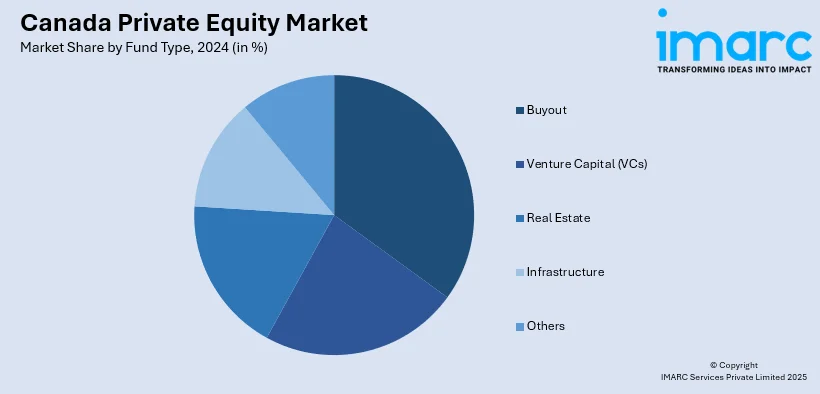

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Private Equity Market News:

- In July 2025, BroadStreet Partners closed a strategic investment led by Ethos Capital, BCI (British Columbia Investment Management Corporation), and White Mountains Insurance Group, with T. Rowe Price also participating. Ontario Teachers’ Pension Plan retains a significant co-control stake. BroadStreet, a leading U.S. middle-market insurance brokerage, will continue its growth strategy through M&A and digital innovation, supporting its Core Agency Partners. The deal reinforces BroadStreet’s co-ownership model and positions it for long-term expansion in the insurance services sector.

- In January 2025, Sagard launched its first private equity fund tailored for Canadian accredited investors, Sagard Private Equity Strategies LP, with an initial close of C$50 million. The evergreen fund offers access to secondaries, co-investments, and primaries in private equity, aiming for 14–18% net annual returns. The initiative targets diversification and long-term upside traditionally reserved for institutional investors.

Canada Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada private equity market on the basis of fund type?

- What is the breakup of the Canada private equity market on the basis of region?

- What are the various stages in the value chain of the Canada private equity market?

- What are the key driving factors and challenges in the Canada private equity market?

- What is the structure of the Canada private equity market and who are the key players?

- What is the degree of competition in the Canada private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada private equity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)