Canada Renewable Energy Storage Market Size, Share, Trends and Forecast by Source, Technology, Application, and Region, 2025-2033

Canada Renewable Energy Storage Market Size and Share:

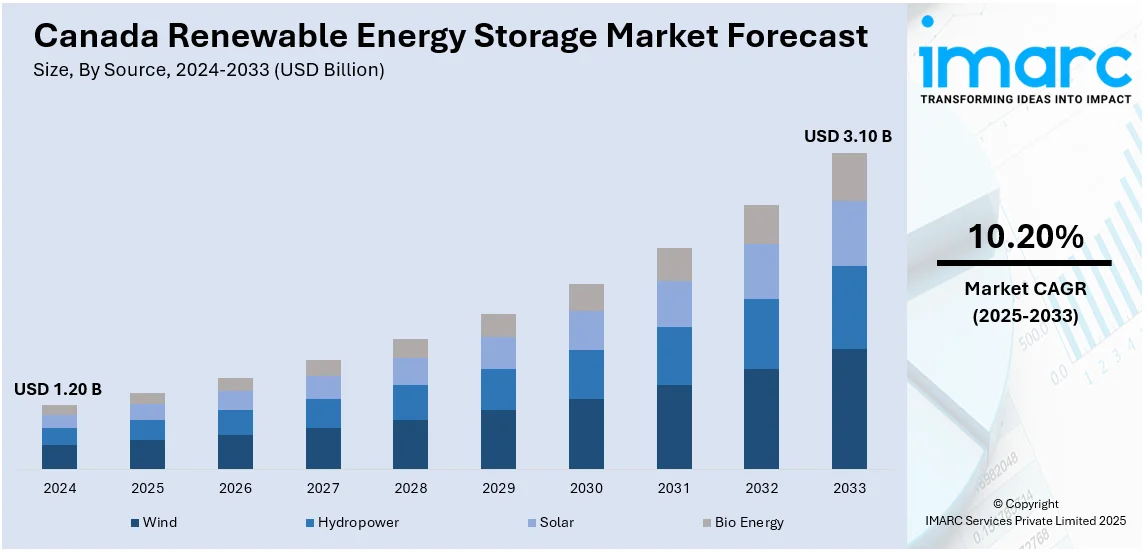

The Canada renewable energy storage market size was valued at USD 1.20 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.10 Billion by 2033, exhibiting a CAGR of 10.20% from 2025-2033. Rising clean energy demand, government incentives, and aggressive net-zero goals are driving Canada's renewable energy storage business. Effective storage solutions are required due to the growing integration of intermittent renewables such as solar and wind. Feasibility is improved by cost reductions and technological developments in grid-scale storage and batteries. Furthermore, carbon pricing, governmental assistance, and smart grid investments all accelerate market expansion. Canada renewable energy storage market share is further driven by growing concerns about energy security and the necessity to lower greenhouse gas (GHG) emissions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2033 | USD 3.10 Billion |

| Market Growth Rate (2025-2033) | 10.20% |

Canada's capability for renewable energy, especially solar and wind, has been growing quickly. The renewable sources are intermittent, with output fluctuating based on weather and daylight conditions, creating a critical need for energy storage systems such as lithium-ion batteries and pumped hydro. Storage ensures grid reliability and stability, allowing utilities in provinces like Ontario, Alberta, and Quebec to balance supply and demand, optimize energy use, reduce curtailment, and maintain continuous power delivery.

Government support is a major driver of renewable energy storage adoption in Canada, with both federal and provincial initiatives encouraging investment in storage infrastructure. Programs such as Canada Infrastructure Bank financing, which has allocated billions to clean power projects, and provincial mandates provide a favorable market environment for advanced storage deployment. Policies promoting carbon reduction and net-zero emissions by 2050 further stimulate adoption. At the provincial level, British Columbia’s Energy Storage Incentive program offers up to $10,000 per kilowatt of battery capacity or 80% of eligible project costs, supporting grid integration. Regulatory frameworks and incentives enhance investor confidence, accelerate technology deployment, thus aiding Canada renewable energy storage market growth.

Canada Renewable Energy Storage Market Trends:

Rising Government Incentives and Environmental Goals

Canada's government has provided substantial assistance for renewable energy storage as a result of its aim to lowering greenhouse gas (GHG) emissions and reaching net-zero emissions by 2050. Through policies, subsidies, and programs that encourage energy storage solutions, the Canadian government is accelerating clean energy adoption. For instance, the 2030 Emissions Reduction Plan, is a bold yet attainable plan that lays out a sector-by-sector course for the Canadian government to reach its goals of reducing emissions by 40% below 2005 levels by 2030 and reaching net-zero emissions by 2050. In the same way, in June 2024, the governments of Canada and Manitoba announced funding for 32 projects with a total value of USD 10.9 Million in an effort to reduce emissions and enable Manitoba businesses' adoption of low-carbon technologies, to create jobs and build climate-resilient communities. In addition to this, Federal and provincial incentives also drive investments in large-scale storage projects to stabilize energy from intermittent sources like solar and wind, which is further facilitating the market growth across the country.

Technological Advancements in Energy Storage Solutions

Fast innovation in energy storage technologies is one of the notable Canada renewable energy storage market trends. Improvements in battery chemistry, like lithium-ion, solid-state, and flow batteries, are enhancing energy density, efficiency, and longevity, which is making large-scale storage more affordable and viable. A significant milestone in this evolution is the completion of Canada's largest grid-scale battery storage facility in Haldimand County, Ontario, hosting 278 lithium-ion battery units and effectively doubling Ontario’s energy storage capacity to 475 megawatts. This facility not only strengthens grid reliability but also supports decarbonization efforts by reducing emissions over its operational lifetime. Concomitantly, innovations in grid-scale storage systems, smart inverters, and energy management software allow for improved integration of intermittent renewable sources like solar and wind. These technological advancements decrease the cost of operations, improve grid stability, and enhance the reliability of the renewable energy supply. Furthermore, research and pilot projects enable scalable and modular storage solutions, drawing in increased investments and speeding up adoption in industrial, commercial, and utility markets, hence driving overall market expansion.

Increasing Initiatives Toward Renewable Energy Adoption

The growing wind and solar capacity necessitate storage solutions for reliability and grid balance, which is a major growth-inducing factor in the market. For instance, in June 2024, Neoen is one of the top makers of renewable energy on the world and commissioned its Fox Coulee solar farm in Starland County in Alberta. With a capacity of 93 MWp, it can generate clean electricity since December 2023 and ends up producing about 100 GWh of green electricity a year-like the homes of 20,000 people will consumption and avoiding around 70,000 tons CO2 per year-once fully operational. Solar farm is wholly owned by Neoen. The next phase of Canadian Solar Inc.'s utility-scale energy storage system, SolBank 3.0, is set to be launched by e-STORAGE, a division of the company's majority-owned subsidiary CSI Solar Co., Ltd. ("CSI Solar"). This announcement was made in December 2023. Additionally, the Canadian Minister of Energy and Natural Resources confirmed an investment of nearly USD 16 Million in June 2025 for renewable energy projects in Nova Scotia, Prince Edward Island, and New Brunswick, in order to help provide dependable and reasonably priced renewable energy to citizens.

Canada Renewable Energy Storage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Canada renewable energy storage market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on source, technology, and application.

Analysis by Source:

- Wind

- Hydropower

- Solar

- Bio Energy

Wind energy is a major driver of storage adoption due to its variability and high capacity in provinces like Ontario, Alberta, and Quebec. Energy storage systems balance intermittent supply, ensure grid reliability, and enable excess energy from wind farms to be stored and dispatched during peak demand periods.

Concurrently, the hydropower provides both electricity generation and storage potential through pumped hydro systems. Canada’s abundant hydro resources, particularly in Quebec and British Columbia, allow large-scale energy storage, grid stabilization, and peak load management, making hydropower a backbone for integrating additional intermittent renewables into the energy system.

Moreover, the solar energy adoption is rising, especially in Ontario and Alberta. Storage systems store excess electricity generated during daylight for use during nighttime or cloudy periods. Coupled with incentives and declining solar costs, storage enables households, businesses, and utilities to maximize self-consumption, reduce grid dependency, and enhance energy reliability.

Besides this, the bioenergy, derived from organic materials, supports decentralized power generation and complements storage systems. Energy storage enables flexible dispatch of bioenergy plants, balancing supply with variable renewable sources. Integrating bioenergy with storage reduces greenhouse gas emissions, improves energy security, and enhances the efficiency and stability of regional grids across Canada.

Analysis by Technology:

- Pumped Hydroelectric Storage

- Battery Energy Storage

- Flywheel Energy Storage

- Compressed Air Energy Storage

- Thermal Energy Storage

- Hydrogen Energy Storage

Based on the Canada renewable energy storage market forecast, the most well-known large-scale storage method is pumped hydro, which uses excess electricity to move water to higher reservoirs for future production. It provides grid stability, peak load management, and long-duration storage. Its extensive hydro resources in provinces like Quebec and British Columbia make it a key component of renewable integration.

In line with this, the battery systems, especially lithium-ion, dominate medium- and small-scale applications. They store electricity from solar and wind for grid balancing, peak shaving, and backup power. Rapid cost reductions, modular deployment, and efficiency improvements drive adoption across residential, commercial, and utility-scale projects, supporting Canada’s clean energy transition.

Moreover, the flywheels store energy kinetically through spinning rotors, offering fast response and high cycle life. They are ideal for short-duration applications, frequency regulation, and stabilizing intermittent renewables. While less common than batteries or pumped hydro, flywheels contribute to grid reliability and resilience in targeted energy storage projects.

Along with this, the compressed air systems store electricity by compressing air in underground caverns or tanks, releasing it to generate power when needed. Suitable for large-scale, long-duration storage, they support renewable integration and grid stability. Canada’s geological formations allow pilot and future projects, complementing hydro and battery storage solutions.

Furthermore, the thermal storage captures and stores heat or cold for later use, reducing electricity demand for heating and cooling. It is widely applied in industrial, commercial, and district energy systems, enabling efficient energy use, peak load reduction, and integration with renewable electricity sources like solar thermal or excess wind power.

Apart from this, the hydrogen storage converts excess renewable electricity into hydrogen via electrolysis, which can later generate electricity, fuel transport, or industrial processes. It provides long-duration, large-scale storage and decarbonizes multiple sectors. Canada’s investments in hydrogen infrastructure aim to complement battery and hydro storage while enabling a low-carbon energy economy.

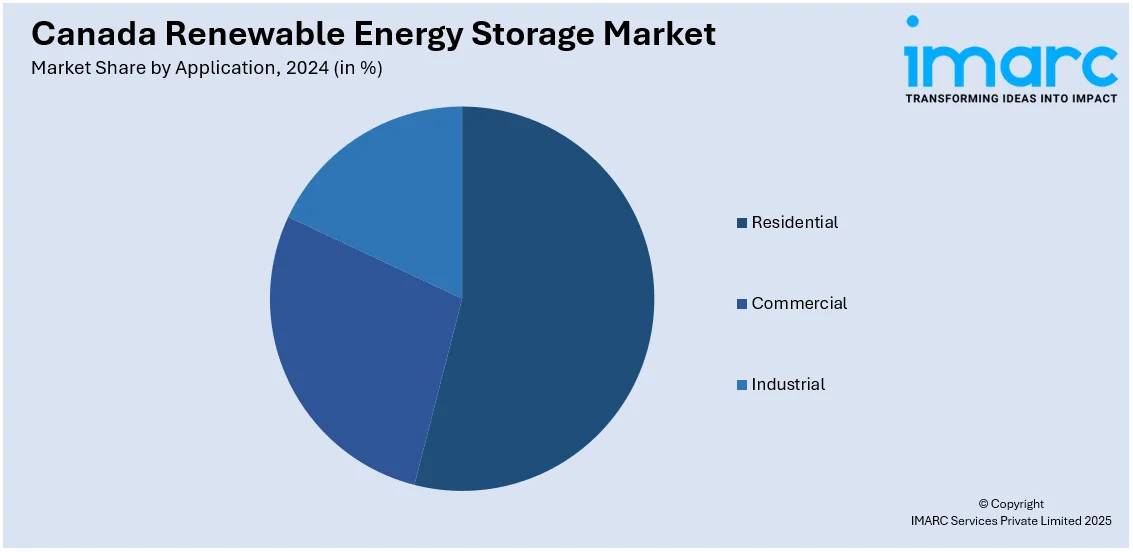

Analysis by Application:

- Residential

- Commercial

- Industrial

Residential energy storage is growing as homeowners adopt rooftop solar and smart home technologies. Battery systems store excess solar energy for self-consumption, reducing electricity bills and providing backup during outages. Government incentives and declining battery costs are driving adoption, promoting decentralized energy generation and enhancing household energy resilience.

Besides this, the commercial applications focus on businesses seeking cost savings, demand charge reduction, and energy reliability. Energy storage enables load shifting, peak shaving, and integration of on-site renewables. Incentives, regulatory support, and sustainability targets motivate commercial enterprises to invest in medium-scale battery systems, enhancing operational efficiency and supporting corporate carbon reduction goals.

Moreover, the industrial energy storage addresses large-scale energy management, grid stabilization, and renewable integration in manufacturing and processing sectors. Systems provide peak load management, uninterrupted power supply, and support for high energy-consuming operations. Industrial adoption is driven by operational efficiency, regulatory compliance, and corporate sustainability commitments, with large-scale storage increasingly vital for decarbonizing energy-intensive industries.

Regional Analysis:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario leads in renewable energy storage adoption due to its high wind and solar capacity. Large-scale projects and supportive provincial policies, such as energy storage mandates and incentives, enhance grid reliability. The province emphasizes balancing intermittent renewable supply with storage solutions, enabling continuous electricity delivery to urban and industrial centers.

Additionally, the Quebec’s renewable energy storage growth is driven by its extensive hydroelectric base and rising wind and solar projects. Storage systems help manage variability and integrate new renewables into the grid. Government programs and clean energy targets support battery and pumped hydro installations, ensuring grid stability while advancing the province’s low-carbon energy transition.

Moreover, the Alberta is rapidly expanding storage to complement its growing solar and wind capacity amid fossil fuel reduction goals. Energy storage ensures grid reliability during peak demand and intermittent renewable generation. Provincial incentives and market reforms encourage battery, flow, and hybrid storage solutions, supporting Alberta’s transition toward a cleaner, more resilient energy system.

Besides this, the BC focuses on integrating energy storage with hydro and expanding solar and wind projects. Provincial incentives, such as BC Hydro’s storage programs, accelerate adoption. Storage solutions improve grid flexibility, reliability, and efficiency while supporting net-zero emission targets. BC’s approach emphasizes combining storage with renewable generation to optimize energy supply.

Also, the others smaller provinces are increasingly adopting energy storage to enhance renewable integration and grid stability. Targeted incentives, pilot projects, and strategic investments in lithium-ion and pumped hydro storage facilitate local renewable adoption. These regions focus on reliable energy supply, emissions reduction, and scalable solutions suited to regional resource availability and demand patterns.

Competitive Landscape:

The competitive dynamics are defined by accelerating technological advancement, changing business models, and growing collaboration across the energy industry. Companies concentrate on improving efficiency, scalability, and affordability of storage to address the accelerating demand from utilities and industrial customers. Strategic partnerships, mergers, and research and development investments are prevalent to enhance technological strength and market presence. Inter-regional disparities in the use of renewable energy as well as government policies introduce differing opportunities and challenges, promoting competition in individual provinces. Generally, the market is extremely dynamic, with high focus on rolling out innovative storage solutions, enhancing grid resilience, and facilitating Canada's shift towards a low-carbon energy system.

The report provides a comprehensive analysis of the competitive landscape in the Canada renewable energy storage market with detailed profiles of all major companies.

Latest News and Developments:

- September 2025: Canadian Solar Inc. reported that its e-STORAGE division plans to introduce FlexBank 1.0, its next-generation modular battery, at RE+ in Las Vegas. FlexBank 1.0 is a scalable renewable energy storage platform developed to address the requirements of various utility-scale applications, further broadening e-STORAGE's Battery Energy Storage System (BESS) product range.

- August 2025: PowerBank Corporation announced the successful installation of its state-of-the-art 4.99 MW Battery Energy Storage System (BESS) in Ontario. This milestone signals PowerBank's venture into the quickly expanding battery storage business, aligning with the company’s objective to promote the use of renewable energy sources through various initiatives.

- April 2025: Colbún, a company based in Chile, partnered with Canadian Solar Inc. through its subsidiary e-STORAGE to supply a Battery Energy Storage System (BESS) for the Diego de Almagro Sur development in Chile's Atacama Region. The unique battery energy storage system SolBank 3.0 from e-STORAGE will be used in the project, guaranteeing the corporation's industrial clients a steady and safe supply of renewable energy.

- March 2025: Canadian Solar Inc., through its subsidiary e-STORAGE, signed a Long-Term Service Agreement (LTSA) and Battery Supply deal with Strata Clean Energy's White Tank Energy Storage LLC. As part of this agreement, e-STORAGE will supply a 100 MW / 576 MWh DC Battery Energy Storage System (BESS) to Strata’s White Tank Battery facility in Arizona, U.S., which will improve grid dependability in the region by supplying Arizona Public Service (APS) with stored renewable energy.

Canada Renewable Energy Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Wind, Hydropower, Solar, Bio Energy |

| Technologies Covered | Pumped Hydroelectric Storage, Battery Energy Storage, Flywheel Energy Storage, Compressed Air Energy Storage, Thermal Energy Storage, Hydrogen Energy Storage |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada renewable energy storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada renewable energy storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada renewable energy storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The renewable energy storage market in Canada was valued at USD 1.20 Billion in 2024.

The Canada renewable energy storage market is projected to exhibit a CAGR of 10.20% during 2025-2033, reaching a value of USD 3.10 Billion by 2033.

The Canada renewable energy storage market is driven by rising renewable adoption, government incentives, and climate policies. Technological advancements in batteries, growing grid modernization, and increasing energy demand further fuel growth. Additionally, the need for grid reliability and reducing carbon emissions accelerates investment in efficient energy storage solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)