Canada Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Canada Running Gear Market Overview:

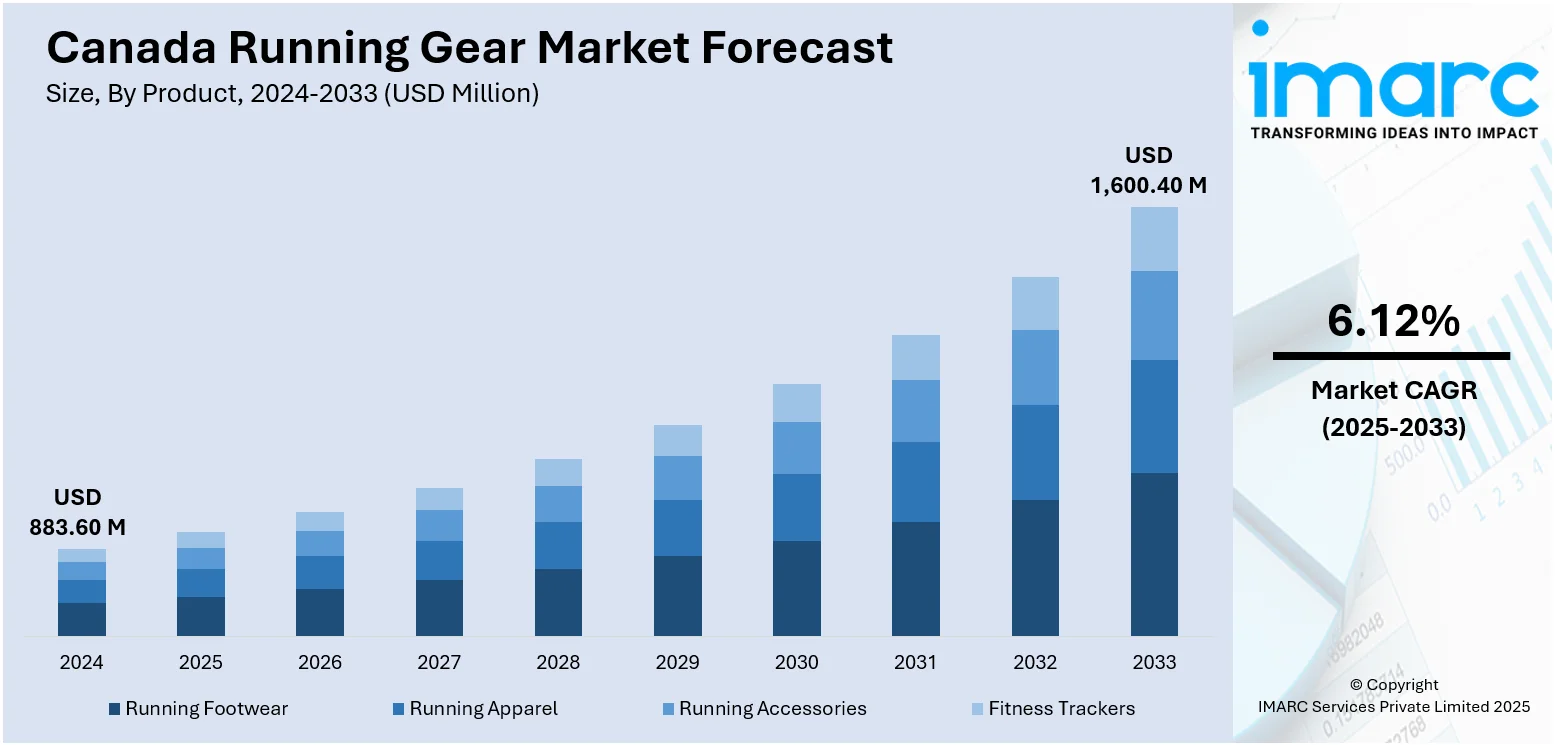

The Canada running gear market size reached USD 883.60 Million in 2024. Looking forward, the market is projected to reach USD 1,600.40 Million by 2033, exhibiting a growth rate (CAGR) of 6.12% during 2025-2033. The market is driven by rapid e-commerce adoption, with consumers preferring personalized digital shopping and seamless service integrations. Growing participation in running activities, fitness events, and wellness-focused lifestyles continues to generate demand for high-performance gear. Ongoing innovations in materials, fit, and climate-specific design, reinforced by strong branding and retail engagement, are further augmenting the Canada running gear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 883.60 Million |

| Market Forecast in 2033 | USD 1,600.40 Million |

| Market Growth Rate 2025-2033 | 6.12% |

Canada Running Gear Market Trends:

Health and Fitness Culture Driving Participatory Demand

Canadians are embracing running as a core fitness activity, supported by high levels of sports participation and growing interest in trail, marathon, and community races. Brands are responding with specialized footwear featuring cushioning, stability, and weather adaptability tailored to Canada’s varied climates. In August 2024, Montreal-based norda™ partnered with Envalior to unveil the 005 ultra-distance trail running shoe, featuring Arnitel® midsoles and Vibram® Mega Grip Elite soleplates. The 005 delivers a market-first 80.6% resiliency, weighs just 211g (M8.5), and offers superior durability, lasting 5–10x longer than conventional super foams. Scheduled for Spring 2025 release, the 005 reinforces Canada’s role in high-performance, sustainable running gear innovation. Performance apparel that also fits athleisure trends is seeing increased demand from both seasoned runners and casual users. Community races, virtual competitions, and social fitness apps foster ongoing interaction with fitness brands, encouraging repeat gear purchases. Moreover, environmental awareness is pushing consumers to seek recycled and ethically produced running gear. This strong alignment between lifestyle values, physical activity, and continuous equipment use is creating a sustained foundation for consumer demand. The availability of customizable running gear and limited‑edition drops further adds to consumer appeal. Subscription-based replenishment services and loyalty programs have enhanced repeat purchase engagement. Influencer collaboration and social commerce integration provide targeted reach to younger fitness communities, further contributing to Canada running gear market growth.

To get more information on this market, Request Sample

Product Innovation and Competitive Branding Landscape

Running gear manufacturers in Canada operate in a competitive environment defined by product differentiation, technical advancement, and strong branding. International and domestic companies invest in research to develop footwear with biomechanical enhancements, lightweight midsoles, and responsive cushioning suitable for multiple terrains. Climate-specific innovations include insulated running apparel, moisture‑wicking layers, and water-resistant designs. Companies such as Nike, Adidas, and Lululemon leverage athlete partnerships and local sponsorships to increase brand affinity, while regional retailers provide in-store gait analysis and digital sizing tools. For instance, in April 2024, lululemon launched its first-ever summer Olympic and Paralympic Athlete Kit as Team Canada’s Official Outfitter for Paris 2024, featuring adaptive apparel designed with input from 19 athletes across 14 sports. The kit integrates magnetic zippers, pull-on loops, convertible designs, and sweat-wicking SenseKnit™ fabrics, combining inclusivity with performance innovation. Retail items became available in Canada starting April 16, reinforcing lululemon’s influence in Canada’s performance apparel market ahead of the Games. Sustainability commitments are increasingly built into product offerings, including recycled materials and lower-emission production methods. Limited releases, custom design options, and collaborations with athletes or influencers support premium positioning. Specialty retailers and global brands have expanded omnichannel strategies, blending brick and mortar expertise with online convenience and livestream shopping experiences. These branding strategies and product enhancements ensure recurring consumer interest and allow companies to effectively maintain their presence in the Canadian market.

Canada Running Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

The report has provided a detailed breakup and analysis of the market based on the product. This includes running footwear, running apparel, running accessories, and fitness trackers.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on gender. This includes male, female, and unisex.

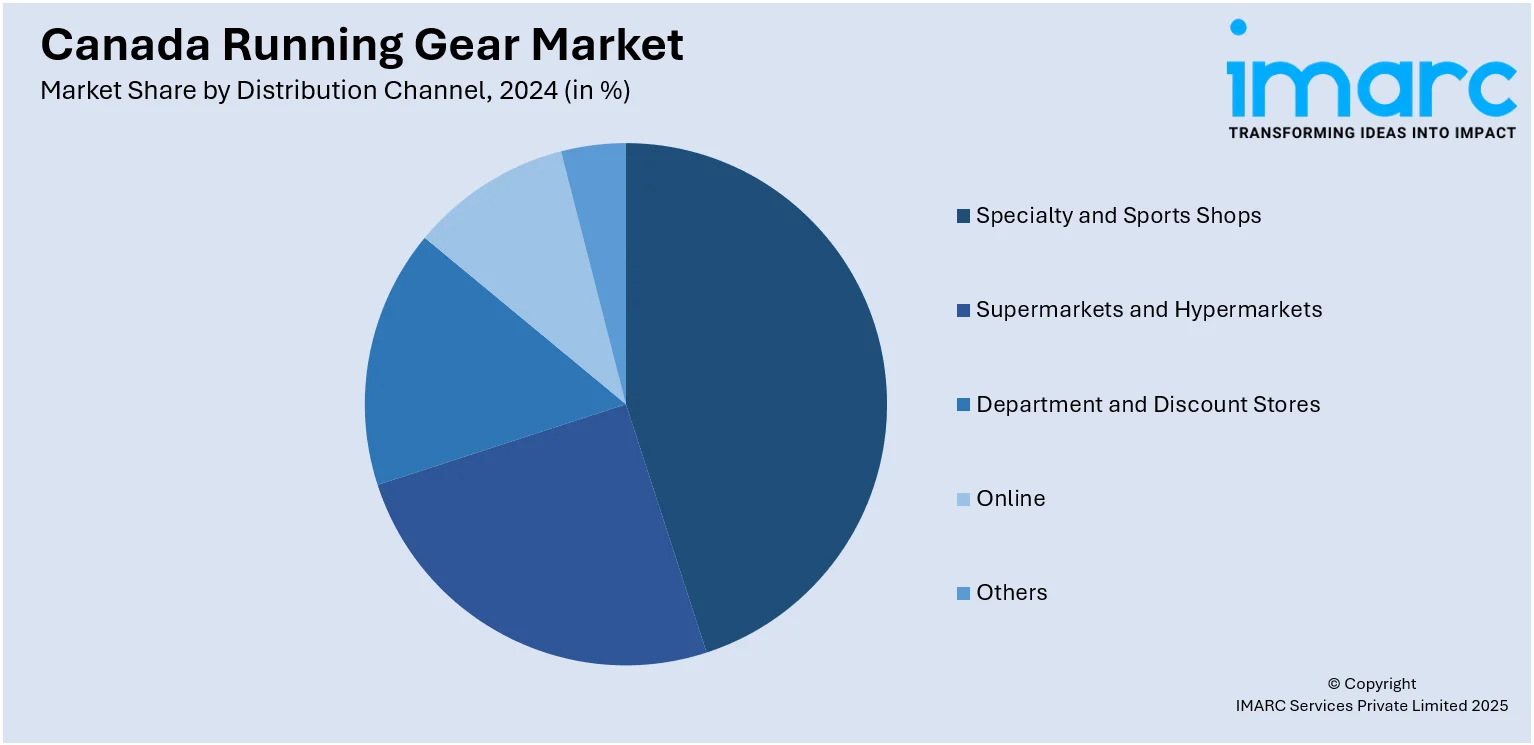

Distribution Channel Insights:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Running Gear Market News:

- In July 2025, KEEN Canada unveiled its first trail running shoe, the Seek, priced at CAD 230 (USD 172), featuring a QuantumFoam midsole and 4mm high-abrasion rubber lugs tested to last 925 miles. Designed for heel strikers, it offers a 6mm heel-to-toe drop, wide forefoot for toe splay, and a snug lockdown fit, targeting both novice and experienced trail runners. This marks KEEN's entry into Canada's performance running gear market, with further trail-focused product expansions planned for 2026.

- In April 2025, Adidas and the Terry Fox Foundation launched the limited-edition ‘Finish It’ collection, featuring running apparel tied to the 45th Terry Fox Run. The gear, including the official 2025 run shirt, is available ahead of the April 12 release and targets participants of Canada’s largest annual running event. The initiative boosts Adidas’ visibility in the Canadian running market while supporting national cancer research.

Canada Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada running gear market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada running gear market on the basis of product?

- What is the breakup of the Canada running gear market on the basis of gender?

- What is the breakup of the Canada running gear market on the basis of distribution channel?

- What is the breakup of the Canada running gear market on the basis of region?

- What are the various stages in the value chain of the Canada running gear market?

- What are the key driving factors and challenges in the Canada running gear market?

- What is the structure of the Canada running gear market and who are the key players?

- What is the degree of competition in the Canada running gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada running gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada running gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)