Canada Seeds Market Size, Share, Trends and Forecast by Type, Seed Type, Traits, Availability, Seed Treatment, and Region, 2025-2033

Canada Seeds Market Overview:

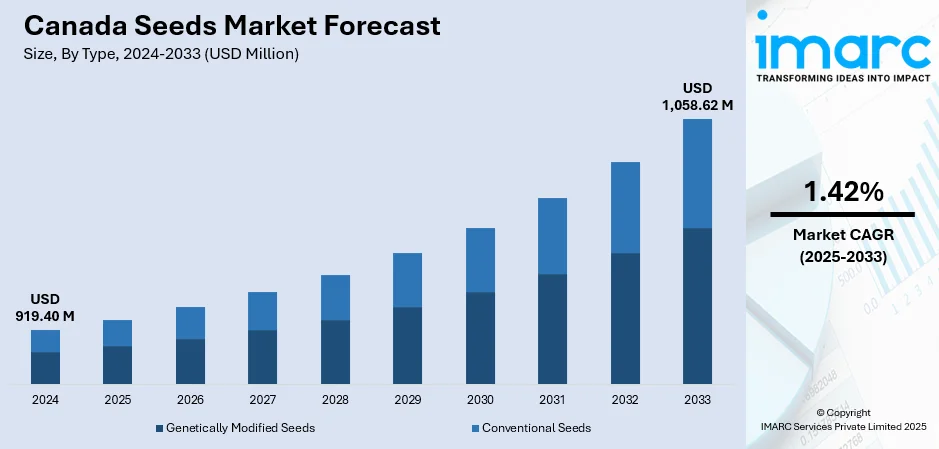

The Canada seeds market size reached USD 919.40 Million in 2024. The market is projected to reach USD 1,058.62 Million by 2033, exhibiting a growth rate (CAGR) of 1.42% during 2025-2033. The market continues to grow steadily, stimulated by technology in seeds and sustainable agriculture. Farmers are rapidly embracing hybrid and genetically modified seeds to improve yields and resistance to pests and diseases. The government subsidizes the production of organic and climate-tolerant seed varieties, encouraging biodiversity and environmental stewardship. Seed demand is affected by regional differences in crop production, with cereals and grains being top by acreage. These factors all help make up the changing Canada seeds market share landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 919.40 Million |

| Market Forecast in 2033 | USD 1,058.62 Million |

| Market Growth Rate 2025-2033 | 1.42% |

Canada Seeds Market Trends:

Modernizing Seed Regulations to Foster Innovation

In July 2025, the Canadian Food Inspection Agency (CFIA) proposed comprehensive reforms to Canada’s seed regulations aimed at making the framework more flexible and responsive to technological advancements in agriculture. The proposed 52 changes are designed to reduce administrative burdens on seed producers while enhancing marketplace competitiveness and maintaining safety for farmers and consumers. Among the key initiatives are updating technical standards more quickly through references, modernizing the variety registration process, and involving a permanent advisory committee to keep regulators connected with industry developments. Additionally, the CFIA plans to improve biosecurity by shifting seed import assessments to occur before seeds enter the country, which helps prevent the spread of pests and diseases. These updates reflect a broader commitment to supporting innovation in seed development and distribution while safeguarding environmental and economic interests. This regulatory overhaul will play a crucial role in shaping Canada seeds market growth by enabling faster adoption of new seed technologies and improving the overall agility of the sector.

To get more information on this market, Request Sample

Staple Crops Continue to Drive Seed Demand

In 2024, cereals and grains covered more than half of the seeded land in Canada, testifying to their pivotal position in the agricultural sector of Canada. Wheat, barley, and oats continue to be the leading crops because of their versatility for various Canadian climates and their value as part of crop rotation programs that maintain soil quality. This emphasis on staple crops underpins both national food security and Canada's role as a leading agricultural product exporter. The consistent demand for these crops determines seed demand, prompting farmers to cultivate varieties that maximize yield, disease tolerance, and climatic resilience. Farmers continue to look for seeds adapted to local conditions, with a focus on attributes that address changing weather patterns and soil heterogeneity. Moreover, seed treatment and breeding technologies' developments have improved seed performance as well as minimized loss. Together, these considerations draw attention to how dominance in staple crops impacts the Canada seeds market trends through the influence on product and investment offerings in the industry.

Growing Focus on Agricultural Research and Innovation

In January 2025, the Canadian government reaffirmed its commitment to backing agricultural research by investing in initiatives focused on enhancing crop resilience, productivity, and sustainability. This renewed emphasis forms a long-term strategy for boosting the agriculture sector's innovation and competitiveness, both locally and internationally. Current research focuses on comprehending pest resistance, disease management, soil fertility, and breeding methods more suitable for Canada's varying growing conditions. By facilitating collaboration among public institutions, research organizations, and farmers, these programs hope to accelerate the generation and uptake of improved seed varieties and agricultural practices. More funding for crop research also directs emphasis on ecologically friendly solutions that minimize environmental effects while preserving crop output. The integrated approach aims to address challenges presented by climate change and changing market needs. Ongoing investment in research infrastructure and human resource development ensures that Canada's agriculture industry is flexible and innovative. These developments in agriculture science form the core of the ongoing transformation and expansion in the seed industry, as these present emerging markets.

Canada Seeds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, seed type, traits, availability, and seed treatment.

Type Insights:

- Genetically Modified Seeds

- Conventional Seeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes genetically modified seeds and conventional seeds.

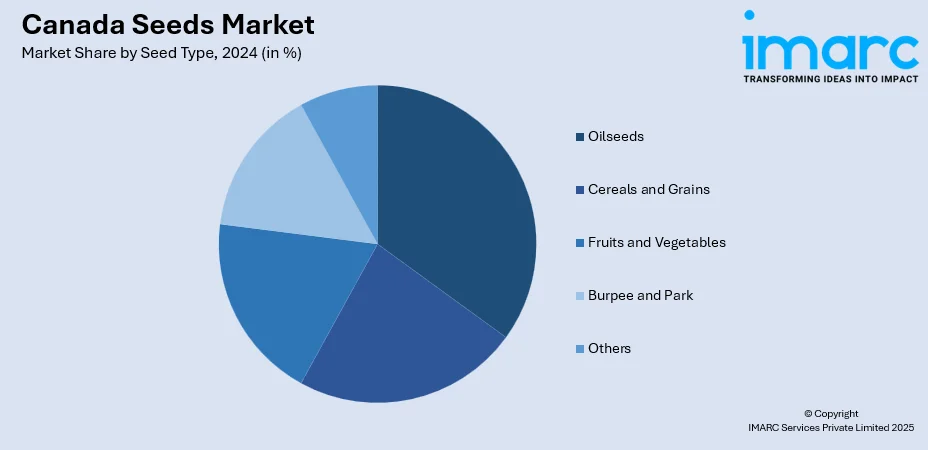

Seed Type Insights:

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Lemons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Burpee and Park

- Others

A detailed breakup and analysis of the market based on the seed type have also been provided in the report. This includes oilseeds (soybean, sunflower, cotton, and canola/rapeseed), cereals and grains (corn, wheat, rice, and sorghum), fruits and vegetables (tomatoes, lemons, brassica, pepper, lettuce, onion, and carrot), burpee and park, and others.

Traits Insights:

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Others

The report has provided a detailed breakup and analysis of the market based on the traits. This includes herbicide-tolerant (HT), insecticide-resistant (IR), and others.

Availability Insights:

- Commercial Seeds

- Saved Seeds

A detailed breakup and analysis of the market based on the availability have also been provided in the report. This includes commercial seeds and saved seeds.

Seed Treatment Insights:

- Treated

- Untreated

The report has provided a detailed breakup and analysis of the market based on the seed treatment. This includes treated and untreated.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Seeds Market News:

- April 2025: Harmoniz Seeds has launched an advanced new facility in Ontario, Canada, to give North American producers early access to unique tomato, pepper, and cucumber varieties. The facility specializes in breeding seeds for local growing conditions, which improves quality and commercial worth. It also serves as a testing center for novel seed materials produced in the Netherlands. Moreover, Harmoniz operates a specific testing program in Canada for virus-resistant varieties, employing genomic and molecular technologies to aid healthier and stronger crops.

- February 2025: Syngenta Seeds launched a new distribution model in Canada for its NK traited soybeans. Pitura Seeds will be responsible for Western Canada distribution, and Jackson Seed Service for Eastern Canada. The strategic change is focused on strengthening responsiveness to market needs and offering growers continued access to high-performance NK soybean genetics. Syngenta is dedicated to producing high-quality soybeans and will continue to provide a complete line of NK and Enogen corn hybrids through its Canadian staff.

Canada Seeds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Seed Types Covered |

|

| Traits Covered | Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Others |

| Availabilities Covered | Commercial Seeds, Saved Seeds |

| Seed Treatments Covered | Treated, Untreated |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada seeds market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada seeds market on the basis of type?

- What is the breakup of the Canada seeds market on the basis of seed type?

- What is the breakup of the Canada seeds market on the basis of traits?

- What is the breakup of the Canada seeds market on the basis of availability?

- What is the breakup of the Canada seeds market on the basis of seed treatment?

- What is the breakup of the Canada seeds market on the basis of region?

- What are the various stages in the value chain of the Canada seeds market?

- What are the key driving factors and challenges in the Canada seeds market?

- What is the structure of the Canada seeds market and who are the key players?

- What is the degree of competition in the Canada seeds market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada seeds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada seeds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada seeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)