Canada Smart Metering Market Size, Share, Trends and Forecast by Product, Technology, End Use and Region, 2025-2033

Canada Smart Metering Market Overview:

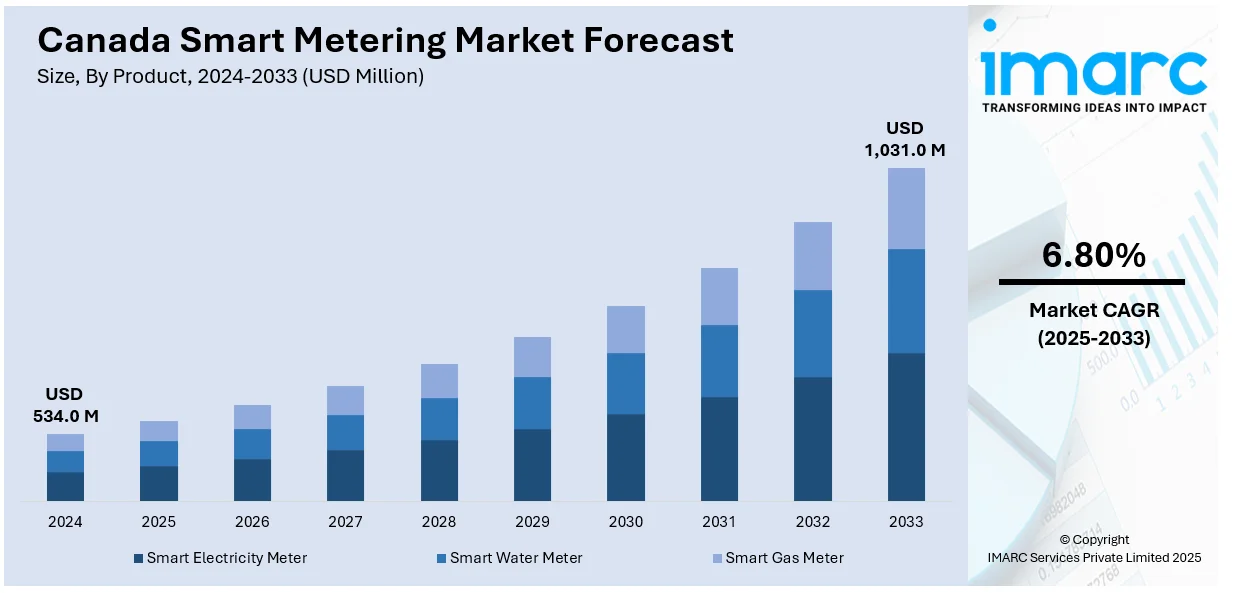

The Canada smart metering market size reached USD 534.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,031.0 Million by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The industry is experiencing steady growth due to supportive government programs, rising demand for energy efficiency, integration of renewable energy, major technology breakthroughs, and broad construction of smart grid infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 534.0 Million |

| Market Forecast in 2033 | USD 1,031.0 Million |

| Market Growth Rate 2025-2033 | 6.80% |

Canada Smart Metering Market Analysis:

- Major Drivers: Government programs encouraging energy efficiency, growing need for real‑time consumption insights, and utility companies’ push for renewable energy integration are major forces driving the adoption of smart meters across Canada.

- Key Market Trends: some of the key Canada smart metering market trends are the increasing use of artificial intelligence (AI) for consumption forecasting, integration with smart home systems, adoption of prepaid models, heightened focus on cybersecurity, and linking meters with storage and demand‑response initiatives are emerging trends.

- Market Opportunities: Potential lies in expanding to water and gas metering, collaborating with utilities for electric vehicle charging networks, using blockchain for secure data, and enabling smart‑city‑focused grid modernization efforts across provinces.

- Market Challenges: Key challenges in the Canada smart metering market analysis include high setup and infrastructure costs, difficulty integrating with older grid systems, ensuring data privacy and regulatory compliance, and overcoming public resistance or limited awareness about smart metering benefits.

Canada Smart Metering Market Trends:

Government Initiatives

In Canada, both the federal and provincial governments have been working to promote energy efficiency and sustainability, thus accelerating the Canada smart metering market share. These schemes are meant to serve the purpose of energy modernization, with the aim of minimizing energy wastage and promoting renewable energy sources. The federal government has set ambitious targets for the reduction of greenhouse gases, largely embedded in programs such as the Pan-Canadian framework on clean growth and climate change, with smart meters being a vital tool to help utilities and consumers manage energy consumption. Meanwhile, provincial governments are keeping pace with their own regulations to enable the installation of smart meters especially in urban locations where energy demand is highest. These regulations, apart from promoting, often requiring that utilities deploy smart metering solutions, has resulted in the Canada smart metering market growth.

To get more information of this market, Request Sample

Demand for Energy Efficiency

In Canada, smart metering solutions are witnessing great demand, as there is increasing awareness regarding energy conservation and the need to use energy efficiently. With rising energy prices, residential and commercial customers alike are looking for ways to optimize energy consumption to reduce their utility bills. Smart meters give consumers real-time data on their energy use, allowing them to determine when and how they want to use electricity. This granular data gives scope for even better energy management, since consumers can know peak usage times and modify their behavior. Utilities also benefit, serving the interests of customers by analyzing those very consumption patterns and then aligning energy production and distribution with them. A growing consumer interest in smart-home technologies that work well with smart meters to build a completely interconnected, energy-efficient home environment provides further impetus to the Canada smart metering market outlook.

Integration of Renewable Energy

Smart metering technology is becoming an increasingly important part of energy management systems as Canada continues to expand its efforts to harness renewable sources like solar and wind. Renewable sources are variable by nature, so energy production may experience fluctuations due to weather and time of the day. Smart meters will provide the real-time data required to offset these fluctuations, with the ultimate goal of matching energy supply to demand without overloading the grid. Utilities use smart meters to collect fine-grained data on energy consumption so as to integrate renewable energy better into their grids. In addition, the Canada smart metering market share provides the pathway for a two-way communication system between the utility and consumer, facilitating the management of distributed resources like residential solar panels.

Canada Smart Metering Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, technology, and end use.

Product Insights:

- Smart Electricity Meter

- Smart Water Meter

- Smart Gas Meter

The report has provided a detailed breakup and analysis of the market based on the product. This includes smart electricity meter, smart water meter, and smart gas meter.

Technology Insights:

- AMI (Advanced Metering Infrastructure)

- AMR (Automatic Meter Reading)

The report has provided a detailed breakup and analysis of the market based on the technology. This includes AMI (Advanced Metering Infrastructure) and AMR (Automatic Meter Reading).

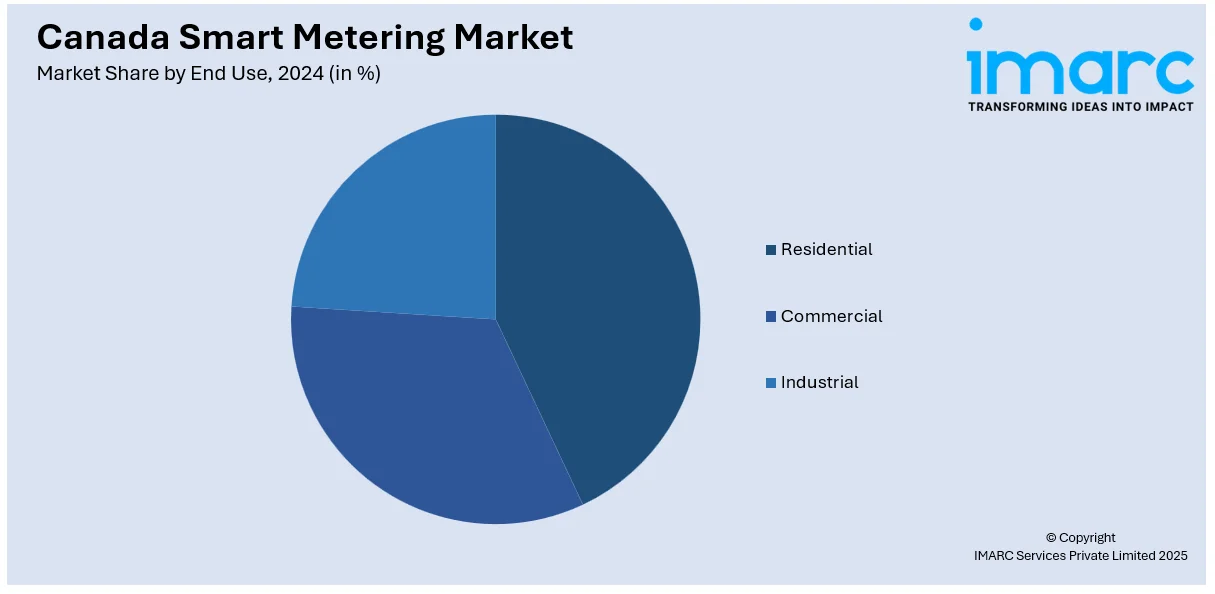

End Use Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end use has also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In August 2024, Canada’s Minister of Energy and Natural Resources announced a federal investment of more than $175 million in 12 clean energy projects in Alberta. Under one of these investments, ATCO will modernize capital assets, improve network and build advanced metering infrastructure in rural and urban communities.

- In October 2023, Advanced Metering Infrastructure (AMI) and private network provider Ubiik partnered with Electricity Canada to deliver private LTE networks for utilities in the 900MHz, 1.4GHz, and 1.8GHz bands.

Canada Smart Metering Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Smart Electricity Meter, Smart Water Meter, Smart Gas Meter |

| Technologies Covered | AMI (Advanced Metering Infrastructure), AMR (Automatic Meter Reading) |

| End Uses Covered | Residential, Commercial, Industrial |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada smart metering market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada smart metering market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada smart metering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart metering market in Canada was valued at USD 534.0 Million in 2024.

The Canada smart metering market is projected to exhibit a CAGR of 6.80% during 2025-2033, reaching a value of USD 1,031.0 Million by 2033.

Canada’s smart metering market is driven by government energy efficiency initiatives, utility modernization goals, and consumer demand for real-time usage insights. Integration with renewable energy, advanced communication technologies, and the need to replace aging infrastructure further accelerate adoption, making smart meters central to Canada’s transition toward smarter, more efficient grids.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)