Canada Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Canada Steel Tubes Market Overview:

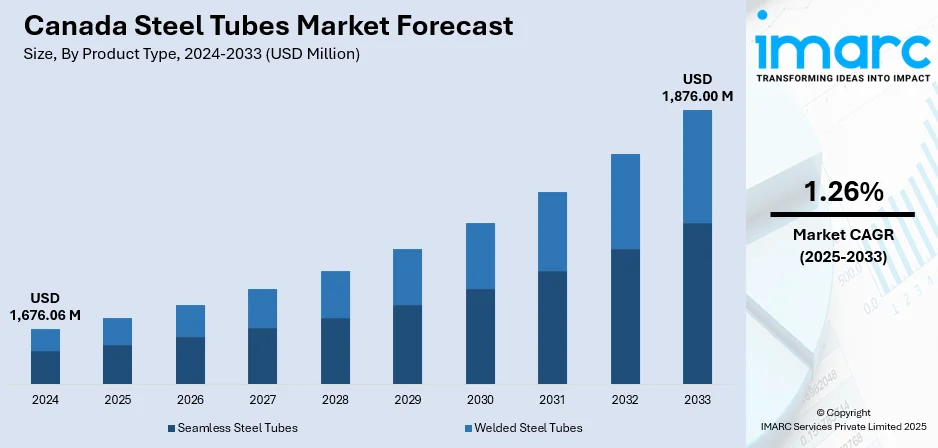

The Canada steel tubes market size reached USD 1,676.06 Million in 2024. The market is projected to reach USD 1,876.00 Million by 2033, exhibiting a growth rate (CAGR) of 1.26% during 2025-2033. The market is witnessing consistent growth fueled by rising demand in construction, automotive, and energy industries. Improvements in manufacturing procedures and growing infrastructure spending are also driving market growth. Regional development coupled with emphasis on sustainable solutions are defining major trends, while applications across various diverse areas are further expanding the market's reach for industry players. As market dynamics evolve with changing consumer needs and industrial advancements, companies are focusing on efficiency and durability to stay competitive in the Canada steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,676.06 Million |

| Market Forecast in 2033 | USD 1,876.00 Million |

| Market Growth Rate 2025-2033 | 1.26% |

Canada Steel Tubes Market Trends:

Domestic Demand Shifts in Focus

In March 2025, Canada launched a 30‑day public consultation on trade measures addressing potential steel diversion into its domestic market, signaling rising concern about import risk linked to foreign overcapacity. That initiative reflects how policymakers are adapting responses to shifts in supply chains and demand. Following this launch, federal authorities introduced reciprocal tariffs affecting steel products in mid‑March, followed by a wider consultation on trade measure adjustments. During this period, anecdotal reports indicated rising inquiries from infrastructure and mechanical engineering players seeking domestically sourced welded and seamless tubing. Analysts noted a rebound in industrial tube usage tied to renewed investment in transit upgrades and clean energy systems. Although precise consumption data for tubes is limited, the consultation itself underscores mounting momentum behind a more protected internal market for tubes and related steel goods. It also hints at evolving demand patterns where domestic content preferences are influencing procurement practices across industrial and public infrastructure projects. These developments offer early insight into emerging Canada steel tubes market growth.

To get more information on this market, Request Sample

Policy Changes Reshape Import Flows

In June 2025, Canada implemented tariff‑rate quotas on steel mill imports including pipe and tube products from non‑FTA partners, setting import thresholds based on volumes, with surtaxes triggered beyond quota limits. That regulatory shift shows that authorities are using volume‑based thresholds to protect the domestic steel tubes segment from price impacts due to global overproduction. Around the same time, the government expanded surtax measures and procurement policies that progressively favour Canadian‑made steel inputs in publicly funded projects. Funding announcements for domestic steel support including Strategic Innovation Fund allocations and labour market agreements in early June enhanced incentives for producers serving infrastructure and machinery sectors. Industry observers commented that demand for welded and mechanical tubing designs is gradually increasing under these policies. While specific domestic tube output numbers are not released, the combined effect of quotas plus procurement preferences will likely reshape supplier behaviour and improve alignment between consumption and locally produced tube supply. This regulatory backdrop underscores how changes in trade and procurement frame Canada steel tubes market trends.

Investments Drive Local Tube Production

In July 2025, Canada had committed over one billion Canadian dollars via the Strategic Innovation Fund toward supporting steel sector resilience, including tube product innovation and domestic capacity expansions. That support comes on top of capital and training investments announced in March and June, aimed at modernizing steel infrastructure and enhancing supply chain security. Industry statements and policy briefings highlight that labelling procurement as “Buy Canadian” for government contracts is increasingly shaping supply preferences, particularly for pipe and tube segments used in infrastructure and defence applications. Observations from government releases note that more than half of Canada’s steel output covering tube categories was exported mostly to the US, making domestic substitution a priority for risk mitigation. The combination of capital support, procurement shifts, and export exposure reduction signals a strategic pivot toward more resilient domestic production and diversified end‑use adoption. These investments are expected to support broader tube fabrication capabilities while improving supply alignment with domestic demand needs.

Canada Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

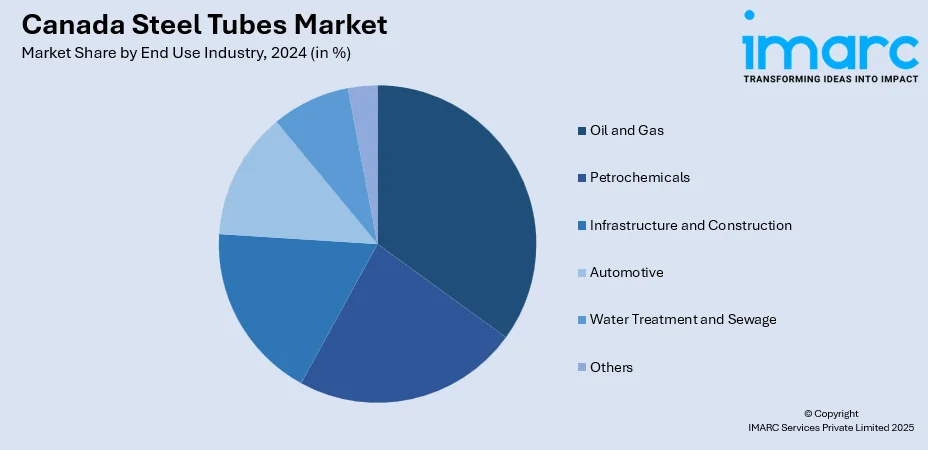

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Ontario, Quebec, Alberta, British Columbia, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Canada Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Canada steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Canada steel tubes market on the basis of product type?

- What is the breakup of the Canada steel tubes market on the basis of material type?

- What is the breakup of the Canada steel tubes market on the basis of end use industry?

- What is the breakup of the Canada steel tubes market on the basis of region?

- What are the various stages in the value chain of the Canada steel tubes market?

- What are the key driving factors and challenges in the Canada steel tubes market?

- What is the structure of the Canada steel tubes market and who are the key players?

- What is the degree of competition in the Canada steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Canada steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Canada steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Canada steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)