Canada Wallpaper Market Size, Share, Trends and Forecast by Wallpaper Type, Distribution Channel, End User, and Region, 2026-2034

Canada Wallpaper Market Summary:

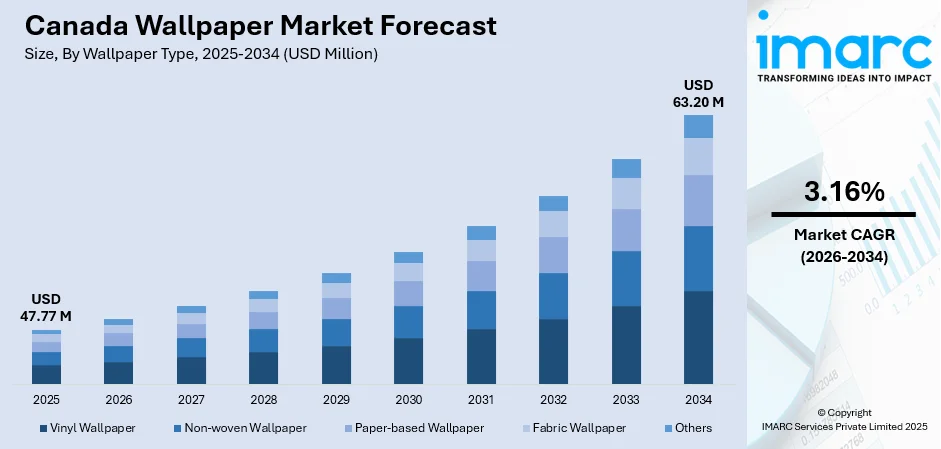

The Canada wallpaper market size was valued at USD 47.77 Million in 2025 and is projected to reach USD 63.20 Million by 2034, growing at a compound annual growth rate of 3.16% from 2026-2034.

The Canadian wallpaper market benefits from sustained residential renovation momentum and growing commercial sector investment in interior aesthetics. Home improvement spending remains robust as Canadians increasingly prioritize personalized living spaces that reflect individual style preferences. Digital printing innovations enable unprecedented customization capabilities while sustainable material development addresses environmental consciousness among the masses. Strong e-commerce infrastructure complements traditional retail channels, facilitating market accessibility across diverse geographic regions. These converging factors position the Canada wallpaper market share for steady expansion throughout the forecast period.

Key Takeaways and Insights:

- By Wallpaper Type: Vinyl wallpaper dominates the market with a share of 36.92% in 2025, driven by superior durability, moisture resistance properties, and versatility across high-traffic commercial environments.

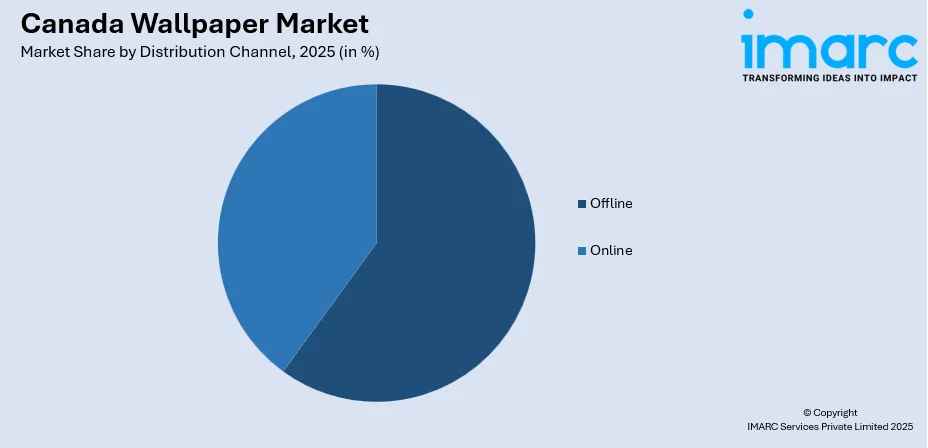

- By Distribution Channel: Offline leads the market with a share of 55.94% in 2025, benefiting from tactile product evaluation capabilities, immediate availability advantages, and personalized customer consultation services.

- By End User: Commercial represents the largest segment with a market share of 54.08% in 2025, propelled by hospitality industry expansion, retail environment differentiation requirements, and corporate workspace modernization initiatives.

- Key Players: The Canada wallpaper market features established international manufacturers competing alongside specialized design-focused suppliers, with competitive dynamics emphasizing product innovation, sustainable material development, and customization capabilities serving diverse consumer segments.

To get more information on this market, Request Sample

Market growth reflects fundamental shifts in Canadian consumer behavior toward personalized interior design solutions and commercial sector recognition of wallpaper's strategic value in creating memorable brand experiences. The convergence of digital printing technology advancement and sustainable material innovation addresses evolving market requirements while maintaining design versatility. Residential renovation spending remains elevated as homeowners invest in aesthetic enhancements that differentiate living spaces without requiring structural modifications. Commercial applications continue expanding as businesses recognize wallpaper's cost-effectiveness compared to alternative interior treatments while offering superior visual impact.

Canada Wallpaper Market Trends:

Digital Printing Technology Advancement

Advanced digital printing capabilities transform wallpaper customization possibilities through high-resolution imaging technology and unlimited color reproduction accuracy. Canadian consumers increasingly demand personalized designs incorporating personal photographs, commissioned artwork, and bespoke patterns that reflect individual aesthetic preferences. Commercial clients leverage digital printing flexibility for brand-specific installations requiring precise color matching and custom size ng. In 2024, Staples Canada has rolled out Print Connect, a complimentary service aimed at addressing the various printing requirements of companies. The retailer announced in a news release that Print Connect functions as a unique collaboration platform, enabling team members to easily access and print branded materials whenever needed.

Sustainable Material Innovation

Environmental consciousness drives demand for eco-friendly wallpaper solutions featuring recyclable substrates, water-based inks, and low-VOC formulations that maintain indoor air quality standards. Canadian manufacturers respond with FSC-certified paper products and PVC-free alternatives that appeal to environmentally responsible consumers. The Business Development Bank of Canada stated that 85% of Canadian consumers consciously look for sustainable products, indicating a substantial market opportunity. Owing to this, key players are launching sustainable wallpapers featuring biodegradable materials and eco-friendly inks, gaining significant traction in the market.

Heritage and Nature-Inspired Design Resurgence

Traditional pattern revival emphasizes vintage aesthetics including William Morris-inspired botanical motifs and heritage chinoiserie designs that connect contemporary interiors with historical craftsmanship traditions. Nature-inspired themes featuring forest landscapes, organic textures, and botanical elements satisfy consumer desires for biophilic design principles promoting wellness through natural environment connections. Canadian design preferences embrace both maximalist bold patterns and subtle organic textures that complement diverse architectural styles. Numerous expos are taking place in the country to showcase the wide range of interior products. For instance, the 26th Interior Design Show (IDS) Toronto took place from January 23 to 26 2025. A significant feature was the introduction of a Canadian preview of Salone del Mobile Milano, presenting Italian design elements in a pavilion by the Italian Trade Commission that exhibited 10 companies such as Calligaris, Technogym, and Londonart, with a booth crafted by Simone Micheli.

Market Outlook 2026-2034:

The Canada wallpaper market demonstrates promising growth trajectory driven by sustained residential renovation activity and commercial sector interior investment expansion. The market generated a revenue of USD 47.77 Million in 2025 and is projected to reach a revenue of USD 63.20 Million by 2034, growing at a compound annual growth rate of 3.16% from 2026-2034. Digital printing capabilities will continue advancing customization possibilities while sustainable material development addresses environmental consciousness requirements. Commercial applications will expand as hospitality renovations accelerate and retail environments prioritize experiential differentiation.

Canada Wallpaper Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Wallpaper Type | Vinyl Wallpaper | 36.92% |

| Distribution Channel | Offline | 55.94% |

| End User | Commercial | 54.08% |

Wallpaper Type Insights:

- Vinyl Wallpaper

- Non-woven Wallpaper

- Paper-based Wallpaper

- Fabric Wallpaper

- Others

Vinyl wallpaper dominates with a market share of 36.92% of the total Canada wallpaper market in 2025.

Vinyl wallpaper dominates the Canadian market through superior durability characteristics that withstand high-traffic commercial environments and challenging residential applications including kitchens, bathrooms, and basement installations. The material's inherent moisture resistance properties prevent degradation in humid conditions while simplifying maintenance through washable surface treatments. Canadians appreciate vinyl's versatility across diverse design aesthetics from contemporary minimalism to traditional elegance, facilitated by advanced printing technologies that reproduce intricate patterns with exceptional fidelity.

The segment benefits from technological innovations including textured vinyl formulations that replicate natural materials like grasscloth and linen while maintaining superior performance characteristics. Fire-resistant vinyl variants meet stringent commercial building code requirements, expanding application possibilities in healthcare facilities, educational institutions, and corporate office environments. Fabric-backed vinyl wallcoverings deliver enhanced dimensional stability and tear resistance for professional installation projects requiring seamless appearance across large wall expanses.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Online

- Offline

Offline leads with a share of 55.94% of the total Canada wallpaper market in 2025.

Physical retail channels maintain dominant market position through tactile evaluation advantages that enable Canadian consumers to assess texture quality, color accuracy, and pattern scale before committing to significant home investment decisions. Specialty wallpaper retailers provide expert consultation services addressing technical installation requirements, pattern matching complexities, and design coordination considerations that enhance purchase confidence. DIY home improvement stores leverage extensive product assortment breadth and immediate availability advantages, eliminating delivery wait times while offering value-added services including custom cutting and pre-pasting preparation

Physical retail environments facilitate spontaneous purchase decisions through inspirational room vignette displays that demonstrate wallpaper's transformative potential across diverse interior design contexts. Sales associates provide personalized recommendations addressing specific room dimensions, lighting conditions, and existing décor elements that influence product selection outcomes. In 2025, Walmart Canada announced a landmark $6.5 billion investment over the next five years as the brand announced its plans to further expand in Canada.

End User Insights

- Residential

- Commercial

Commercial exhibits a clear dominance with a 54.08% share of the total Canada wallpaper market in 2025.

Commercial applications dominate the Canadian wallpaper market as businesses recognize strategic value in creating distinctive interior environments that reinforce brand identity and enhance customer experience quality. Hospitality establishments including hotels, restaurants, and bars leverage wallpaper for atmosphere creation that differentiates competitive positioning while facilitating memorable guest experiences encouraging repeat visitation and positive social media engagement. Retail environments utilize wallpaper for brand storytelling and experiential merchandising that transforms shopping from transactional activities into engaging brand encounters generating organic marketing amplification.

The commercial segment benefits from project-based procurement patterns involving large-scale installations that generate substantial revenue concentration relative to residential applications. Professional specification processes favor established manufacturer relationships and certified product performance characteristics including fire ratings, durability standards, and maintenance requirements that ensure regulatory compliance and lifecycle value optimization. Social media influence amplifies commercial wallpaper adoption as Instagram-worthy interior designs generate free marketing exposure while attracting clientele seeking photogenic environments. In 2024, 91.9% of Canadians who used internet were using social media platforms.

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Ontario dominates the Canadian wallpaper market through population concentration in Toronto and Greater Toronto Area metropolitan regions generating substantial residential renovation activity and commercial property development. The province benefits from diverse demographic composition supporting varied design preference requirements while hosting established retail infrastructure facilitating product accessibility.

Quebec represents significant secondary market characterized by distinct francophone design aesthetics valuing traditional craftsmanship and European-influenced patterns. Montreal drives substantial commercial adoption through vibrant hospitality sector and creative industry concentration demanding distinctive interior environments.

Alberta experiences market growth driven by Calgary and Edmonton economic activity supporting residential construction and commercial development despite cyclical energy sector influences.

British Columbia particularly Vancouver demonstrates premium product adoption reflecting elevated real estate values and design-conscious consumer base prioritizing aesthetic differentiation. The region benefits from Pacific Rim cultural influences encouraging eclectic design integration.

Other regions represent developing markets characterized by value-oriented purchasing patterns and growing renovation activity as homeowners seek affordable transformation alternatives to structural modifications while expressing regional identity through localized design preferences.

Market Dynamics:

Growth Drivers:

Why is the Canada Wallpaper Market Growing?

Sustained Home Renovation and Remodeling Activity

Canadian homeowners maintain elevated renovation spending driven by pandemic-accelerated housing investment patterns and sustained property value appreciation encouraging aesthetic enhancement projects. At the end of 2024, CIBC polling revealed that 49 percent of Canadians had recently completed or were actively planning home improvement projects with average expenditures reaching 19,000 dollars, reflecting widespread commitment to residential property enhancement despite broader economic uncertainties. Unique renovation motivations is encouraging homeowners to prioritize visual transformation over structural modifications, positioning wallpaper as cost-effective solution delivering dramatic aesthetic impact without extensive construction requirements. This sustained renovation momentum creates consistent market demand for wallpaper products offering relatively accessible installation processes.

Commercial Sector Interior Investment Expansion

Commercial property owners recognize wallpaper's strategic value in competitive differentiation and customer experience enhancement across hospitality, retail, and corporate office applications. Hospitality establishments leverage wallpaper for atmosphere creation that reinforces brand positioning while generating Instagram-worthy environments encouraging organic social media marketing through guest photography and sharing behaviors. Moreover, there is a rise in opening of bars and restaurants in Canada. Restaurants Canada’s Consumer Dining Index increased for the third month in a row in July, hitting 94.2, up from 92.6 in June. This signifies the peak level noted thus far in 2025 and indicates consistent growth in consumer dining engagement. Restaurant and bar operators utilize wallpaper for ambiance differentiation that transforms dining experiences from purely functional activities into memorable occasions justifying premium pricing and encouraging repeat visitation patterns.

Wallpaper is Merging with Smart-Home and Acoustic Features

Manufacturers in Canada are introducing wallpaper that supports acoustic comfort, and homeowners are installing it to soften sound in condos and multi-storey houses. Brands are developing felt-backed and foam-layered sheets, and designers are specifying them in home offices and entertainment rooms. Tech-forward companies are experimenting with sensor-ready surfaces, and early adopters are exploring these ideas for future integration with lighting and climate systems. Offices and co-working spaces are adopting sound-absorbent wallpaper to improve privacy, and facility managers are seeking materials that meet fire and safety standards. Retailers are showcasing performance-driven designs, and buyers are comparing ratings before making decisions.

Market Restraints:

What Challenges the Canada Wallpaper Market is Facing?

Premium Material Cost Sensitivity

Higher-end wallpaper options including non-woven substrates and eco-friendly materials command premium pricing that deters price-sensitive consumer segments particularly in value-oriented markets and emerging regions. A major portion of people opt for more affordable vinyl-based or paper-type wallpapers instead of sustainable alternatives despite environmental consciousness preferences, reflecting budget constraint realities influencing purchase decisions. Professional installation costs compound financial barriers particularly for premium wallpaper types requiring specialized application techniques and precise pattern matching capabilities that necessitate experienced contractor engagement. Economic uncertainty periods amplify price sensitivity as consumers defer discretionary renovation expenditures or seek budget-friendly alternatives including conventional paint applications offering lower upfront investment requirements despite limited aesthetic differentiation capabilities.

Competition for Alternative Wall Covering Solutions

Advanced paint technologies including textured formulations and decorative techniques provide cost-effective alternatives perceived as more accessible for DIY application without specialized skills or professional assistance requirements. Wall tiles and cladding materials offer superior moisture resistance and durability characteristics for specific applications including bathrooms and commercial kitchens where wallpaper performance limitations become apparent. Consumer familiarity with paint application processes reduces psychological barriers compared to wallpaper installation perceived as complex undertaking requiring pattern matching expertise and precise technique execution.

Environmental Regulations and VOC Compliance Requirements

Traditional vinyl wallpapers raise environmental concerns regarding volatile organic compound emissions and plasticizer content that affect indoor air quality and occupant health particularly in residential applications involving children or individuals with respiratory sensitivities. Regulatory standards governing VOC emissions require manufacturers to reformulate products using water-based inks and low-emission adhesives that increase production costs while potentially compromising performance characteristics valued by commercial applications. Disposal considerations for non-recyclable wallpaper materials generate sustainability concerns among environmentally conscious consumers despite durability advantages reducing replacement frequency compared to paint alternatives.

Competitive Landscape:

The Canada wallpaper market features established international manufacturers competing alongside specialized design-focused suppliers and regional distributors serving diverse market segments through differentiated product portfolios and channel strategies. Major players leverage extensive manufacturing capabilities and distribution networks that deliver economies of scale advantages while maintaining broad product assortment breadth spanning budget-oriented to premium positioning. Competitive dynamics emphasize product innovation particularly sustainable material development and digital printing capabilities that address evolving consumer preferences for customization and environmental responsibility. Distribution channel relationships significantly influence competitive positioning as manufacturers cultivate partnerships with specialty retailers and design professionals who influence specification decisions and recommend products addressing specific project requirements.

Canada Wallpaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Wallpaper Types Covered | Vinyl Wallpaper, Non-woven Wallpaper, Paper-based Wallpaper, Fabric Wallpaper, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial |

| Regions Covered | Ontario, Quebec, Alberta, British Columbia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Canada wallpaper market size was valued at USD 47.77 Million in 2025.

The Canada wallpaper market is expected to grow at a compound annual growth rate of 3.16% from 2026-2034 to reach USD 63.20 Million by 2034.

Vinyl Wallpaper dominated the market with 36.92% revenue share, driven by superior durability characteristics, moisture resistance properties, and design versatility across residential and commercial applications requiring balanced aesthetic appeal and practical performance attributes.

Key factors driving the Canada wallpaper market include sustained home renovation and remodeling activity, commercial sector interior investment expansion across hospitality and retail environments, and digital printing technology advancement enabling customization capabilities while addressing environmental sustainability requirements through eco-friendly material development.

Major challenges include premium material cost sensitivity with people opting for more affordable alternatives due to budget constraints, competition from alternative wall covering solutions including advanced paint technologies and decorative materials perceived as more accessible for DIY application, and environmental regulations governing VOC emissions requiring product reformulation investments while balancing performance characteristics valued by commercial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)