Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033

Carbon Black Market Size and Share:

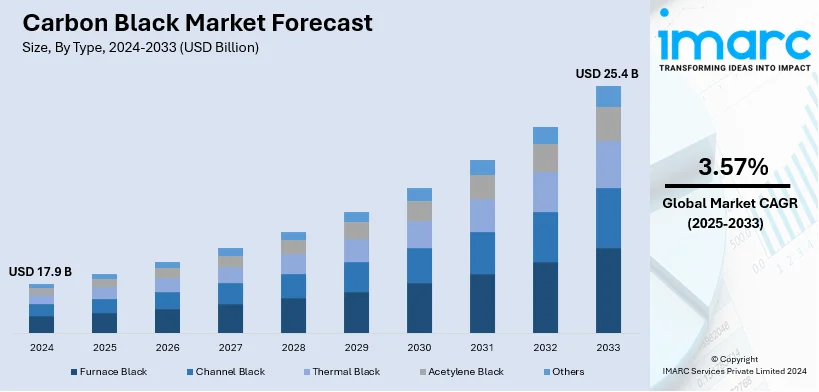

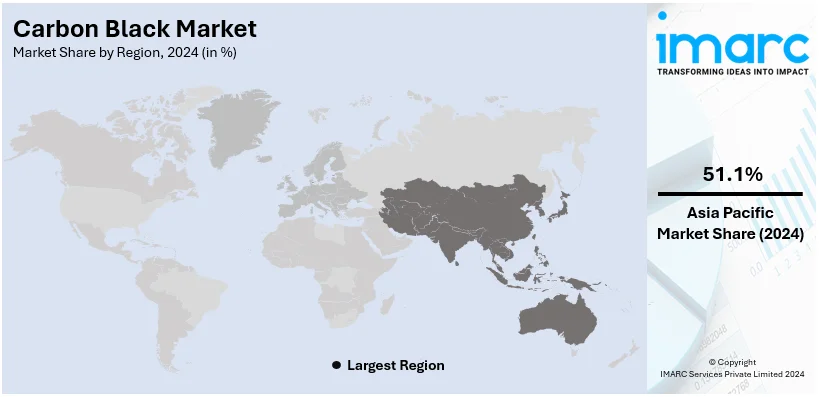

The global carbon black market size was valued at USD 17.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.4 Billion by 2033, exhibiting a CAGR of 3.57% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 51.1% in 2024. The increasing product usage in the tire and plastics industries, rising construction activities across the globe, the advent of smart manufacturing processes, and strict environmental regulations imposed by governments are acting as crucial growth-inducing factors for the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.9 Billion |

|

Market Forecast in 2033

|

USD 25.4 Billion |

| Market Growth Rate 2025-2033 | 3.57% |

The automotive industry is a major consumer of carbon black, as tires constitute a significant portion of this sector, resulting in the expansion of the global market. Its reinforcing properties enhance durability and performance, making it indispensable in rubber production. Additionally, the increasing adoption of carbon black in industrial applications, including plastics, coatings, and inks, supports market expansion. Increased infrastructure construction also increases the usage of carbon black in construction applications, such as adhesives and seals. Furthermore, changes in production technologies and gradually increasing demand for high-quality products, including recovered carbon black, also impact the carbon black market share.

To get more information on this market, Request Sample

The United States carbon black market is fueled by its extensive use in tire manufacturing, supported by the robust automotive industry. Its role in improving rubber durability and performance underpins demand in this sector. For instance, in June 2024, CSRC Group partnered with Eco Infinic, a SHEICO Group subsidiary, to develop a recovered carbon black (rCB) plant at the former CCC Phenix site in North America. Scheduled for production in 2026, the facility will produce 30,000 tons of rCB annually. This joint venture supports carbon neutrality goals, reduces emissions, and promotes the circular economy, aligning with sustainability efforts. Additionally, the increasing adoption of carbon black in plastics, coatings, and inks boosts its industrial applications. According to the carbon black market growth analysis, infrastructure development drives further demand for construction materials, including adhesives and sealants. Furthermore, advancements in sustainable production methods, such as recovered carbon black, align with the growing focus on environmental responsibility.

Carbon Black Market Trends:

The Rising Product Use in the Tire Industry

The carbon black market report shows that the rising product use in the tire industry is one of the major carbon black industry growth drivers. In the tire industry, carbon black is used for its strength and resilience. According to an industrial report, carbon black is an essential rubber, which forms approximately 30 percent of the total weight of tires. The sector growth has increased the demand for tires, consequently boosting carbon consumption and market expansion. The tire industry’s growth is further fueled by the growing demand for both personal and commercial vehicles due to urbanization and developments. Additionally, the increasing preference for high-performance tires that offer handling, fuel efficiency, and safety is driving the demand for carbon black. The carbon black market forecast shows immense growth due to this factor.

The Increasing Construction Activities

The rising construction activities play a role in driving the carbon black market demand. Carbon black finds use in construction applications such as coloring concrete and enhancing material strength. Industry reports predict that during the next 15 years, the amount of construction work done worldwide will increase by about USD 4.2 Trillion. The carbon black industry price trends are growing due to urbanization, industrialization, and infrastructure development that are driving the demand for construction materials, including those with carbon black. Additionally, governments worldwide investing in large-scale infrastructure projects that need construction materials are also contributing to this growth in the global carbon black industry report. The shifting trend towards aesthetically pleasing architecture, which has led to the increased use of colored concrete where carbon black is used as a pigment, is contributing to the carbon black market recent developments.

The Recent Advancements in the Manufacturing Process

The progress made in manufacturing techniques, which has enhanced the efficiency of producing carbon black while minimizing waste and achieving particle sizes, is driving the carbon black industry outlook. As per Balakrishna Industries, one of the leading manufacturers of off-highway tires (OHT) under the brand name Balkrishna Tires (BKT), claims carbon black contributes to about 7% of the overall company revenue, and it is predicted to grow to 8-9 % by the end of this financial year since the company has recently launched a new production line. Moreover, advancements in process control and automation have improved quality checks, enabling the creation of grades of carbon black, thus supporting carbon black industry research. Furthermore, ongoing research and development in carbon production have introduced methods to enhance performance characteristics, fueling carbon black industry analysis. Additionally, cost optimization in production and the flexibility to adjust manufacturing processes according to market needs are further boosting market growth. Furthermore, increased collaborations between research institutions and industry players are fostering innovation, and technological advancements in carbon production are contributing to the carbon black market share.

Carbon Black Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global carbon black market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, grade, and application.

Analysis by Type:

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

Furnace black leads the market with around 76.6% of market share in 2024. Furnace black remains a player in the market due to its use across various industries such as tire manufacturing, plastics, coatings, and rubber products. The production process of furnace black is known for its efficiency and scalability as it involves the combustion of petroleum products making it suitable, for large-scale production. Additionally, the technique employed in its creation provides management of particle size and composition resulting in grades and quality standards tailored to meet specific industry requirements. Furthermore, the integration of manufacturing methods that reduce impact and align, with the worldwide shift towards sustainability is driving market expansion in a positive direction.

Analysis by Grade:

- Standard Grade

- Specialty Grade

Standard grade leads the market with around 84.3% of market share in 2024. Standard grade carbon black is dominating the market as it is suitable for a wide array of applications, including the automotive, construction, plastics, and rubber industries. Furthermore, it is more cost-effective to produce, making it attractive to various industries looking to minimize expenses. Additionally, the standard grade carbon black is readily available across different markets, which ensures that it meets the demands of various industries without supply chain disruptions. Moreover, it exhibits compatibility with different polymers and materials, enhancing its appeal to manufacturers across diverse sectors. Apart from this, standard grade carbon black offers ease of integration into various products and processes.

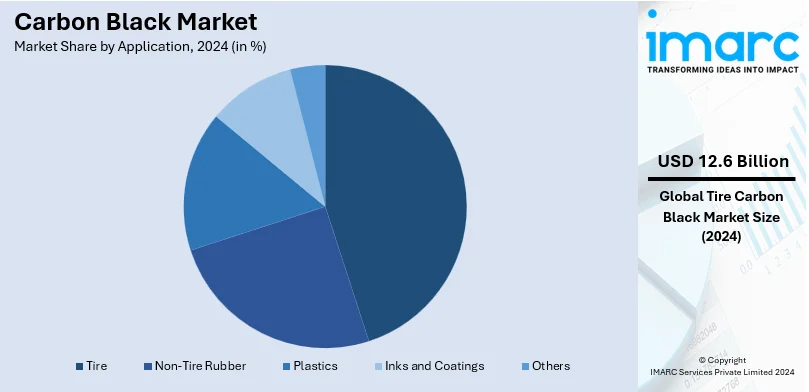

Analysis by Application:

- Tire

- Non-Tire Rubber

- Plastics

- Inks and Coatings

- Others

Tire lead the market with around 70.2% of market share in 2024. The tire industry is currently thriving due to the use of carbon black as a strengthening agent boosting the endurance and toughness of tires. This material also enhances wear resistance and tensile strength making it essential in tire manufacturing. Moreover, the increasing global expansion of the sector in emerging economies has resulted in a growing need for tires driving market growth. Additionally, there is a shift towards performance and eco tires that promise better fuel efficiency and safety leading to an increased demand for carbon black as it plays a key role in achieving these attributes. Furthermore, advancements in tire production technology are enabling use of carbon black, further fueling market expansion.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 51.1%. The Asia Pacific region is home to some of the world markets, which directly correlates with high tire demand and subsequently drives the need for carbon black. The region's rapid industrial development across sectors like construction, manufacturing, and electronics is also contributing to the demand for carbon black in applications such, as pigments and reinforcement materials. In addition, the growing income levels in developing countries have resulted in a rise in the consumption of products containing carbon black, such, as electronics, personal care items, and vehicles. For instance, the Asian Development Outlook (ADO) September 2024 raises developing Asia's growth forecast to 5.0% for 2024, up from 4.9%, driven by strong domestic demand and export recovery. Inflation is expected to decline to 2.8% in 2024. Furthermore, numerous prominent carbon black producers that cater to needs and engage in exporting are contributing to the market expansion.

Key Regional Takeaways:

United States Carbon Black Market Analysis

In 2024, United States accounted for 86.10% of the market shares in North America. The main factor driving the carbon black market in the US is its widespread application as a reinforcing agent in the tire and automobile industries. Carbon black plays a major role in the production of tires and automotive parts like hoses and seals in the United States, which produces more than 9 Million cars a year. The market is also expected to increase due to the growing demand for specialty carbon black in paints, coatings, and polymers, especially in the packaging and construction sectors.

The need for carbon black in wire and cable applications has increased due to the push for grid expansion and renewable energy infrastructure. Since carbon black is essential to battery components and EV tire compositions, the growing popularity of electric vehicles (EVs) is another factor propelling growth. The market is further enhanced by developments in low-PAH and bio-based carbon black that satisfy stringent environmental standards. Companies like Cabot Corporation and Orion Engineered Carbons make major contributions to the robust domestic production base that supports the U.S. market.

Europe Carbon Black Market Analysis

Strong environmental laws and the growing need for sustainable materials are the main drivers of the carbon black market in Europe. With over 13.1 million vehicles manufactured year, the European automotive sector uses a lot of carbon black and helps to meet the need for high-performance tires and automotive components, according to data from the European Automobile Manufacturer's Association.

Due to restoration initiatives throughout the EU, specialty carbon black is being used more often in the coatings and construction industries. Demand for advanced battery technology is bolstered by the region's emphasis on electric cars (EVs), which accounted for roughly 23% of new automobile registrations in 2023, as per the data by European Environmental Agency. To reduce carbon emissions and comply with the EU Green Deal, European carbon black producers are investing in eco-friendly production techniques, such as recovered carbon black (rCB). A significant portion of the demand in the region comes from important markets like Germany, Italy, and France. Furthermore, the expanding e-commerce industry is driving up demand for carbon black in packaging materials.

Asia Pacific Carbon Black Market Analysis

Asia-Pacific is determined to be the largest consumer, accounting for more than half of the global carbon black market. The rapid urban growth and industrial development in China, India, and Southeast Asia drive demand across multiple sectors. Over 5 million tons are produced annually in China, the greatest producer and consumer in the world, thanks to its thriving construction and tire manufacturing sectors.

India is expanding significantly because of government programs like "Make in India" and an increase in auto output. For instance, the automobile industry manufactured 28.43 Million vehicles between April 2023 and March 2024, including passenger cars, commercial cars, three-wheelers, two-wheelers, and quadricycles, as per the data by Invest India. Demand for specialty carbon black is rising in the electronics and plastics industries, especially in South Korea and Japan. Wire and cable applications are becoming more and more in demand as the region's renewable energy sector expands, particularly in China and India. Growing environmental concerns are driving an increase in investment in sustainable industrial technology.

Latin America Carbon Black Market Analysis

The growing tire and automobile manufacturing sectors, especially in Brazil and Mexico, are the main drivers of the carbon black market in Latin America. The Brazilian automakers' group, Anfavea, estimated that in 2023, the country's manufacturing park produced about 2.3 Million cars, meeting a sizable need for carbon black in the manufacture of tires and other automotive parts. The expansion of the building sector in the area is driving up demand for carbon black in coatings, paints, and plumbing systems. Specialty carbon black demand is being fueled by Mexico's expanding plastics sector, which is being pushed by an increase in e-commerce. The region is becoming more interested in recovered carbon black (rCB) production technologies because of a greater emphasis on economical and sustainable materials.

Middle East and Africa Carbon Black Market Analysis

The growing automobile industry and the construction of infrastructure are driving the Middle East and Africa carbon black market. The demand for carbon black in building materials like pipes and coatings is being driven by infrastructure investments made by nations like Saudi Arabia and the United Arab Emirates. The need for carbon black in tires and rubber parts is increased by the automotive assembly dominance of South Africa and Nigeria. Energy initiatives in the area are also contributing to the expansion of the wire and cable sector. The region's sustainability objectives are met via innovations in environmentally friendly carbon black production.

Competitive Landscape:

Major players are creating new grades of carbon black and enhancing existing products to meet specific industry needs and adhere to evolving regulations and standards. Furthermore, the leading companies are acquiring or merging with other companies to broaden their product portfolio, expand into new markets, and leverage synergies in technology and distribution. They are focusing on developing greener manufacturing processes and products that align with global sustainability goals. Additionally, several key players are ensuring consistent product availability, reducing costs, and improving efficiency to meet global demand and navigate complex international trade landscapes. For instance, in June 2024, Klean Industries Inc. signed a non-binding Letter of Intent (LOI) to provide its patented equipment for upgrading pyrolysis char from end-of-life tires into recovered carbon black (rCB). The project will establish four plants, two in India and two in Malaysia, with a combined capacity to process 50,000 metric tons of char annually, creating high value rCB. Moreover, companies are segmenting their offerings to cater to specific industries, provide more targeted solutions, and differentiate themselves from competitors.

The report provides a comprehensive analysis of the competitive landscape in the carbon black market with detailed profiles of all major companies, including:

- Cabot Corporation

- Birla Carbon

- Orion S.A.

- PCBL Chemical Limited

- Tokai Carbon Co., Ltd.

- Omsk Carbon Group

- Anhui Black Cat Material Science Co., Ltd.

- OCI Company Ltd.

- International CSRC Investment Holdings Co., Ltd.

Latest News and Developments:

- September 2025: Birla Carbon announced the launch of its new carbon black grade BC1060 at RubberTech 2025held from September 17–19 in Shanghai, China. Designed for rubber and tire applications, BC1060 offers low hysteresis and high durability, ideal for anti-vibration and sealing components.

- June 2025: Epsilon Carbon launched its high-quality N134 grade hard carbon black, addressing import dependency and supply issues in India’s tire industry. This product, made at their Vijayanagar facility, offers superior abrasion resistance and durability for premium tires.

- February 2025: Phillips Carbon Black Ltd. announced the development of its sixth carbon black plant in Naidupeta, Andhra Pradesh, with a planned capacity of up to 450,000 tons per year. The first phase will involve a 150,000 ton/year facility, aiming to meet growing demand and support sustainable production. The company is also expanding specialty and recycled product lines, including ECOZENT6000.

- January 2025: Epsilon Carbon launched Terrablack, a new line of sustainable recovered carbon black products at the India International Tire Exhibition in New Delhi. Designed for both tire and non-tire industries, Terrablack offers high performance with up to 50% lower Global Warming Potential. The company also announced plans for a tire recycling plant in Karnataka to support circular economy efforts.

- January 2025: Sumitomo Rubber Industries and Mitsubishi Chemical launched a joint project to recycle carbon black from tire manufacturing waste and end-of-life tires using chemical recycling in coke ovens. The recycled carbon black will be used in tires for race cars and passenger vehicles, promoting a circular economy. This marks the world’s first commercialization of carbon black made from recycled tires via this method.

Carbon Black Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others |

| Grades Covered | Standard Grade, Specialty Grade |

| Applications Covered | Tire, Non-Tire Rubber, Plastics, Inks and Coatings, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Cabot Corporation, Birla Carbon, Orion S.A., PCBL Chemical Limited, Tokai Carbon Co., Ltd., Omsk Carbon Group, Anhui Black Cat Material Science Co., Ltd., OCI Company Ltd., International CSRC Investment Holdings Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global carbon black market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the carbon black industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carbon black market was valued at USD 17.9 Billion in 2024.

The carbon black market is projected to exhibit a CAGR of 3.57% during 2025-2033, reaching a value of USD 25.4 Billion by 2033.

The market is primarily driven by the growing demand from the automotive and tire industries, increased use in electronics, expanding infrastructure development, rising industrialization in emerging economies, and the growing need for high-performance materials in manufacturing sectors.

Asia Pacific currently dominates the market, accounting for a share of over 51.1%, driven by rapid industrialization, increasing demand from automotive and manufacturing sectors, and a rising focus on infrastructure development.

Some of the major players in the carbon black market include Cabot Corporation, Birla Carbon, Orion S.A., PCBL Chemical Limited, Tokai Carbon Co., Ltd., Omsk Carbon Group, Anhui Black Cat Material Science Co., Ltd, OCI Company Ltd., and International CSRC Investment Holdings Co., Ltd, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)