Carbon Fiber Prepreg Market Size, Share, Trends and Forecast by Manufacturing Process, Resin Type, Resin, End Use Industry, and Region, 2025-2033

Carbon Fiber Prepreg Market 2024, Size And Forecast:

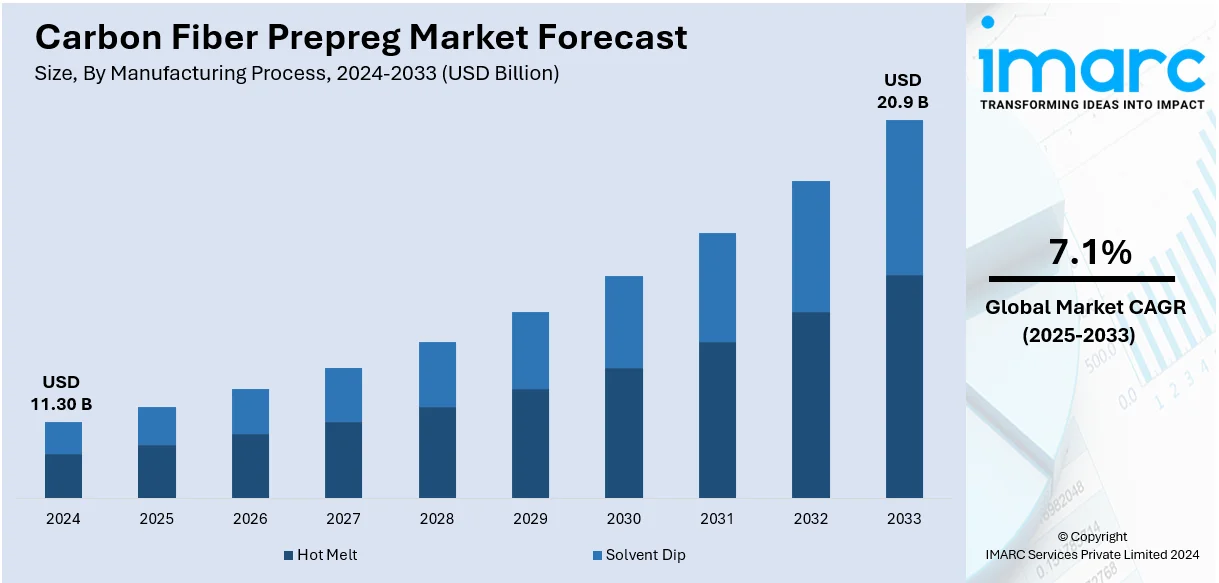

The global carbon fiber prepreg market size was valued at USD 11.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20.9 Billion by 2033, exhibiting a CAGR of 7.1% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.4% in 2024. The increasing demand for lightweight materials in the aerospace industry to improve fuel efficiency is boosting the carbon fiber prepreg market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.30 Billion |

|

Market Forecast in 2033

|

USD 20.9 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

The global carbon fiber prepreg market growth is primarily driven by its growing adoption in aerospace, automotive, and wind energy industries. This can be attributed to its superior strength-to-weight ratio, durability, and resistance to environmental factors. Along with this, the increasing demand for lightweight materials in aircraft and electric vehicles to enhance fuel efficiency and reduce emissions is further accelerating carbon fiber prepreg market demand. Additionally, advancements in manufacturing technologies and expanding applications in sports equipment and marine sectors are fueling demand. The rising emphasis on sustainability and the recyclability of prepreg materials also contribute to their widespread adoption. Furthermore, government incentives and investments in renewable energy projects, such as wind turbines, are propelling the use of carbon fiber prepregs in structural components, reinforcing the market’s expansion globally. On 30th September 2024, Tata Power signed an MoU with the Rajasthan government, committing an investment of ₹1.2 lakh crore over 10 years to make the state a clean energy hub. Key initiatives include developing 10,000 MW of renewable energy capacity (6,000 MW solar, 4,000 MW hybrid), ₹75,000 crore for renewables, a ₹2,000 crore solar module facility in Jodhpur, and ₹1,000 crore for 1 lakh EV charging points. Investments of ₹20,000 crore in distribution and ₹10,000 crore in transmission infrastructure aim to modernize the grid, alongside exploring nuclear energy and rooftop solar for 10 lakh homes. This supports India's 500 GW renewable target by 2030 and net zero by 2070.

The United States stands out as a key regional market, primarily driven by the increasing integration of advanced materials in next-generation industries. Growing investments in electric vehicle (EV) production are also positively influencing the market, as carbon fiber prepregs help achieve lightweight and energy-efficient designs. The expanding space exploration sector, with private and public collaborations, also drives demand for these high-performance materials in satellite and spacecraft manufacturing. Concurrently, the rising usage of carbon fiber prepregs in sports equipment and medical devices reflects their versatility and growing preference across sectors. Apart from this, favorable government policies supporting renewable energy and high-tech manufacturing further stimulate the market. Furthermore, the emphasis on technological innovation and the push for sustainability in manufacturing processes are essential factors contributing to the US carbon fiber prepreg market share.

Carbon Fiber Prepreg Market Trends:

Innovation in High-Strength Carbon Fibers

Advances in carbon fiber technology are improving the strength, flexibility, and overall performance of carbon fiber prepreg materials. In addition, this progress enables the production of more durable and lightweight components, which is driving adoption in industries such as aerospace, automotive, and energy, where high performance and efficiency are essential. For instance, in January 2024, Toray Industries launched TORAYCA M46X carbon fiber, which is 20% stronger than previous models, while maintaining a high tensile modulus. This launch enhances compressive strength, reduces weight, and broadens design flexibility for carbon fiber prepreg applications in various high-performance markets.

Rising Demand for Sustainable Materials

The carbon fiber prepreg sector is experiencing growth due to the increasing focus on sustainability. Moreover, manufacturers are developing eco-friendly alternatives, including bio-based resins and recycling initiatives to reduce environmental impact. In addition, this shift aligns with global sustainability goals, particularly in industries that prioritize greener and more responsible solutions. For instance, in March 2024, Mitsubishi Chemical Group introduced a series of carbon fiber prepreg, incorporating plant-derived resin with up to 25% biomass content. This new prepreg maintains conventional performance, targeting sports, mobility, and industrial applications while supporting environmental sustainability efforts.

Growing Investments in Carbon Fiber Production

According to the latest carbon fiber prepreg market outlook, significant investments in carbon fiber production facilities are expanding the availability and capacity of prepreg materials. Besides this, the expansion is crucial for meeting the growing demand across industries, such as wind energy, automotive, and defense, as it enables more efficient manufacturing processes and reduces supply chain constraints. For instance, in March 2024, Jindal Advanced Materials (JAM) partnered with Italy's MAE S.p.A. to invest USD 27 Billion in India's first carbon fiber plant, producing 3,500 metric tonnes annually. The facility offers fabrics and composites, thereby elevating the carbon fiber prepreg market's recent price.

Carbon Fiber Prepreg Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global carbon fiber prepreg market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on manufacturing process, resin type, resin, and end use industry.

Analysis by Manufacturing Process:

- Hot Melt

- Solvent Dip

As per the recent carbon fiber prepreg market forecast, hot melt leads the market with around 43.2% of market share in 2024 due to its efficient, solvent-free method, which reduces environmental impact and processing time. This process eliminates the need for solvents, reducing emissions and making it eco-friendly. Its ability to deliver consistent resin distribution ensures superior material performance, making it ideal for industries such as aerospace, automotive, and wind energy. For example, Solvay's MTM 23 series launched using the hot melt process, which highlights the method's efficiency and superior product quality in aerospace applications. Additionally, the cost-effectiveness and adaptability of hot melt processes further drive its widespread adoption.

Analysis by Resin Type:

- Thermoset

- Thermoplastic

Thermoset leads the market in 2024 due to their superior heat resistance and structural integrity after curing. On the contrary, these resins, such as epoxy, create strong, durable bonds, thereby making them ideal for aerospace and automotive applications. For instance, Hexcel recently launched HexPly M79, a thermoset prepreg designed for faster curing times in wind turbine blades. Additionally, its ability to withstand extreme conditions makes it ideal for applications in the aerospace, automotive, and wind energy sectors. Moreover, thermoset resins provide long-term durability and enhanced structural integrity, making them the preferred option for high-performance composite materials in demanding industrial and engineering applications.

Analysis by Resin:

- Phenolic

- Epoxy

- Bismaleimide

- Polyimide

- Cynate Ester

- PEEK

- Others

Epoxy leads the market with around 49.7% of market share in 2024 due to its excellent mechanical properties, high strength-to-weight ratio, and superior bonding with fibers. Additionally, it offers exceptional durability and resistance to environmental factors. For example, Solvay launched MTM 348FR, an epoxy prepreg designed for the aerospace industry, thereby offering improved fire resistance and performance. Besides this, it offers excellent adhesion, thermal stability, and resistance to moisture and chemicals, making it ideal for demanding industries such as aerospace, automotive, and wind energy. The lightweight and durable characteristics of epoxy resin enhance product performance, enabling its widespread use in manufacturing high-strength, lightweight components. Its adaptability and reliability continue to drive significant demand across multiple sectors.

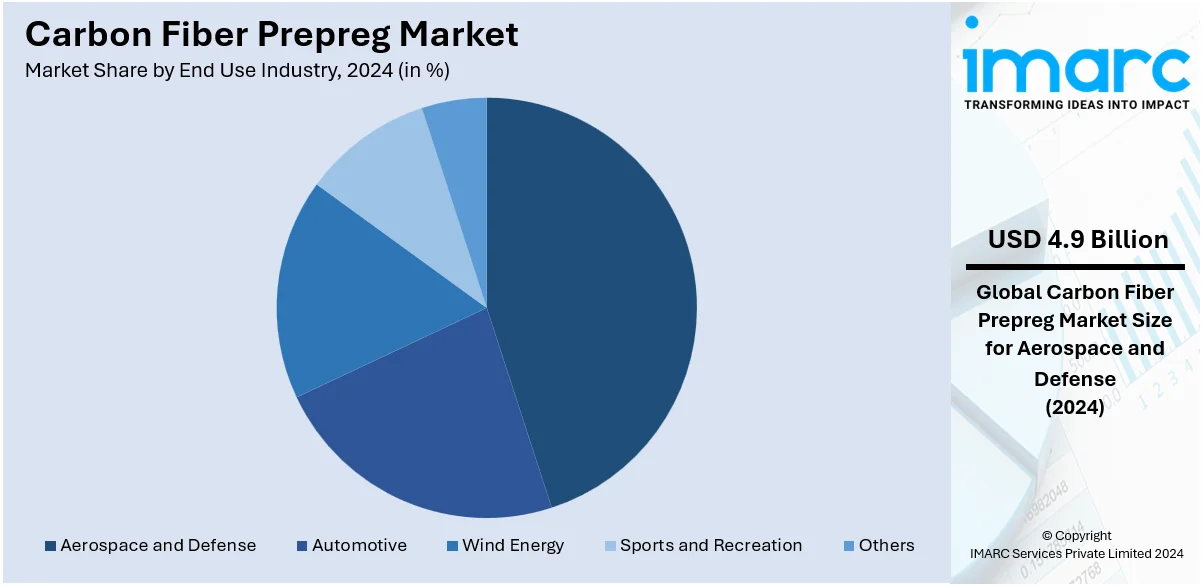

Analysis by End Use Industry:

- Aerospace and Defense

- Automotive

- Wind Energy

- Sports and Recreation

- Others

Aerospace and defense lead the market with around 43.2% of market share in 2024 due to the industry's demand for lightweight, high-strength materials. For instance, Boeing’s 787 Dreamliner uses carbon fiber prepregs to reduce weight and enhance fuel efficiency, improving its performance. Carbon fiber prepregs are essential for reducing aircraft weight, improving fuel efficiency, and enhancing performance. In defense applications, they provide superior strength and durability for advanced weaponry, unmanned vehicles, and protective equipment. The growing focus on next-generation aircraft and increasing defense budgets globally further enhance the adoption of carbon fiber prepregs in this industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

As per the emerging carbon fiber prepreg market trends, the competitive landscape is shaped by leading companies prioritizing innovation, forming strategic partnerships, and expanding capacities to bolster their market position. They are also investing in advanced manufacturing technologies to improve product quality and streamline production costs. Efforts to develop sustainable and recyclable prepregs are gaining momentum, aligning with global environmental goals. Many players are also entering collaborations with aerospace, automotive, and renewable energy sectors to drive innovation in lightweight and high-performance materials. Additionally, expanding production facilities and targeting emerging markets are key strategies to meet rising global demand. Continuous research and development efforts to create customized solutions for specific industry needs are further intensifying competition in the market.

Key Regional Takeaways:

United States Carbon Fiber Prepreg Market Analysis

In 2024, the US accounted for around 87.50% of the total North America carbon fiber prepreg market. The U.S. market is growing due to increasing demand from the aerospace, automotive, and wind energy sectors. According to the U.S. Department of Energy, wind energy capacity stood at 150 GW in 2023, thus fueling demand for carbon fiber prepreg in turbine blades. Aerospace is also one of the key sectors that drive demand for lightweight materials. Boeing and Airbus are driving the need for lightweight materials. Automotive companies increasingly use carbon fiber prepreg to enhance the fuel efficiency of their vehicles. Renewable energy initiatives and the use of lightweight materials in transportation encourage governments to implement policies supporting this development. Companies such as Hexcel and Toray are pioneering improvements in efficiency and sustainability of production. Production at home eliminates reliance on imports and supports consistent supply chains. The U.S. is also exploring export opportunities for advanced material technology positioning strengthening with increasing interest in bio-based prepregs in line with the federal sustainability goals.

Europe Carbon Fiber Prepreg Market Analysis

The European carbon fiber prepreg market is growing as emissions regulations and renewable energy targets continue to tighten while advancements in automotive and aerospace industries gain pace. As per industrial reports, wind energy was 18% of the electricity produced in the EU in 2023, thus establishing the position of lightweight prepregs in turbine manufacturing. Carbon fiber prepregs are widely adopted by Germany's auto sector with a Euro 8 Billion (USD 8.39 Billion) funding initiative into the R&D of lightweight material. With Airbus driving growth for next-generation aircraft and making sustainability a major thrust, companies including SGL Carbon and Solvay come up with their prepregs that are now going green to achieve a circular economy. The manufacturer-academia nexus in Europe has the highest driving force of innovative technologies through research, wherein EU's programs such as Horizon Europe give a further enhance to sustainability materials. Europe leads the global carbon fiber prepreg market since its focus remains on green solutions.

Asia Pacific Carbon Fiber Prepreg Market Analysis

The Asia Pacific carbon fiber prepreg market is growing at a tremendous rate due to the significant investment in renewable energy and the light materials that are being developed. According to China Briefing, China's 14th Five-Year Plan resulted in an investment amounting to around RMB 6.3 Trillion (USD 890 Billion) for clean energy in 2023, which has increased by 40% annually. This massive investment increases the demand for carbon fiber prepregs in wind turbine manufacturing and solar applications. FAME II initiatives by India further add to the adoption of electric vehicles, while Japan and South Korea push innovation in the aerospace segment. Local partnerships, such as Mitsubishi Chemical's collaborations, strengthen regional supply chains. The leadership in renewable energy and advanced materials positions Asia Pacific as an important hub for carbon fiber prepregs, backed by government-sponsored R&D and increasing applications across wind energy, transportation, and aerospace sectors.

Latin America Carbon Fiber Prepreg Market Analysis

Latin America carbon fiber prepreg market is growing owing to renewable energy projects, along with the increasing automotive industry. As per IRENA, wind energy capacity in Brazil was up to 11.9 GW in 2023, and due to this, carbon fiber prepregs demand is seen in the market. In Mexico, the adoption of lightweight materials is seen in the automotive sector as well, as a result of growth in its electric vehicle market, assisted by USMCA trade agreements. Aerospace demand is also rising, driven by Embraer innovation in lightweight aircraft structures. Local companies join forces with international firms to increase capabilities in manufacturing. The government, through its policies, is keen on renewable energy and new material technology. Carbon fiber prepregs in construction and energy applications are being spurred by increased disposable incomes and infrastructure investment. The opportunities to export to North America continue to strengthen Latin America's role in the global supply chain for advanced materials.

Middle East and Africa Carbon Fiber Prepreg Market Analysis

The rapid adoption of renewable energy and the advances being brought about in sustainability have contributed much to the Middle East and Africa carbon fiber prepreg market. In its capacity statistics for 2023, IRENA disclosed that the Middle East saw its highest growth in renewable capacity this year, with 12.8% coming through the addition of a record 3.2 GW in new renewables in 2022. This growth supports increased demand for carbon fiber prepregs in wind energy applications, such as turbine blades. Africa has also shown growth, adding 2.7 GW of renewable capacity in 2022. In this way, Africa reflects the world's rising ambition for sustainability. It has been dominated by solar and wind technologies, which constitute 90% of new capacity in 2022, directly reflecting the increased use of lightweight and durable materials such as carbon fiber prepregs in these industries. Local production facilities and R&D in countries such as South Africa ensure competitive advantages in the prepreg market.

Competitive Landscape:

The competitive landscape of the global carbon fiber prepreg market is shaped by leading companies prioritizing innovation, forming strategic partnerships, and expanding capacities to bolster their market position. They are also investing in advanced manufacturing technologies to improve product quality and streamline production costs. Efforts to develop sustainable and recyclable prepregs are gaining momentum, aligning with global environmental goals. Many players are also entering collaborations with aerospace, automotive, and renewable energy sectors to drive innovation in lightweight and high-performance materials. Additionally, expanding production facilities and targeting emerging markets are key strategies to meet rising global demand. Continuous research and development efforts to create customized solutions for specific industry needs are further intensifying competition in the market.

The report provides a comprehensive analysis of the competitive landscape in the carbon fiber prepreg market with detailed profiles of all major companies, including:

- Axiom Materials Inc. (Kordsa Incorporated)

- Gurit

- Hexcel Corporation

- Mitsubishi Chemical Corporation

- SGL Carbon SE

- Teijin Limited

- Toray Industries Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- March 2024: TCR Composites Inc. has released TR1116, an epoxy prepreg resin system optimized for press-cure applications, now with improved room-temperature stability. It can cure within 2 minutes at 177°C, improving throughputs in automotive and sporting goods industries while offering options for carbon and glass fiber prepreg formats.

- March 2024: Hexcel Corporation debuted the HexTow IM9 24K carbon fibre at JEC World, which has 12 percent of tensile strength above an IM7 fibre and enables aerospace applications to enjoy more attractive affordability, strength, and productivity. High-rate manufacturing in addition to compatibility with advanced resin systems including epoxies and BMI are enabled.

- March 2024: Mitsubishi Chemical Group introduced the series of carbon fiber prepreg, incorporating plant-derived resin with up to 25% biomass content. This new prepreg maintains conventional performance, targeting sports, mobility, and industrial applications while supporting environmental sustainability efforts.

- March 2024: Jindal Advanced Materials (JAM) partnered with Italy's MAE S.p.A. to invest USD 27 Billion in India's first carbon fiber plant, producing 3,500 metric tons annually.

- January 2024: Toray Industries launched TORAYCA M46X carbon fiber, which is 20% stronger than previous models while maintaining a high tensile modulus. This launch enhances compressive strength, reduces weight, and broadens design flexibility for carbon fiber prepreg applications in various high-performance markets.

Carbon Fiber Prepreg Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Manufacturing Processes Covered | Hot Melt, Solvent Dip |

| Resin Types Covered | Thermoset, Thermoplastic |

| Resins Covered | Phenolic, Epoxy, Bismaleimide, Polyimide, Cynate Ester, PEEK, Others |

| End Use Industries Covered | Aerospace and Defense, Automotive, Wind Energy, Sports and Recreation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Axiom Materials Inc. (Kordsa Incorporated), Gurit, Hexcel Corporation, Mitsubishi Chemical Corporation, SGL Carbon SE, Teijin Limited, Toray Industries Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the carbon fiber prepreg market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global carbon fiber prepreg market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the carbon fiber prepreg industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Carbon Fiber Prepreg market was valued at USD 11.30 Billion in 2024.

IMARC estimates the Carbon Fiber Prepreg market to exhibit a CAGR of 7.1% during 2025-2033.

The key drivers include increasing demand for lightweight materials in aerospace and automotive industries to improve fuel efficiency, advancements in manufacturing technologies, and the rising emphasis on sustainability and recyclable materials.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the Carbon Fiber Prepreg market include Axiom Materials Inc. (Kordsa Incorporated), Gurit, Hexcel Corporation, Mitsubishi Chemical Corporation, SGL Carbon SE, Teijin Limited and Toray Industries Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)