Cardiac Arrhythmias Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

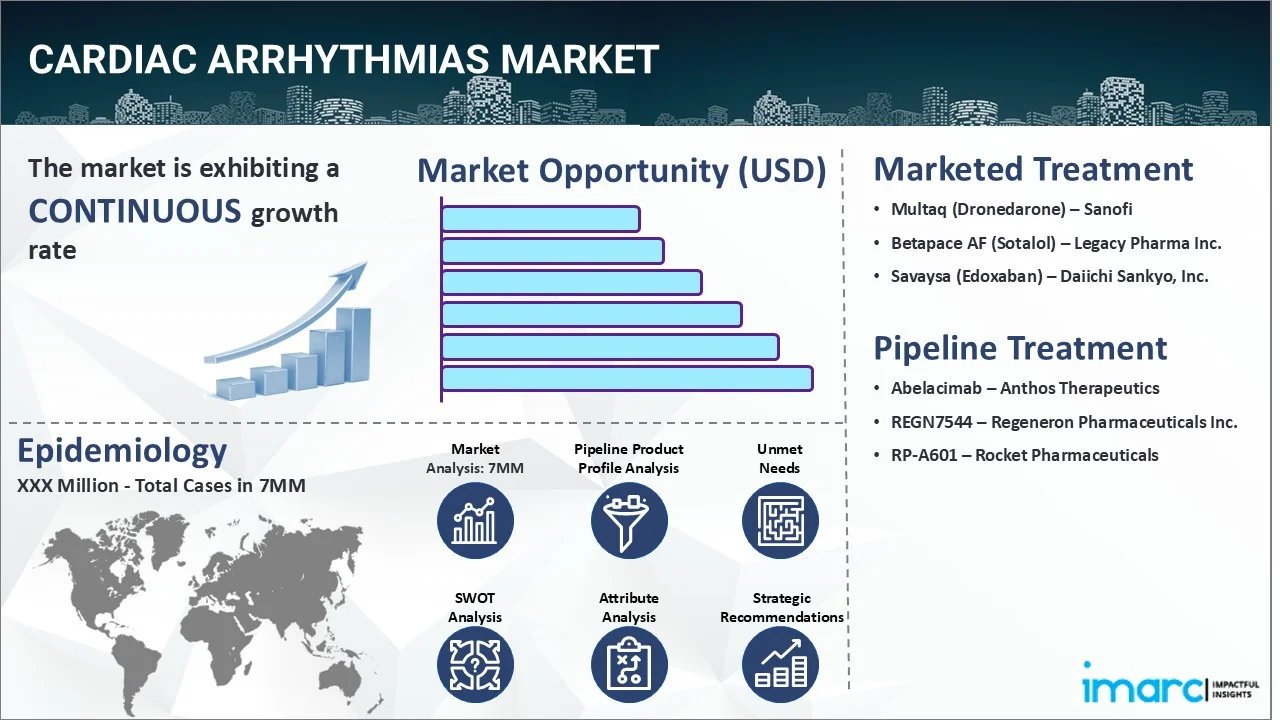

The cardiac arrhythmias market reached a value of USD 5.1 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 8.7 Billion by 2035, exhibiting a growth rate (CAGR) of 4.94% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 5.1 Billion |

|

Market Forecast in 2035

|

USD 8.7 Billion |

| Market Growth Rate 2025-2035 | 4.94% |

The Cardiac arrhythmias market has been comprehensively analyzed in IMARC's new report titled "Cardiac Arrhythmias Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Cardiac arrhythmias refer to a medical disorder in which there are abnormal electrical impulses in the heart that disrupt its normal rhythm. In this condition, the heart may beat too fast (tachycardia), too slow (bradycardia), or irregularly. These abnormal rhythms can occur in different areas of the heart, affecting the atria (upper chambers) or ventricles (lower chambers). Individuals suffering from the ailment may experience a fluttering in the chest, shortness of breath, anxiety, fatigue, lightheadedness, dizziness, excessive sweating, fainting episodes, chest pain, palpitations, etc. The diagnosis of cardiac arrhythmias typically involves a thorough medical history review, clinical assessment, and physical examination. A blood workup to evaluate the electrolyte levels or genetic mutations associated with the disease is also recommended for patients. The healthcare provider may perform several diagnostic procedures, such as an electrocardiogram, Holter monitoring, stress tests, an echocardiogram, electrophysiological studies, etc., to determine an irregular heart rhythm. Furthermore, a computed tomography scan and cardiac magnetic resonance imaging are utilized to provide detailed pictures of the heart and identify the exact cause of underlying symptoms.

To get more information on this market, Request Sample

The rising prevalence of abnormalities in the heart's structure, such as heart valve problems or scar tissue, which can disrupt the normal electrical pathways, is primarily driving the cardiac arrhythmias market. In addition to this, the increasing incidences of various associated risk factors, including high blood pressure, electrolyte imbalance, sleep apnea, excessive consumption of alcohol, obesity, etc., are also bolstering the market growth. Moreover, the widespread adoption of beta-blockers, such as atenolol, bisoprolol, metoprolol, etc., to reduce cardiac contractility and manage disease symptoms is acting as another significant growth-inducing factor. Apart from this, the inflating application of subcutaneous implantable cardioverter-defibrillators, which are implanted beneath the skin to monitor and deliver electrical therapy to patients, is further propelling the market growth. Additionally, the escalating demand for vagal nerve stimulation techniques, since they can decrease the duration and inducibility of arrhythmias by enhancing parasympathetic activity, is creating a positive outlook for the market. Besides this, the emerging popularity of cardiac resynchronization therapy that helps to optimize the pumping action of the heart, thereby leading to improved blood flow and increased cardiac output, is expected to drive the cardiac arrhythmias market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the Cardiac Arrhythmias market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for Cardiac Arrhythmias and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the Cardiac Arrhythmias market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the Cardiac Arrhythmias market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the Cardiac Arrhythmias market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current cardiac arrhythmias marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Multaq (Dronedarone) | Sanofi |

| Betapace AF (Sotalol) | Legacy Pharma Inc. |

| Savaysa (Edoxaban) | Daiichi Sankyo, Inc. |

| Abelacimab | Anthos Therapeutics |

| REGN7544 | Regeneron Pharmaceuticals Inc. |

| RP-A601 | Rocket Pharmaceuticals |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the Cardiac Arrhythmias market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the Cardiac Arrhythmias across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the Cardiac Arrhythmias across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of Cardiac Arrhythmias across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Cardiac Arrhythmias by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Cardiac Arrhythmias by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of Cardiac Arrhythmias by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with Cardiac Arrhythmias across the seven major markets?

- What is the size of the Cardiac Arrhythmias’ patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend of Cardiac Arrhythmias?

- What will be the growth rate of patients across the seven major markets?

Cardiac Arrhythmias: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for Cardiac Arrhythmias drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the Cardiac Arrhythmias market?

- What are the key regulatory events related to the Cardiac Arrhythmias market?

- What is the structure of clinical trial landscape by status related to the Cardiac Arrhythmias market?

- What is the structure of clinical trial landscape by phase related to the Cardiac Arrhythmias market?

- What is the structure of clinical trial landscape by route of administration related to the Cardiac Arrhythmias market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)