Cassava Starch Market Report by End Use (Sweeteners, MSG/Lysine, Food Industries, Paper Industries, Modified Starch, Sago Pearl, Textile, and Others), and Region 2026-2034

Cassava Starch Market Size & Share:

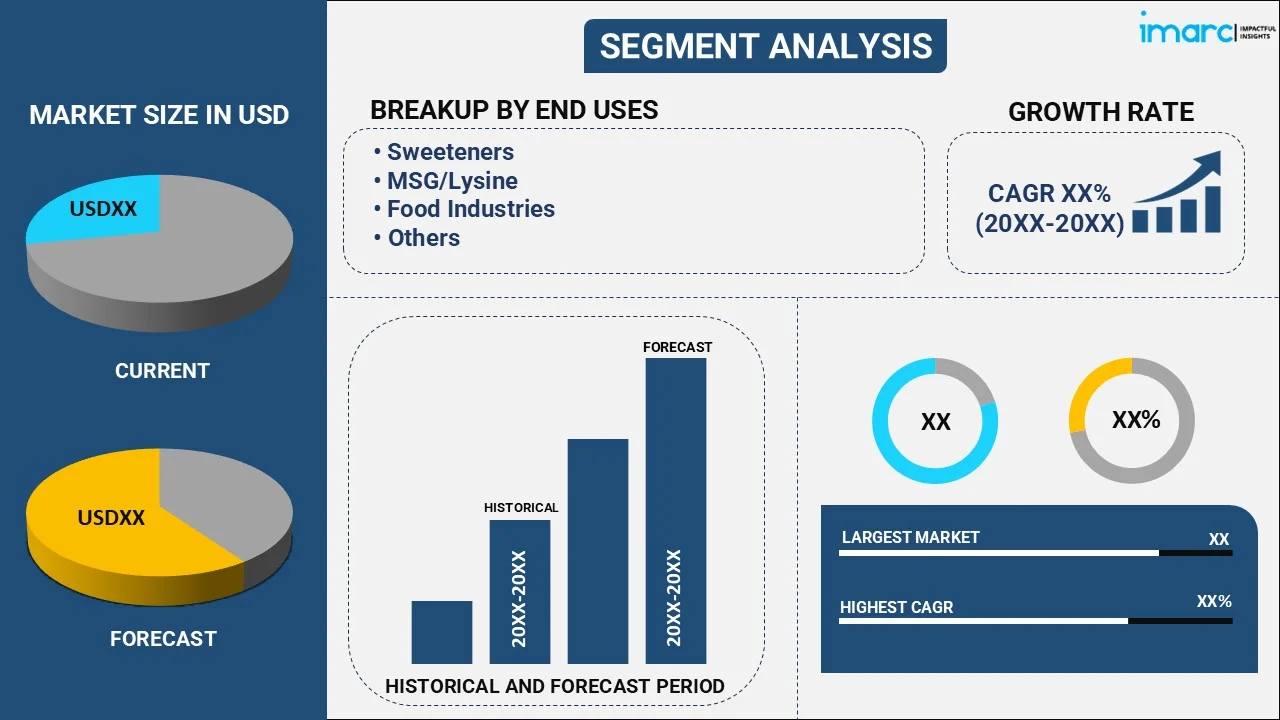

The global cassava starch market size reached USD 5.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 8.4 Billion by 2034, exhibiting a growth rate (CAGR) of 4.40% during 2026-2034. The rapid utilization of cassava starch as an essential ingredient for celiac disease and diabetic diet, increasing demand for natural food additives from the food and beverage industry, and the growing popularity of veganism and vegetarianism among the masses represent some of the key factors driving the cassava starch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.7 Billion |

|

Market Forecast in 2034

|

USD 8.4 Billion |

| Market Growth Rate 2026-2034 | 4.40% |

The Rapid Utilization of Cassava Starch as An Essential Ingredient for Celiac Disease and Diabetic Diet Is Augmenting the Market Growth

The cassava starch market outlook is experiencing significant growth due to the increasing product usage as an alternative sweetener for consumers with diabetes. Cassava starch has a low glycemic index, thereby preventing a sudden spike in blood sugar levels and is a preferred ingredient for people with diabetes, who need to monitor their blood sugar levels carefully. In addition to this, cassava starch is an effective gluten-free substitute to traditional wheat-based flours, which makes it an ideal ingredient for people who suffer from celiac disease, a digestive disorder caused by heightened gluten sensitivity. With more consumers growing aware of the health benefits of cassava starch, the demand for it as an essential ingredient for celiac disease and diabetic-friendly diet, thereby driving the market. Additionally, the rise in gluten-free and health-conscious food trends has further accelerated the cassava starch market growth. This trend is resulting in a higher product uptake for preparing a wide range of food products, including baked goods, sauces, soups, and noodles.

To get more information on this market Request Sample

The Increasing Demand for Natural Food Additives From The Food and Beverage Industry Is Stimulating Market Growth

The global cassava market is driven by the increasing demand for cassava starch as a versatile food additive ingredient in food and beverage applications. This can be attributed to the rising demand for processed and convenience foods, coupled with the growing consumer preference for natural and clean label ingredients. Cassava starch, being a natural and minimally processed ingredient, is perceived as a clean label option and is increasingly being used as a substitute for synthetic thickeners and stabilizers in various food and beverage applications. Cassava starch serves as a functional ingredient, providing thickening, stabilizing, and texturizing properties in various food and beverage products, including bakery, confectionery, sauces, soups, and dairy products. This trend is particularly evident in the processed and convenience food segment, where cassava starch is being used as a sustainable alternative for synthetic thickeners and stabilizers.

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is fragmented in nature due to the presence of large number of manufacturers. The volume of new entrants is low in the cassava starch industry due to its high capital costs and economies of scale.

What is Cassava Starch?

Cassava starch is a starch derived from the cassava root, an edible tuber crop native to South America that is widely cultivated around the world in tropical and subtropical regions. Starch content in cassava starch is typically more than 80%, which makes it a highly concentrated source of starch and it is generally used as a food ingredient or additive. Cassava starch is characterized by a fine texture, neutral flavor and odor, excellent thickening and gelling properties, high viscosity, and gluten-free properties. The thickening properties of cassava starch are retained even at high temperatures and under acidic conditions, making it ideal for use in a variety of food processing applications. Cassava starch stabilizes food products, which helps prevent phase separation, syneresis, and other undesirable changes to texture and consistency. In addition to providing barrier properties, cassava starch can improve the shelf life of food products by forming edible coatings and films.

Cassava Starch Market Trends:

Increased Demand from Ethnic Cuisines and Changing Food Habits

Heightened demand for ethnic cuisines that naturally have cassava as a staple is largely driving the demand for cassava starch as an accommodating ingredient. With globalization promoting culinary interactions, dishes based on cassava are gaining popularity across a broader spectrum, and hence more incorporation of cassava starch is being seen in traditional as well as modern-day recipes. At the same time, changing food consumption patterns towards gluten-free, vegan, and plant-based foods are further increasing the popularity of cassava starch. As per the sources, in May 2024, UBS introduced its "Tasuko" organic cassava starch during THAIFEX, marketing 100% locally sourced, chemical-free manufacture to address increasing global demand for health-oriented and sustainable food options. Moreover, being naturally gluten-free and plant-derived, it is well-suited to support consumer health trends and dietary needs. Its functional properties—thickening, binding, and stabilizing—position it for various food applications such as baked foods, snacks, ready meals, and drinks. Food companies are highly using cassava starch to redefine products in response to emerging nutritional requirements. Its expanding applicability across health-focused and multiculturally diverse food industries is making cassava starch a go-to input in both established and upstart food economies.

Technology Innovation and Industrial Uses

Constant technological innovation in cassava starch extraction, purification, and modification is playing a central role in improving the quality, consistency, and efficiency of products. New processing technology allows for increased yields, better purity levels, and the creation of functional starches specific to particular industrial uses. Altered cassava starches are commonly employed in the textile industry as sizing agents, which improve yarn strength and weaving efficiency. The paper and pulp industry also finds usefulness in its film-forming and binding characteristics, used to treat surfaces and finish paper. In the pharmaceutical industry, cassava starch is a consistent excipient, aiding in tablet disintegration and capsule preparation. A boost in certifications like SO, FSSC, and GMP adopted by manufacturers also increases buyers' confidence within international markets. These certifications also help increase export opportunities. In total, the combination of technology advancements with variable industrial applications is accelerating the cassava starch market's value within the global value chain.

Government Support, Global Trade, and Market Accessibility

Both trade facilitation and supportive government policies are key drivers of cassava starch market growth. As global integration of cassava production mounts, many nations are taking strategic steps to increase production, improve supply chains, and enhance export competitiveness. These involve subsidies for agriculture, capacity-building initiatives for farmers, and investments in processing facilities. Government-sponsored programs intended to commercialize cassava have also led to employment and rural growth. Concurrently, heightened international trade in cassava products is linking markets in a manner that allows producers access to new consumer bases. Expanding organized retail, including physical outlets and online channels, has further enhanced access to cassava starch and awareness. These cassava starch market trends find their biggest impact in metropolitan areas, where increasing incomes and knowledge of healthier food options are boosting consumption. Further, growing research and development activities by the private sector are developing innovation, guaranteeing product diversification, and backing the long-term growth of cassava starch market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global cassava starch market report, along with forecasts at the global and regional level from 2026-2034. Our report has categorized the market based on end-use.

End Use Insights:

To get detailed segment analysis of this market Request Sample

- Sweeteners

- MSG/Lysine

- Food Industries

- Paper Industries

- Modified Starch

- Sago Pearl

- Textile

- Others

The report has provided a detailed breakup and analysis of the cassava starch market based on the end use. This includes sweeteners, MSG/lysine, food industries, paper industries, modified starch, sago pearl, textile, and others. According to the report, sweeteners represented the largest segment due to the excellent texture and attributes, such as smoothness, creaminess, and viscosity, offered by cassava starch-based sweeteners to numerous dishes. In addition to this, the increasing number of health-conscious consumers adopting natural alternatives to artificial sweeteners is resulting in a higher uptake of natural and minimally processed cassava starch-based sweeteners.

Regional Insights:

To get more information on the regional analysis of this market Request Sample

- Production

- Asia

- Africa

- Latin America

- Others

- Consumption

- China

- Indonesia

- Malaysia

- Japan

- Philippines

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include production (Asia, Africa, Latin America, and others) and consumption (China, Indonesia, Malaysia, Japan, Philippines, and others). According to the report, Asia was the largest market for cassava starch. Some of the factors driving the Asia cassava starch market included the rising health consciousness among the masses, continual technological advancements in cassava starch processing, increasing demand for natural food additives from the food and beverage industry, rising international trade and globalization of cassava cultivation, etc.

Key Regional Takeaways:

Asia Cassava Starch Market Analysis

The market for Asia cassava starch is witnessing strong growth, led by the increasing demand in various industries like food and beverage, paper, textiles, and pharmaceuticals. The region enjoys good climatic conditions and high cassava cultivation, especially in regions such as Thailand, Vietnam, and Indonesia, which are the leading producers and exporters. Increasing consumer demand for clean-label and gluten-free ingredients further boosted the popularity of cassava starch in food processing and baked products. Improvements in starch extraction and processing technologies are enhancing production efficiency and quality, facilitating growth in the market. In industry, cassava starch is being increasingly employed as a biodegradable substitute for synthetic products, fitting into sustainability objectives. In addition, enlarging trade networks and favorable government policies for agricultural development and export promotion drive the market's positive momentum. Overall, the Asia cassava starch market is transforming as a dynamic sector with high potential for sustained growth in various end-use applications.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global cassava starch market. Some of the companies covered in the report include:

- TCS Tapioca

- Eiamheng Tapioca

- Sunrise International

- PT Buda Starch & Sweetener

- Sharp SPAC Tapioca

Please note that this only represents a partial list of companies, and the complete list has been provided in the report.

Latest News and Developments:

- In August 2024, Roquette extended its texturizing solutions with the introduction of four tapioca-based cook-up starches—Clearam TR 2010, TR 2510, TR 3010, and TR 4010. These clean-tasting starches provide a boost in viscosity, stability, and appearance in sauces, desserts, and bakery applications, providing enhanced mouthfeel, clarity, and technical performance for food manufacturers.

- In December 2024, Uganda Development Corporation revealed intentions to construct a cassava starch plant in Gulu under the Acholibur Parish Project, in collaboration with the Archdiocese of Gulu. The plant will feature two production lines for starch and ethanol, enabling Uganda's industrial development and minimizing reliance on imported pharmaceutical-grade starch.

- In February 2024, the Niger Delta Development Commission disclosed a tie-up with Bayelsa's Ebedebiri Starch Company to produce over 250,000 metric tonnes per day cassava starch. The joint effort will enhance domestic production, mitigate importation reliance, and enhance Nigeria's agro-industrial strength, as part of national agendas towards food security and industrial autonomy.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons, Billion USD |

| Segment Coverage | End-Use, Region |

| Region Covered | Production (Asia, Africa, Latin America, Others), Consumption (China, Indonesia, Malaysia, Japan, Philippines, Others) |

| Companies Covered | TCS Tapioca, Eiamheng Tapioca, Sunrise International, PT Buda Starch & Sweetener and Sharp SPAC Tapioca |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cassava starch market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cassava starch market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cassava starch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cassava starch market was valued at USD 5.7 Billion in 2025.

We expect the global cassava starch market to exhibit a CAGR of 4.40% during 2026-2034.

The extensive application of cassava starch as a thickening agent in bakery products, yogurt, soups, noodles, ice creams, etc., is primarily driving the global cassava starch market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of cassava starch.

Based on the end-use, the global cassava starch market can be segmented into sweeteners, MSG/lysine, food industries, paper industries, modified starch, sago pearl, textile, and others. Currently, sweeteners exhibit a clear dominance in the market.

On a regional level, the market has been classified into Asia, Africa, Latin America, and others, where Asia currently dominates the global market.

Some of the major players in the global cassava starch market include TCS Tapioca, Eiamheng Tapioca, Sunrise International, PT Buda Starch & Sweetener, Sharp SPAC Tapioca, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)