Cell Analysis Market Report by Product (Flow Cytometry Products, qPCR Products, Cell Microarrays, Microscopes, Spectrophotometers, Cell Counters, HCS Systems, and Others), Analysis Type (Cell Identification, Cell Viability, Cell Signaling Pathways/Signal Transduction, Cell Proliferation, Cell Counting and Quality Control, Cell Interaction, Target Identification and Validation, Single-Cell Analysis, and Others), Techniques (Molecular Approaches, Image-Based Approaches), End-User (Pharmaceutical and Biotechnology Companies and CROs, Hospitals and Diagnostic Laboratories, Research Institutes, Cell Culture Collection Repositories, and Others), and Region 2025-2033

Global Cell Analysis Market:

The global cell analysis market size reached USD 22.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 41.2 Billion by 2033, exhibiting a growth rate (CAGR) of 7.1% during 2025-2033. The shift towards personalized medicine, increasing cases of cancer across the globe, and growing integration of artificial intelligence and machine learning in cell analysis are some of the key factors, catalyzing the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.2 Billion |

| Market Forecast in 2033 | USD 41.2 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

Cell Analysis Market Analysis:

- Major Market Drivers: Increasing demand for cell analysis tools in drug discovery and development, particularly in fields like oncology and immunology, is primarily boosting the cell analysis market size. The rising prevalence of chronic diseases like cancer and autoimmune disorders is augmenting the need for advanced cell analysis techniques for disease diagnosis and treatment, which is also contributing to the market growth.

- Key Market Trends: The expansion of regenerative medicine and stem cell research is augmenting the need for cell analysis tools to study cell behavior, differentiation, and therapeutic applications, which is creating a positive outlook for the overall market.

- Competitive Landscape: Some of the leading cell analysis companies operating in the global market include Agilent Technologies Inc., BD Biosciences, Bio-RAD Laboratories Inc., Danaher Corporation, Illumina Inc., Merck KGaA, Miltenyi Biotec, Olympus Corporation, PerkinElmer Inc., Promega Corporation, Sysmex Corporation, and Thermo Fisher Scientific, among others.

- Geographical Trends: According to the report, North America currently dominates the global market. The growth of the region can be attributed to the increase in incidences of cancer and rising corporate and government funding in cell-based research activities.

- Challenges and Opportunities: Challenges include the complexity of interpreting large-scale data, maintaining cell viability during analysis, and the high cost of advanced technologies. Opportunities lie in expanding applications in personalized medicines, regenerative therapies, and the integration of artificial intelligence to enhance analytical capabilities and streamline processes.

Global Cell Analysis Market Trends:

Growing Burden of Cancer

The rising number of cancer cases across the world is primarily driving the market growth. Cell analysis tools and techniques in cancer research enable precise characterization of tumor cells, including their genetic mutations, protein expression profiles, and cellular interactions within the tumor microenvironment. The growing number of cancer patients is catalyzing the cell analysis market share. For instance, as per an American Cancer Society 2022 update, around 1,918,030 new cancer cases were estimated in the U.S. in 2022. Furthermore, lung cancer and breast cancer are two of the most common cancers found among individuals. The Canadian Cancer Society (CCS) stated that in 2020, nearly 29,800 Canadians were diagnosed with lung cancer, which accounted for 13% of all new cancer cases. About 21,200 Canadians were expected to die from lung cancer, which represented 25% of all cancer deaths in 2020. This indicates an inflating need for effective and more advanced cancer cell analysis. Thus, the increasing demand for effective and lasting cancer treatment is anticipated to offer lucrative growth opportunities to the overall market.

Increasing Development of Novel Molecules

The rising prevalence of various infectious diseases is prompting the development of novel molecules and vaccines, which in turn is augmenting the cell analysis market revenue. Cell analysis tools play a crucial role in drug discovery and development by enabling researchers to assess the efficacy, safety, and mechanism of action of potential drug candidates. Furthermore, various pharmaceutical and biotech firms are increasingly relying on cell analysis techniques and tools to introduce new and improved drugs. For instance, according to the data published by the Congressional Budget Office, in 2021, it was observed that pharmaceutical industries spent nearly USD 200 Billion on research and development in 2020 globally, compared to USD 83 Million in 2019. Similarly, Danaher Corporation invested USD 1,742 Million in its research and development in 2021, as compared to USD 1,348 Million in 2020. In addition, Bio-Rad Laboratories Inc., invested USD 879.6 Million in 2021 as compared to USD 800.3 Million in 2020. Thus, the rising investment in research and development by the companies further increases the capabilities of the company to adopt innovative cell analysis techniques, thereby propelling the cell analysis market growth.

Rising Number of Strategic Collaborations and Acquisitions

Various key market players are forming partnerships and collaborations to develop new and improved cell analysis methods, tools, and techniques. For instance, in August 2022, DeNovix Inc., the manufacturer of the award-winning CellDrop Automated Cell Counter, developed two dedicated nuclei counting apps capable of differentiating isolated nuclei and intact cells from debris. The CellDrop Series is a line of image-based, automated cell counters. Systems include a high-definition 7-inch touchscreen for live preview and instant review of results. Similarly, in November 2022, Sony Corporation launched the SFA - Life Sciences Cloud Platform, a flow cytometry data analysis cloud solution that can quickly identify rare cells, such as cancer cells and stem cells, from a wide variety of cell populations, using data obtained from flow cytometers. In addition to this, in March 2022, Thermo Fisher Scientific introduced a new large-volume electroporation system that is intended to enable the development of cell therapies. Such innovations are expected to bolster the cell analysis market demand in the coming years.

Global Cell Analysis Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cell analysis market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product, analysis type, techniques, and end-user.

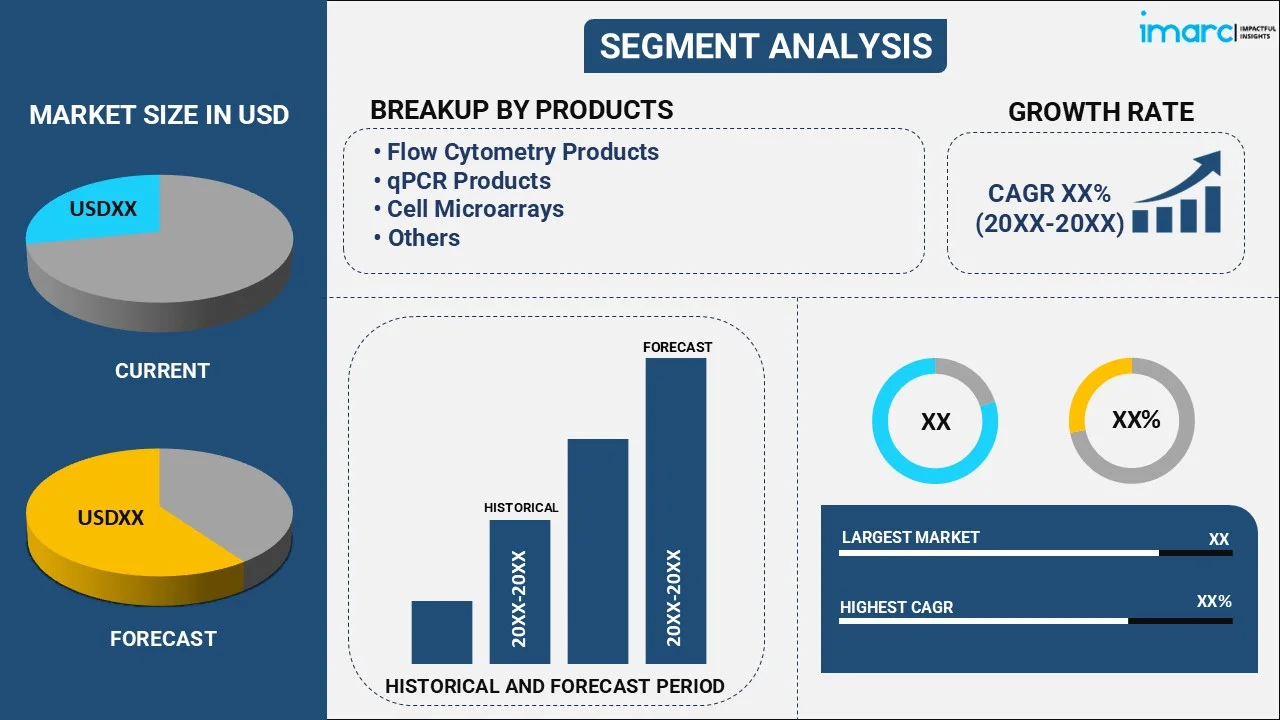

Breakup by Product:

- Flow Cytometry Products

- qPCR Products

- Cell Microarrays

- Microscopes

- Spectrophotometers

- Cell Counters

- HCS Systems

- Others

Flow cytometry products exhibit a clear dominance in the market

The cell analysis market report has provided a detailed breakup and analysis of the market based on the product. This includes flow cytometry products, qPCR Products, cell microarrays, microscopes, spectrophotometers, cell counters, HCS systems, and others. According to the report, flow cytometry products exhibit a clear dominance in the market.

Flow cytometry products are pivotal in the cell analysis market, offering precise quantification and characterization of cells based on their physical and chemical properties. Key components include flow cytometers, which analyze cells in fluid suspension using lasers to detect fluorescently labeled cells. Reagents such as fluorescent dyes and antibodies enable specific labeling for biomarker detection, while software facilitates data analysis and visualization. These products are essential in research, clinical diagnostics, and drug discovery, providing insights into cell function, differentiation, and disease mechanisms. Ongoing advancements in technology are enhancing sensitivity, multiplexing capabilities, and automation, expanding the utility of flow cytometry in diverse biomedical applications.

Breakup by Analysis Type:

- Cell Identification

- Cell Viability

- Cell Signaling Pathways/Signal Transduction

- Cell Proliferation

- Cell Counting and Quality Control

- Cell Interaction

- Target Identification and Validation

- Single-Cell Analysis

- Others

Cell identification analysis type holds the majority of the total market share

The cell analysis market research report has provided a detailed breakup and analysis of the market based on the analysis type. This includes cell identification, cell viability, cell signaling pathways/signal transduction, cell proliferation, cell counting and quality control, cell interaction, target identification and validation, single-cell analysis, and others. According to the report, cell identification analysis type holds the majority of the total market share.

Cell identification in cell analysis involves various techniques to distinguish and classify cells based on their morphological, molecular, or functional characteristics. Methods include microscopy for visual inspection, flow cytometry for quantitative analysis of cell surface markers, and molecular techniques like PCR for genetic profiling. Immunohistochemistry and immunofluorescence enable detection of specific proteins within tissues or cell samples. Advances in single-cell analysis technologies allow for high-resolution characterization of individual cells within heterogeneous populations. Accurate cell identification is crucial in understanding disease mechanisms, assessing treatment responses, and advancing personalized medicine by tailoring therapies based on individual cell profiles.

Breakup by Techniques:

- Molecular Approaches

- Image-Based Approaches

Molecular approaches represent the largest market share

The report has provided a detailed breakup and analysis of the market based on the techniques. This includes molecular approaches and image-based approaches. According to the report, molecular approaches represent the largest market share.

Molecular approaches in cell analysis focus on studying cellular components at the molecular level to understand biological processes and diseases. Techniques include PCR (Polymerase Chain Reaction) for amplifying and detecting DNA or RNA sequences, Western blotting for protein detection and quantification, and next-generation sequencing (NGS) for comprehensive genomic analysis. These methods enable researchers to investigate gene expression, mutations, protein interactions, and epigenetic modifications within cells. Molecular approaches are vital in biomarker discovery, drug development, and personalized medicine, offering insights into cellular function and disease mechanisms with high sensitivity and specificity. Continued advancements enhance their utility in diverse biomedical research applications.

Breakup by End-User:

- Pharmaceutical and Biotechnology Companies and CROs

- Hospitals and Diagnostic Laboratories

- Research Institutes

- Cell Culture Collection Repositories

- Others

Pharmaceutical and biotechnology companies and CROs currently account for the majority of the total market share

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes pharmaceutical and biotechnology companies and CROs, hospitals and diagnostic laboratories, research institutes, cell culture collection repositories, and others. According to the report, pharmaceutical and biotechnology companies and CROs currently account for the majority of the total market share.

Pharmaceutical and biotechnology companies develop and commercialize drugs and therapies for medical use. They conduct extensive research and clinical trials to discover new compounds, validate their efficacy and safety, and obtain regulatory approvals. Contract Research Organizations (CROs) support these efforts by providing specialized, such as clinical trial management, data analysis, and regulatory compliance. CROs enable companies to outsource non-core activities, accelerate timelines, and manage costs effectively. Furthermore, the increasing rate of new drug development is also contributing to the segment’s growth. For instance, between 2010 and 2019, around 38 new drugs were approved each year, on an average. That is about a 60% increase compared with the previous decade. Drug approvals reached a new peak in 2018, surpassing the record number of approvals of the late 1990s. The cell analysis market statistics by IMARC indicate that together, pharmaceutical/biotech firms and CROs are playing crucial roles in advancing healthcare innovation, bringing new treatments to market, and improving patient outcomes through rigorous scientific research and development.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America currently dominates the global market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America currently dominates the global market.

The growth of the region can be attributed to the increase in incidences of cancer and rising corporate and government funding in cell-based research. For instance, according to the Canadian Cancer Statistics 2022 Special Report, the number of people living with and after cancer in Canada continued to grow to over 1.5 million people. Additionally, according to another report, 2 in 5 Canadians are expected to be diagnosed with cancer in their lifetime. Approximately 1 in 4 Canadians is expected to die of the disease. Besides this, the presence of major companies, the growing number of product launches, and the strong R&D in biotechnology are further positively impacting the cell analysis market outlook. For instance, in September 2022, Becton, Dickinson, and Company launched BD Research Cloud, a cloud-based software solution designed to streamline the flow cytometry workflow to enable higher-quality experiments with faster time to insight for scientists working across a range of disciplines, including immunology, virology, oncology, and infectious disease monitoring.

Competitive Landscape:

The competitive landscape of the industry has also been examined with the detailed profiles of the following key players:

- Agilent Technologies Inc.

- BD Biosciences

- Bio-RAD Laboratories Inc.

- Danaher Corporation

- Illumina Inc.

- Merck KGaA

- Miltenyi Biotec

- Olympus Corporation

- PerkinElmer Inc.

- Promega Corporation

- Sysmex Corporation

- Thermo Fisher Scientific

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Cell Analysis Market News:

- June 2024: Bio-Rad Laboratories, Inc., a global leader in life science research and clinical diagnostics products, announced the launch of the ddSEQ™ Single-Cell 3' RNA-Seq Kit and complementary Omnition v1.1 analysis software for single-cell transcriptome and gene expression research.

- March 2024: US-headquartered Cytek Biosciences, Inc., opened a new 50,000-square-foot facility in Wuxi, China. This strategic move increases the company's manufacturing capacity to meet the growing worldwide demand for comprehensive cell analysis solutions.

- February 2024: 10x Genomics, Inc., a leader in single-cell and spatial biology, announced the launch of GEM-X, the next generation of the company's leading single-cell technology. GEM-X is built on a new and improved microfluidic chip design, featuring the latest technological advancements and optimized reagents for superior performance and high reliability.

Global Cell Analysis Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Flow Cytometry Products, qPCR Products, Cell Microarrays, Microscopes, Spectrophotometers, Cell Counters, HCS Systems, Others |

| Analysis Types Covered | Cell Identification, Cell Viability, Cell Signaling Pathways/Signal Transduction, Cell Proliferation, Cell Counting and Quality Control, Cell Interaction, Target Identification and Validation, Single-Cell Analysis, Others |

| Techniques Covered | Molecular Approaches, Image-Based Approaches |

| End-Users Covered | Pharmaceutical and Biotechnology Companies and CROs, Hospitals and Diagnostic Laboratories, Research Institutes, Cell Culture Collection Repositories, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia,Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., BD Biosciences, Bio-RAD Laboratories Inc., Danaher Corporation, Illumina Inc., Merck KGaA, Miltenyi Biotec, Olympus Corporation, PerkinElmer Inc., Promega Corporation, Sysmex Corporation, Thermo Fisher Scientific, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cell analysis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cell analysis market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cell analysis industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cell analysis market was valued at USD 22.2 Billion in 2024.

We expect the global cell analysis market to exhibit a CAGR of 7.1% during 2025-2033.

The extensive utilization of cell analysis technology across hospitals and medical research laboratories pertaining to immunology, neurology, non-invasive prenatal diagnosis, in-vitro fertilization, etc., is primarily driving the growth in the cell analysis industry.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of cell analysis technology in several research procedures for developing effective vaccines, drugs, and testing kits to combat the risk of coronavirus infection.

Based on the product, the global cell analysis market has been divided into flow cytometry products, qPCR Products, cell microarrays, microscopes, spectrophotometers, cell counters, HCS systems, and others. Currently, flow cytometry products exhibit a clear dominance in the market.

Based on the analysis type, the global cell analysis market can be categorized into cell identification, cell viability, cell signaling pathways/signal transduction, cell proliferation, cell counting and quality control, cell interaction, target identification and validation, single-cell analysis, and others. Among these, cell identification analysis type holds the majority of the total market share.

Based on the techniques, the global cell analysis market has been segmented into molecular

approaches and image-based approaches. As per the cell analysis market forecast by IMARC, molecular approaches represent the largest market share.

Based on the end-user, the global cell analysis market can be bifurcated into pharmaceutical and

biotechnology companies and CROs, hospitals and diagnostic laboratories, research institutes, cell culture collection repositories, and others. Among these, pharmaceutical and biotechnology

companies and CROs currently account for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global cell analysis market include Agilent Technologies Inc., BD Biosciences, Bio-RAD Laboratories Inc., Danaher Corporation, Illumina Inc., Merck KGaA, Miltenyi Biotec, Olympus Corporation, PerkinElmer Inc., Promega Corporation, Sysmex Corporation, Thermo Fisher Scientific, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)