Cellular IoT Market Report by Component (Hardware, Software), Type (2G, 3G, 4G, LTE-M, NB-LTE-M, NB-IoT, 5G), End Use (Agriculture, Automotive and Transportation, Consumer Electronics, Energy, Environment Monitoring, Healthcare, Retail, Smart Cities, and Others), and Region 2025-2033

Cellular IoT Market Size:

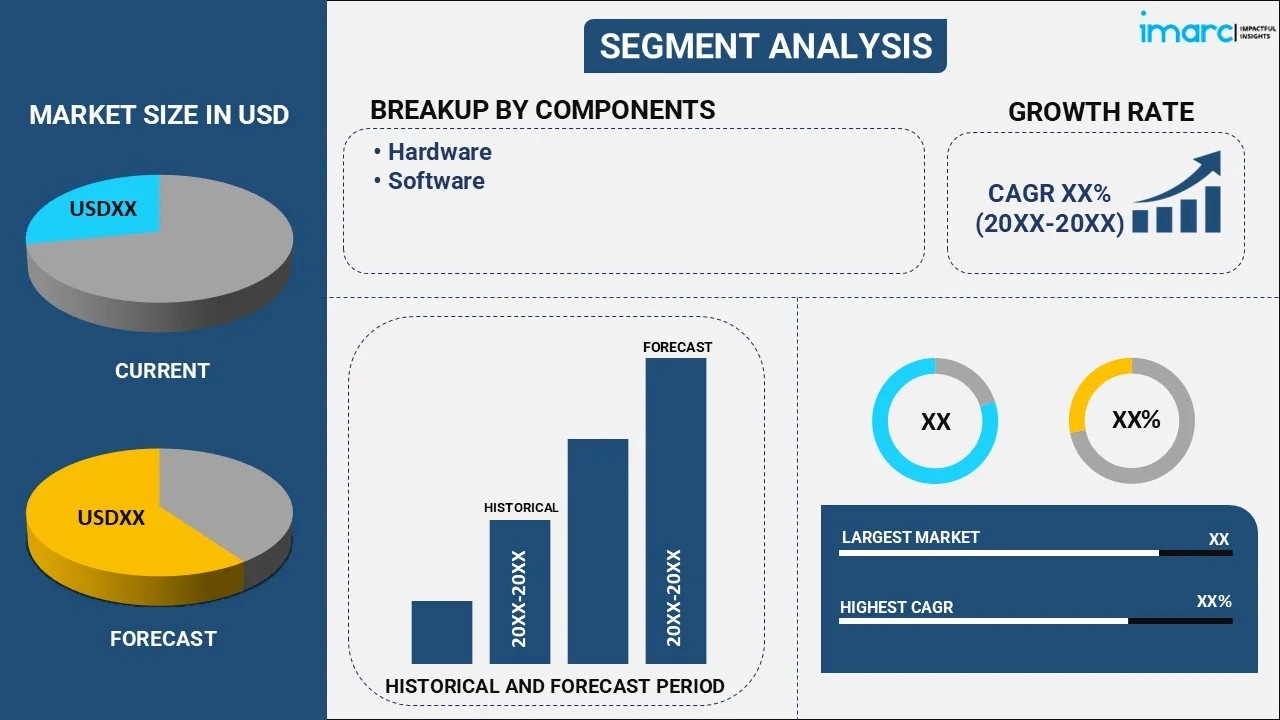

The global cellular IoT market size reached USD 6.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 28.7 Billion by 2033, exhibiting a growth rate (CAGR) of 17.33% during 2025-2033. The market is majorly driven by the increasing adoption of connected devices, continual technological advancements in 5G technology, the rising demand for real-time data analytics, numerous innovations in vehicle telematics, and the rapid expansion of smart cities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.4 Billion |

|

Market Forecast in 2033

|

USD 28.7 Billion |

| Market Growth Rate 2025-2033 | 17.33% |

Cellular IoT Market Analysis:

- Major Market Drivers: The market is majorly driven by the increasing demand for connected devices, advancements in 5G technology, expansion of smart cities, industrial automation, improved network coverage, cost-effective solutions, regulatory support, and the growing need for real-time data analytics.

- Key Market Trends: Key trends in the market include the augmenting adoption of 5G for IoT applications, higher uptake of connected devices across various end-use industries, the integration of AI and machine learning, the expansion of smart home and healthcare IoT solutions, and the emergence of edge computing for data processing.

- Geographical Trends: North America leads in expanding cellular IoT market size, driven by technological advancements, robust infrastructure, and high IoT investment.

- Competitive Landscape: Some of the key market players include Fibocom Wireless Inc., Huawei Technologies Co., Ltd., MediaTek Incorporated, Nordic Semiconductor, Qualcomm Technologies, Inc., Quectel, Sequans, Sierra Wireless, Telit Cinterion and U-Blox.

- Challenges and Opportunities: Some of the challenges in the market include interoperability issues, security concerns, and high initial deployment costs. On the other hand, opportunities lie in expanding IoT applications in various end-use industries such as healthcare, agriculture, and logistics.

To get more information on this market, Request Sample

Cellular IoT Market Trends:

Growing applications in vehicle telematics and fleet management

The implementation of vehicle telematics is rapidly emerging as one of the most critical applications for cellular IoT, significantly enhancing both performance and connectivity. The trend of deploying telematics systems in off-highway and highway vehicles is expected to unlock substantial development potential. As the demand for integrated vehicle management and enhanced data-driven decision-making grows, adopting these advanced telematics systems is becoming increasingly essential for stakeholders across the transportation sector, thereby fostering a positive cellular IoT market outlook. Real-time monitoring capabilities enabled by IoT, and telematics technologies are also pivotal in improving overall safety standards. These systems allow for continuous tracking of vehicle location, condition, and driver behavior, facilitating a swift response to crises and potential threats. This enhancement in safety measures is a key driver in the growing adoption of cellular IoT solutions in the vehicle telematics sector. Additionally, predictive maintenance facilitated by real-time data analysis minimizes downtime and prolongs the lifespan of vehicles, further contributing to cost savings and sustainability. Such advancements provide valuable cellular IoT market insights.

Rising implementation of cellular IoT modules in smart city infrastructure and building automation

Smart city infrastructure and building automation are the two most important vertical deployments of cellular IoT modules, accounting for the majority of the market revenue. Battery-operated devices can now connect to the internet due to emerging cellular IoT technologies. These technologies connect devices more effectively than current 2G and 3G technologies, including smart parking and smart street lighting. Modern infrastructure improvements are a priority for governments around the world, and several pilot projects are being launched to achieve this goal. This, in turn, is helping with the increasing cellular IoT market revenue.

Increasing demand for cellular IoT for C-V2X in the automotive sector

The demand for Cellular Vehicle-to-Everything (C-V2X) in the automotive industry is expanding significantly due to the increased need for safe and reliable road transportation. The growing necessity for highly dependable, real-time communication at high speeds and in dense traffic environments, coupled with the capability to leverage the extensive coverage of secure and well-established LTE networks, is propelling the demand for C-V2X cellular IoT solutions. Advancements in 5G technology are enabling 5G-V2X applications, which are enhancing cybersecurity performance and managing large volumes of communications in congested traffic settings. These technological advancements are further driving the adoption of C-V2X, providing robust, real-time communication solutions that are critical for modern automotive applications. Apart from this, the affordability of hardware components is another aspect creating a positive cellular IoT industry outlook.

Cellular IoT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, type, and end use.

Breakup by Component:

- Hardware

- Software

- Device Management

- Signal Processing

Hardware dominates the market

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software (device management and signal processing). According to the report, hardware represented the largest segment.

According to the cellular IoT market research report, the hardware segment is dominating the market. Hardware is critical to propelling the cellular IoT market forward, as it provides the basic technologies for reliable connectivity and data transfer. Cellular IoT gear, including as modules and gateways, allows IoT devices to be seamlessly integrated into existing networks, ensuring dependable and scalable communication across a wide range of situations. Furthermore, ongoing innovation in cellular IoT hardware promotes rapid adoption and integration into a wide range of verticals, including smart cities, agriculture, healthcare, and industrial automation, hence driving market development and innovation.

Breakup by Type:

- 2G

- 3G

- 4G

- LTE-M

- NB-LTE-M

- NB-IoT

- 5G

3G holds the largest share in the market

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes 2G, 3G, 4G, LTE-M, NB-LTE-M, NB-IoT, and 5G. According to the report, 3G accounted for the largest market share.

3G technology continues to play an important role in the cellular IoT market dynamics, particularly in applications that require moderate data rates and consistent connectivity. It provides larger coverage than newer technologies such as LTE-M and NB-IoT, making it ideal for IoT deployments in remote or rural locations where network infrastructure may be less established. 3G held the largest market share in revenue as it offers low-cost modem options and certifications and has the most users worldwide. It is the ideal choice for applications such as fleet management, smart metering, and industrial monitoring that require seamless connectivity and data reliability.

Breakup by End Use:

- Agriculture

- Automotive and Transportation

- Consumer Electronics

- Energy

- Environment Monitoring

- Healthcare

- Retail

- Smart Cities

- Others

Energy holds the maximum share in the market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes agriculture, automotive and transportation, consumer electronics, energy, environment monitoring, healthcare, retail, smart cities, and others. According to the report, energy accounted for the largest market share.

According to the cellular IoT industry report, energy is dominating the market. Cellular IoT is transforming the energy sector by allowing for real-time monitoring, remote management, and optimization of essential infrastructure such as power grids, renewable energy assets, and oil and gas installations. IoT sensors and devices with cellular connectivity generate continuous data streams about energy output, consumption patterns, and equipment performance. This data enables predictive maintenance, increases equipment utilization, and improves overall operational efficiency. Furthermore, cellular IoT aids grid modernization efforts by integrating renewable energy sources and enabling smart grid functionality. Cellular IoT solutions in the energy sector help to reduce costs, improve dependability, and promote sustainable energy practices by increasing automation and control.

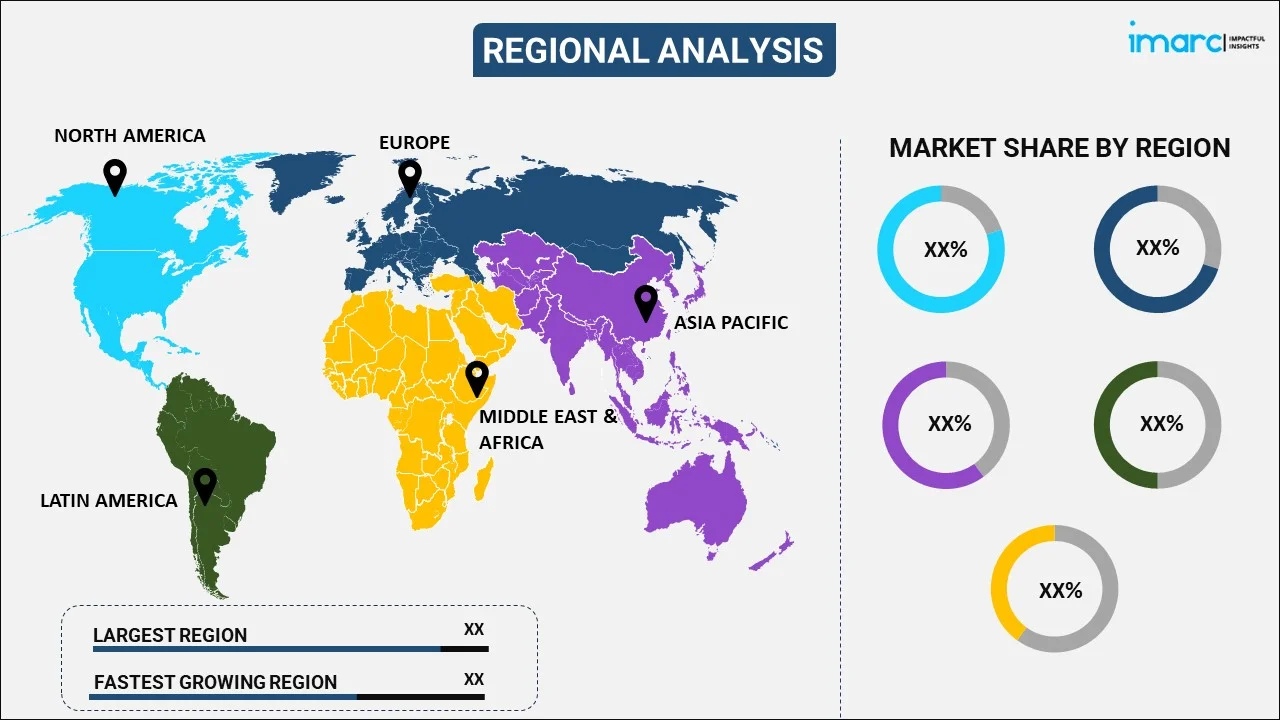

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest cellular IoT market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for cellular IoT.

North America is poised to maintain its position as the leading regional market during the cellular IoT market forecast period. It is also anticipated to be the fastest-growing market of cellular IoT driven by the presence of a substantial number of semiconductor vendors. Additionally, the increasing influx of technology companies in the region and rising investments in IoT technology are expected to further propel market growth. Government interest in the cellular IoT market is evident through the initiation of numerous smart infrastructure projects across the region. In addition to this, national cellular IoT strategies promoted by the government are also providing a boost to the cellular IoT market growth.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Fibocom Wireless Inc.

- Huawei Technologies Co., Ltd.

- MediaTek Incorporated

- Nordic Semiconductor

- Qualcomm Technologies, Inc.

- Quectel

- Sequans

- Sierra Wireless

- Telit Cinterion

- U-Blox

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The cellular internet of things (IoT) industry is semi-consolidated, with a few large and minor firms operating both domestically and internationally. Due to a few technological advancements, the market appears semi-consolidated. The leading players' key market tactics include product innovation and mergers and acquisitions. For instance, Qualcomm, a mobile semiconductor firm based in the United States, announced Qualcomm Aware in February 2023, a cloud-friendly bundle that comprises Qualcomm silicon as well as an ecosystem of hardware and software partners. The notion appears to be a one-stop shop for all IoT initiatives managed by Qualcomm. These initiatives are, in turn, accelerating the growth of the cellular IoT market share.

Cellular IoT Market News:

- May 29, 2024: Arm Limited introduced AI-Optimized Arm CSS for Client and New Arm Kleidi Software. New compute solution, Arm Compute Subsystems (CSS) for Client, brings together Armv9 benefits with validated and verified production ready implementations of new Arm CPUs and GPUs on 3nm process nodes to enable silicon partners to rapidly innovate and speed time to market.

- June 11, 2024: MediaTek Inc. announced that it will integrate NVIDIA TAO with MediaTek’s NeuroPilot SDK, part of its edge inference silicon roadmap. MediaTek’s support for NVIDIA TAO will create a seamless experience for developers as they bring edge AI (including Generative AI) capabilities to a wide variety of IoT applications powered by MediaTek’s cutting-edge silicon.

- April 9, 2024: Qualcomm Incorporated unveiled additions to its portfolio of products and solutions designed to empower its customers in the embedded ecosystem. The new Qualcomm QCC730 Wi-Fi solution and Qualcomm RB3 Gen 2 Platform provide critical upgrades to enable on-device AI, high-performance, low-power processing, and connectivity for the latest IoT products and applications.

Cellular IoT Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Types Covered | 2G, 3G, 4G, LTE-M, NB-LTE-M, NB-IoT, 5G |

| End Uses Covered | Agriculture, Automotive and Transportation, Consumer Electronics, Energy, Environment Monitoring, Healthcare, Retail, Smart Cities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Fibocom Wireless Inc., Huawei Technologies Co., Ltd., MediaTek Incorporated, Nordic Semiconductor, Qualcomm Technologies, Inc., Quectel, Sequans, Sierra Wireless, Telit Cinterion, U-Blox, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cellular IoT market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cellular IoT market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cellular IoT industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cellular IoT market size was valued at USD 6.4 Billion in 2024. The rising deployment of cellular IoT modules in smart city infrastructures and autonomous vehicles is primarily driving the market growth. Moreover, the emerging trend of industrialization, along with the growing adoption of automated devices for better efficiency, remote monitoring, and increased productivity across diverse sectors, is also augmenting the demand for cellular IoT platforms. Additionally, the elevating preferences toward cellular IoT in weather monitoring and infrastructure security are further propelling the global market.

Several benefits of cellular technology include extensive coverage, improved cost-effectiveness and affordability, enhanced remote management, high flexibility associated with connectivity, and excellent security. The cellular IoT networks are ubiquitous, mature, reliable and work out-of-the-box without requiring any extra hardware installation. Thus, the benefits associated with cellular IoT technology make it a predominant option among consumers these days.

The future of cellular IoT seems to be optimistic. The rising digitization and automation across diverse industries, such as manufacturing, automotive and agriculture, healthcare, energy & utilities, etc., are expected to drive the market growth in the coming years. Moreover, numerous medium- and large-scale organizations are widely adopting Narrowband Internet of Things (NB-IoT) and Long-Term Evolution for Machines (LTE-M) solutions, which will continue to augment the global cellular IoT market over the forecast period. Additionally, the growing adoption of cellular IoT for smart metering, weather monitoring, infrastructure security, and flood and agricultural management, is further anticipated to propel the market growth.

Cellular IoT is a cost-effective and affordable technology for several applications, such as assets in motion (cars, trucks, trains) as well as static assets (smart meters, smart city, smart factory environments). The cellular IoT uses the cellular network to connect physical devices to the internet. It can provide both indoor and outdoor applications and helps to support both low- and high-bandwidth applications. Furthermore, cellular-IoT platforms are also used for tracking data in public park systems, remote-starting excavators, environmental management, and fleet management with safer transportation, among others.

We expect the global cellular IoT market to exhibit a CAGR of 17.33% during 2025-2033.

As per the IMARC Group, the segments of the global cellular IoT market includes, by Component (Hardware and Software), by Type (2G, 3G, 4G, LTE-M, NB-LTE-M, NB-IoT, 5G), by End-Use (Agriculture, Automotive and Transportation, Consumer Electronics, Energy, Environment Monitoring, Healthcare, Retail, Smart Cities, and Others) and by Region (North America, Asia-Pacific, Europe, Middle East, and Africa).

The rising adoption of cellular IoT solutions across various industries, such as agriculture, healthcare, manufacturing, etc., to establish a secure connection with other shared networks, simplify global deployment, support low and high bandwidths, etc., is primarily driving the global cellular IoT market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing deployment of cellular IoT solutions to provide a reliable connectivity, during the remote working scenario.

Based on the component, the global cellular IoT market can be categorized into hardware and software. Currently, hardware accounts for the majority of the global market share.

Based on the type, the global cellular IoT market has been segregated into 2G, 3G, 4G, LTE-M, NB-LTE-M, NB-IoT, and 5G. Among these, 3G currently exhibits a clear dominance in the market.

Based on the end use, the global cellular IoT market can be bifurcated into agriculture, automotive and transportation, consumer electronics, energy, environment monitoring, healthcare, retail, smart cities, and others. Currently, energy holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global cellular IoT market include Fibocom Wireless Inc., Huawei Technologies Co., Ltd., MediaTek Incorporated, Nordic Semiconductor, Qualcomm Technologies, Inc., Quectel, Sequans, Sierra Wireless, Telit Cinterion, and U-Blox.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)