Cephalosporin Market Size, Share, Trends and Forecast by Generation, Route of Administration, Application, and Region, 2025-2033

Cephalosporin Market Size and Share:

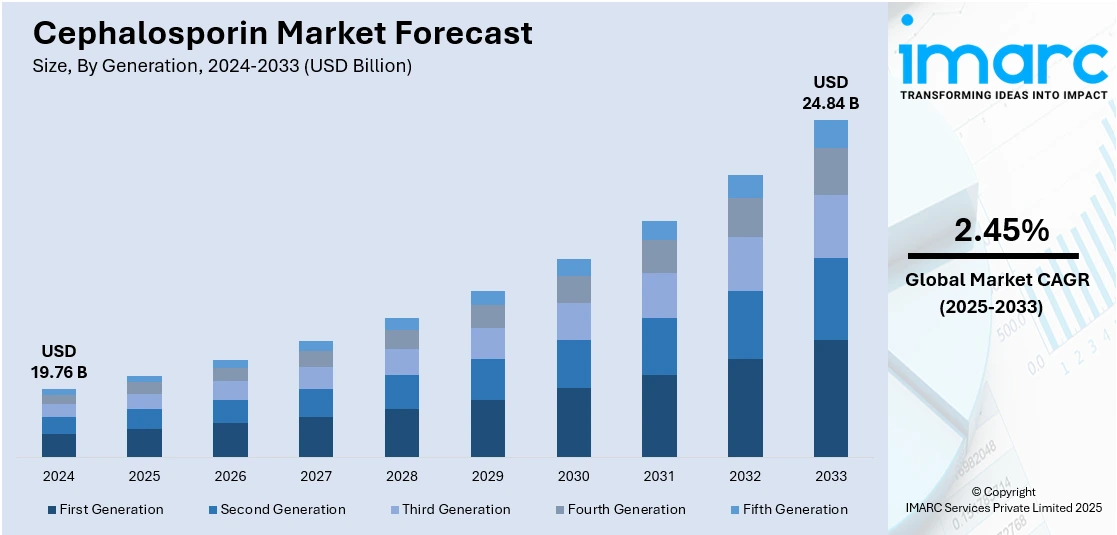

The global cephalosporin market size was valued at USD 19.76 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.84 Billion by 2033, exhibiting a CAGR of 2.45% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 40.5% in 2024. The market is experiencing steady growth driven by increasing antibiotic-resistant infections, the demand for effective and safer treatment options, ongoing research and development efforts to introduce new cephalosporin formulations. In addition, hospital reliance on advanced injectables and consistent treatment outcomes continues to support cephalosporin market share across critical care and outpatient settings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 19.76 Billion |

|

Market Forecast in 2033

|

USD 24.84 Billion |

| Market Growth Rate 2025-2033 | 2.45% |

The market for cephalosporins is experiencing robust growth due to high demand for broad-spectrum antibiotics. These antibiotics are widely used in the treatment of various bacterial infections, including those resistant to traditional treatments. Doctors favor cephalosporins because they inhibit both Gram-positive and Gram-negative bacteria, making them effective against a broad spectrum of ailments. The increasing number of cases of respiratory tract infections, skin infections, and hospital-acquired infections continues to drive this demand. Population-dense countries with limited access to early care, such as India, Indonesia, and Nigeria, are significantly contributing to this growing trend. Healthcare professionals are also turning to newer cephalosporins, which offer improved clinical outcomes and fewer side effects.

Injectable cephalosporins are increasingly being utilized in the United States because they are highly effective for treating serious infections and also meet hospital standards for care. They are widely used in emergency rooms, inpatient units, and surgical units where immediate action is required. US healthcare professionals often opt for injectable formulations in cases of pneumonia, sepsis, and complex urinary tract infections because they have a quicker onset and greater bioavailability. Demand is also fueled by increasing incidences of antimicrobial resistance, making hospitals switch to trusted treatments with established clinical effectiveness. Throughout late 2023 and into 2024, several US-based drug manufacturers diversified their injectable antibiotic product lines, focusing on cephalosporin preparations that reduce the frequency of dosing and enhance safety. Hospital purchasing departments have increasingly favored these newer agents as they seek to maximize treatment protocols and minimize hospital stays.

Cephalosporin Market Trends:

Increasing Prevalence of Bacterial Infections

Rising global cases of bacterial infections are driving demand for cephalosporins, a significant factor in the market. These antibiotics are essential for treating common and severe conditions such as pneumonia, sinus infections, tonsillitis, staph infections, and strep throat. Reports from 2019 indicated over 7 Million deaths were linked to bacterial infections globally, demonstrating the continued need for dependable treatment options. Cephalosporins remain a top choice due to their broad-spectrum capabilities and suitability for different patient groups. Population growth, poor sanitation in certain areas, and limited access to early treatment in many regions contribute to the increasing burden of infection. Health authorities, such as the CDC and WHO, continue to report sharp increases in bacterial disease rates, prompting the widespread use of established antibiotic classes. Public interest in early intervention and hygiene education is helping drive up diagnosis rates, which in turn boosts the demand for antibiotics. The growing number of infections, particularly in developing countries, means that cephalosporins will continue to be widely used in both hospitals and primary care settings. Their safety profile and effectiveness against a wide range of bacterial strains keep them among the most trusted antibiotics globally.

Advancements in Product Variants

Recent pharmaceutical advancements have led to the development of improved cephalosporin formulations that are more effective against resistant bacterial strains. These newer versions offer enhanced action against Gram-negative bacteria, which are harder to treat due to their protective outer layers. Innovations in drug chemistry have led to the development of third- and fourth-generation cephalosporins, which are more effective in managing complex infections. Bacterial resistance remains a serious global threat, contributing to over a Million deaths in 2021, according to the National Institutes of Health. This has prompted drug developers to create more targeted solutions. Pharmaceutical companies are increasing research investments to produce next-generation cephalosporins that address these emerging challenges. These efforts include improving absorption rates, reducing the frequency of dosing, and minimizing side effects. Some recent products have also demonstrated improved penetration into infection sites, providing quicker and more sustained effects. These developments have made modern cephalosporins suitable for treating infections that are difficult to treat and hospital-acquired conditions. The growing demand for effective treatment options is expected to sustain development in this segment. Continued R&D, backed by growing investments from global firms, will likely bring more advanced products to the market, helping to sustain global cephalosporin market growth in the cephalosporin segment.

Growing Awareness and Government Initiatives

Efforts by public health agencies and governments to promote responsible antibiotic use are strengthening the cephalosporin market. As awareness grows about the dangers of antibiotic misuse and resistance, health campaigns are encouraging timely and proper treatment of bacterial infections. These programs focus on educating communities about how and when to use antibiotics, including cephalosporins, safely and effectively. Alongside public outreach, many countries are expanding their healthcare spending to improve access to essential medicines. One major example occurred in India, where the government announced over 200 health infrastructure projects in early 2024, totaling nearly INR 11,700 Crores. These developments are designed to improve health services in underserved regions, which will naturally raise the demand for critical antibiotics. With health awareness on the rise and medical infrastructure improving, more patients are receiving accurate diagnoses and appropriate treatments. This has led to more consistent use of antibiotics across a wide population. Government support also helps standardize treatment protocols that favor broad-spectrum antibiotics, such as cephalosporins, which remain vital in managing a wide variety of infections. As more countries commit to strengthening health systems and patient education, the market for cephalosporins is expected to see steady growth.

Developing Healthcare Infrastructure

Upgrades in healthcare infrastructure, particularly in low- and middle-income countries, are enhancing access to antibiotics and enhancing treatment for bacterial infections. Better-equipped hospitals, clinics, and diagnostic centers are making it easier for healthcare providers to diagnose and manage infections using cephalosporins. Expanded access to diagnostics and improved patient tracking systems also help identify infections earlier, leading to more timely treatments. As of March 2023, India had nearly 32,000 primary health centers and over 700 district hospitals nationwide, with expanding coverage in both urban and rural areas. This expansion plays a direct role in antibiotic usage rates, as more facilities are equipped to dispense effective drugs. As rural areas gain access to modern treatment, the demand for reliable and affordable antibiotics continues to climb. Cephalosporins, known for their broad effectiveness and safety profile, remain a first-line treatment in many of these settings. The ongoing investments in health infrastructure will continue to support cephalosporin market growth, especially where infection control programs are being implemented more rigorously. As healthcare systems mature, the need for efficient and widely accepted antibiotics is likely to increase, reinforcing the position of cephalosporins in daily clinical use.

Cephalosporin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cephalosporin market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on generation, route of administration, and application.

Analysis by Generation:

- First Generation

- Second Generation

- Third Generation

- Fourth Generation

- Fifth Generation

As per the cephalosporin market outlook, in 2024, the third generation segment led the market, accounting for 38% of the total market share driven by its broad-spectrum activity against both Gram-positive and Gram-negative bacteria. These antibiotics are often prescribed for respiratory tract infections, meningitis, and gonorrhea, making them widely used in both hospital and outpatient settings. Their effectiveness against resistant strains further boosts demand. For instance, ceftriaxone remains a preferred choice in treating community-acquired pneumonia and severe infections due to its long half-life and ease of once-daily dosing, contributing to the dominance of third-generation cephalosporins in the global market.

Analysis by Route of Administration:

- Injection

- Oral

In 2024, the injection segment led the cephalosporin market, accounting for 67.7% of the total market share, driven by the need for rapid drug delivery in severe infections. Injectable cephalosporins are commonly used in hospitals to treat conditions such as sepsis, pneumonia, and post-surgical infections where oral antibiotics are ineffective. Their high bioavailability and immediate action make them essential in emergency and inpatient care. Drugs such as cefepime and ceftriaxone are routinely used via injection for managing critical infections, reinforcing the strong market demand for parenteral formulations and making the injection segment the most preferred route of administration in clinical settings.

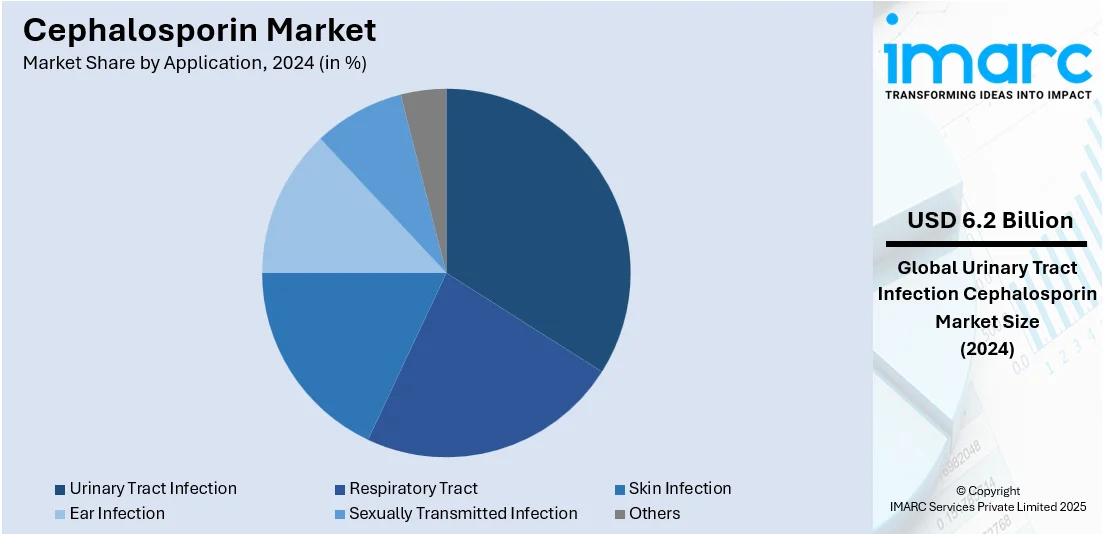

Analysis by Application:

- Respiratory Tract

- Skin Infection

- Ear Infection

- Urinary Tract Infection

- Sexually Transmitted Infection

- Others

In 2024, the urinary tract infection led the cephalosporin market, accounting for 31.3% of the total market share, driven by the rising prevalence of urinary tract infections (UTIs) globally and the effectiveness of cephalosporins in treating both uncomplicated and recurrent cases of UTIs. These antibiotics provide reliable coverage against common uropathogens, such as E. coli. The increasing resistance to other antibiotic classes has made cephalosporins a go-to treatment. For example, cefixime is often prescribed for outpatient UTI management due to its safety and effectiveness. The high burden of UTIs, especially among women and the elderly, has kept demand for cephalosporins consistently strong in this therapeutic segment.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, the Asia Pacific led the cephalosporin market, accounting for 40.5% of the total market share, driven by high rates of infectious diseases, increasing healthcare infrastructure, and the affordability of antibiotic production. Countries like India and China are major manufacturing hubs for generic cephalosporins, allowing for cost-effective supply across the region. Additionally, rising awareness, urban population growth, and supportive government healthcare initiatives are expanding access to antibiotics. For instance, India's large pharmaceutical base produces drugs like cefuroxime at scale, fulfilling both domestic and international demand. These factors collectively fuel Asia Pacific's leading position in the global cephalosporin market.

Key Regional Takeaways:

United States Cephalosporin Market Analysis

In 2024, the United States accounted for 93.50% of the cephalosporin market in North America, driven by multiple medical and economic factors. The widespread use of cephalosporins in treating infections, such as pneumonia, urinary tract conditions, and skin infections, has helped them become a standard option across various care settings. The rise in antimicrobial resistance is also leading to a stronger reliance on newer cephalosporin generations, particularly third- and fourth-generation drugs, which are more effective in addressing difficult bacterial strains. With approximately 2.8 Million antimicrobial-resistant infections occurring annually in the US, as reported by the CDC, the need for potent antibiotics remains a pressing concern. Major pharmaceutical firms based in the country are actively investing in research and development (R&D) to create more effective cephalosporin-based solutions tailored to specific bacterial threats. Additionally, precision medicine is influencing drug development, helping researchers build formulations that align more closely with patient and pathogen profiles. Regulatory support for affordable generic versions of these drugs has also improved access to them. The US market is witnessing an increase in the use of oral cephalosporins in outpatient settings, reflecting a shift toward home-based care. Altogether, ongoing innovation, government support, and rising infection rates are driving sustained demand for cephalosporins nationwide.

Asia Pacific Cephalosporin Market Analysis

The cephalosporin market in the Asia Pacific region is expanding due to rising healthcare investments, increasing infection rates, and growing awareness of the effectiveness of antibiotics. Countries like India and China are experiencing high demand, as their large populations and rising incidence of bacterial diseases fuel the need for dependable treatments. In India, healthcare spending increased from 1.4% in 2017–18 to 1.9% in 2023–24, growing at a rate of nearly 15.8% annually, according to government sources. This increase in funding is improving access to both hospital-based and outpatient treatments. Cephalosporins are widely used in this region because they are both effective and affordable, particularly in their generic form. Expanded healthcare access in rural and underserved communities is helping more patients receive proper treatment for common infections. The presence of domestic pharmaceutical manufacturers has also helped reduce costs and ensure a stable supply of pharmaceuticals. Both oral and injectable forms are seeing growing use, particularly in facilities that previously had limited antibiotic options. As public and private healthcare investments increase, along with rising awareness of early treatment, the demand for cephalosporins is expected to remain high across the Asia Pacific.

Europe Cephalosporin Market Analysis

In Europe, the cephalosporin market is benefiting from an aging population and a rise in bacterial infections. Many elderly individuals are more prone to infections like UTIs, respiratory diseases, and pneumonia, all of which often require cephalosporin-based treatment. Cephalosporins are especially valued for their strong safety profile and coverage against multiple pathogens. Hospital-acquired infections are also increasing in Europe, prompting hospitals to stock advanced-generation antibiotics for better patient outcomes. Industry data indicates over 670,000 people in the EU contract antibiotic-resistant infections each year. This growing resistance makes newer cephalosporin options essential. Third-generation formulations are now widely used to manage severe cases of bloodstream infections, particularly those caused by resistant strains of E. coli. In 2023, roughly 10 out of every 100,000 people in the EU were affected by such resistant bloodstream infections, underlining the importance of updated treatments. Pharmaceutical companies across the region are focusing on creating new formulations and combination drugs to fight multi-drug-resistant bacteria. At the same time, health systems are under pressure to reduce costs, which is pushing demand for effective generics. These conditions are fueling steady growth in the European cephalosporin market.

Latin America Cephalosporin Market Analysis

The Latin America cephalosporin market is significantly influenced by the region's increasing investment in healthcare modernization and expansion, particularly in countries such as Brazil and Mexico. For instance, 9.47% of the GDP of Brazil is spent on healthcare, equating to USD 161 Billion and making Brazil the largest healthcare market in Latin America, as per the International Trade Administration (ITA). As healthcare access improves, there is a growing demand for both inpatient and outpatient antibiotic treatments, with cephalosporins being a preferred option for managing bacterial infections. Additionally, government programs aimed at controlling the spread of infections and improving public health are contributing substantially to industry expansion. The growing presence of multinational pharmaceutical companies and collaborations with local players are further boosting the availability of both branded and generic cephalosporins.

Middle East and Africa Cephalosporin Market Analysis

The Middle East and Africa are experiencing a rising demand for cephalosporins due to persistent challenges from infectious diseases and improved access to healthcare. Rapid urban development and increasing public awareness about antibiotics have contributed to greater usage, particularly in countries such as Saudi Arabia, South Africa, and the United Arab Emirates. Government health budgets are expanding, supporting more structured infection control strategies. In Saudi Arabia, approximately 17% of the 2023 national budget roughly USD 50 Billion was allocated to healthcare, reflecting the growing state involvement in health delivery. As infrastructure improves and access to clinics and hospitals increases, more patients are receiving timely treatment. Cephalosporins are widely used as frontline antibiotics because they are both effective and familiar to practitioners. Policymakers are also introducing regulations to enhance antibiotic stewardship, thereby reducing misuse and guiding healthcare providers toward recommended medications. These combined factors are raising the demand for both branded and generic cephalosporins. As the region continues to strengthen healthcare systems and public health awareness grows, the market for cephalosporin-based treatments is expected to expand steadily.

Competitive Landscape:

Leading companies in the cephalosporin market are focusing on R&D to develop advanced formulations with better efficacy and fewer side effects, reflecting the shift toward safer and more effective treatments. To support a strong cephalosporin market forecast, firms are also expanding through acquisitions, partnerships, and global collaborations to access new markets and technologies. Regulatory compliance and sustainable manufacturing remain key priorities, underscoring their commitment to quality, safety, and environmental responsibility.

The report provides a comprehensive analysis of the competitive landscape in the cephalosporin market with detailed profiles of all major companies, including:

- Allergan Plc.

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline plc

- Lupin Limited

- Merck & Co. Inc.

- Novartis International AG (Sandoz)

- Pfizer Inc.

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Abbott Laboratories

- Sun Pharmaceutical Industries Limited

Latest News and Developments:

- January 2025: Venus Remedies successfully acquired the renewal of the European Good Manufacturing Practices (EU-GMP) certification by Infarmed, the National Authority of Medicines and Health Products in Portugal. The renewal will apply to the firm's Cephalosporin, Carbapenem, and Oncology formulations production plant.

- January 2025: Innova Captab commenced the commercial manufacturing at its production plant in Kathua, India. The plant is made up of four distinct production blocks, including one for cephalosporin, and will produce a wide variety of goods, such as injectables and oral solid doses.

- December 2024: Innoviva Specialty Therapeutics Inc., a division of Innoviva Inc., signed an exclusive license and distribution deal with Basilea Pharmaceutica Ltd for the commercialization of Zevtera, which is an advanced cephalosporin antibiotic, in the United States. Zevtera's licensing will broaden the varied but complementary line of unique therapies of IST that address significant unmet medical needs.

- June 2024: Sands Active, a pharmaceutical company based in Sri Lanka, inaugurated its new Cephalosporin Injectable Plant at the launch event for its new paracetamol tablet, Meldol. The launch of this facility will greatly increase Sri Lanka’s capacity to manufacture superior injectable antibiotics, which are necessary for treating a range of bacterial diseases.

- July 2023: Orchid Pharma entered into a technology transfer contract with an international biotechnology firm to support its 7ACA project under the production linked incentive (PLI) scheme. With this agreement, the company will be able to produce 1,000 tons of 7-ACA, which is the essential intermediate for the production of semisynthetic cephalosporin antibiotics, each year.

Cephalosporin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Generations Covered | First Generation, Second Generation, Third Generation, Fourth Generation, Fifth Generation |

| Routes of Administration Covered | Injection, Oral |

| Applications Covered | Respiratory Tract, Skin Infection, Ear Infection, Urinary Tract Infection, Sexually Transmitted Infection, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Allergan Plc., Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Lupin Limited, Merck & Co. Inc., Novartis International AG (Sandoz), Pfizer Inc., Sanofi, Teva Pharmaceutical Industries Ltd., Abbott, Sun Pharmaceutical Industries Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cephalosporin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cephalosporin market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cephalosporin industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cephalosporin market was valued at USD 19.76 Billion in 2024.

The cephalosporin market is projected to exhibit a CAGR of 2.45% during 2025-2033, reaching a value of USD 24.84 Billion by 2033.

The cephalosporin market is driven by rising bacterial infections, increasing antibiotic resistance, expanding healthcare access in emerging regions, and demand for broad-spectrum antibiotics. Government initiatives, hospital-acquired infection control, and new generation drug development also contribute to market growth across pharmaceutical and clinical sectors.

In 2024, Asia Pacific dominated the cephalosporin market accounting for 40.5% of the total market share, driven by a high prevalence of infectious diseases, growing population, increased healthcare spending, improved access to antibiotics, and strong pharmaceutical manufacturing capabilities across countries like China and India.

Some of the major players in the global cephalosporin market include Allergan Plc., Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Lupin Limited, Merck & Co. Inc., Novartis International AG (Sandoz), Pfizer Inc., Sanofi, Teva Pharmaceutical Industries Ltd., Abbott, Sun Pharmaceutical Industries Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)