Champagne Market Size, Share, Trends and Forecast by Product, Price, Distribution Channel, and Region, 2026-2034

Champagne Market Size and Share:

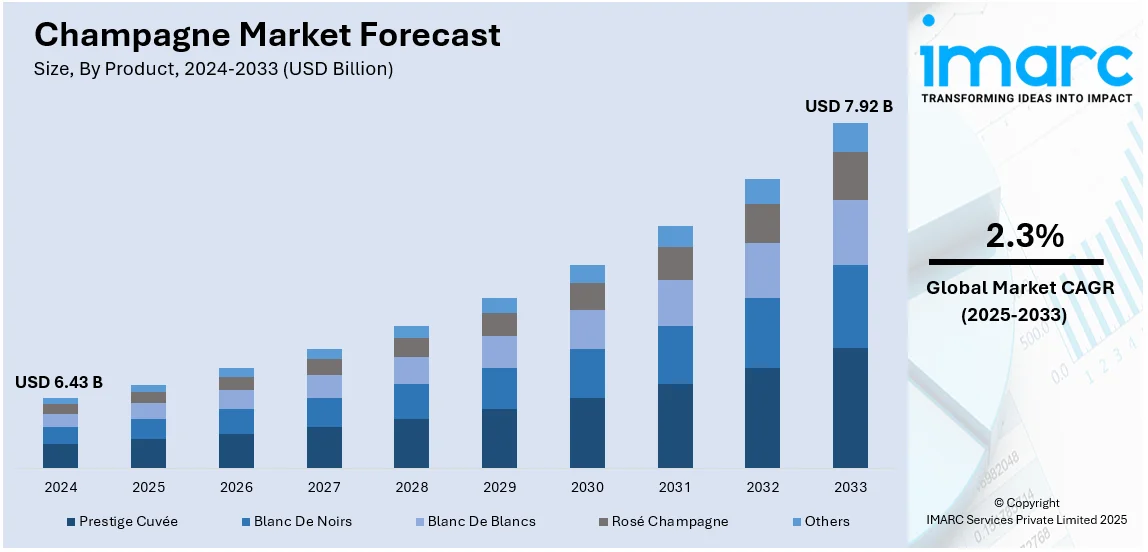

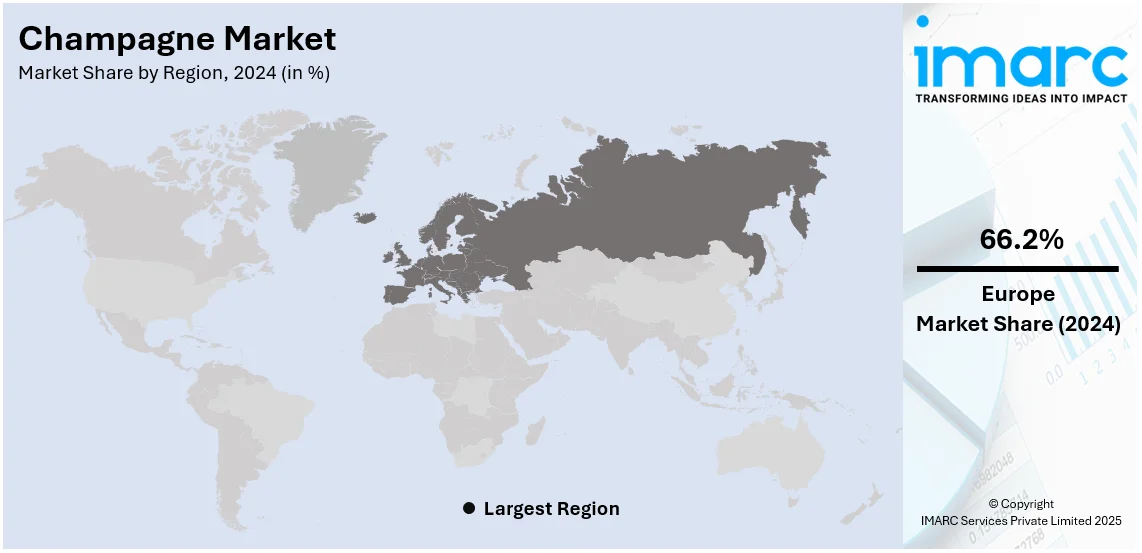

The global champagne market size was valued at USD 6.43 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7.92 Billion by 2034, exhibiting a CAGR of 2.3% during 2026-2034. Europe currently dominates the market. The growing popularity of wine tourism, rising number of e-commerce platforms, and increasing consumption of alcohol among the masses to cope with work stress and anxiety are some of the major factors propelling the champagne market share across Europe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6.43 Billion |

|

Market Forecast in 2034

|

USD 7.92 Billion |

| Market Growth Rate 2026-2034 | 2.3% |

Some of the factors driving the global champagne market growth include increased premium and luxury alcoholic beverage sales among consumers, particularly over special occasions and celebrations, rising disposable incomes, specifically in developing economies, and shifting lifestyle trends including experiential consumption. Apart from this, champagne symbolizes status as well as sophistication, creating a wider customer base. Increasing social media popularity amplifies luxury product visibility, hence improving brand recognition and demand. Moreover, growing distribution networks of champagne producers and rising e-commerce boost the product's accessibility throughout regions. According to the IMARC Group, the global e-commerce market has reached USD 26.8 Trillion in 2024, exhibiting a CAGR of 25.83% during 2025-2033. Demand for sustainable and organic champagne is also on the rise as consumers seek eco-friendly and health-conscious products. In line with this, the tourism and hospitality industry are also a significant contributor, as champagne is highly featured in upscale restaurants, hotels, and events.

The United States has emerged as a key regional market for champagne. The United States champagne market is driven by some crucial factors, such as the growing demand for premium and luxury alcoholic beverages during celebrations, holidays, and special occasions. The trend of experiential consumption, where consumers look out to purchase high-end products as a means to experience exciting social gatherings, is substantially increasing champagne sales. Rising disposable incomes, especially among younger consumers, along with the influence of social media, have further fueled the champagne market demand, as it is very often associated with status and sophistication. Moreover, access through new online retail channels and direct-to-consumer sales has enhanced ease of access, opening champagne for more consumers to purchase at their convenience. Market growth is also assisted by high-end restaurants, hotels, and event venues that comprise parts of the hospitality and tourism sectors.

Champagne Market Trends:

Rising popularity of wine tourism

At present, wine tourism is gaining popularity globally, and champagne is becoming a sought-after destination for wine enthusiasts. It allows enthusiasts to learn about wine-making processes, grape varieties, and wine pairings while experiencing the unique charm of vineyards. For instance, the Champagne region welcomed approximately 3.3 million wine tourists in 2016, reflecting a 33% increase from 2009. This surge underscores the rising interest in exploring the origins of premium beverages. Visitors enjoy opportunities to taste wines at their source, which is considered the ultimate wine experience, and to access exclusive or limited-edition wines available only on-site. Wine tourism also allows individuals to expand their knowledge about the history of champagne, its geographical influences, and the artistry behind its production. By fostering communal experiences and emphasizing quality, wine tourism not only promotes cultural appreciation but also significantly boosts the champagne market share.

Increasing number of e-platforms selling champagne

The expansion of e-commerce is revolutionizing the champagne market by enhancing accessibility and convenience for consumers globally. According to an article, in the United States, the online alcohol market experienced a dramatic surge, with direct-to-consumer (DTC) alcohol sales rising by 73% in 2020, making up nearly a quarter of the U.S. DTC wine business. This trend highlights the proliferation of platforms offering champagne alongside other alcoholic beverages. Events like the Future Drinks Expo emphasize the potential of digital platforms in shaping consumer behavior and promoting brand visibility. E-commerce platforms empower consumers with detailed product information, ratings, and reviews, enabling informed decisions. They also overcome geographic limitations, allowing consumers in remote areas to access a wide variety of champagne brands. Competitive pricing, exclusive discounts, and customer loyalty programs further drive online champagne purchases, ensuring a shift toward digital retail as a primary channel for champagne sales globally.

Growing focus on sustainability and organic trends

Champagne manufacturers are increasingly adopting sustainable practices in response to both consumer demand for eco-friendly products and the need to reduce their environmental impact. This trend includes organic production methods and a focus on reducing carbon footprints and material waste. According to CSR (Charles Heidsieck) report, champagne houses are implementing efficient vineyard management techniques, such as HVE/VDC certification, which 100% of their own vineyards have achieved, to ensure sustainable production. They are also reducing waste by recycling or composting materials, with over 1,000 shrubs planted since 2016 to support biodiversity in their terroir.

In terms of energy consumption, champagne houses are making strides toward carbon neutrality. A notable example is a 22.7% reduction in electricity consumption since 2019, with a goal of a 40% reduction by 2025. Furthermore, 80% of their bottles are made from recycled glass, and 82% of Charles Heidsieck’s 75cl bottles are lighter, helping to reduce energy consumption during production and transportation. The adoption of renewable energy sources, like solar and wind power, is also key to these efforts, ensuring that operations are more sustainable and cost-efficient.

The trend toward sustainability is also reflected in the growing preference for brands that align with environmental values. In this context, champagne houses are working to strengthen their eco-credentials, aiming for 100% of their supplies to be sourced within Europe by 2030, and reducing bottle weight by 3% by 2030. By embedding sustainability in their decision-making processes and fostering long-term partnerships with eco-conscious suppliers, champagne manufacturers are not only contributing to environmental preservation but also positioning themselves as responsible and forward-thinking brands.

Champagne Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global champagne market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on product, price and distribution channel.

Analysis by Product:

- Prestige Cuvée

- Blanc De Noirs

- Blanc De Blancs

- Rosé Champagne

- Others

Based on the champagne market trends, Blanc De Blancs leads the market in 2024. It refers to a sparkling wine that is produced using only white grape varieties. It offers a vibrant bouquet of citrus fruits like lemon, lime, and grapefruit, along with floral notes like white flowers and honeysuckle. It can be enjoyed on its own as a delightful aperitif or as a celebratory drink. Its crisp and refreshing nature, combined with elegant flavors, makes it a popular choice for toasting and special occasions. It pairs well with a variety of foods due to its bright acidity and nuanced flavors. It complements dishes, such as seafood, shellfish, sushi, and salads. Its versatility makes it suitable for both light and rich dishes.

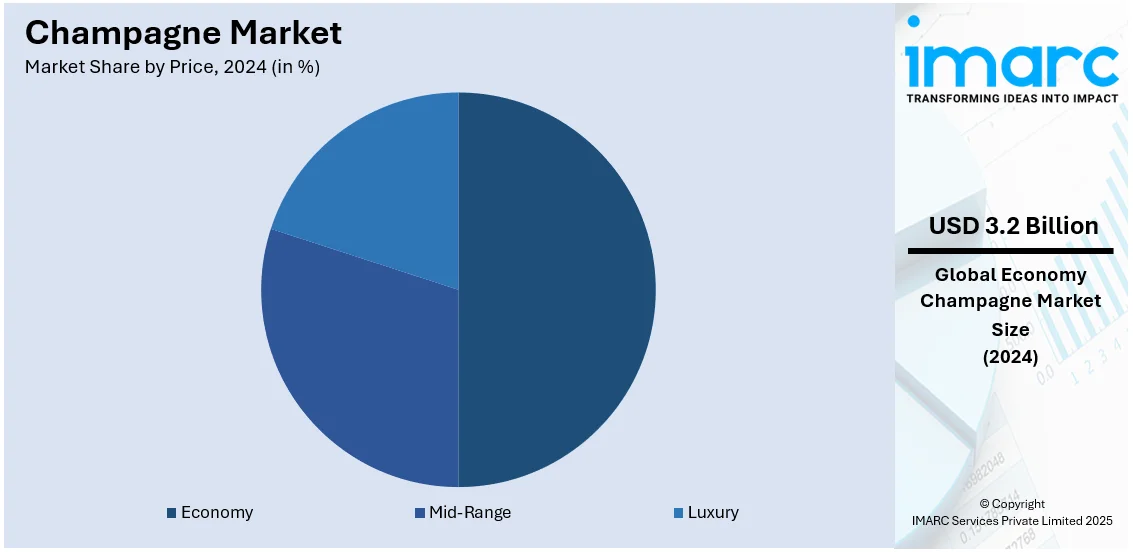

Analysis by Price:

- Economy

- Mid-Range

- Luxury

As per the champagne market forecast, economy holds the maximum number of shares in 2024. Economy champagne is easily accessible and available at an affordable price range allowing consumers to enjoy high-quality champagne. Champagne houses and producers are responding to the growing demand by expanding their offerings and introducing more affordable options. The increasing production is making economy champagne readily available in markets around the world. Moreover, advancements in logistics and transportation are making it easier to distribute champagne to a wider audience and improving its accessibility in terms of geographical reach. Furthermore, the increasing trend of serving champagne on various occasions and celebrations is raising the demand for economy champagne among the masses.

Analysis by Distribution Channel:

- Supermarket and Hypermarket

- Specialty Stores

- Online Stores

According to the champagne market outlook, supermarket and hypermarket lead the market in 2024. Supermarkets and hypermarkets are focusing on providing a one-stop shopping experience to their customers. These stores provide a wide variety of products, including groceries, beverages, household items, and more. Champagne is considered a premium product and is often perceived as a luxury item. By including champagne in their product offerings, supermarkets can enhance the perceived quality of their store, attracting customers who value the convenience of finding all their shopping needs in one place. Additionally, selling champagne provides supermarkets with an opportunity to differentiate themselves and stand out from their competitors. Champagne is a product category that is associated with prestige and offering a range of champagne options allows supermarkets to cater to different consumer preferences and budgets. By curating a selection of champagnes that vary in price points, brands, and styles, supermarkets are attracting a broader customer base and creating a competitive advantage over other retailers.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share. Europe champagne is ruled by a strong tradition for luxury consumption, where the drink is deeply embedded within the cultural and social happenings. Increasing disposable incomes, predominantly in Western Europe, is aiding the demand for the high-end and vintage version of champagne. Tourism and hospitality have increased, particularly in France, Italy, and Spain, and this boosts market growth, as tourists are eager for genuine champagne experiences. Increased consumers' awareness of sustainability and organic production has led to choices made for eco-friendly brands.

Key Regional Takeaways:

United States Champagne Market Analysis

The United States is the most critical market for champagne worldwide, and the year 2022 happened to be a record year when sales rebounded post-pandemic. The Comité Champagne reports that shipment volume declined slightly, but the value increased by 19% to USD 998 Million. As per a news article, the U.S. imported over 33 million bottles to remain as one of the premium champagne markets. Moët Hennessy leads U.S. consumption, with Veuve Clicquot being the best-selling brand in 2022, up 2.4% from 2021. Low-dosage champagnes were particularly popular, with imports topping 1 million bottles, up more than 50% from the previous year. Rosé Champagne and prestige cuvées remain in growth, reflecting changing consumer preferences. Transport issues and shifts in global demand had a minor effect on supply but could not stop the growth. U.S. consumers' propensity to try out brands and styles means the market will continue to grow with high-value retail and direct-to-consumer channels.

Europe Champagne Market Analysis

Europe is champagne's birthplace, and it leads the market. France alone accounts for more than 50% of the total production as stated in Comité Champagne's 2023 report. France exported 326 million bottles in 2023. Its largest buyers included Germany, Belgium, and the UK. High domestic consumption at an estimated 132 million bottles annually underscores its cultural significance. European champagne houses focus on quality preservation with sustainable demands through High Environmental Value certifications. The best-selling brands such as Dom Pérignon and Laurent-Perrier are focusing on fewer and vintage releases that enhance the value growth. Cross-border e-commerce has opened premium champagne brands to be sold across Europe, hence raising the sales. Government initiatives on tourism like Champagne Wine Routes in France have increased the visibility of brands and exports.

Asia Pacific Champagne Market Analysis

The Asia Pacific champagne market is growing rapidly because of increased disposable incomes and changes in consumer preferences towards luxurious beverages. Japan is the biggest market in the region and, according to Comité Champagne, imports are now above 15.8 million bottles in 2023. China and Australia are the emerging markets and see annual double-digit growth rates. Champagne demand is driven by high-end celebrations and gifting culture, which focuses on prestige cuvées. Collaborative marketing efforts, such as Moët Hennessy's experiential campaigns in Shanghai, enhance brand visibility and customer engagement. The emergence of e-commerce platforms, such as Alibaba, has made premium brands easily accessible throughout the region. Increased interest in biodynamic and organic champagnes reflects shifting consumer priorities. Increased government-sponsored wine expos and events further fuel market awareness and sales.

Latin America Champagne Market Analysis

Latin America's champagne market is on the upswing, driven by urbanization, growing incomes, and an increasing luxury culture. The region's largest economy, Brazil, imported more than 1.5 million bottles of champagne in 2023, according to Comité Champagne. Events and weddings remain important drivers of demand, and premium segments are seeing healthy growth. G.H. Mumm, among other French houses, has a distribution agreement with local distributors, ensuring that supply remains consistent and penetration into the market. Growing wine culture in Mexico has boosted the importation of champagne, especially among younger consumers interested in premium experiences. Sustainability is on the rise as eco-conscious consumers push for biodynamic offerings. Tourism to wine-producing regions and growth in high-end bars and restaurants also support champagne consumption throughout Latin America.

Middle East and Africa Champagne Market Analysis

The Middle East and Africa champagne market is growing and is fueled by luxury hospitality as well as growing expatriate communities. Comité Champagne reported that the UAE imported more than 2 million bottles in 2023, making it the regional leader. Premium hotels and fine-dining establishments make up a large portion of consumption, while brands such as Krug and Ruinart are busy courting high-end clients. Saudi Arabia is fast growing hospitality sector, in tune with Vision 2030. Non-alcoholic sparkling wine versions are subtly encouraging champagne consumption in the country. In Africa, South Africa is the major consumer of regional champagne. In the country, the middle class and upper class are opting for imported premium beverages. Local distributors are strengthening their market ties with champagne producers. It is also promoting demand with luxury events and private parties.

Competitive Landscape:

Key market players are diversifying their product portfolio by introducing new cuvées, limited editions, and different styles of champagne. They are also focusing on sustainability practices to address environmental concerns and meet consumer expectations. Top companies are leveraging digital channels to reach consumers and drive sales. They are investing in online marketing campaigns, social media engagement, and influencer collaborations to create brand awareness and engage with their target audience. They are also experimenting with innovative packaging and branding concept by incorporating customized map into champagne bottles which allow consumers to track the journey of the bottle. Leading companies are actively targeting international markets to expand their reach and increase sales. They are experimenting with different winemaking techniques, including the use of organic and biodynamic practices.

The report provides a comprehensive analysis of the competitive landscape in the champagne market with detailed profiles of all major companies, including:

- Arvitis

- Centre Vinicole – Champagne Nicolas Feuillatte

- Champagne Piper-Heidsieck

- Diageo

- LANSON-BCC

- Laurent-Perrier

- LVMH Moët Hennessy Louis Vuitton

- Pernod Ricard

- Taittinger

- Vranken - Pommery Monopole SA

Latest News and Developments:

- October 2024: Champagne Taittinger reopens its cellars in the World Heritage-listed area of Reims with a redesigned visitor centre. The cellars make up part of the Saint-Nicaise site and here Taittinger keeps some of its most exclusive wines, including the prestige cuvées Comtes de Champagne and Comtes de Champagne Rosé. New tasting tours are Instant Rosé; Instant Gourmet for; Instant Comtes which come in batches of 12-14 people. All visits are recommended to be reserved online, with the Instant Gourmet experience requiring a 48-hour notice.

- September 2024: Piper-Heidsieck has launched a new cinematic ad campaign, "Twist the Script," in partnership with British artist Miles Aldridge. The campaign emphasizes the "daring and pioneering spirit" of the Champagne house through striking visual scenes from its history. Some of the most memorable moments include disguising Champagne as books during Prohibition and Marilyn Monroe breaking conventions as an actress.

- June 2024: Laurent-Perrier launched Heritage, a Chardonnay-led multi-vintage Champagne at £75, which bridges the gap between its Brut NV at £45 and Grand Siècle at £200. The "second wine of Grand Siècle," Heritage uses a blend from four vintages (2014, 2016, 2018, and 2019) and includes 40 crus, of which half are grands crus. It is targeted at restaurants and follows the reductive winemaking approach of Grand Siècle. Disgorged in December 2023, Heritage had four years of lees aging at a dosage of 6g/l. It represents a new tier for the brand in its premium range.

- In 2023, Pernod Ricard announced about the investment in ecoSPIRITS to scale up the distribution system for premium quality wine and spirits.

- In 2022, Laurent-Perrier announced its partnership with leading department store Selfridges to launch a customization service in-store and online, offering Maison's first personalized tin for the iconic Cuvee Rose bottle.

Champagne Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Prestige Cuvée, Blanc De Noirs, Blanc De Blancs, Rosé Champagne, Others |

| Prices Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarket and Hypermarket, Specialty Stores, Online Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arvitis, Centre Vinicole – Champagne Nicolas Feuillatte, Champagne Piper-Heidsieck, Diageo, LANSON-BCC, Laurent-Perrier, LVMH Moët Hennessy Louis Vuitton, Pernod Ricard, Taittinger, Vranken - Pommery Monopole SA etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the champagne market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global champagne market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the champagne industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market..

Key Questions Answered in This Report

Champagne is a sparkling wine that originates from the Champagne region of northeastern France. It is produced using a specific method called the méthode champenoise (traditional method), where the wine undergoes a second fermentation in the bottle, creating its signature bubbles.

The champagne market was valued at USD 6.43 Billion in 2024.

IMARC estimates the global champagne market to exhibit a CAGR of 2.3% during 2025-2033.

The rising consumer demand for luxury beverages, increasing disposable incomes, growing influence of social media on lifestyle choices, expanding e-commerce and distribution networks, and a shift toward sustainable and organic products, are some of the factors primarily driving the global champagne market.

According to the report, Blanc De Blancs represented the largest segment by product, driven by its premium positioning, rising consumer preference for 100% Chardonnay-based Champagne, and its association with luxury and refined taste.

Champagne prized at economy levels creates higher revenue as it directly influences consumer purchasing decisions.

Supermarket and hypermarket represent the leading segment by distribution channel, driven by their wide product selection, competitive pricing, and high foot traffic, offering consumers convenience and accessibility.

Europe currently is the largest champagne consuming country. This dominance is fueled by a strong tradition for luxury consumption, where the drink is deeply embedded within the cultural and social happenings.

Some of the major players in the global champagne market include Arvitis, Centre Vinicole – Champagne Nicolas Feuillatte, Champagne Piper-Heidsieck, Diageo, LANSON-BCC, Laurent-Perrier, LVMH Moët Hennessy Louis Vuitton, Pernod Ricard, Taittinger, Vranken - Pommery Monopole SA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)