China Cassava Processing Market Size, Share, Trends and Forecast by End Use and Region, 2025-2033

China Cassava Processing Market Overview:

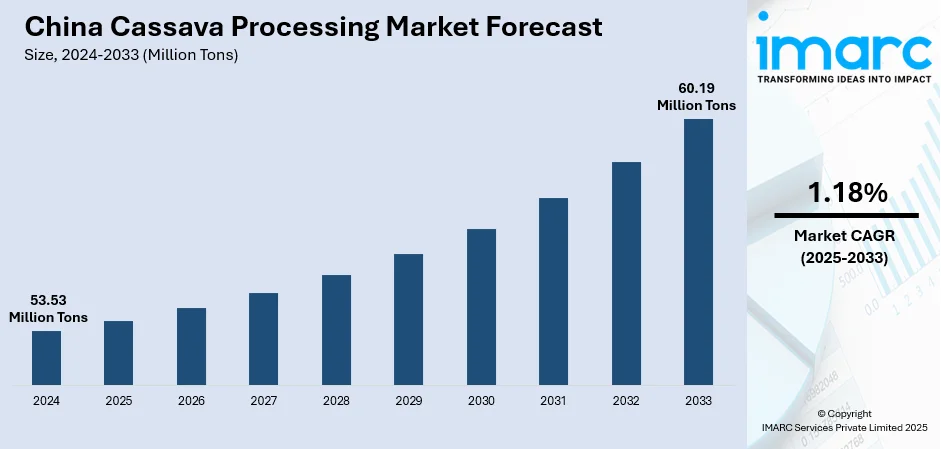

The China cassava processing market size reached 53.53 Million Tons in 2024. The market is projected to reach 60.19 Million Tons by 2033 exhibiting a growth rate (CAGR) of 1.18% during 2025-2033. The market is growing with rising demand for cassava products in food, beverage, and biofuel markets. Technological developments in processing methods and government incentives are promoting growth, contributing to the rise in China cassava processing market share across multiple sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 53.53 Million Tons |

| Market Forecast in 2033 | 60.19 Million Tons |

| Market Growth Rate 2025-2033 | 1.18% |

China Cassava Processing Market Trends:

Increasing Demand for Cassava-Based Products

Cassava, being a diverse root crop, finds application in various forms such as flour, starch, and ethanol. The market is experiencing a strong upsurge in demand for cassava products led mainly by the growing food and beverage market. Moreover, the growing popularity of cassava flour as a wheat flour substitute, due to the spiking demand for gluten-free and low-carb diets and heightened health awareness among consumers, has significantly boosted the demand for cassava flour. The use of cassava starch is also on the rise in the food industry as an additive and in packaged snack manufacture. This has been led by the increasing demand for cassava as a substitute for the more costly grains. The China cassava processing market growth is also fueled by the growing industrial applications of cassava in bioplastics, biofuels, and pharmaceuticals. All of these elements work together to make China's processing sector diverse and sustainable, which presents both domestic and foreign companies with encouraging prospects. Additionally, with the Chinese government's interest in modernizing agriculture, there are huge investments in cassava processing technologies, which has further led to growth in the industry.

To get more information on this market, Request Sample

Advancements in Cassava Processing Technology

Technological innovations in cassava processing are leading the way in the growth of the industry in China. New processing methods have enhanced the yield and quality of cassava products, which have become more competitive in the home and international markets. New processing equipment, including automated peelers, grinders, and dryers, have decreased the cost of labor and raised the capacity of production, hence addressing the increased demand. In addition, the development of new technologies to extract cassava starch has enhanced yield, which is essential for industries using this starch for the production of products such as adhesives and textile. The option to attain better-quality cassava flour with less wastage has also led to a decrease in the cost of production, enabling businesses to provide cheaper products. In addition, biotechnology research is investigating the possibilities of genetically engineered cassava varieties with higher quality output and resistance to pests and diseases that increase the efficiency of production. All these innovations, in combination with favorable government policies and programs for improving agricultural processing, are facilitating the development of the China cassava processing industry into a more sustainable and competitive one in the world.

China Cassava Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on end use.

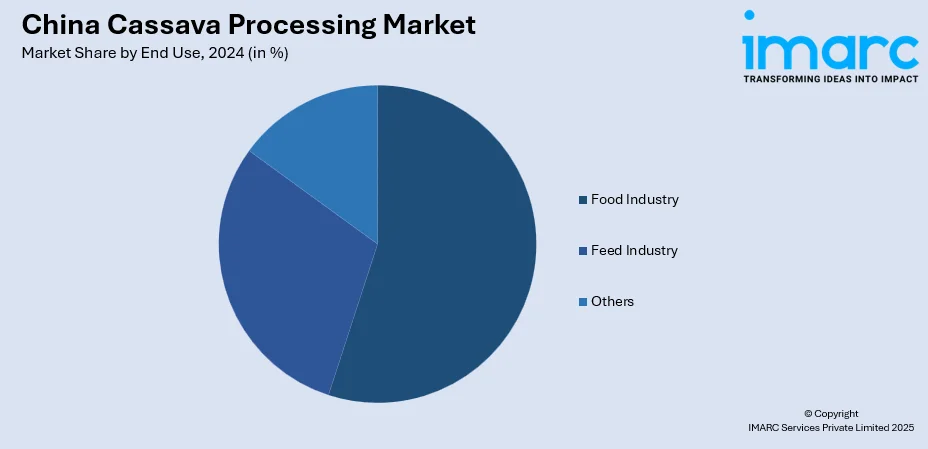

End Use Insights:

- Food Industry

- Feed Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes food industry, feed industry, and others.

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

The report has also provided a comprehensive analysis of all the major regional markets, which include North China, East China, South Central China, Southwest China, Northwest China, and Northeast China.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

China Cassava Processing Market News:

- March 2025: COFCO Bio-Energy Co Ltd signed an MoU with Hang Harvest Agriculture Co Ltd to purchase 200,000 Tons of Cambodian dried cassava chips, boosting China’s cassava processing market by securing supply, enhancing trade cooperation, and supporting processing industry growth.

- March 2025: Laos exported its first cassava starch shipment to Zhengzhou via special train, led by Huangfanqu Industrial Group. This boosted China’s cassava processing market by securing a high-quality supply, enhancing ASEAN trade ties, and expanding industrial applications in food, medicine, and manufacturing.

China Cassava Processing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Food Industry, Feed Industry, Others |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the China cassava processing market performed so far and how will it perform in the coming years?

- What is the breakup of the China cassava processing market on the basis of end use?

- What is the breakup of the China cassava processing market on the basis of region?

- What are the various stages in the value chain of the China cassava processing market?

- What are the key driving factors and challenges in the China cassava processing market?

- What is the structure of the China cassava processing market and who are the key players?

- What is the degree of competition in the China cassava processing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China cassava processing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the China cassava processing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China cassava processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)